Get the free CREDIT CARD AUTHORIZATION FORM X X Please Fax or ...

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Forms

Understanding the credit card authorization form

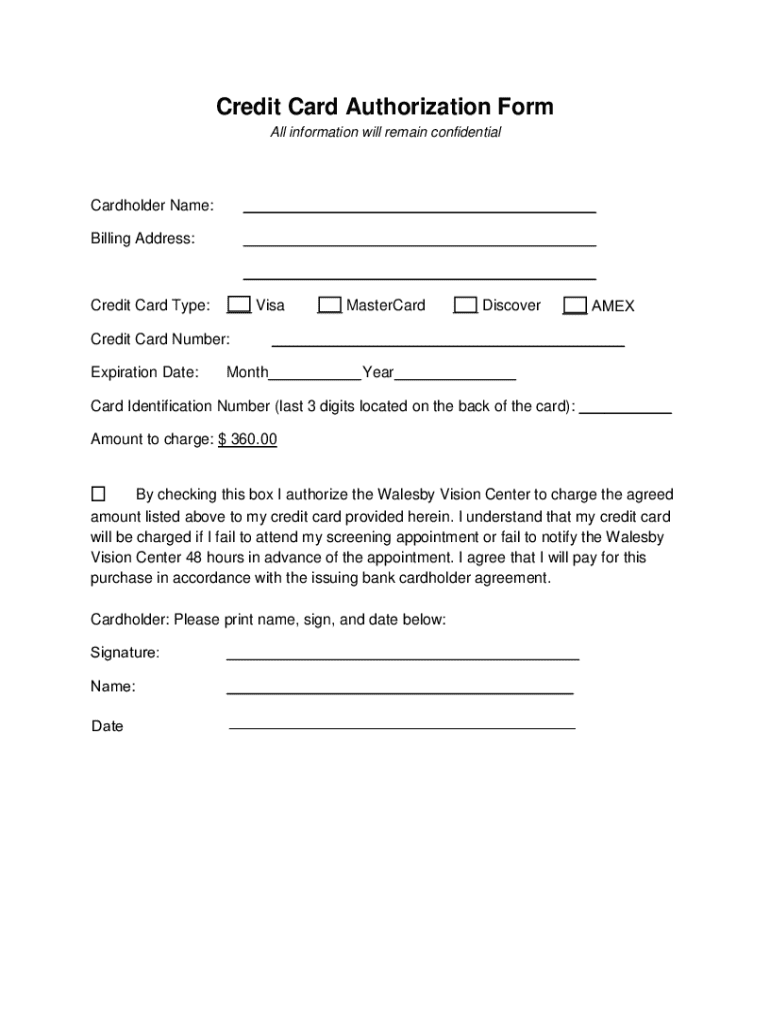

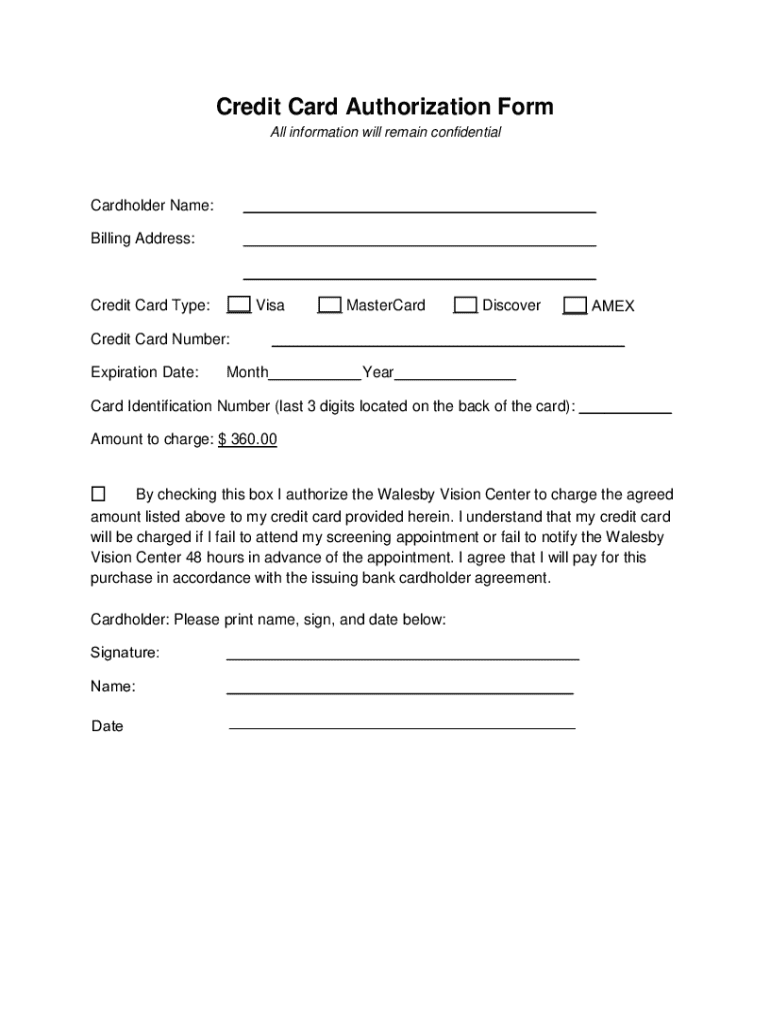

A credit card authorization form is a document used by businesses to obtain permission from a cardholder for a specified transaction. Its main purpose revolves around allowing a merchant to charge a customer's credit card while ensuring compliance with security protocols. By implementing this form, businesses not only safeguard themselves against unauthorized transactions but also enhance their payment processes, boosting overall transaction efficiency.

Key components of a credit card authorization form

Crafting an effective credit card authorization form requires specific details. Essential information usually includes the cardholder's details such as their name, billing address, and contact information. Card information is also pivotal—this encompasses the credit card number, expiration date, and the CVV code. Additionally, particular transaction details including the amount, date, and purpose of the charge should clearly be specified to avoid any ambiguity.

For enhanced security, optional components can be included, such as the cardholder’s signature, which serves as an extra layer of verification, alongside any authorization terms and conditions that outline the obligations and rights of both parties.

Legal and compliance considerations

The use of a credit card authorization form must align with legal standards, particularly the Payment Card Industry Data Security Standard (PCI DSS). These regulations establish guidelines to help secure card information against theft and breaches. Companies must ensure their forms adhere closely to these benchmarks in storing and processing card data.

Furthermore, businesses need to consider local and international regulations such as Europe’s General Data Protection Regulation (GDPR), particularly regarding the handling of personal data. Confidential information from customers must be meticulously secured to avoid compliance issues and potential penalties.

Benefits of using a credit card authorization form

Employing a credit card authorization form comes with numerous advantages, one of the most significant being the minimization of chargeback risks. Chargebacks often arise when a consumer disputes a transaction, leading to potential losses for businesses. The authorization form acts as proof of the cardholder’s consent, thereby playing a pivotal role in dispute resolution.

In addition to lowering chargeback occurrences, the form also fosters improved customer trust and transparency. When customers see that businesses are taking their financial security seriously, it enhances their confidence in making purchases. Not to mention, having well-organized authorization documentation streamlines accounting and record-keeping, significantly reducing administrative burdens.

How to fill out a credit card authorization form

Filling out a credit card authorization form might seem straightforward, but it’s essential to follow a precise approach to ensure accuracy. Here’s a step-by-step guide:

Common mistakes one should avoid include leaving out crucial information, misplacing decimal points in amounts, and failing to read the terms and conditions thoroughly.

Interactive tools for creating a credit card authorization form

Creating a credit card authorization form can be seamless with the right tools. pdfFiller offers intuitive features designed to simplify this process with easy-to-use templates. Users can customize forms to fit specific needs, ensuring compliance and efficiency.

To create a credit card authorization form through pdfFiller, follow these steps:

Frequently asked questions

Potential users often have inquiries about credit card authorization forms. Here are some common questions and their answers:

Practical tips for implementing credit card authorization forms in your business

Incorporating credit card authorization forms into your business’s payment processing workflow can prevent many potential issues. Start by ensuring that all transactions require a completed form upfront to foster a systematic approach.

Training staff is equally crucial; they should understand how to handle the forms correctly and maintain customer confidentiality. Regular audits of your authorization practices can also pinpoint any inconsistencies or areas ripe for improvement.

Downloadable resources and templates

For businesses looking to streamline their payment processes, having access to ready-to-use templates can be a game-changer. pdfFiller offers a customizable credit card authorization form template available for download.

Additional templates tailored for specific business needs are also accessible, ensuring immediate compliance and ease of use.

User testimonials on the benefits of the authorization form

Real-life feedback from users emphasizes how significantly the credit card authorization form has improved operational efficiency. Businesses report reduced chargeback frequencies, streamlined transaction processes, and boosted customer satisfaction.

Users have also shared their experiences with pdfFiller, noting the ease of creating and managing authorization forms, which contributes to a more organized approach to handling payment permissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my credit card authorization form in Gmail?

How can I edit credit card authorization form on a smartphone?

How do I fill out credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.