Get the free CREDIT AUTH FORM - Made in Hawaii

Get, Create, Make and Sign credit auth form

How to edit credit auth form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit auth form

How to fill out credit auth form

Who needs credit auth form?

Understanding the Credit Auth Form: A Comprehensive Guide

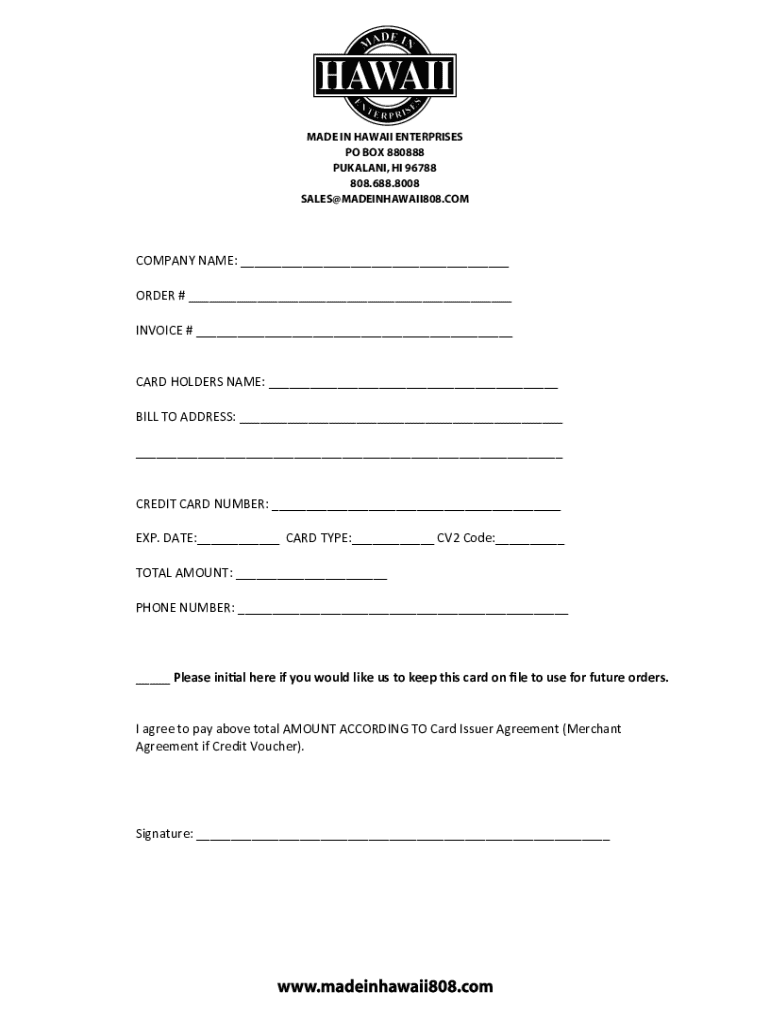

Understanding the credit authorization form

A credit authorization form is a critical document in the financial transaction process, allowing businesses to securely authorize payments using customers' credit cards. This form serves as a legal agreement, granting businesses the authority to charge specific amounts to a cardholder's credit card. When utilized correctly, it helps foster a transparent and trustworthy relationship between the service provider and the customer.

The importance of using a credit authorization form cannot be overstated—especially in today’s digital transaction environment. With countless businesses and restaurants accepting credit card payments, having a structured approach to this process ensures that both parties are protected and there is a clear record of authorization, thus minimizing risks associated with transactions.

Components of a credit authorization form

A well-structured credit authorization form contains several key components that ensure its effectiveness and legal standing. First and foremost, it should include the customer’s details, which typically encompass their full name, address, and contact information. This personal data helps establish the identity of the cardholder and is crucial for both verification and record-keeping purposes.

The form must also request credit card details, including the credit card number, expiration date, and the CVV code. These elements are fundamental as they allow the business to process payments securely. Equally important is the specification of the amount to be charged, which must be clearly stated to avoid any misunderstandings.

Additionally, including an authorization statement where the customer consents to the transaction is vital. Optional elements that can enhance the form but are not mandatory may include terms for recurring payments, terms and conditions of use, and spaces for signatures, whether they are digital or electronic.

How to fill out a credit authorization form

Filling out a credit authorization form requires a systematic approach to ensure accuracy and security. Start by gathering all relevant customer information, including their name, address, and contact details. Next, input the credit card details meticulously—this includes the card number, expiration date, and CVV—ensuring that no typographical errors are made.

Once the personal and credit card information is complete, specify the amount that needs to be charged. If applicable, include any terms related to automatic billing to clarify the duration and frequency of payments. Before finalizing the form, take a moment to review all entered data for correctness. Confirm that the information is up-to-date to avoid potential transaction issues.

When filling out the form, it's essential to prioritize safety. Use secure platforms, such as pdfFiller, for submitting sensitive information. Furthermore, ensure that the recipient of this information is reputable and trustworthy, as this will help safeguard against identity theft and payment fraud.

Editable templates and tools

Having access to customizable templates for credit authorization forms can save time and enhance compliance. Many businesses, including restaurants and various service providers, can benefit from easy-to-use templates that cater to specific industry requirements. These templates can typically be downloaded, allowing for quick edits to personalize the content while maintaining the necessary legal standards.

pdfFiller provides a robust array of interactive tools perfect for filling out credit authorization forms. Its online form editor allows for seamless editing and customization. Furthermore, its eSigning capabilities enable users to sign documents electronically—a crucial feature that enhances transaction efficiency without compromising security. Collaboration tools are also available, facilitating multiple users to sign and edit in real-time, thus streamlining workflows.

Managing credit authorization forms

Efficient tracking and management of transactions made with credit authorization forms is vital for minimizing disputes and ensuring accurate financial records. Businesses should establish a regular monitoring routine to scrutinize transaction charges for any discrepancies. Best practices reinforce the importance of maintaining comprehensive records, including copies of signed authorization forms, as these documents serve as valuable proof in case of chargebacks.

In instances where unauthorized charges occur, having a signed credit authorization form can significantly bolster the business’s position in dispute proceedings. Clear documentation and timely responses can help mitigate financial loss stemming from chargebacks, which can be detrimental to businesses, especially those with tight cash flows.

Common questions about credit authorization forms

One prevalent inquiry regarding credit authorization forms revolves around their role in preventing chargeback abuse. A chargeback is initiated when a cardholder disputes a transaction, which can lead to financial losses for businesses. Effectively, credit authorization forms serve as critical evidence pointing to customer consent, mitigating risks associated with chargebacks. These forms highlight that customers willingly authorized specific charges, thus protecting businesses in disputes.

Alternatively, failing to utilize a credit authorization form can expose businesses to several risks. Not having a clear authorization can result in unauthorized charges, leading to potential legal issues and financial losses. Without proper documentation, a business may struggle to defend itself against chargebacks, which highlights the necessity of implementing these forms as standard operating procedure.

Additional considerations for businesses

It's crucial for businesses to remain compliant with legal regulations surrounding payment processing and the handling of sensitive information. Dual compliance with GDPR and PCI standards is important, as it establishes trust with customers while protecting their data. Properly managing how customer data is collected, stored, and shared is vital for maintaining security and credibility in the marketplace.

In engaging customers transparently about the use of authorization forms, businesses should be clear about how this information is retained and used. Open dialogue can build trust and encourage customers to feel confident in sharing their details. It is not only about gaining the authority to charge but also ensuring customers know their data is being handled appropriately, thus enhancing customer loyalty.

Final insights

As digital transactions continue to evolve, the future of credit authorization forms looks promising. The ongoing shift towards electronic and cloud-based solutions is reshaping how businesses manage payment authorizations. Emerging technologies are standing at the forefront of document management, offering solutions that increase security and accessibility, particularly for those in fast-paced environments such as restaurants and retail stores.

Adopting innovative tools like pdfFiller allows businesses to integrate these advancements into their operations seamlessly. The trend towards digital solutions not only reflects efficiency but also emphasizes the importance of adapting to changing customer behaviors, making accessibility a priority in document management strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit auth form to be eSigned by others?

How do I execute credit auth form online?

How do I complete credit auth form on an iOS device?

What is credit auth form?

Who is required to file credit auth form?

How to fill out credit auth form?

What is the purpose of credit auth form?

What information must be reported on credit auth form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.