Get the free CREDIT CARD AUTHORIZATION FORM WUHS

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding the Credit Card Authorization Form: Your Comprehensive Guide

Understanding the credit card authorization form

A credit card authorization form serves as a crucial document used by businesses to obtain permission from customers to charge their credit cards. The primary purpose of this form is to secure a signature or confirmation from the cardholder, allowing businesses to process transactions with clarity and legality. Without it, companies expose themselves to numerous risks and complications, including disputes or chargebacks.

In the ever-evolving landscape of digital payments, the importance of the credit card authorization form cannot be overstated. For businesses, this form acts as a layer of protection against fraud. By documenting the customer's consent and payment authorization, businesses mitigate the potential for unauthorized transactions and protect themselves from financial loss.

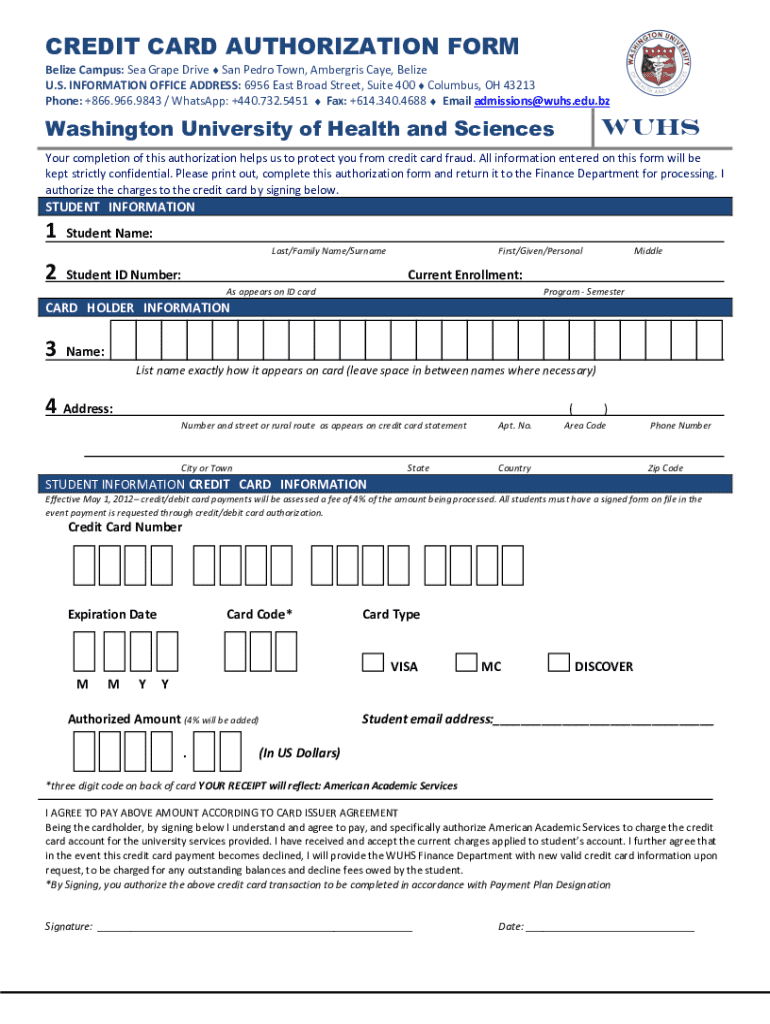

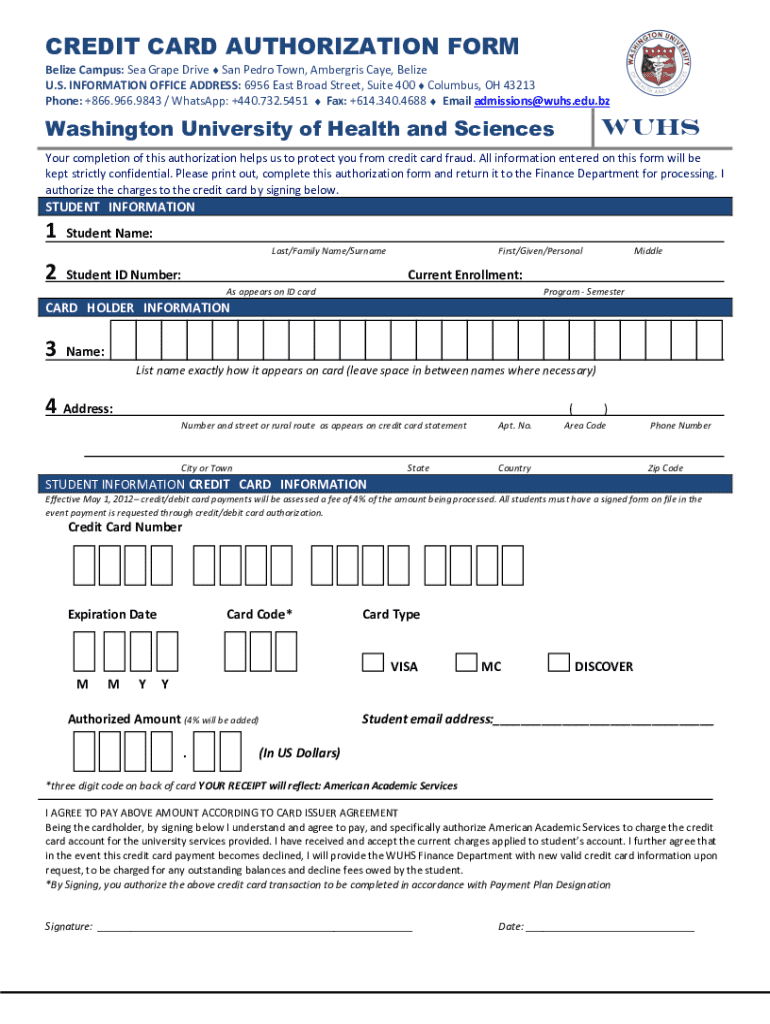

Key components of a credit card authorization form

A well-equipped credit card authorization form contains several key components, which help ensure that all necessary information is captured. Essential information includes cardholder details such as their full name, billing address, and contact information. This foundational data helps verify the identity of the cardholder and is crucial for processing transactions securely.

Furthermore, specific card details must be included, comprising the card number, expiration date, and CVV (Card Verification Value). This information allows for secure transaction processing. The form should also outline transaction details like the payment amount, transaction date, and the purpose of the payment, ensuring transparency for both the business and cardholder.

Optional components can enhance security further. For instance, the cardholder's signature serves as a verification method, confirming that they authorize the transaction. Additionally, including specific terms and conditions related to the authorization can clarify the rights and responsibilities of both parties.

Legal and compliance considerations

Incorporating a credit card authorization form not only helps streamline payment processes but also ensures compliance with various legal standards. One of the most recognized frameworks is the Payment Card Industry Data Security Standard (PCI DSS), which sets security requirements for organizations that handle credit card information. Complying with PCI DSS is imperative to protect sensitive customer data and avoid hefty fines.

Moreover, businesses must consider local and international regulations, such as the General Data Protection Regulation (GDPR). The GDPR outlines how personal data should be handled and emphasizes the importance of secure data storage. Maintaining compliance with such regulations ensures that customer information remains protected and reduces the risk of data breaches.

Benefits of using a credit card authorization form

Implementing a credit card authorization form offers several benefits to businesses. First and foremost, it minimizes the risks associated with chargebacks. Chargebacks occur when a customer disputes a transaction, leading to reversals of payments. A properly filled-out authorization form can serve as crucial evidence in dispute resolution, proving that the customer did indeed authorize the charge.

Moreover, using this form fosters trust between customers and businesses. By providing clear documentation of the permissions granted, customers feel more secure about the transaction, enhancing transparency. This, in turn, can lead to improved customer relations and retention. Lastly, the form allows for better accounting and record keeping since all transactions are documented in a uniform manner.

How to fill out a credit card authorization form

Filling out a credit card authorization form correctly is crucial for effective transaction processing. Here’s a step-by-step guide to assist you in completing this form accurately.

Common mistakes to avoid include not obtaining all necessary signatures, neglecting to verify card information, or failing to clarify the payment purpose. Such oversights can lead to unauthorized charges or disputes, so attention to detail is vital.

Interactive tools for creating a credit card authorization form

Creating a credit card authorization form doesn’t have to be daunting. pdfFiller offers a seamless solution with easy-to-use templates that allow businesses to create customized authorization forms quickly. With a few clicks, users can edit, sign, and collaborate on documents, streamlining the entire process while ensuring compliance with legal standards.

Here's a simple step-by-step guide on how to use pdfFiller to create a credit card authorization form:

With pdfFiller, you can rest assured that your authorization forms are formatted correctly and compliant with necessary regulations, allowing your business to move forward confidently.

Frequently asked questions

With numerous queries revolving around credit card authorization forms, a few common questions often arise among businesses and individuals alike.

Practical tips for implementing credit card authorization forms in your business

To effectively implement credit card authorization forms, businesses should incorporate them into their payment processing workflows. This includes training employees on the proper handling of these forms and emphasizing the importance of accuracy and compliance.

Regular audits of authorization practices can help identify areas for improvement and ensure that all staff adhere to compliance guidelines. Create a culture of transparency regarding payments and authorizations, consistently communicating with customers about their rights and responsibilities.

Downloadable resources and templates

To help you get started with credit card authorization forms, we provide easy access to templates that can be customized to fit various business needs. Download the Credit Card Authorization Form Template from pdfFiller today to simplify your transaction processes.

User testimonials on the benefits of the authorization form

Many businesses have shared success stories regarding the implementation of credit card authorization forms. Users have reported simplified payment processes, increased customer trust, and reduced chargeback risks due to clear documentation provided by the forms.

Furthermore, insights from companies using pdfFiller emphasize the ease of use and effectiveness in managing these forms. Customers appreciate the clarity and security that these authorization forms bring to transactions, making them an essential part of their businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card authorization form without leaving Google Drive?

Can I sign the credit card authorization form electronically in Chrome?

How do I complete credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.