Get the free credit card authorization form - Googleapis.com

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding Credit Card Authorization Forms: A Comprehensive Guide

Understanding the credit card authorization form

A credit card authorization form is a document that authorizes a business to charge a customer's credit card for specific transactions. This form is pivotal in ensuring that the merchant has explicit permission from the buyer to process the payment. It plays a critical role in preventing fraud and unauthorized transactions, which can lead to significant financial losses.

For businesses, using a credit card authorization form is not just a best practice but a necessity. These forms help protect against fraud by providing proof of authorization, which can be crucial in case of disputes. Moreover, they streamline the payment process, making it simpler for customers to complete their transactions securely and efficiently.

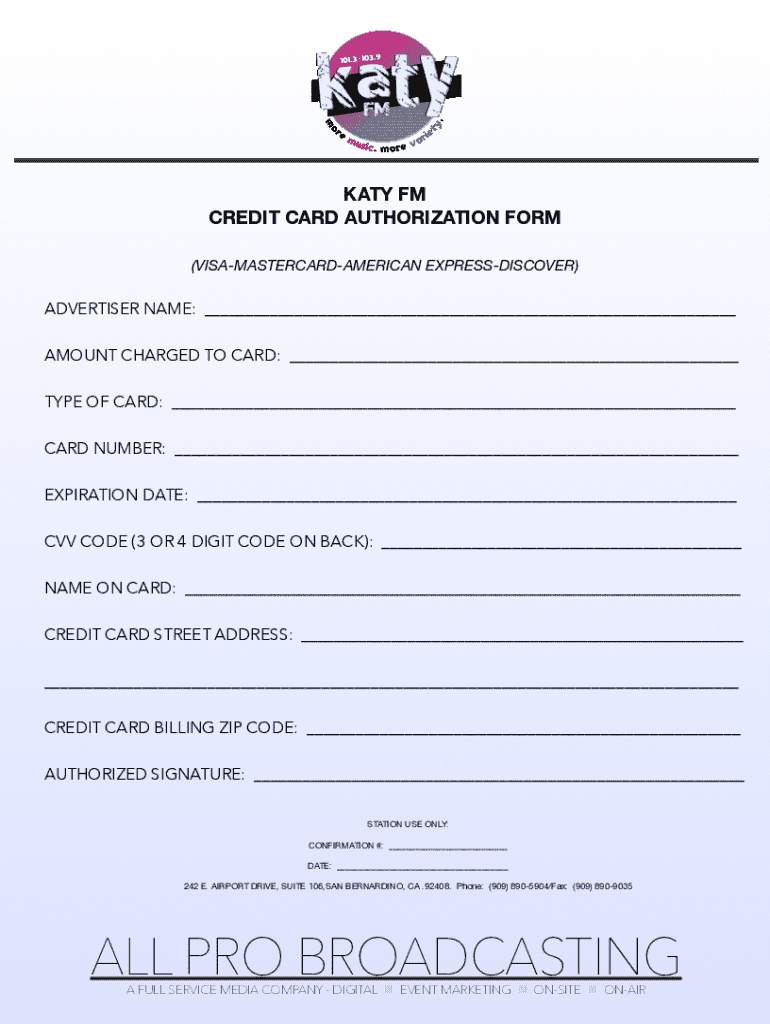

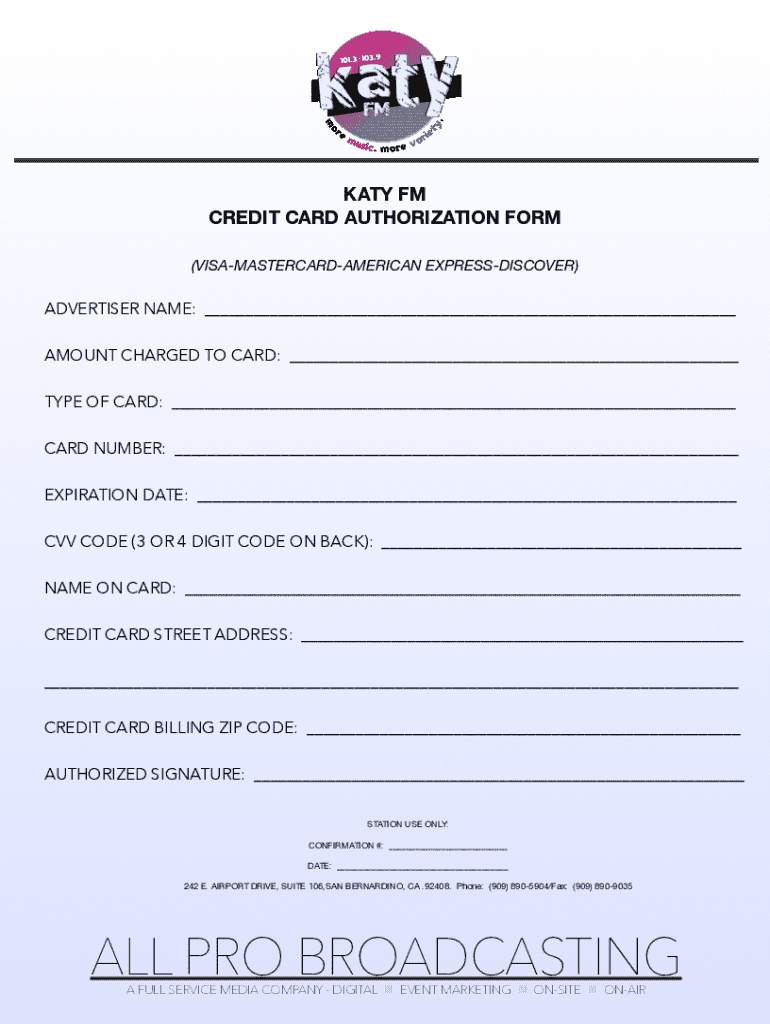

Key components of a credit card authorization form

A robust credit card authorization form contains several essential components that capture necessary details. Firstly, cardholder information, which includes the cardholder's name, billing address, and contact information, is vital. This establishes the identity of the individual making the payment.

Next, the form requires specific card details, such as the credit card number, expiration date, and CVV code. These components ensure the merchant has all the information needed to process the payment accurately. Finally, transaction details, including the amount to be charged, the date, and the purpose of the payment, must be included to clarify what the funds are being authorized for.

To enhance security, optional components like the cardholder's signature and specific authorization terms and conditions can also be included. This additional layer of authentication helps protect both the consumer and the business by ensuring the transaction has been verified.

Legal and compliance considerations

Navigating the legal landscape surrounding credit card authorization forms is crucial for any business. The Payment Card Industry Data Security Standard (PCI DSS) outlines security measures that merchants must implement to protect cardholder information. Compliance with these standards is non-negotiable and helps prevent data breaches that could expose sensitive customer information.

Additionally, businesses must be aware of local and international regulations affecting payment processing. For example, the General Data Protection Regulation (GDPR) imposes strict guidelines on how personal data, including cardholder information, should be collected, processed, and stored. Compliance ensures businesses not only avoid hefty fines but also build customer trust.

Benefits of using a credit card authorization form

Employing a credit card authorization form comes with several significant benefits. One of the primary advantages is the mitigation of chargeback risks. Chargebacks occur when a customer disputes a transaction, prompting the issuing bank to reverse the charges. By presenting a signed authorization form in these instances, businesses can often successfully contest chargebacks, thus protecting their revenue.

Moreover, having these forms enhances customer trust and transparency. Customers feel more secure knowing that their payments are being processed with explicit authorization, fostering a sense of accountability on the part of the business. Additionally, credit card authorization forms improve accounting and record-keeping processes, enabling better financial management.

How to fill out a credit card authorization form

Filling out a credit card authorization form correctly is critical for both merchants and customers. To begin, gather all necessary information, ensuring you have the cardholder's details, card specifics, and transaction particulars on hand.

Next, fill in the cardholder information, including their name, address, and contact information. This step verifies the identity of the individual approving the charges. Following this, enter the payment details like the credit card number, expiration date, and CVV. Make sure to input the transaction amount, date, and purpose accurately. Before submitting, always review the form for accuracy to avoid discrepancies.

Common mistakes to avoid include omitting crucial information, such as the CVV or expiration date, which can lead to payment processing errors. Additionally, ensure that the cardholder's name matches the name registered with the credit card, as discrepancies can raise flags during authorization.

Interactive tools for creating a credit card authorization form

Creating an effective credit card authorization form has never been easier, thanks to tools like pdfFiller. This platform offers easy-to-use templates that can be customized to fit your business's specific needs. Whether you run a small restaurant or a large corporation, pdfFiller's features are designed to cater to all sizes of businesses, ensuring a seamless user experience.

Using pdfFiller to create a credit card authorization form involves accessing their template library, where you can choose from a variety of pre-designed forms. Once you select a template, you can customize the form by adding your business's branding elements, such as logos or colors. After completing the form, it's easy to save and share with customers or staff as needed.

Frequently asked questions

As businesses and customers navigate payment processes, several common questions arise regarding credit card authorization forms. One frequent query is what happens if the cardholder refuses to sign the form. In such cases, the merchant may need to consider alternative payment methods or establish trust mechanisms to complete the transaction.

Additionally, businesses often ask about how long they should keep records of authorization. Keeping these records for a minimum of six months is advisable, as this duration suffices in many chargeback dispute scenarios. Lastly, many wonder if a credit card authorization form can be utilized for recurring payments, which it can, as long as both parties agree to the terms outlined in the form.

Practical tips for implementing credit card authorization forms in your business

To successfully integrate credit card authorization forms into your business's payment processing system, consider incorporating them strategically into your workflow. This involves training staff on proper handling and filing of these forms to maintain security and organization.

Another vital aspect is performing regular audits of authorization practices. Ensuring that your methods are up to date with compliance regulations and effective in reducing risks will contribute significantly to your operation's overall success. Additionally, collecting customer feedback on the authorization process can help to refine and improve the overall experience for both staff and clients.

Downloadable resources and templates

For those looking to simplify the creation of credit card authorization forms, a downloadable template can be a valuable resource. Various customizable options are available to meet distinct business needs. These templates not only save time but also provide a framework ensuring that all critical information is captured accurately.

By leveraging pdfFiller's offerings, businesses can enhance their documentation process while ensuring they remain compliant and secure in their payment practices. Access your credit card authorization form template today and begin streamlining your transaction processes.

User testimonials on the benefits of the authorization form

User feedback highlights the transformative impact that credit card authorization forms can have on business processes. Companies across various sectors report increased confidence in their payment handling after implementing these forms. Business owners from restaurants to e-commerce platforms have shared success stories about how authorization forms helped in managing payment disputes effectively.

Furthermore, many users have praised the ease of use found with tools like pdfFiller, noting how quickly they can create and distribute professional-looking authorization forms. This level of convenience plays a significant role in the efficient daily operations of staff while enhancing customer experience, thereby fostering loyalty and trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in credit card authorization form without leaving Chrome?

Can I create an eSignature for the credit card authorization form in Gmail?

How do I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.