Get the free CASH RECEIPT - NET

Get, Create, Make and Sign cash receipt - net

How to edit cash receipt - net online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash receipt - net

How to fill out cash receipt - net

Who needs cash receipt - net?

Cash receipt - net form: A comprehensive guide

Understanding cash receipts

Cash receipts represent a fundamental component of financial transactions, capturing the inflow of cash received by a business or individual. They serve as a formal acknowledgment of payment, ensuring clarity and transparency in any monetary exchange. Whether processed through direct sales or indirect payments, the significance of cash receipts is profound, establishing an official record for accounting and auditing purposes.

The importance of cash receipts extends beyond mere record-keeping; they are vital in maintaining accurate financial statements, facilitating effective budgeting, and supporting tax compliance. Additionally, understanding the nuances between different types of cash receipts, such as direct and indirect cash receipts, enables individuals and businesses to manage their finances more effectively.

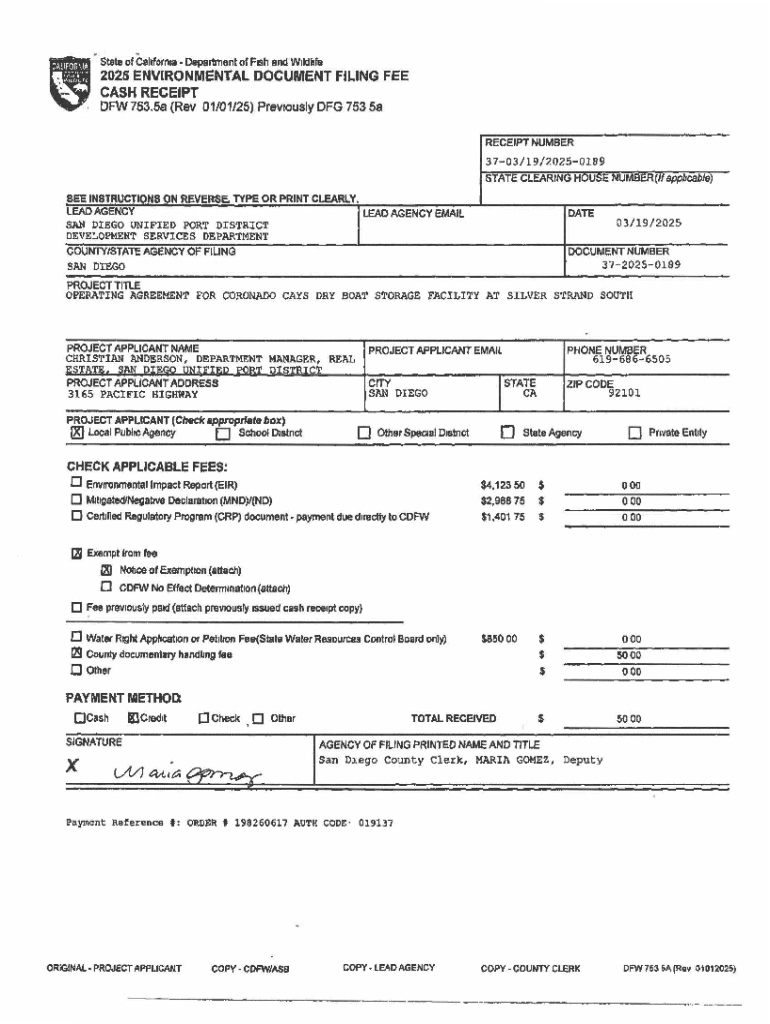

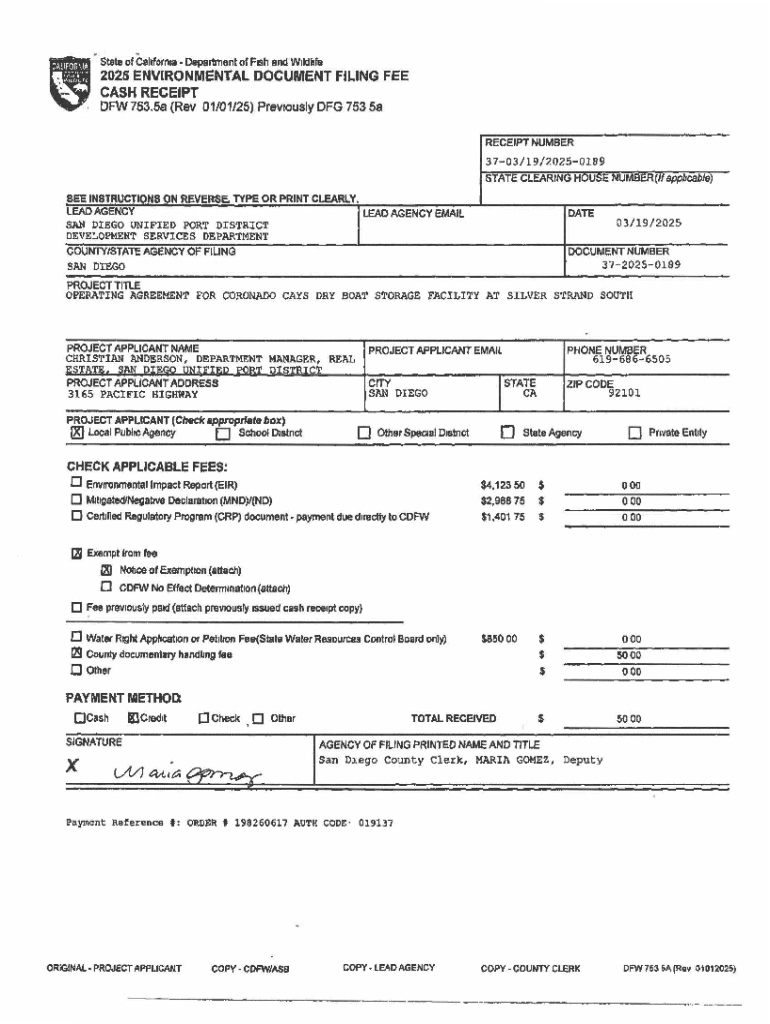

The cash receipt - net form

The cash receipt - net form is a structured document designed to capture essential details regarding cash inflow. This form aids businesses in documenting transactions accurately while providing clarity for both the payer and payee. It is particularly significant due to its clarity and straightforward nature, ensuring that all involved parties can access detailed financial information quickly.

Key components of the cash receipt - net form include vital information like payer details, merchant specifics, payment amounts, and payment methods. Each section of this form is critical, as accurate input of data minimizes discrepancies and enhances trust between the transaction parties. Notably, errors during data entry can lead to severe complications, underscoring the importance of accuracy at this early stage.

Steps to create a cash receipt - net form

Creating a cash receipt - net form requires careful attention to detail. To ensure a smooth process, beginning by gathering essential information is vital. This includes reviewing all necessary documentation, collecting payer details, transaction specifics, and any reference numbers relevant to the transaction. Accurate data collection sets a solid foundation for the entire process.

Gather required information

The documentation needed for preparation of a cash receipt - net form includes invoices, transaction records, and identification information of both the payer and merchant. Important data points to collect involve payment amounts, the date of transaction, and the method by which the payment is made. This meticulous approach ensures that no vital information is overlooked.

Accessing the pdfFiller platform

After the necessary information is gathered, navigating to the pdfFiller platform is the next step. pdfFiller provides an intuitive interface that allows users to access the cash receipt - net form template easily. Its array of functionalities empowers users to create, edit, and manage important documents efficiently, underscoring the convenience of cloud-based solutions.

Filling out the form

Filling out the cash receipt - net form requires a step-by-step approach. First, input payer information, including names, contact details, and any organization identifiers necessary. Next, record payment details, specifying the amount received, date, and payment type. Before finalizing, reviewing the form for accuracy is essential to prevent potential mistakes that could affect accounting records.

Editing and finalizing the form

Utilizing the editing tools on pdfFiller, users can easily make any necessary adjustments to the cash receipt - net form. Finalizing the document ensures compliance with legal standards, confirming that all required fields are completed accurately. This thorough attention to detail not only enhances the integrity of the documentation but also strengthens business practices.

eSigning and sharing the cash receipt - net form

eSigning the cash receipt - net form provides a convenient and efficient way to finalize transactions. Utilizing pdfFiller’s eSigning capabilities, users can quickly sign documents digitally, enhancing the overall workflow. This process not only speeds up transactions but also offers a reliable method for maintaining records of signed agreements.

When it comes to sharing the completed cash receipt - net form, pdfFiller presents multiple options. Users can share documents directly via email, download them for physical distribution, or integrate with other software tools used for managing finances. These versatile sharing options facilitate seamless communication between parties involved.

Managing cash receipts: best practices

Proper management of cash receipts is crucial for effective financial administration. When considering storage solutions, businesses must choose between cloud-based and physical storage options. Each method has its advantages, with cloud solutions providing easy access and enhanced security, while physical records allow for tangible documentation.

Tracking and accounting for cash receipts can be optimized by using pdfFiller’s transaction management capabilities. Integration with accounting software enhances visibility into cash flow, making it easier to monitor expenditures, report variances, and maintain accurate financial statements. Additionally, implementing proper archiving strategies helps in compliance and record-keeping.

Troubleshooting common issues

When filling out the cash receipt - net form, common errors include missing information and incorrect calculations. These mistakes can lead to confusion and discrepancies in financial records. It is vital to double-check all entries and ensure calculations align with the amounts stated.

If errors occur, pdfFiller offers robust support features. Users can access help articles that guide them through common issues or reach out to customer support for personalized assistance. Utilizing these resources ensures a smoother experience when managing cash receipts.

Additional features of using pdfFiller

Collaboration among team members can be significantly improved through pdfFiller’s capabilities. Real-time editing and commenting allow for dynamic teamwork on cash receipts and other forms, ensuring that all involved parties can engage effectively. Implementing user permissions for document access adds an extra layer of security and control over who can view or edit specific documents.

For those on the go, pdfFiller offers mobile access through its app, allowing users to manage documents anytime and anywhere. Security remains a top priority, with features such as encryption and data protection strategies ensuring sensitive information stays secure.

Case studies: effective use of cash receipt - net form

Examining real-world applications of the cash receipt - net form reveals its versatility across various scenarios. One case study highlights individual freelancers, who utilize the form to invoice clients while managing their cash flow effectively. This not only enhances professionalism but also aids in tracking payments for taxation purposes.

Another case study showcases small to mid-sized businesses that adopt the cash receipt - net form to streamline their accounting processes. By centralizing transaction records, these businesses can quickly report expenditures and improve financial planning. The insights drawn from these success stories illustrate the importance of adopting structured templates for efficient financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cash receipt - net for eSignature?

How do I edit cash receipt - net straight from my smartphone?

How do I complete cash receipt - net on an iOS device?

What is cash receipt - net?

Who is required to file cash receipt - net?

How to fill out cash receipt - net?

What is the purpose of cash receipt - net?

What information must be reported on cash receipt - net?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.