Get the free UK Step Down Kick-out Plan (HS572)

Get, Create, Make and Sign uk step down kick-out

Editing uk step down kick-out online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uk step down kick-out

How to fill out uk step down kick-out

Who needs uk step down kick-out?

Understanding the UK Step Down Kick-Out Form: A Comprehensive Guide

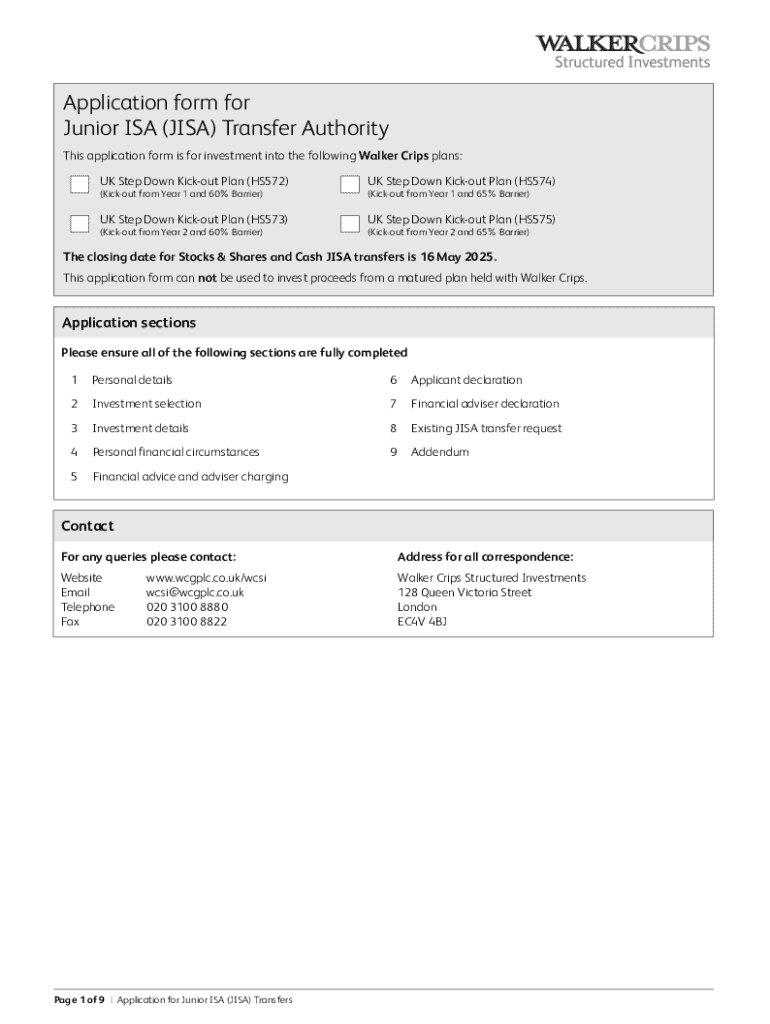

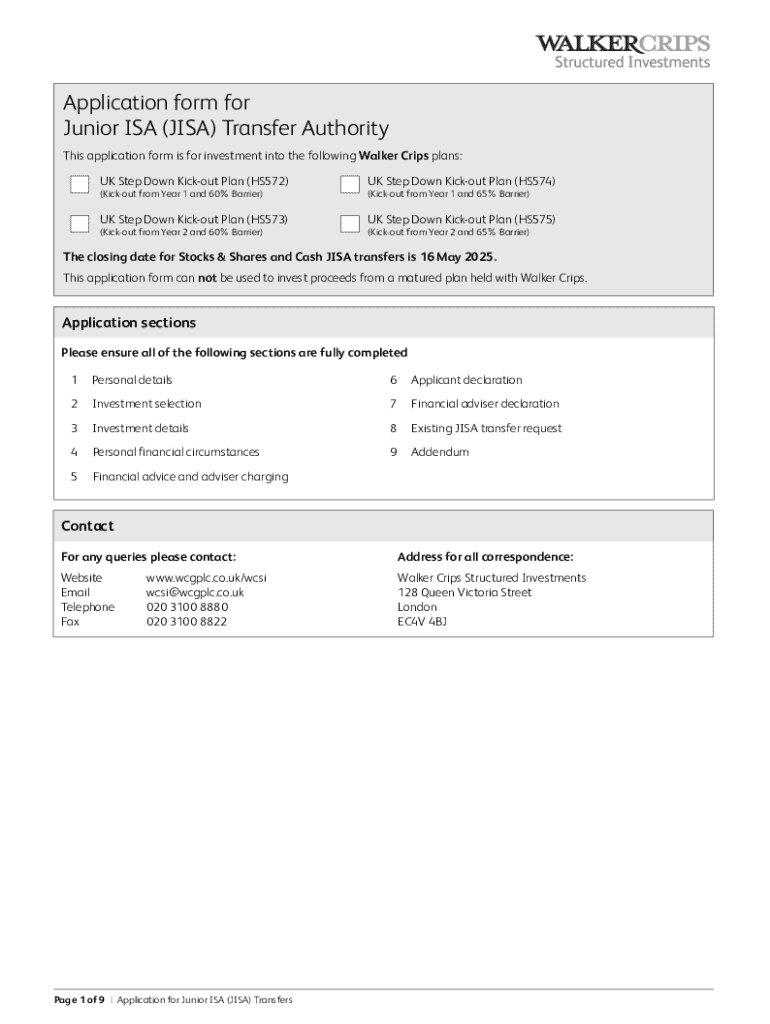

Overview of the UK Step Down Kick-Out Form

The UK Step Down Kick-Out Form is an essential document utilized in particular financial product applications, specifically the Step Down Kick-Out strategy. This form is designed to gather necessary information, which assists financial institutions in assessing risks and determining eligibility for various investment products. By effectively using this form, individuals can make informed decisions about their financial futures.

Its importance in financial planning cannot be overstated. This document provides clarity and structure, streamlining the investment process and aligning clients’ financial goals. The key features of the UK Step Down Kick-Out Form include fields for personal identification, financial details, and details pertaining to the specific investment strategy being pursued.

Understanding the UK Step Down Kick-Out Mechanism

The Step Down Kick-Out product represents a type of structured investment where returns are contingent on underlying asset performance. Essentially, it allows investors to achieve returns even when the market is down to a certain threshold. Understanding how it works is crucial for potential investors to utilize it effectively.

In simpler terms, if the price of the underlying asset remains above a predefined lower limit at the end of certain periods, investment returns are guaranteed. The benefits of employing Step Down Kick-Out strategies are multifaceted; they offer investors the potential for higher income while simultaneously reducing risk exposure compared to traditional equity investments. However, as with all investments, there are associated risks including market volatility and the possibility of capital loss.

Key information needed

To ensure the successful completion of the UK Step Down Kick-Out Form, several key pieces of information and documentation are required. Individuals must provide accurate personal identification details, which may include the National Insurance number and proof of address. Additionally, it's crucial to gather comprehensive financial information, including income statements, asset valuations, and previous investment records.

Documentation review is another critical step; potential investors should check all necessary papers to ensure compliance with financial institution requirements. The successful submission of this form depends heavily on the accuracy and completeness of the information provided, making thorough preparation indispensable.

Step-by-step instructions on completing the UK Step Down Kick-Out Form

Completing the UK Step Down Kick-Out Form can seem daunting at first, but breaking it down into manageable steps makes the process easier.

The first step is to gather all necessary information. This includes personal identification, such as a government-issued ID, and financial details, which may consist of bank statements and assets. Accurate reporting of this information is crucial for acceptance.

Step two involves filling out the form. It's important to follow the instructions provided for each section meticulously. Common mistakes include misreporting financial data or failing to sign the form correctly; these can lead to processing delays.

After this, step three requires reviewing and verifying information. Ensure that all entries are correct by double-checking against supporting documents. Finally, step four involves submission, which can usually be done online, by mail or in-person at a relevant financial institution. Confirmations regarding the submission process will be provided after submission.

Editing and managing your form

Editing your UK Step Down Kick-Out Form is straightforward, especially using tools available online. Revisions can be made easily, allowing users the flexibility to adapt their submissions as new financial information arises. Utilize pdfFiller’s advanced editing features for seamless adjustments.

For digital signing and collaboration, pdfFiller provides collaborative tools that streamline document management. Keeping your form secure and well-managed is imperative; ensure that it is stored in a safe digital environment, protecting sensitive financial information from unauthorized access.

Interactive tools for form management

pdfFiller’s interactive features greatly enhance the management of the UK Step Down Kick-Out Form. Users can edit documents in real time, upload new versions, and share for collaboration. These tools are crucial for teams working together to finalize their submission.

Using pdfFiller’s online platform, individuals can also access various editing tools, making the form completion process more user-friendly. This platform supports multiple users, enriching collaboration and minimizing the chance of errors occurring during form completion.

Frequently asked questions (FAQs)

When filling out the UK Step Down Kick-Out Form, potential submitters often have common questions. Many wonder how to ensure the form is filled out correctly or what to do if they encounter issues submitting online. To troubleshoot these common issues, reviewing the form guidelines and contacting support if needed is recommended.

Furthermore, clarifying terms and conditions related to the form can also be beneficial. Being informed helps to avoid misunderstandings about the requirements and the implications of the decisions made.

Important dates and deadlines

Keep track of key dates associated with the UK Step Down Kick-Out Form submission. Generally, financial institutions have specified deadlines, especially around fiscal year-end or quarter-end submissions. Being aware of these dates allows for timely completion and submission, preventing last-minute rush and potential errors.

Additionally, financial period considerations play a crucial role. Ensure that any relevant financial information provided reflects your status accurately to meet the timelines, increasing the chances of a favorable outcome.

Expert tips for maximizing benefits

To fully leverage the benefits of the UK Step Down Kick-Out Form, consider strategic tips from financial advisors. One approach is to align your investment choices with your overall financial goals, being mindful of the risks involved.

Additionally, staying informed about market conditions can give insights into opting for the right Step Down Kick-Out products. Regularly consulting with financial advisors will help ensure that your strategies remain relevant and effective in achieving your investment objectives.

Conclusion: Streamlining your document management

The significance of the UK Step Down Kick-Out Form in the realm of structured investment products is clear. This document plays a critical role in facilitating informed investment decisions. Leveraging platforms like pdfFiller enhances your experience, allowing you to manage, edit, and collaborate on your investment documents effectively.

With the proper tools and resources, individuals can simplify the complexities of financial documentation and ensure that they are on the right path towards achieving their financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit uk step down kick-out from Google Drive?

How can I send uk step down kick-out for eSignature?

How do I edit uk step down kick-out online?

What is uk step down kick-out?

Who is required to file uk step down kick-out?

How to fill out uk step down kick-out?

What is the purpose of uk step down kick-out?

What information must be reported on uk step down kick-out?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.