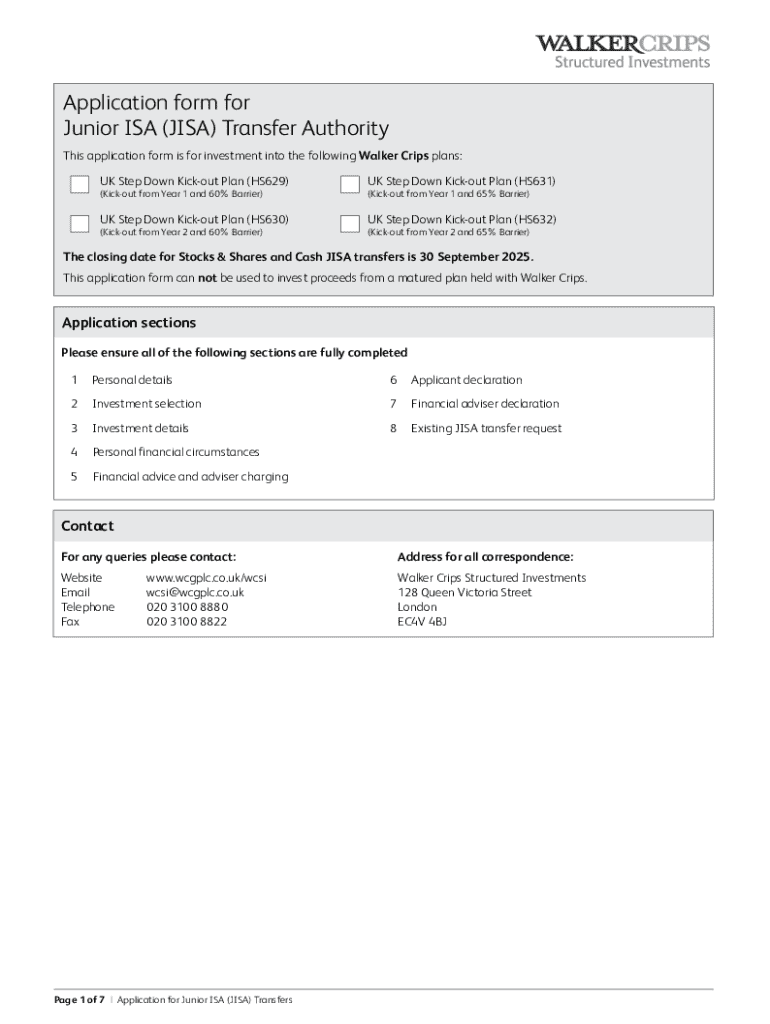

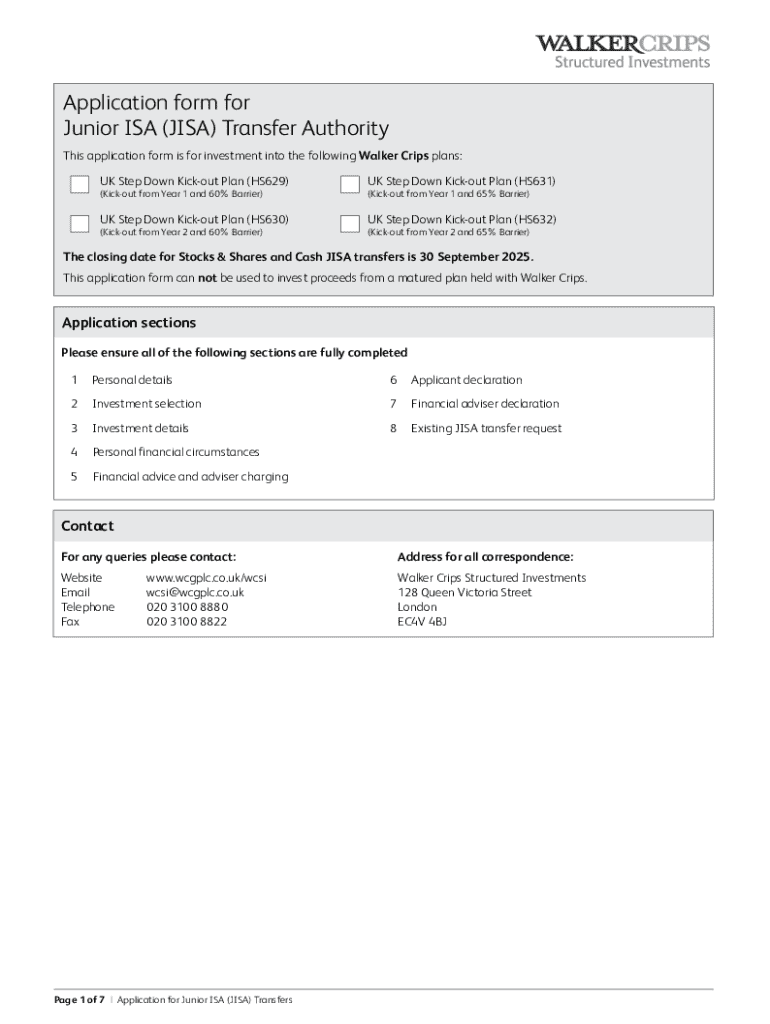

Get the free UK Step Down Kick-out Plan (HS629)

Get, Create, Make and Sign uk step down kick-out

Editing uk step down kick-out online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uk step down kick-out

How to fill out uk step down kick-out

Who needs uk step down kick-out?

Comprehensive Guide to the UK Step Down Kick-Out Form

Key information about the UK Step Down Kick-Out Form

The UK Step Down Kick-Out Form is a specialized document used in financial sectors, primarily for structured products involving step-down features. These products allow the holder to benefit from certain conditions under which the returns can be enhanced. These forms are essential for customers looking to modify their financial agreements and gain flexibility in their investments.

The primary purpose of the UK Step Down Kick-Out Form is to facilitate a seamless process for investors to request adjustments that may lead to early exit or modifications in returns based on predefined conditions. This can be advantageous in fluctuating market circumstances, allowing investors more control over their financial dealings.

Overview of the kick-out process

The kick-out process is a compelling feature within structured products, allowing investors to exit their agreements before the maturity date if certain market conditions are met. This typically means that if the underlying asset performs within a specified range, a predetermined payout occurs, which can be particularly lucrative in a bullish market.

Step-downs are an integral part of this mechanism, derating the product's performance targets over time. It makes the kick-out feature accessible earlier in the product's lifecycle if the asset performs well suiting various investor risk profiles. For instance, during high volatility, investors can leverage this form to safeguard against downturns, making it essential for dynamic investment strategies.

Important dates and deadlines

When considering the UK Step Down Kick-Out Form, understanding the relevant timelines is crucial. Investors must be aware of key submission dates to ensure their requests are timely and within the eligibility criteria. Generally, forms should be submitted well ahead of the closing dates for kick-out windows, which can vary based on the financial institution's policies.

Eligibility for kick-out features often depends on predefined dates based on performance metrics. It's advisable to regularly review the performance as deadlines approach, allowing investors to react swiftly if favorable conditions arise or if their portfolio requires adjustments—timeliness can significantly affect financial outcomes.

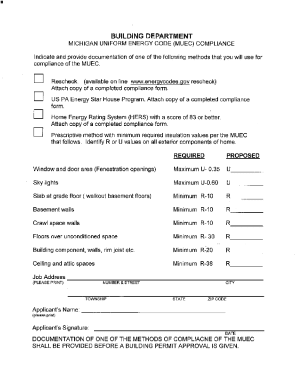

Document requirements

Accompanying your UK Step Down Kick-Out Form with the necessary documentation is essential for a smooth process. Standard requirements typically include your identification, investment account details, and specific product documentation illustrating the performance metrics. Collecting all relevant documents ahead of time saves potential delays and ensures compliance with submission guidelines.

Verification processes may demand supporting documentation that shows current investments or historical performance data. Be prepared with transaction records or past statements. Using a checklist can provide structure to this collection phase, ensuring nothing is overlooked before submission.

Step-by-step instructions for completing the UK Step Down Kick-Out Form

Completing the UK Step Down Kick-Out Form can seem daunting, but breaking it down into steps simplifies the process. Start by gathering all necessary information, such as your personal details and the specifics of the financial product you are addressing. Ensure your records are complete, as this will streamline the subsequent steps.

Next, navigate to pdfFiller's website to access the form. Once downloaded, fill it out meticulously. Pay special attention to each section. Common pitfalls include incomplete information or misinterpreted questions, which could delay processing or lead to incorrect submissions. Schedule time for a thorough review of the form before submitting.

Submitting the form

After meticulously filling out the form, it's time for submission. The choice of how to submit your UK Step Down Kick-Out Form may vary. You can opt for online submission via pdfFiller, or choose to deliver it in person at your financial institution's office. Each method has its advantages, so consider what's most convenient.

Following submission, you should receive confirmation regarding the status of your request. Whether via email or a notification in your account, this step is essential to ensure that your form has been successfully received. Keeping track of this information is important for future reference or follow-ups.

Editing and customizing your form

Navigating changes on your UK Step Down Kick-Out Form may arise from evolving financial situations. pdfFiller provides robust editing tools to make necessary amendments efficiently. From text alterations to layout adjustments, utilize the platform's functionalities to customize your form as per your requirements.

If you're working in a team, collaboration features allow multiple users to edit and finalize the form collectively. This real-time coordination ensures that all contributions are included accurately, enhancing the efficiency of the process. Additionally, the cloud storage offered by pdfFiller allows you to save different versions of your documents, providing a safeguard against data loss.

Managing responses and next steps

After submitting the UK Step Down Kick-Out Form, investors need to manage expectations regarding responses. Typically, processing times can vary, so understanding the normal timelines for kick-out evaluations helps in setting expectations. If approved, the next steps will often involve confirming payouts and adjusting strategies based on the outcomes.

Different outcomes will dictate various actions. Should the submission be rejected, having a clear understanding of the reason allows you to make necessary corrections and resubmit promptly. Careful tracking of future kick-outs and lifecycle management of your investments is crucial to maintaining a healthy portfolio.

FAQs about the UK Step Down Kick-Out Form

Several questions often arise regarding the UK Step Down Kick-Out Form. Investors frequently ask what to do if their form is rejected or if corrections are needed. Understanding the appeals process is crucial, as timing and thoroughness can streamline this effort significantly.

Another common inquiry relates to the timelines associated with form processing and approvals. It's advisable to inquire about average turnaround times specific to your financial institution to remain informed. Further, clarifications on the implications of step-downs in financial products help investors navigate their decisions more effectively.

Additional considerations and tips

When contemplating the use of the step-down feature within your financial products, consider the factors that can greatly influence your decision. These could include current market conditions, personal investment goals, or input from financial professionals. Consulting a financial advisor can provide insights tailored to your situation, further refining your strategy.

Lastly, leveraging pdfFiller’s resources can enhance the overall document management process. Familiarizing yourself with all the features available on the platform can reveal opportunities for not just filling but also strategically managing your financial documents for maximum efficiency.

Interactive tools via pdfFiller for streamlining form management

The platform pdfFiller provides an extensive suite of tools designed to streamline document management, especially in handling the UK Step Down Kick-Out Form. With features dedicated to form customization, automatic data population, and multi-user editing capabilities, users can significantly reduce the time spent drafting and revising forms. This optimization allows investors to focus more on strategic adjustments to their portfolios rather than administrative tasks.

Exclusive features for users managing financial documents can also include templates tailored specifically for structured products, ensuring compliance and accuracy at every level. Case studies reveal that utilizing these tools has led to higher rates of successful submissions and reduced turnaround times for approvals in similar financial processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my uk step down kick-out directly from Gmail?

How do I complete uk step down kick-out online?

How do I complete uk step down kick-out on an Android device?

What is uk step down kick-out?

Who is required to file uk step down kick-out?

How to fill out uk step down kick-out?

What is the purpose of uk step down kick-out?

What information must be reported on uk step down kick-out?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.