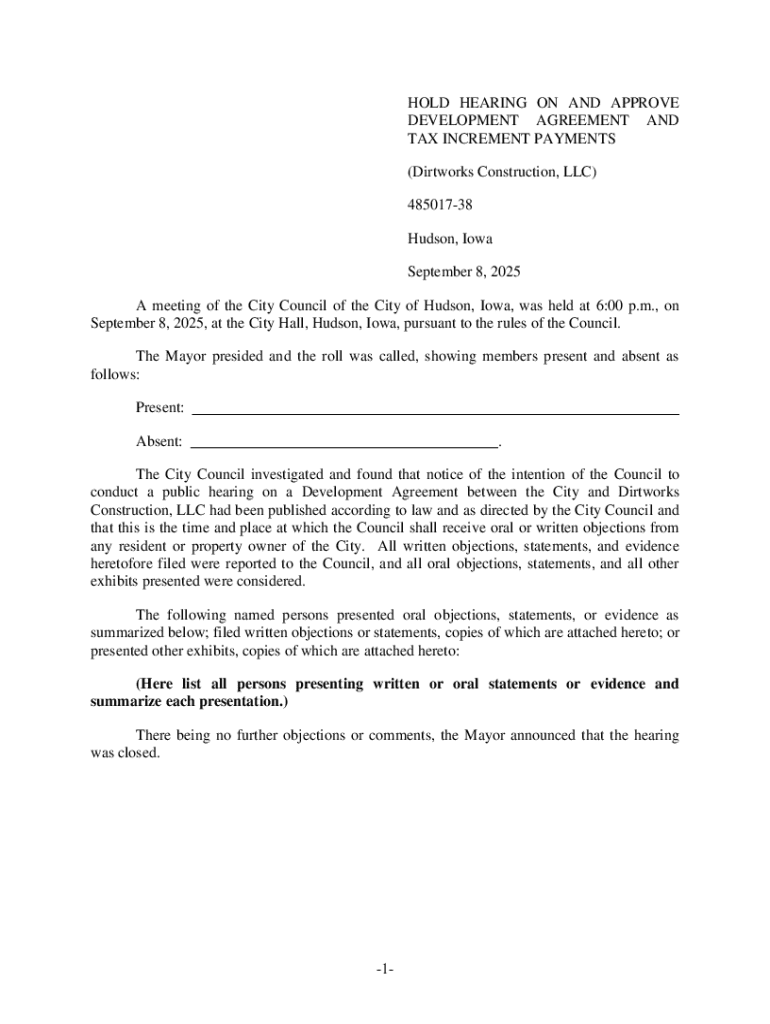

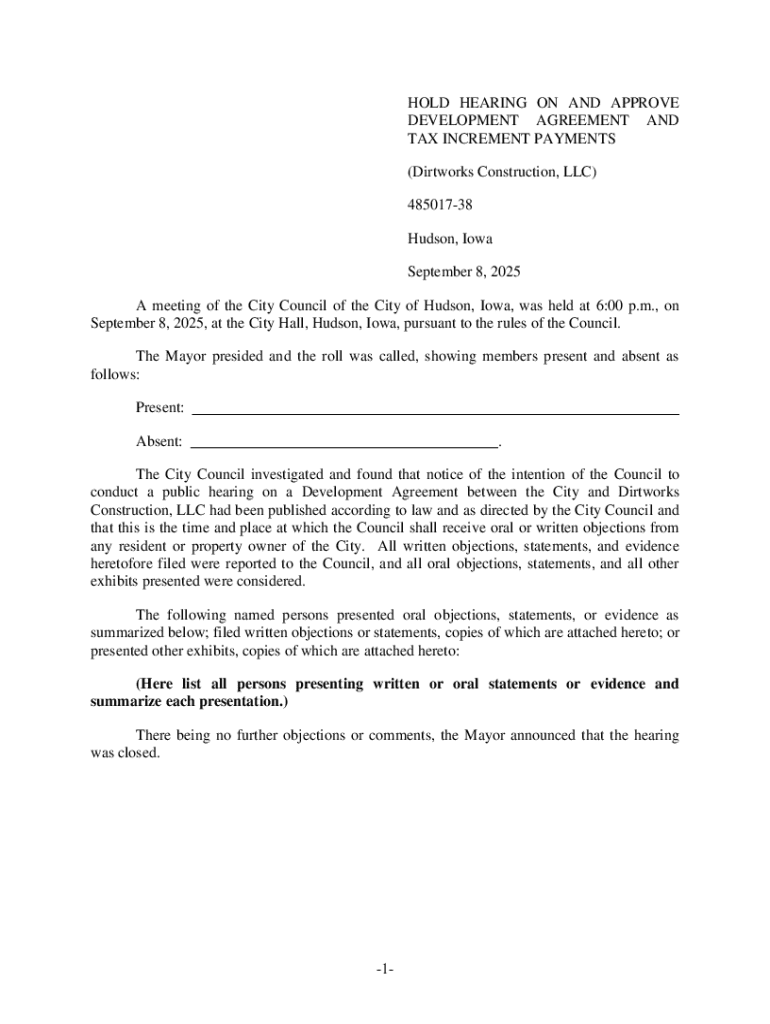

Get the free TAX INCREMENT PAYMENTS

Get, Create, Make and Sign tax increment payments

Editing tax increment payments online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax increment payments

How to fill out tax increment payments

Who needs tax increment payments?

Comprehensive Guide to the Tax Increment Payments Form

Understanding Tax Increment Financing (TIF)

Tax Increment Financing (TIF) is a public financing method that is used to subsidize infrastructure and other improvements in a designated area, aiming to revitalize communities and spur economic development. The key premise is that the increase in property value resulting from the improvements generates additional property tax revenue, which is then used to fund the same projects or infrastructure enhancements.

The primary purpose of TIF is to encourage development in blighted or underdeveloped areas where private investment might be insufficient without some incentive. By redirecting the increased property tax revenues back into the area, municipalities can finance public transportation, parks, or other community resources. Over time, this leads to a healthier economic environment and boosts the local tax base.

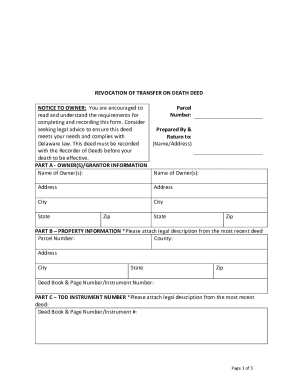

Overview of the Tax Increment Payments Form

The Tax Increment Payments Form is a crucial document used in managing and documenting financial flows resulting from TIF projects. This form outlines the financial obligations related to the TIF district and provides necessary details to local governments and other stakeholders to track performance and compliance. It plays a central role in ensuring transparency in the distribution of funds generated through property taxes.

Structurally, the form consists of various fields that capture detailed information about the project, including the total amount of the tax increment, proposed uses for the funds, and the specific projects funded through TIF revenues. Entities involved in TIF processes, including developers, municipal finance officers, and tax assessors, frequently utilize this form to submit and track expenditures.

Preparing to complete the Tax Increment Payments Form

Prerequisites

Before diving into the form, it's essential to gather all required documentation and information. This ensures that the process is streamlined and reduces the likelihood of errors during submission.

Understanding eligibility criteria

Various eligibility criteria apply to the TIF program depending on local legislation. Typically, properties must be located within designated TIF zones, and developments must demonstrate a public benefit through job creation or infrastructure improvement. Reviewing the local government criteria is essential for qualifying for tax increment payments.

Tools and resources for filling out the form

Utilizing advanced tools such as pdfFiller can enhance the efficiency of completing the Tax Increment Payments Form. With pdfFiller’s powerful editing tools, users can easily populate forms, ensuring all necessary data is correctly inputted. The platform also provides access to pre-formatted templates designed specifically for the Tax Increment Payments Form, removing much of the manual entry struggles.

Additionally, pdfFiller's e-signature capabilities allow for swift approvals facilitating collaboration among team members who may be required to authorize particular financial data before submission. This creates an efficient flow, especially in larger teams managing multiple TIF projects.

Step-by-step instructions for filling out the form

Section-by-section breakdown

Completing the Tax Increment Payments Form can be simplified by breaking it down into manageable sections. Each section corresponds to specific pieces of information needed by municipal authorities.

Reviewing and editing your form

Before submitting the Tax Increment Payments Form, it's crucial to conduct a thorough review. Utilize pdfFiller’s editing features to make necessary adjustments and ensure all information is effectively captured. Peer review options are also available, allowing collaborative input from team members, which further enhances accuracy.

Employ best practices for double-checking compliance with local regulations and ensuring that all financial data is up-to-date. Identifying and correcting errors in this phase can prevent delays and rejections during submission.

Submitting the Tax Increment Payments Form

Submission channels

The process of submitting the Tax Increment Payments Form can vary depending on local regulations. pdfFiller offers a straightforward online submission process that many municipalities now prefer. Users can easily send the completed form directly to the required government offices through the platform.

For those preferring traditional methods, there may also be options to submit via mail or fax, although these are becoming less common. It's essential to familiarize yourself with your specific local submission guidelines to avoid any complications.

Tracking your submission

After submission, tracking your form's status can provide peace of mind. pdfFiller enables users to monitor submission updates in real-time, ensuring you receive timely notifications about the form’s progress and status. This tracking capability allows you to take prompt follow-up actions if necessary.

Frequently asked questions (FAQ) about the Tax Increment Payments Form

Addressing common questions and issues related to the Tax Increment Payments Form can greatly assist users. Key topics often revolve around submission deadlines, how changes in property value affect tax increments, and the proper channels for error resolution. Having a clear understanding of these common queries ensures readiness for any complications that may arise.

Leveraging pdfFiller for ongoing document management

Beyond the immediate use of the Tax Increment Payments Form, pdfFiller provides an invaluable platform for ongoing document management associated with TIF projects. Users can create templates for future submissions, thus simplifying the process of reusing key information and keeping records organized.

Archiving previous forms is made seamless, allowing for easy access in case of audits or future planning needs. Implementing best practices for document management across teams promotes enhanced productivity and ensures consistency in handling TIF-related paperwork.

Conclusion of the Tax Increment Payments Form process

Utilizing the Tax Increment Payments Form effectively can lead to significant positive outcomes for communities involved in TIF initiatives. Properly documenting and managing TIF funds enhances transparency and allows stakeholders to better understand the economic impact of their projects.

Engaging with platforms like pdfFiller ensures not only compliance but also efficiency in managing considerable documentation complexity. Efficient practices in using the Tax Increment Payments Form can maximize benefits for both municipalities and developers alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tax increment payments online?

How can I edit tax increment payments on a smartphone?

Can I edit tax increment payments on an Android device?

What is tax increment payments?

Who is required to file tax increment payments?

How to fill out tax increment payments?

What is the purpose of tax increment payments?

What information must be reported on tax increment payments?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.