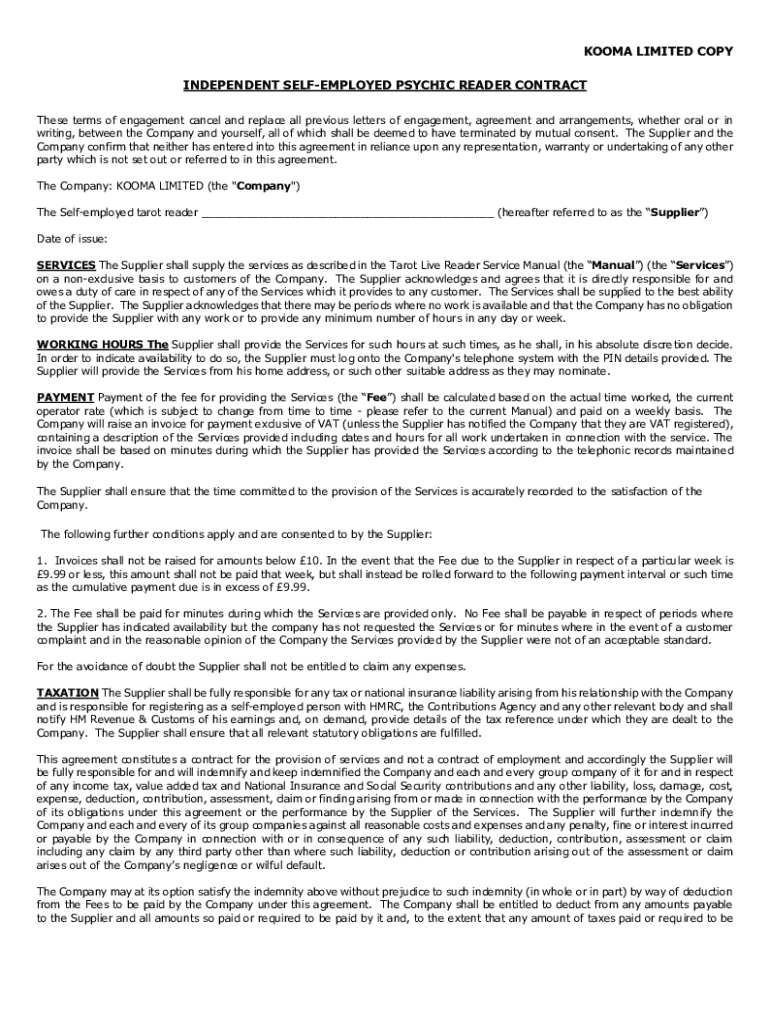

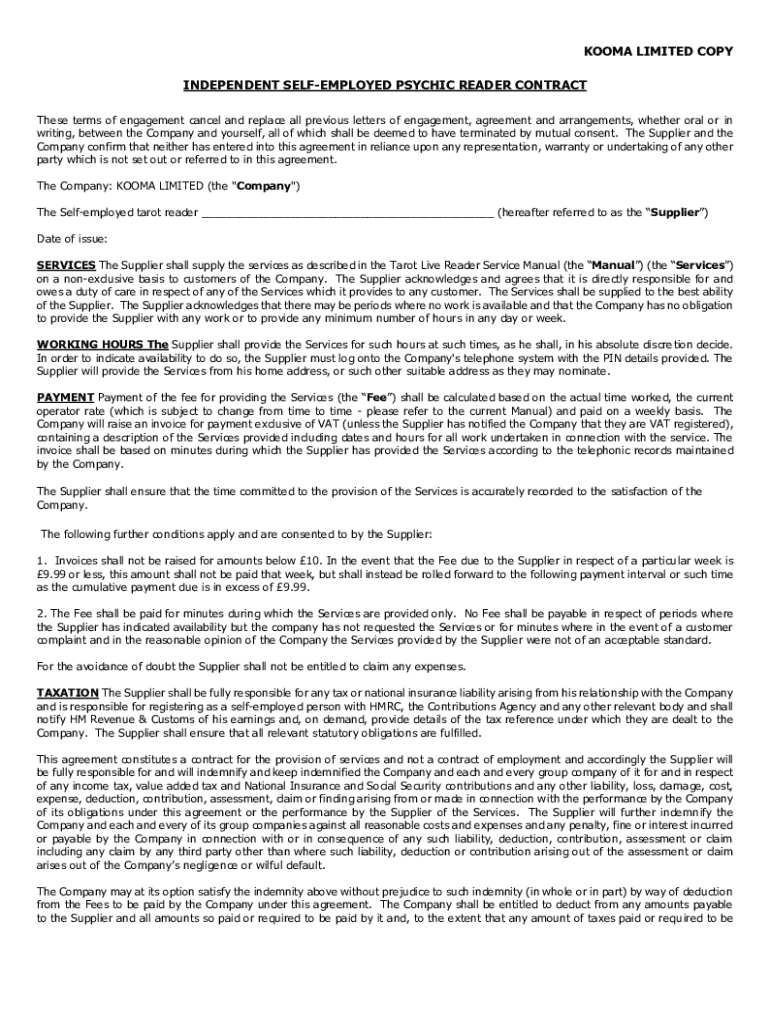

Get the free INDEPENDENT SELF-EMPLOYED TAROT READER CONTRACT

Get, Create, Make and Sign independent self-employed tarot reader

Editing independent self-employed tarot reader online

Uncompromising security for your PDF editing and eSignature needs

How to fill out independent self-employed tarot reader

How to fill out independent self-employed tarot reader

Who needs independent self-employed tarot reader?

Understanding the Independent Self-Employed Tarot Reader Form

Understanding the Independent Self-Employed Tarot Reader Form

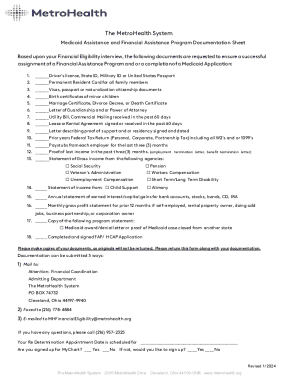

The Independent Self-Employed Tarot Reader Form serves as a vital document for tarot professionals to manage their business operations effectively. This form is specifically designed to help tarot readers keep track of their services, income, and expenses. By systematically documenting their activities, practitioners can gain clarity on their financial standing, which is crucial for any thriving tarot business.

In the world of tarot reading, financial management can often be overlooked. However, understanding how to utilize this form not only provides insights into one’s earnings but also showcases professionalism. By utilizing the Independent Self-Employed Tarot Reader Form, readers can ensure they are organized and prepared for tax seasons, enabling them to maintain compliance with the IRS and local regulations.

Key components of the Independent Self-Employed Tarot Reader Form

Every effective Independent Self-Employed Tarot Reader Form comprises essential components that cater specifically to the needs of tarot professionals. The first part is the personal information section, where readers provide their name, contact details, and business name. This vital information is necessary not only for client communication but also for creating a professional presence.

The form also includes a section dedicated to service offerings. Here, tarot readers detail the types of readings they provide, such as holistic tarot, intuitive guidance, or specialized readings, along with their pricing structure. Clear descriptions help potential clients understand what they can expect, encouraging bookings and fostering trust.

Step-by-step guide to filling out the form

Filling out the Independent Self-Employed Tarot Reader Form is straightforward. Begin with Section 1, where you will fill in your personal details, ensuring that all contact information is accurate. This is crucial for client communication and for potential collaboration with other tarot professionals. After ensuring your details are correct, proceed to Section 2, where you list your services. Clearly describe each offering, highlighting the unique aspects of your tarot readings. Engaging descriptions can significantly affect client interest.

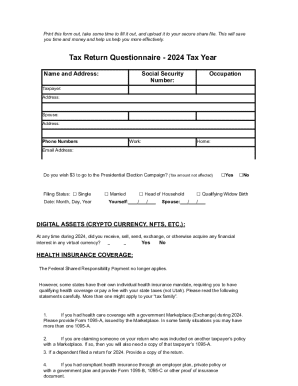

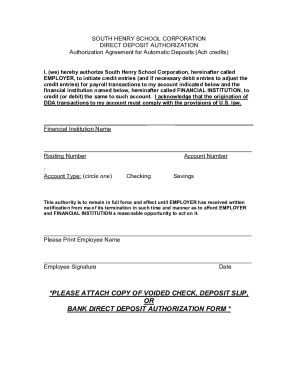

Next, move on to Section 3, documenting your income. Tracking revenue is critical; maintain a log of all readings in a segmented manner. This is where you will also note professional expenses, like tarot deck purchases or promotional materials. Section 4 guides you through the process of calculating expenses. Be sure to include all tax deductible items to maximize your potential savings come tax season. Lastly, in Section 5, utilize e-signature options to complete the form efficiently. Ensuring your form is signed before submission solidifies its authenticity.

Editing and managing the Independent Self-Employed Tarot Reader Form

Using pdfFiller for document editing enables tarot readers to customize their forms effortlessly. Users can upload custom templates unique to their business needs. Making changes to pre-filled forms becomes a simple task, ensuring that every document reflects the current state of their services and pricing. Given the dynamic nature of the tarot reading industry, the flexibility to edit content seamlessly is a significant advantage.

Moreover, version control features allow tarot professionals to keep track of document changes. With cloud-based access, users can store multiple versions of their forms and have easy access from any location. This is particularly beneficial for those who travel for events or remote readings. Collaborative features make it easy to share the document with assistants or partners for feedback and input.

Collaborating effectively with clients and teams

Collaboration plays a vital role in the service-oriented nature of being an independent tarot reader. Sharing the Independent Self-Employed Tarot Reader Form with clients ensures transparency in services offered and payment structures. The eSignature feature streamlines this process, providing clients with a professional touch and an easy way to consent to conditions of service. By having an interactive form, readers can customize paths for client engagement, making the overall experience seamless.

Incorporating a comments and feedback section within the form allows clients to provide valuable input. A concise feedback loop not only enhances service quality but also builds lasting relationships. By enabling clients to express their thoughts and suggestions, tarot readers can adjust their services accordingly, enhancing client satisfaction and retention.

Legal considerations for independent tarot readers

As an independent tarot reader, understanding legal considerations is crucial for managing your business properly. The IRS requires self-employed individuals to report their income accurately, and failing to do so can lead to penalties. It's vital to keep thorough records, not just for tax purposes, but also for legal protection should any disputes arise. This form helps you stay accountable, ensuring that all sources of income and expenses are documented.

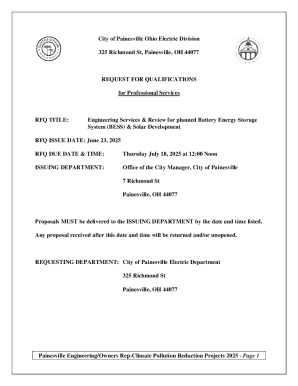

Besides reporting income, it's also important to understand local regulations regarding self-employment. Each state may have specific requirements that tarot readers need to adhere to, such as necessary permits or licenses. Comprehensive record-keeping is essential for compliance, reflecting professionalism and dedication to your craft.

Maximizing the benefits of being a self-employed tarot reader

The journey of a self-employed tarot reader comes with its own set of challenges and rewards. Building strong client relationships is key. Engage with clients regularly, follow up after readings, and incorporate feedback. A robust client base not only secures income but also provides a support network of referrals through satisfied customers, which is invaluable in the tarot reading community.

Additionally, effective financial management should be part of your strategy. Create budgets based on past readings, project future earnings, and recognize seasonal fluctuations in demand. By planning effectively, you can ensure financial stability and growth in your tarot business. Utilizing tools like pdfFiller for managing expenses can aid in achieving these financial goals.

Testimonials and experiences from other independent tarot readers

Hearing from other tarot professionals highlights the real-world applications of the Independent Self-Employed Tarot Reader Form. Many have shared success stories that underscore how structured documentation of income and expenses positively impacts their businesses. For instance, one reader reported they could identify peaks in earnings simply by reviewing their forms, allowing them to create more effective marketing strategies.

However, challenges do exist. Some readers encountered difficulties in accurately tracking expenses due to fast-paced work environments. Solutions found include dedicated document management tools like pdfFiller, which help streamline records while allowing for easy edits. Such shared experiences create a supportive community built on learning from each other's paths.

Navigating tools and applications for independent tarot readers

For tarot readers seeking to thrive in a competitive landscape, managing bookings and finances effectively is indispensable. There are various platforms available that are tailored for managing tarot appointments, such as scheduling applications that integrate seamlessly with your calendar. Such tools allow for easy oversight of appointments and can notify clients of upcoming readings, ensuring constant communication.

Additionally, integrating pdfFiller with other financial management tools enhances efficiency. Users can create invoices that align with their forms, making the financial aspect of the tarot business manageable and transparent. This ensures a cohesive approach to managing both client relationships and business finances, ultimately steering towards long-term success.

FAQs about the Independent Self-Employed Tarot Reader Form

First-time users of the Independent Self-Employed Tarot Reader Form often have a slew of questions. One common concern is understanding how to accurately report income while considering variables such as seasonal demands and the types of services offered. Readers should know that it's best to log sessions regularly to mitigate any potential reporting errors.

Another frequent inquiry relates to the deductible nature of certain expenses. Many tarot professionals can indeed write off expenses such as decks, promotional materials, and even software costs as business-related deductions. Consulting with a tax professional can provide clarity on maximizing these benefits. By addressing these questions at the outset, tarot readers can navigate their entrepreneurial journeys with confidence.

Interactive tools and resources

To further enhance your experience as an independent tarot reader, interactive tools and resources are invaluable. For example, a dedicated Tarot Reading Business Expense Calculator can help you track and categorize your business expenses, ensuring you maximize your deductions come tax season. Additionally, downloadable resources for effective client management can streamline your operational processes, allowing you to focus more on your tarot reading capabilities.

These resources not only enhance productivity but also empower tarot readers with the information needed to make informed business decisions. By leveraging such tools, independent readers can not only manage their documents seamlessly but also equip themselves with the knowledge to maximize both their financial performance and client satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the independent self-employed tarot reader in Chrome?

How do I fill out the independent self-employed tarot reader form on my smartphone?

Can I edit independent self-employed tarot reader on an iOS device?

What is independent self-employed tarot reader?

Who is required to file independent self-employed tarot reader?

How to fill out independent self-employed tarot reader?

What is the purpose of independent self-employed tarot reader?

What information must be reported on independent self-employed tarot reader?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.