Comprehensive guide to general liability claim reporting form

Understanding general liability claims

General liability claims are legal claims that arise from incidents where an individual or organization is held responsible for damages or injuries sustained by another party. These claims are essential for protecting businesses from unforeseen financial burdens that result from accidents or negligence.

The importance of general liability insurance cannot be overstated; it covers third-party bodily injuries, property damage, and personal injury claims. A well-structured general liability claim reporting form is critical, as it allows claimants to report incidents clearly and accurately, ensuring that all parties understand the nature of the claim and the evidence surrounding it.

Bodily injury – Claims arising from injuries sustained by people due to your business operations.

Property damage – Claims resulting from damages to property that occurs during your business activities.

Personal injury – This can include claims related to emotional distress or reputational harm caused by your business.

Understanding the legal implications of filing a claim is crucial. A poorly submitted claim can lead to denied coverage, legal battles, and could even result in financial loss for your business.

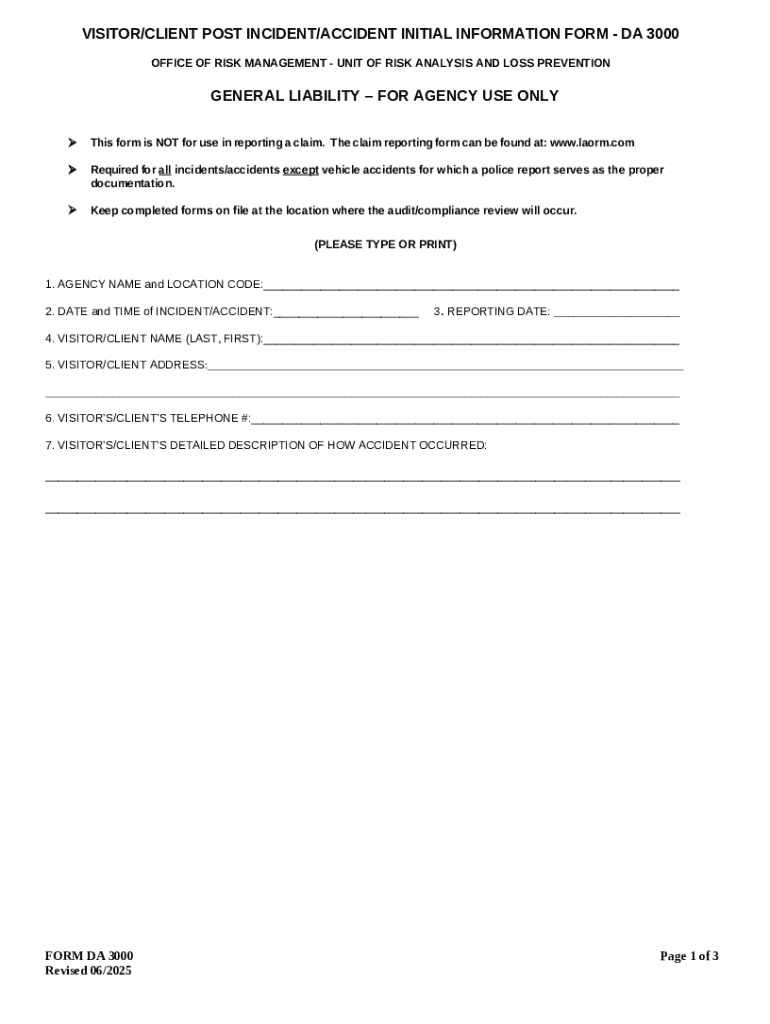

Key components of a general liability claim reporting form

Every general liability claim reporting form includes several key components that are critical for processing a claim efficiently. Accurate and thorough information is paramount; missing or incomplete sections can lead to delays in claim resolution.

Includes the full name, contact information, and address of the individual reporting the claim.

A detailed account of the incident's nature, including all relevant circumstances and context.

A clear estimate of the damages incurred as a result of the incident, which must be supported by documentation.

Accurate reporting is not just beneficial; it’s essential for a smooth claims process. Failure to provide complete information can lead to repeated requests for further details and elongate the claims cycle.

How to fill out the general liability claim reporting form

Filling out the general liability claim reporting form should be approached methodically. Here's a step-by-step guide to ensure you cover all necessary details:

Provide claimant information, including your name, address, and contact information.

Detail the incident, including the date, time, and location, along with other involved parties and witnesses.

Document damages, highlighting types of damages to report, and attach supporting evidence such as photos and receipts.

Add any additional information necessary, including your insurance policy number and any previous related claims.

This structured approach minimizes errors, making it easier for both you and your insurance provider to process the claim efficiently.

Editing and customizing your claim form

After filling out your general liability claim reporting form, it’s wise to use editing tools, such as those offered by pdfFiller, for a final review. This ensures clarity and precision in your submission.

Use pdfFiller’s editing tools to correct any mistakes or add any additional comments necessary to clarify your claim.

Add signatures and annotations where required, particularly if there are multiple stakeholders involved in the claim.

Save and share your customized form easily for record-keeping and communication purposes.

The customization features within pdfFiller empower users to personalize their forms not just for aesthetic purposes, but also for enhancing the functional clarity essential in claims communication.

Submitting your general liability claim

Once your claim form is completed and polished, the next step is to submit it. Choosing how to submit effectively can make a difference in how fast your claim is processed.

Best practices for submission include understanding whether to submit via email or online. Online submission can often streamline the process.

Once submitted, don't hesitate to follow up with your insurance provider to confirm receipt and inquire about the expected timeline.

After submission, be prepared to provide any further documentation or clarification needed as your claim is investigated.

Proper submission not only expedites the claims process but also builds a positive rapport with the insurance provider, which is invaluable when navigating potential disputes.

Common mistakes to avoid when filing a claim

Several common pitfalls can impede the successful filing of a general liability claim. Avoiding these mistakes can save you time and frustration down the road.

Incomplete information on your claim form can lead to delays and complications. Always double-check your work.

Delays in reporting incidents can undermine your position. Ensure you file your claim promptly, as many insurers have strict reporting timelines.

Underestimating damages may lead to insufficient claim support. Always document thoroughly and include all relevant evidence.

Staying aware of these common mistakes not only helps in streamlining the claim process but also ensures you maximize your potential settlement.

Interactive tools for claim management

Managing your claim effectively can significantly affect its outcome. Utilizing interactive tools such as those offered by pdfFiller can enhance your experience.

Track your claim status online to stay updated on its progress and respond to any requirements swiftly.

Utilize collaboration features in pdfFiller that allow multiple team members to contribute and communicate effectively during the claim process.

Access support for claim management directly through pdfFiller, ensuring you have the necessary guidance throughout the process.

Interactive management tools not only make the claims process smoother but also empower users with the resources they need to approach their claims confidently.

Legal and compliance considerations

Understanding your rights and obligations when filing a general liability claim is critical. The process can be legally complex, and clarity on compliance is vital to avoid pitfalls.

It's essential to keep well-organized records of all communication and documentation submitted during the claims process.

Consider the role of legal counsel when handling claims, especially if your case involves significant damage or liability disputes.

Stay informed about local laws regarding general liability claims, as these can influence your reporting obligations.

Incorporating legal considerations into your claim process helps mitigate potential headaches down the line, reinforcing the importance of due diligence.

Navigating the claims process

The claims process can often seem daunting, but understanding the overall claims cycle can make it much more manageable. Knowing what to expect at each stage demystifies the experience.

After filing your claim, the insurance provider will investigate the validity of the claim, reviewing submitted evidence and circumstances.

Expect to receive updates about your claim throughout the investigation. Be proactive in asking questions to clarify timelines and next steps.

In cases of disputes, know the steps you can take. This might involve discussions with your insurer or legal escalation if necessary.

Understanding this process is crucial as it enables you to effectively navigate potential challenges, reinforcing a structured approach to claim management.

Feedback and testimonials

User experiences with pdfFiller during claim submission frequently highlight how the platform simplifies what can often be a convoluted process.

Testimonials often reflect increased user satisfaction from streamlined editing and submission processes.

Success stories showcase how users managed to reclaim damages efficiently using pdfFiller's features.

Many users appreciate the support and guidance provided via the platform, affirming its role in easing claim management.

Feedback from users fosters confidence in new clients, establishing pdfFiller not only as a tool but as an indispensable partner in the claims process.

Frequently asked questions (FAQs)

Addressing common queries about general liability claims can clarify many uncertainties individuals may face during the reporting process.

What are the critical documents needed to file a claim?

How long does the claims process usually take?

What should I do if my claim is denied?

Clarifying these misconceptions ensures that individuals are well-equipped to manage their claims effectively, reducing anxiety related to potential complexities.

Contact information for further assistance

For those needing further assistance, pdfFiller offers multiple support avenues.

Reach out to pdfFiller’s support team directly through their website for personalized assistance.

Explore additional resources available on the pdfFiller website for more information on navigating the claim process.

Having these contacts readily available helps users gain confidence and ensures they are never alone in their claims journey.