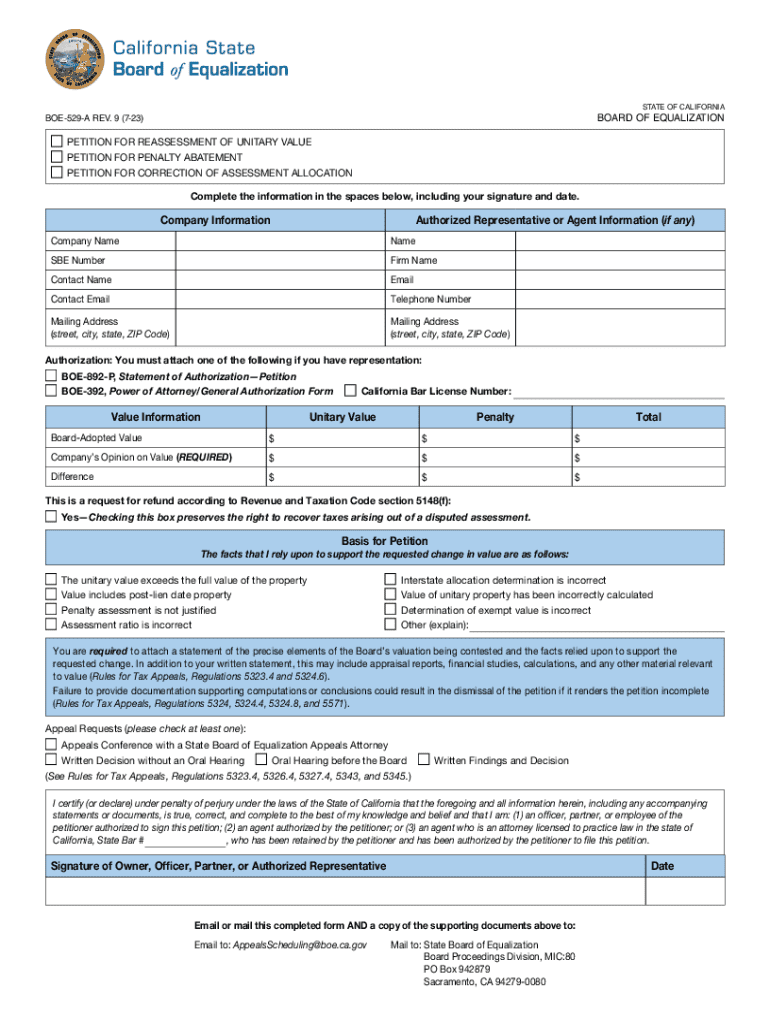

Get the free State Board of Equalization Petition for Unitary Property Reassessment. BOE-529-A - ...

Get, Create, Make and Sign state board of equalization

Editing state board of equalization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state board of equalization

How to fill out state board of equalization

Who needs state board of equalization?

Navigating the State Board of Equalization Form: A Comprehensive How-to Guide

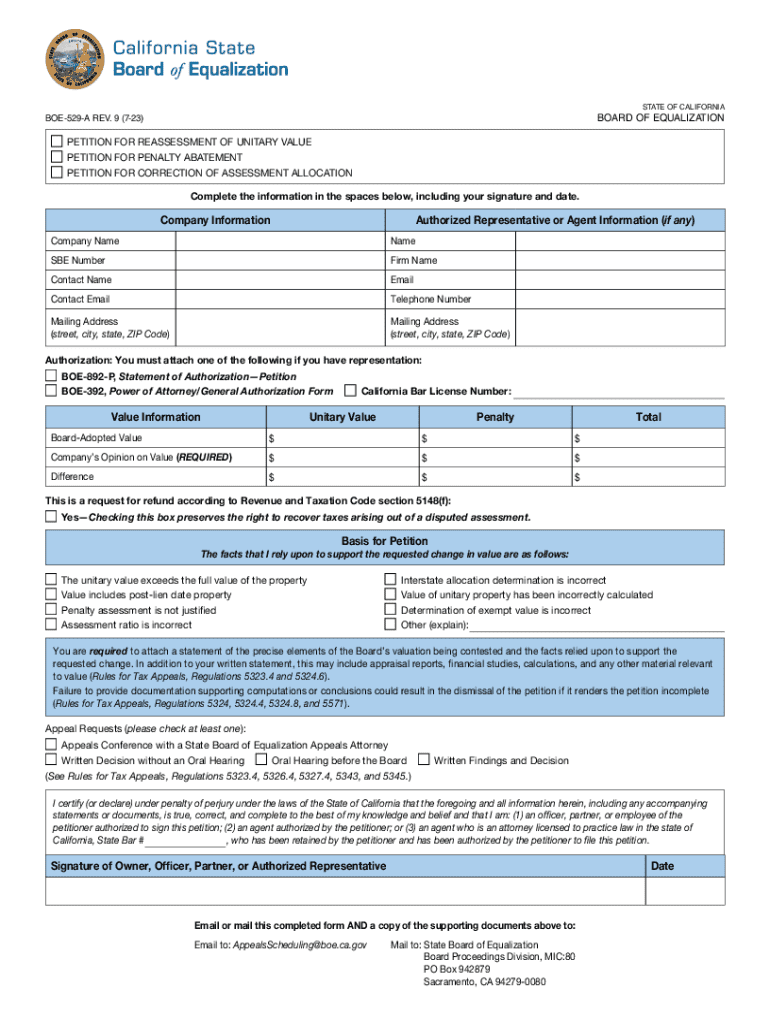

Understanding the State Board of Equalization Form

The State Board of Equalization (SBOE) form is a crucial document for property owners, enabling them to participate in the property tax assessment process. Essentially, it provides a structured way for property owners to appeal assessments made by county assessors, ensuring they are not overcharged for taxes based on inflated property values. This form serves as a pivotal vehicle in upholding fair taxation, which ultimately supports the equitable distribution of public resources.

The importance of this form cannot be overstated. It allows individuals and businesses to formally challenge their property assessments, advocating for corrections that reflect the true market value. Understanding the nuances of this form is vital for both property owners and real estate professionals alike.

Getting started with the State Board of Equalization Form

Understanding who needs to use the State Board of Equalization form is key. Primarily, it is targeted at homeowners and property owners who believe their property’s assessed value is incorrectly high. This form is not only important for individuals but also for businesses that own real estate and wish to contest the assessments made by local county officials.

Every property owner, including residential and commercial real estate entities, stands to benefit from familiarity with this process. Fortunately, the form can be accessed easily through various online resources. Many state government websites host downloadable versions of the form, while local government offices also provide hard copies to ensure accessibility for all property owners.

Step-by-step guide to filling out the form

Before filling out the State Board of Equalization form, it is essential to gather all necessary information. This typically includes personal identification details such as your name, address, and tax identification number. Subsequently, you'll need specifics about the property in question, including a complete description and any relevant assessment information received from your local county assessor.

Once you have gathered this data, proceed to complete the form section by section. Start with Section 1, where you provide personal information. Next, move to Section 2 to offer details pertaining to the property. Lastly, Section 3 requires a clear explanation of your claims and reasons for the appeal, making it essential to be thorough and precise.

Editing and adjusting your State Board of Equalization form

After filling out the State Board of Equalization form, consider utilizing tools like pdfFiller’s editing functions. Through pdfFiller, you can easily modify your PDFs. This platform allows you to make seamless adjustments, enhancing your document before submission. Interactive tools make it simple to correct any mistakes or update information as needed.

Moreover, collaboration is straightforward with pdfFiller. Sharing the form with colleagues or advisors for feedback is made easier, making sure that the submission is accurate and complete before sending it to the State Board.

Sign and submit your form

Once your State Board of Equalization form has been accurately completed, the next step involves signing it. Digital signatures are increasingly accepted, enhancing the submission process by eliminating the need for physical document handling. PdfFiller provides a streamlined method for signing, ensuring that your document is ready for submission without unnecessary delays.

When it comes to submission, understanding the guidelines is essential. You typically can submit your form via postal mail or through designated online platforms. Be mindful of deadlines, as missing them could result in the denial of your appeal. Therefore, it’s vital to keep track of timelines closely.

Managing your submission

After submission, tracking the status of your State Board of Equalization form is wise. Most state boards provide a mechanism for checking the status of your submission online. This feature allows you to stay informed about any developments and to quickly respond if further information or clarification is required.

In the event your form is denied, it’s crucial to understand the appeal process. The appeal steps typically involve submitting additional information, potentially addressing the reasons for the denial directly. Being prepared for reapplication means reviewing your case carefully and ensuring that your documentation is comprehensive.

Utilizing additional resources

For further assistance, reaching out to the State Board of Equalization is a practical step. Most boards provide contact information for inquiries, as well as frequently asked questions to help guide property owners through the complexities of the assessment process. These resources are invaluable for clearing doubts and understanding procedural nuances.

For more complex cases, consulting legal resources may be necessary. Various platforms offer legal guides specific to property tax matters. Professional assistance can provide insights into intricate cases, maximizing the chances of a successful appeal.

Enhance your document management experience

Utilizing pdfFiller for your document management not only simplifies the process of filling out the State Board of Equalization form, but it also enhances your overall experience with document creation. As an all-in-one cloud-based tool, pdfFiller enables seamless management of your forms and other documents, ensuring security and compliance while saving time.

In addition to simplifying form completion, pdfFiller offers capabilities that allow you to integrate with other platforms, expanding your document management abilities. As technology continues to evolve, utilizing such tools can future-proof your document processes, making your workflow more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my state board of equalization directly from Gmail?

How do I make edits in state board of equalization without leaving Chrome?

Can I sign the state board of equalization electronically in Chrome?

What is state board of equalization?

Who is required to file state board of equalization?

How to fill out state board of equalization?

What is the purpose of state board of equalization?

What information must be reported on state board of equalization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.