Get the free PF & ESIC declaration certificate We, M/s. CSK Facility ...

Get, Create, Make and Sign pf amp esic declaration

How to edit pf amp esic declaration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pf amp esic declaration

How to fill out pf amp esic declaration

Who needs pf amp esic declaration?

Understanding the PF and ESIC Declaration Form: A Comprehensive Guide

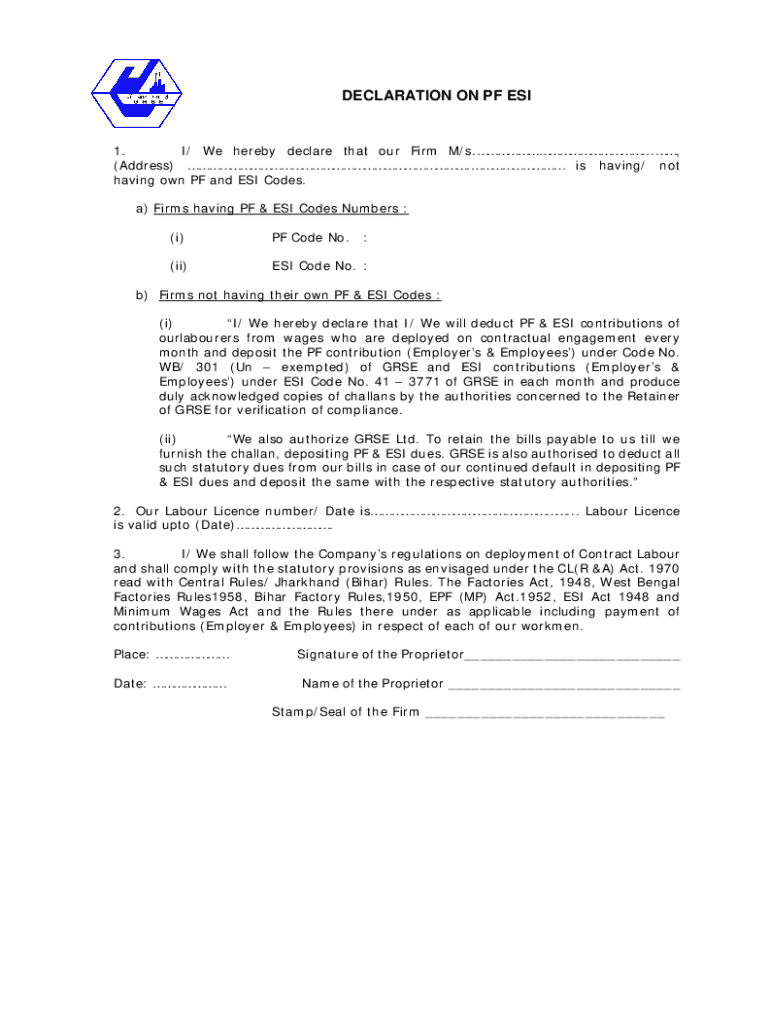

Understanding the PF and ESIC declaration form

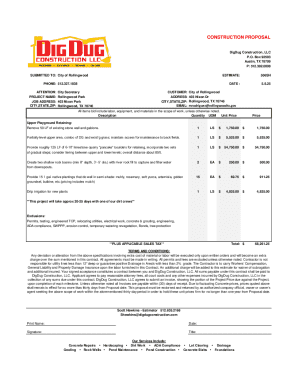

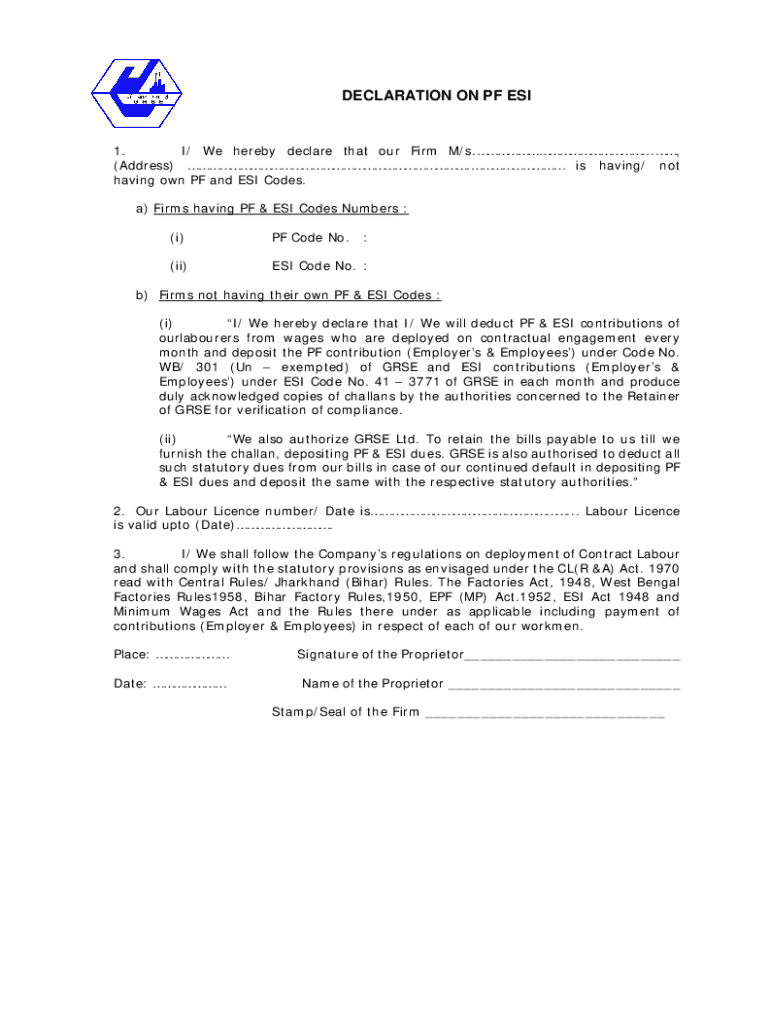

The PF (Provident Fund) and ESIC (Employee State Insurance Corporation) declaration form is a pivotal document for employees and employers within India’s labor ecosystem. This form acts as a template through which employees declare their intent to enroll in these schemes, thereby securing their financial and medical benefits. The PF is a savings scheme initiated by the government of India, encouraging employees to save for retirement, while ESIC provides health insurance and medical benefits in times of need.

These frameworks protect employees' interests while placing certain obligations on employers, ensuring a stable workforce and a healthier society. By offering these declarations, employees can allocate their contributions efficiently, reaping the full benefits of these statutory safety nets.

Overview of the PF and ESIC declaration process

The declaration form must be completed under various circumstances, such as when a new employee joins an organization, or during any subsequent changes in employment status. For instance, if an employee has switched jobs or undergone a change in salary, this form becomes essential to ensure accurate and timely contributions to the PF and ESIC accounts.

The information captured within the form is crucial, typically including personal identification details, employment information like the name of the company, the employee's role, and the necessary PF and ESIC contribution amounts. Proper completion of this form lays the groundwork for future financial benefits, and maintaining accurate records is vital to avoid complications during withdrawals or claims.

Step-by-step guide to filling out the PF and ESIC declaration form

Before diving into filling out the PF and ESIC declaration form, it's essential to gather all required documents. This may include your personal identification certificates, your previous employment details, and any other documentation relevant to your current status. Understanding your rights is equally important; all employees are entitled to enjoy the benefits these schemes offer, so it is your right to declare accurately.

Start with the personal information section, where you will enter your full name, date of birth, and address. Ensuring accuracy here is crucial as any discrepancies could lead to delays in processing your contributions. The next section will focus on your employment details: specify your company’s name and your designation. If you are transitioning from a previous job, mention your prior employment accurately to maintain a consistent employment history.

Next, you’ll need to declare your PF contributions based on your earnings. Calculate your monthly earnings and understand the statutory percentages to ensure you’re declaring the right amount. Similarly, for the ESIC contributions, make sure you have your salary details handy and declare like-wise. It is also prudent to double-check your entries to avoid common mistakes such as incorrect names or missed fields.

Editing and signing the declaration form

Once the declaration form is filled, it’s time to edit and finalize your document. Digital solutions such as pdfFiller provide a user-friendly platform for seamless editing. Users can easily adjust any fields on the declaration form, ensuring all the information is correct before submission. If any worries arise about editing, pdfFiller offers an intuitive interface, making modifications straightforward.

After ensuring that the form is entirely accurate, you must sign it to authenticate your declarations. Electronic signatures have gained immense popularity due to their efficiency and legality. To sign your PDF, simply use pdfFiller's eSigning service, where you can add your signature by typing your name, drawing it directly, or uploading an image file of your signature. This digital signing method not only saves time but also expedites the document submission process.

Submitting the PF and ESIC declaration form

Submitting your PF and ESIC declaration form can be done through various channels, including online submissions to your company’s HR department or in-person drops at designated offices. Many organizations facilitate an online process, ensuring that forms are submitted swiftly without delays, aligning with modern digitization efforts. Regardless of the method chosen, retaining a copy of the submitted form for your records is essential.

After submission, confirmation is key. Employees should receive acknowledgment from their employers or the relevant department confirming receipt of the declaration. This can help mitigate any future issues. Utilizing tools that allow you to track submission status, like pdfFiller, ensures you are always up-to-date on every stage of your document management.

Troubleshooting common issues

Mistakes happen, and if your submission is rejected for any reason, a structured response can assist with resolution. Start by contacting your HR department or the appropriate authority to understand the reason for rejection. Sometimes errors stem from incorrect information being entered, like mismatched signatures or unresolved employment details. Clear and proactive communication is vital.

If you cannot resolve the issue at the organizational level, exploring support services offered via pdfFiller or local government representatives can provide alternative solutions. Being informed about your resources serves you well when navigating bureaucratic challenges related to your PF and ESIC declaration.

Maintaining your PF and ESIC records

Keeping accurate records of your PF and ESIC contributions is vital for future reference and audits. This documentation can come in handy when withdrawing funds or claiming health benefits. Tight organization of these documents can streamline future processes, reducing delays, and enhancing your financial planning.

Employing tools for document management, like pdfFiller, can significantly ease the burden of maintaining these records. The platform allows users to store documents securely online, ensuring that they can access their PF and ESIC records from anywhere, simplifying the management process.

FAQs about the PF and ESIC declaration form

Addressing common questions can help demystify the PF and ESIC declaration process. Many individuals often inquire about the exact contribution percentages for PF and ESIC or what to do if they switch jobs frequently. Knowing the current contribution rates is essential, with PF typically at 12% of basic salary, while ESIC contributions vary depending on income levels.

Another concern is understanding deadlines related to declarations. Generally, the declaration form should be filled immediately upon hiring, or during salary updates to guarantee accurate processing. Additionally, clarifications around related terms such as 'employment status' or 'eligibility' for different contributions can further assist users in navigating their responsibilities.

Community discussions and insights

Engaging with community forums regarding the PF and ESIC declaration process can uncover new tips and experiences from fellow employees. Users often share their insights around navigating complex situations, such as misunderstandings during submission or discrepancies in contribution amounts. This exchange can empower individuals with firsthand accounts and solutions to enhance their understanding.

There is also value in sharing personal experiences related to PF and ESIC issues, which can spark further discussions and solutions within the community. Highlighting scenarios of successful claims, bumps in the road during the declaration process, or simply asking questions can lead to valuable insights for many users trying to navigate their employee benefits effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete pf amp esic declaration online?

How do I edit pf amp esic declaration online?

How do I edit pf amp esic declaration on an iOS device?

What is pf amp esic declaration?

Who is required to file pf amp esic declaration?

How to fill out pf amp esic declaration?

What is the purpose of pf amp esic declaration?

What information must be reported on pf amp esic declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.