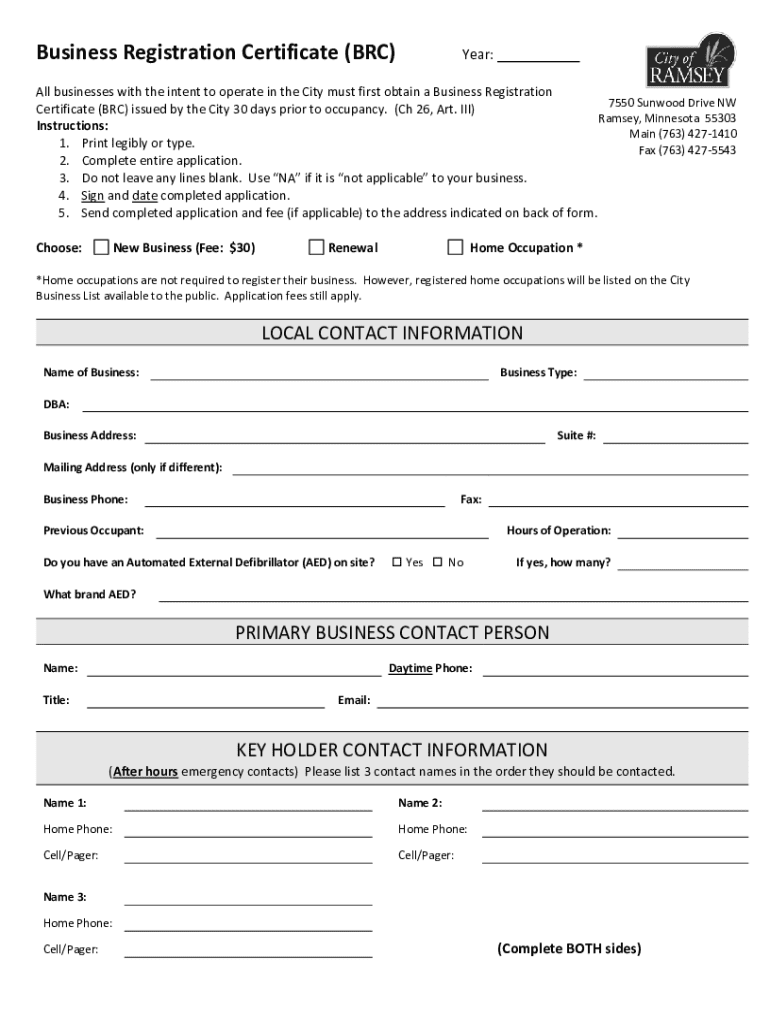

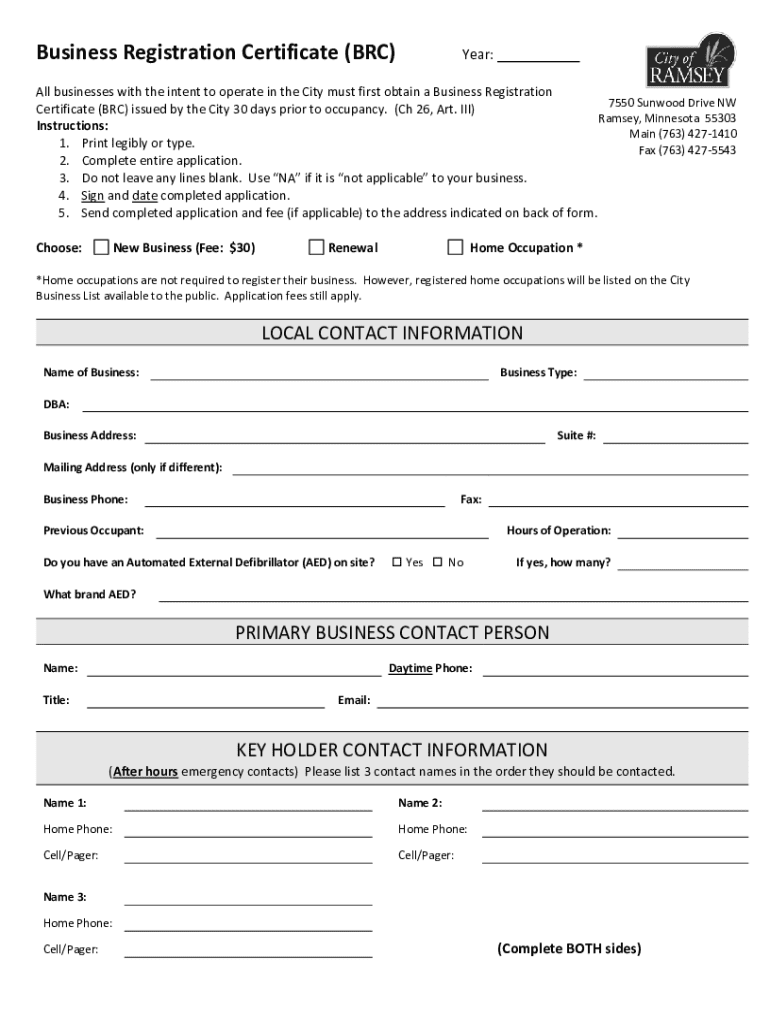

Get the free Business Registration Certificate (BRC) Year: - Ramsey

Get, Create, Make and Sign business registration certificate brc

How to edit business registration certificate brc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business registration certificate brc

How to fill out business registration certificate brc

Who needs business registration certificate brc?

Business Registration Certificate (BRC) Form: A Comprehensive Guide

Understanding the business registration certificate (BRC)

A Business Registration Certificate (BRC) is an official document that recognizes an organization's formation and legitimacy within the jurisdiction it operates. The BRC serves several vital purposes, such as confirming the lawful existence of a business and allowing it to take part in various activities like banking, taxation, and obtaining insurance. The significance of the BRC extends beyond mere formalities; it communicates essential information to stakeholders, such as clients and suppliers, affirming that the business operates within the legal framework.

Legally, almost every new venture, whether a sole proprietorship or a partnership, must apply for a BRC. Different jurisdictions may have specific regulations regarding business registration. Typically, these regulations stipulate requirements relating to accurate business information, applicable fees, and necessary documentation that must be provided during the registration process.

Eligibility for applying for a BRC

Understanding who is eligible to apply for a Business Registration Certificate is crucial. The eligibility typically extends to several types of business structures, including individuals, corporations, and partnerships. Individuals may register as sole proprietors, while corporations need to follow more complex procedures that typically involve multiple stakeholders. Partnerships, often composed of two or more individuals running a business together, must also adhere to specific legal guidelines when applying for their BRC.

Before diving into the application process, applicants must ensure they possess the necessary documentation. Commonly required documents include identification proofs, business plans, and any previous business registration numbers. Additionally, providing accurate business information—such as the business name, type, and addresses—plays an important role in securing a successful application.

Step-by-step guide to completing the BRC form

To initiate the BRC application, the first step is obtaining the BRC form. This form can usually be acquired from official government websites or local registration offices. Alternatively, users can access it effectively using pdfFiller, streamlining the process of downloading and managing forms online.

Filling out the BRC form requires careful attention to detail. Each section must be completed accurately to prevent delays or rejections. For instance, when selecting a business name, ensure it complies with local naming conventions and is unique. Address and contact information must be correct, as this serves as the primary communication channel for the registration authority. Ownership structure details must clearly state the primary stakeholders and their respective roles within the organization. Additionally, taxation and licensing questions should be answered truthfully to facilitate a smooth review process.

Common mistakes can lead to application delays or rejections. Inaccuracies or omitted information regarding the business name, contact details, or ownership structure are often pivotal missteps. Therefore, it is advisable to double-check the entire form before submission and solicit feedback from colleagues or mentors.

Submitting your BRC application

Once you have completed the BRC form, the next step is submission. Depending on your country's regulations, submission can typically be done physically at designated government offices or through online platforms. Utilizing tools such as pdfFiller simplifies the online submission process, making it straightforward and secure.

Processing times can vary significantly based on the volume of applications and the workload of the registration office. Generally, applicants should expect processing times ranging from a few days to several weeks. Fees associated with the BRC application will also depend on your region and the type of business structure being registered. Payment methods are usually flexible, with options for credit card, bank transfers, or physical payments at designated locations.

Tracking your BRC application status

After submitting your BRC application, staying informed about its status is vital. Most jurisdictions offer simple online tracking tools that allow you to check the progress of your application. Keeping independent records can also be beneficial. If there are extended delays or concerns, direct communication with the registration authority is encouraged.

What to do after receiving your business registration certificate

Upon receiving your Business Registration Certificate, take immediate steps to verify the details outlined in the document. Any discrepancies should be addressed with the registration office as soon as possible to avoid complications in the future. It's crucial to protect your BRC from unauthorized use; consider storing it in a secure location and only sharing it when absolutely necessary.

A valid BRC serves various compliance purposes within business operations. It is often required for opening a business bank account, obtaining business licenses, and securing other critical partnerships. Keeping track of renewal dates is equally important, as lapses could lead to penalties or complications in business dealings.

Troubleshooting common issues with BRC applications

Even after thorough preparation, some BRC applications may face rejection. Common reasons for such outcomes often include insufficient documentation, inaccuracies on the form, or eligibility issues. In such instances, applicants should carefully review the rejection notice, identify the issues stated, and address them before reapplying. Engaging with an advisor who has experience in business registration can also help alleviate confusion.

If a BRC is lost after issuance, don't panic. The process for reissuing a lost certificate is relatively straightforward. Contact your registration authority and provide them with the necessary details pertaining to your business and the loss of the BRC. Most jurisdictions allow for expedited processing in cases involving lost certificates.

Comprehensive document management via pdfFiller

pdfFiller streamlines the BRC management process by offering unique tools for editing, signing, and collaborating on documents. Users can easily customize their BRC forms using pdfFiller's editing tools, making it simple to create legally compliant documents. Collaboration with team members is also a breeze. With pdfFiller, individuals can share access to necessary documents and manage contributions effectively.

Additionally, storing BRC forms securely in the cloud further assures simplicity and safety. Accessing your documents from anywhere ensures that even if you're away from the office, your business registration documents are readily available, further enhancing operational efficiency.

Frequently asked questions (FAQs) about the BRC

Navigating the BRC process can lead to various questions for applicants. Key inquiries often relate to the specific documentation required, the waiting period for processing, and methods to amend or update previously submitted applications. Lesser-known requirements, such as local variations in the business registration process, are also a common source of confusion.

It is highly recommended for prospective business owners to review official resources and consult with local experts to ensure compliance. Being well-informed can not only facilitate an easier application process but also aid in avoiding unexpected hurdles.

User experiences and testimonials

Real stories from individuals and teams who successfully obtained their BRC using pdfFiller illustrate the advantages of using this platform. Users praise how the tools helped simplify their registration experience and allowed for efficient input and edit of relevant information. Best practices shared by these users often include thorough initial checks on business names and maintaining close communication with registration authorities throughout the application to avoid pitfalls.

Testimonials from satisfied users often reflect the feeling of empowerment offered by pdfFiller, as it enables seamless editing, e-signing, and document collaboration. These experiences epitomize how effective document management can lead to a smooth and timely business registration process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business registration certificate brc straight from my smartphone?

Can I edit business registration certificate brc on an iOS device?

How do I fill out business registration certificate brc on an Android device?

What is business registration certificate brc?

Who is required to file business registration certificate brc?

How to fill out business registration certificate brc?

What is the purpose of business registration certificate brc?

What information must be reported on business registration certificate brc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.