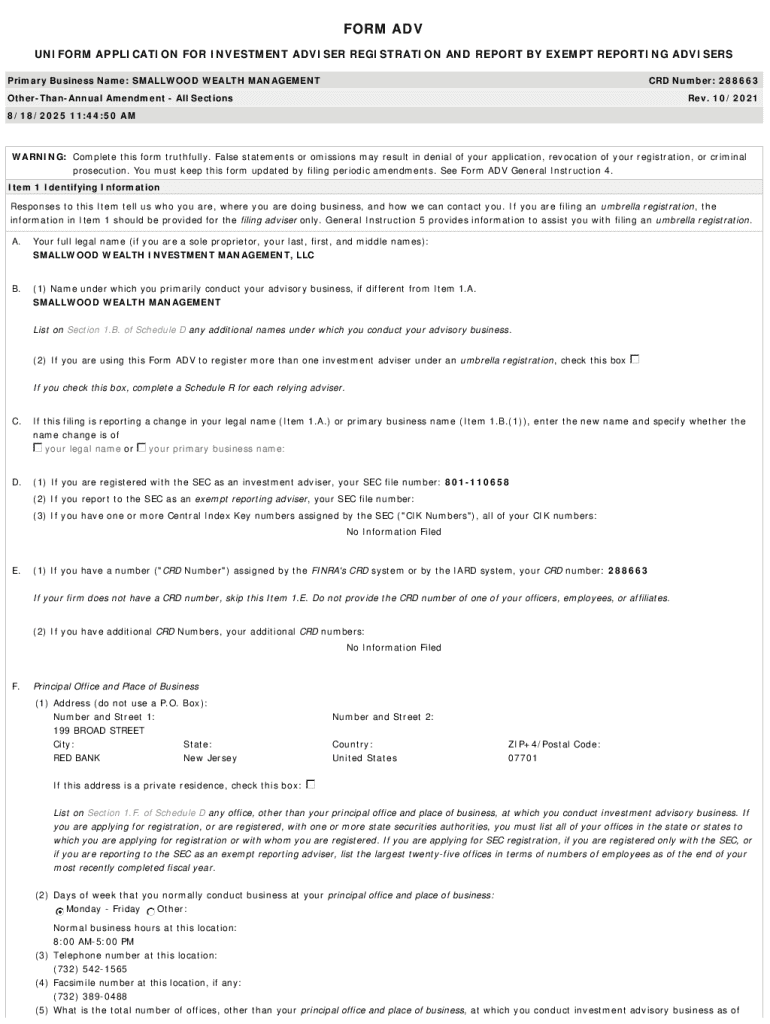

Get the free SMALLWOOD WEALTH MANAGEMENT

Get, Create, Make and Sign smallwood wealth management

Editing smallwood wealth management online

Uncompromising security for your PDF editing and eSignature needs

How to fill out smallwood wealth management

How to fill out smallwood wealth management

Who needs smallwood wealth management?

A comprehensive guide to the Smallwood wealth management form

Understanding the Smallwood wealth management form

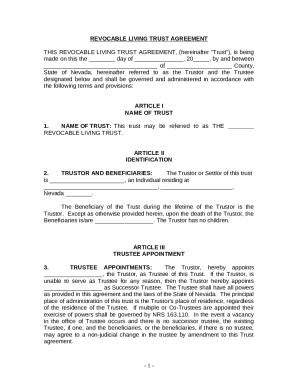

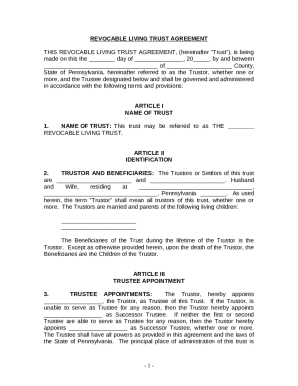

The Smallwood wealth management form is a crucial tool designed for individuals and families aiming to strategically manage their financial portfolios. This document encompasses essential information, providing a snapshot of personal and financial circumstances that can inform long-term wealth planning. Accurately completing this form is vital, as the details directly impact the creation of a tailored financial strategy.

With the right information at hand, wealth management professionals can provide personalized advice to optimize investment performance, navigate tax implications, and plan for estate transfer objectives. Common applications of the Smallwood wealth management form include retirement planning, investment management, and ensuring that financial goals are aligned with an individual’s risk tolerance.

Key components of the Smallwood wealth management form

The Smallwood wealth management form is divided into several key components that capture pertinent data. Each section serves a specific purpose in shaping a comprehensive financial profile.

Step-by-step guide to filling out the Smallwood wealth management form

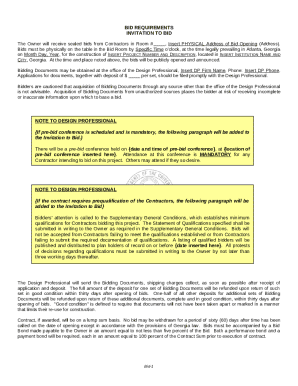

Filling out the Smallwood wealth management form can seem daunting, but with the right preparation, it can be a streamlined process. Here’s a step-by-step guide to help you effectively complete the form.

Interactive tools for form completion

In the digital age, utilizing interactive tools can significantly enhance the process of completing the Smallwood wealth management form. Platforms like pdfFiller provide a user-friendly experience that simplifies document handling.

Common mistakes to avoid when filling out the form

While filling out the Smallwood wealth management form, being vigilant about common pitfalls can save you time and ensure accuracy. Here are some mistakes to avoid.

After submission: what to expect

Once you submit the Smallwood wealth management form, there are several important steps and considerations to keep in mind. Understanding the post-submission process can help manage your expectations.

Leveraging the Smallwood wealth management form for future financial planning

Using the Smallwood wealth management form extends beyond initial completion; it should be an integrated part of your ongoing financial journey. Regularly leveraging this form can optimize your financial planning.

Customer testimonials and success stories

Individuals and teams who have utilized the Smallwood wealth management form often share positive experiences regarding its impact on their financial planning. Here are some testimonials that highlight these successes.

FAQs about the Smallwood wealth management form

As financial planning often involves intricate details, it’s common to have questions about the Smallwood wealth management form. Below are some frequently asked questions.

Conclusion

The Smallwood wealth management form is a pivotal element in structuring an effective financial strategy. By accurately completing this document and leveraging interactive tools provided by pdfFiller, you empower yourself to make informed decisions about your wealth management journey. Embrace this opportunity to craft a tailored financial plan that evolves with your aspirations and helps secure your financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute smallwood wealth management online?

How do I make changes in smallwood wealth management?

How can I fill out smallwood wealth management on an iOS device?

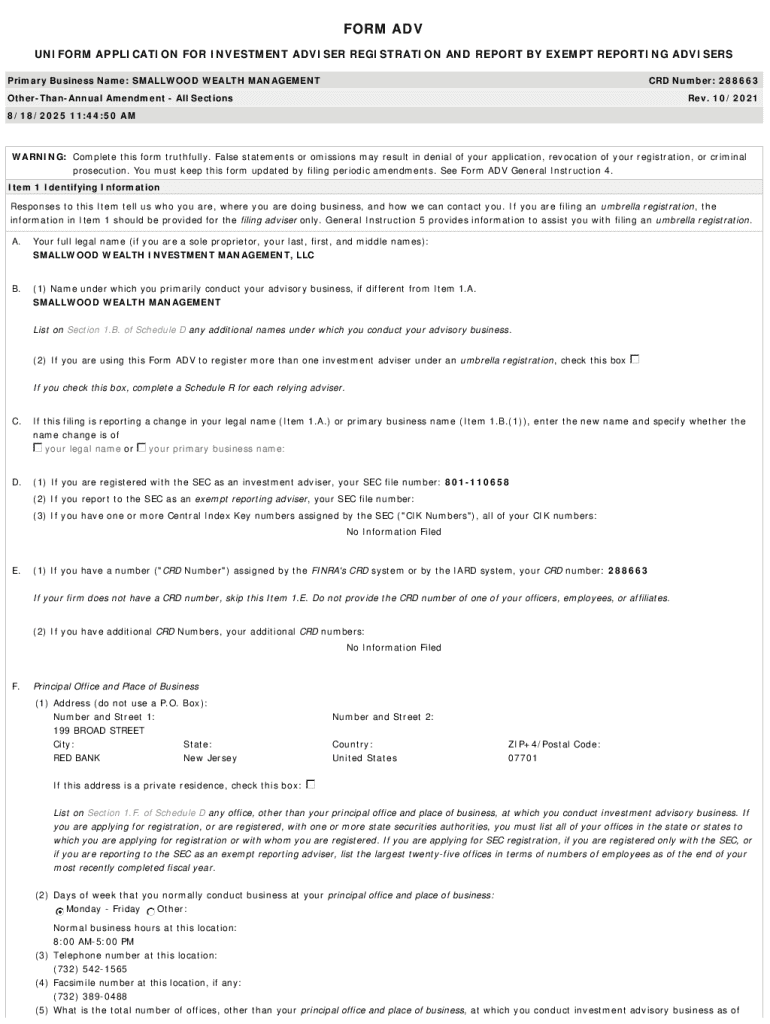

What is smallwood wealth management?

Who is required to file smallwood wealth management?

How to fill out smallwood wealth management?

What is the purpose of smallwood wealth management?

What information must be reported on smallwood wealth management?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.