Get the free homestead tax credit - Wisconsin Legislative Documents

Get, Create, Make and Sign homestead tax credit

How to edit homestead tax credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out homestead tax credit

How to fill out homestead tax credit

Who needs homestead tax credit?

Homestead Tax Credit Form - How-to Guide Long-Read

Understanding the Homestead Tax Credit

The Homestead Tax Credit is a financial relief mechanism that allows eligible homeowners to reduce their property tax bills. This credit is designed to make homeownership more affordable, particularly for primary residences. It helps to alleviate the financial burden of property taxes, ensuring that homeowners can allocate their funds more efficiently.

Eligibility for the Homestead Tax Credit varies by state, but generally, to qualify, homeowners must demonstrate that the property is their primary residence. Additionally, certain states impose income limitations, which may affect the amount of credit received. Understanding these criteria is essential for homeowners looking to benefit from this program.

The benefits of the Homestead Tax Credit are multifaceted. Homeowners can enjoy property tax reductions, which can be significant, ultimately leading to long-term financial savings. By reducing annual tax bills, homeowners may have more discretionary income to invest in home improvements or other financial goals.

Preparing to apply for the Homestead Tax Credit

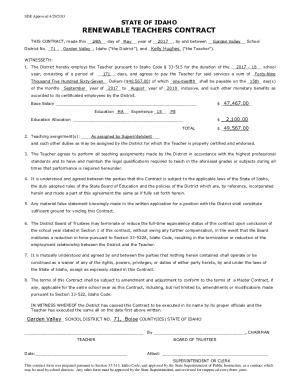

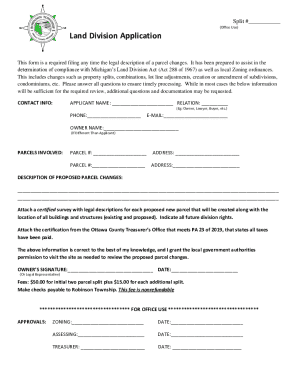

Before diving into the application process, it's crucial to gather the necessary documentation. This prepares you for a smooth application experience. Common documents needed include proof of identity such as a driver’s license or a utility bill, along with a recent property tax assessment to verify the home's valuation.

It's also important to note that application processes can differ significantly by state or county. Some areas may require additional documentation or have distinct forms to fill out. Understanding these local variations can save time and effort in your application process.

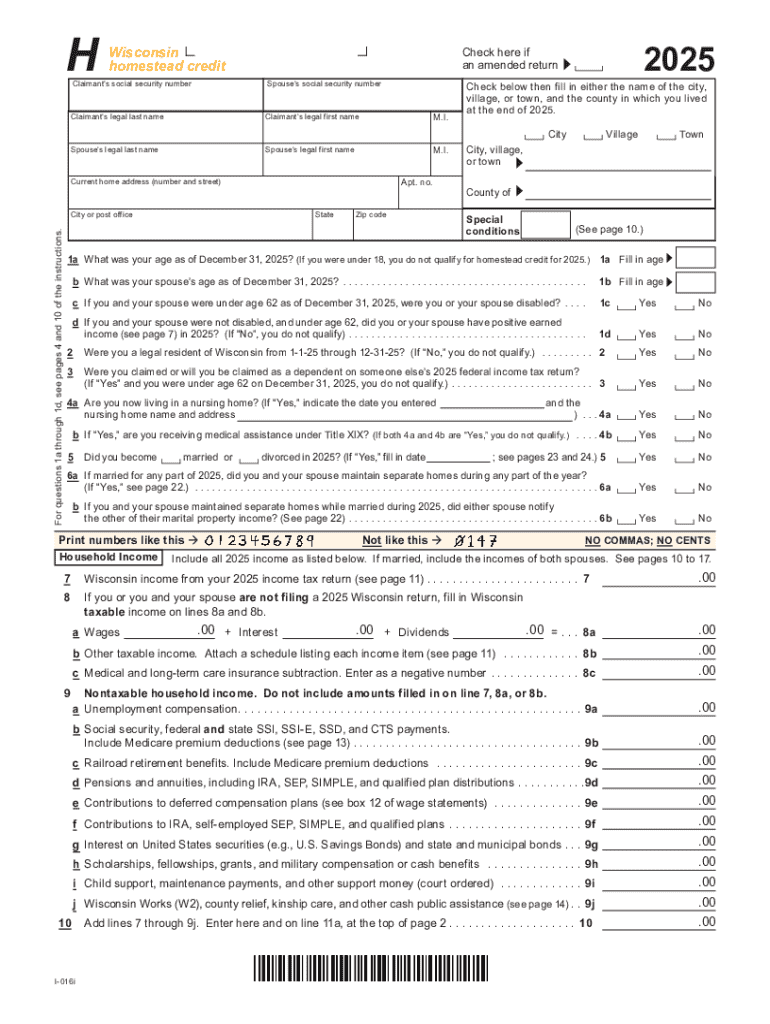

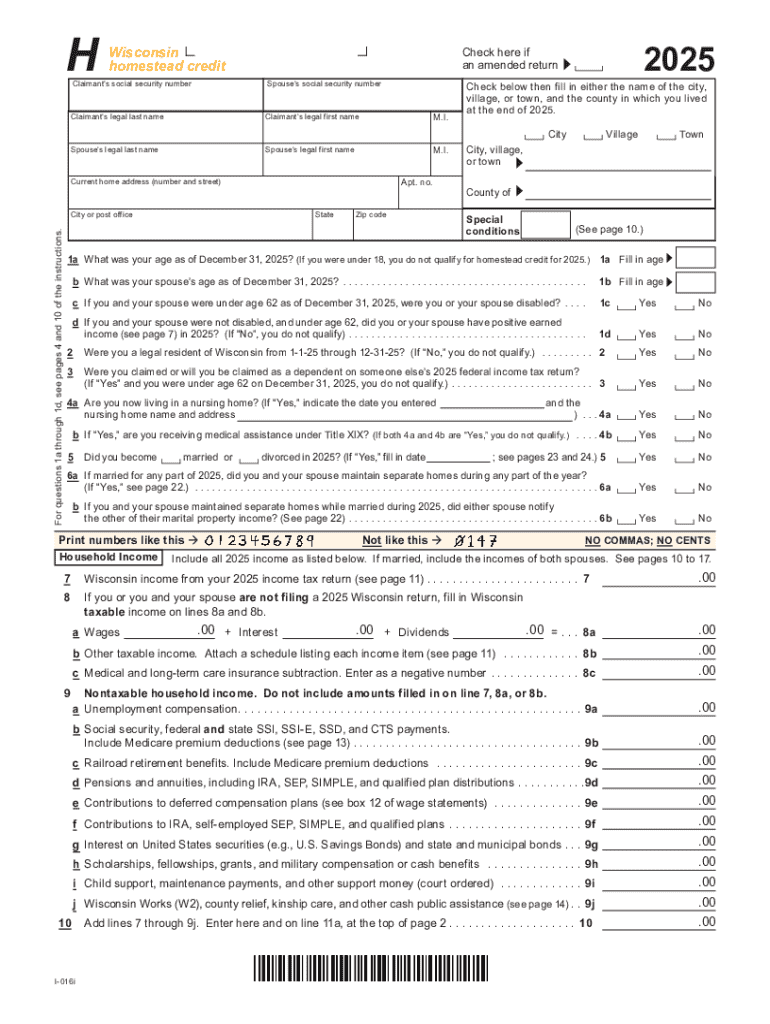

Step-by-step guide to filling out the Homestead Tax Credit Form

To begin the application process, you need to download the Homestead Tax Credit form. You can access this form through the Maryland Department of Assessments and Taxation website. For efficient PDF download, consider using pdfFiller, which can simplify the process by providing a user-friendly interface for downloading and filling forms.

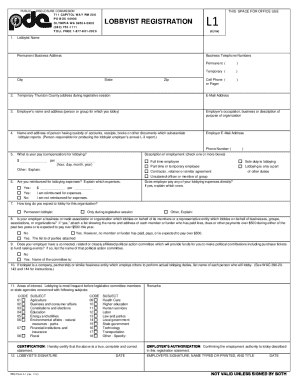

Filling out the form requires attention to detail. Start with the Personal Information Section, where you will enter your name, address, and contact information. Next, move to the Property Description Section, which details the property’s assessment and any exemptions or deductions you may be claiming.

Avoid common pitfalls when completing the form; ensuring all required information is filled in is crucial. Missing or inaccurate information may lead to application delays or even denial of the credit.

Editing and collaborating on your application

After filling out the Homestead Tax Credit form, you might want to make changes or collaborate with others before finalizing the application. Utilizing pdfFiller’s editing tools can make this process seamless. The platform allows users to edit PDFs effortlessly—whether it’s correcting typos or adding additional information.

Besides, you can collaborate on the document directly within pdfFiller. This feature is especially useful if you need a second opinion or assistance from family members or co-owners. Remember to add signatures and dates to your application, as eSigning is a convenient option provided by pdfFiller, ensuring that your application is valid and carries the necessary authorizations.

Submitting your Homestead Tax Credit application

Once your application is complete, it’s time to submit it. There are several submission methods available, depending on your locality. Many states now offer online submission through dedicated portals, which can be a faster option. For those preferring traditional methods, mailing your application is still a viable choice.

When mailing your application, ensure you follow best practices, such as using a secure envelope and obtaining a tracking number for peace of mind. After submission, it’s essential to track your application status; you can often do this online or by contacting your local tax office. Knowing the expected timelines for processing can help manage your expectations.

Common questions and troubleshooting

As you navigate the Homestead Tax Credit application process, you may encounter challenges or questions. Frequently asked questions often revolve around what to do if your application is denied. In such cases, it’s advisable to carefully review the denial notice, as it typically outlines the reasons for rejection and potential steps for appeal.

Additionally, addressing discrepancies in property assessment can be critical. If you believe your property has been inaccurately assessed, it’s crucial to gather evidence to support your case and approach your local assessment office promptly.

Post-application tips

After submitting your Homestead Tax Credit application, keeping detailed records and documentation is crucial. Tracking communications, submission confirmations, and any correspondence you have with tax authorities can save you from potential headaches down the line. In case of any future audits, having organized records will prove invaluable.

Understanding renewals and ongoing eligibility is also essential. Each year, homeowners may need to verify their continued eligibility for the credit. Stay informed about any changes in your financial situation, property valuation, or local regulations that may impact your qualification for future credits.

Leveraging pdfFiller for document management

With pdfFiller, managing your document lifecycle becomes effortless. Save and store important documents securely within the platform, ensuring that your Homestead Tax Credit application and any associated paperwork are easily retrievable when needed. Access these forms anytime and from anywhere, making it convenient to handle your documentation.

By leveraging pdfFiller as a comprehensive document solution, you empower yourself to manage not only your Homestead Tax Credit Form but a variety of other important documents. This can lead to a more organized financial life and peace of mind when it comes to managing taxes and credits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit homestead tax credit from Google Drive?

How do I fill out homestead tax credit using my mobile device?

Can I edit homestead tax credit on an iOS device?

What is homestead tax credit?

Who is required to file homestead tax credit?

How to fill out homestead tax credit?

What is the purpose of homestead tax credit?

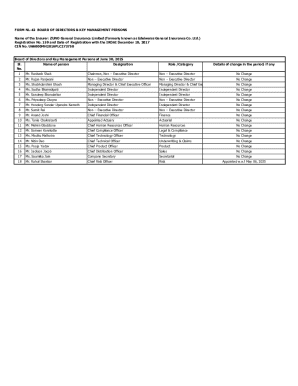

What information must be reported on homestead tax credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.