Get the free Property Tax Postponement - State Controller's Office - CA.gov

Get, Create, Make and Sign property tax postponement

How to edit property tax postponement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax postponement

How to fill out property tax postponement

Who needs property tax postponement?

A Comprehensive Guide to Property Tax Postponement Forms

Understanding property tax postponement

The property tax postponement program allows eligible homeowners to defer payment of property taxes on their residence. This can be invaluable for those facing financial challenges, particularly individuals over the age of 62 or those with disabilities. The program is designed to provide financial relief by enabling qualified individuals to put off tax payments until they sell their home, transfer ownership, or pass away.

Eligibility for this program often hinges on specific criteria. Generally, to qualify, applicants must be either seniors, disabled, or meet income thresholds that indicate financial need. Each state may have different regulations and requirements, so it’s essential to consult your local tax authority or the state controller’s office for detailed information.

Program facts and eligibility

Determining your eligibility for the property tax postponement program begins with an understanding of the criteria set forth by your local government. Most often, individuals who are at least 62 years old, persons with permanent disabilities, or low-income homeowners will meet the qualifications. Additionally, an evaluation of household income—including all sources—will be necessary.

Documentation is essential for verifying eligibility. Applicants may need to provide income statements, proof of residence, and any relevant medical documentation if claiming disability. It’s wise to gather these materials before initiating the application process, as having all necessary items will streamline your submission.

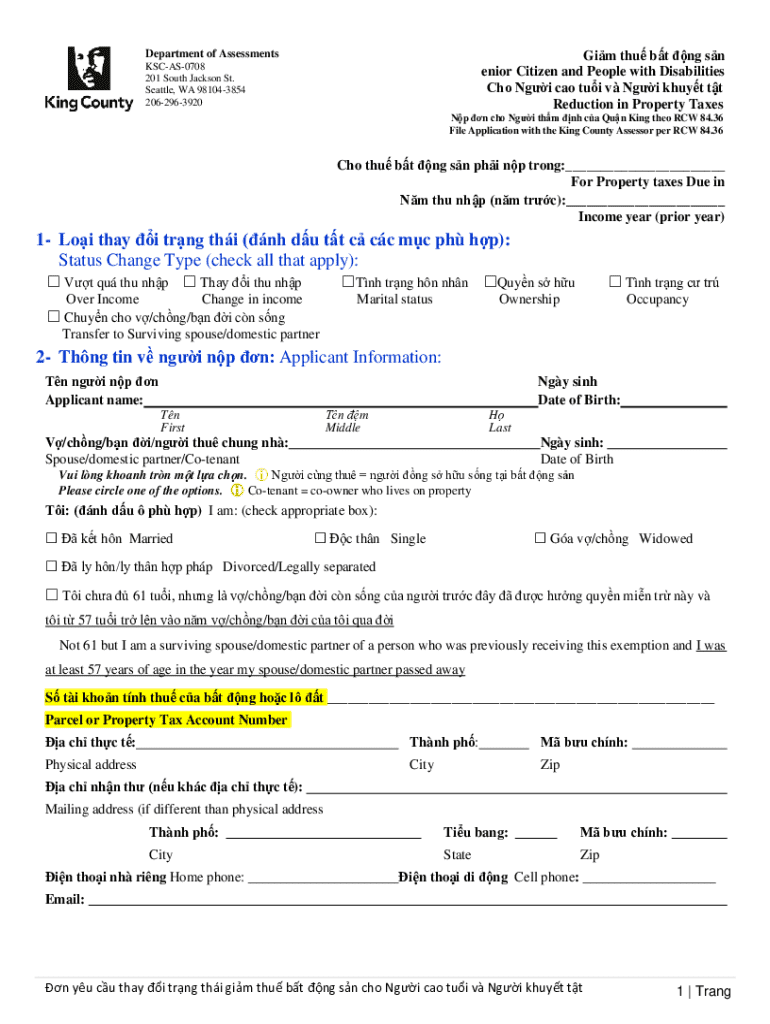

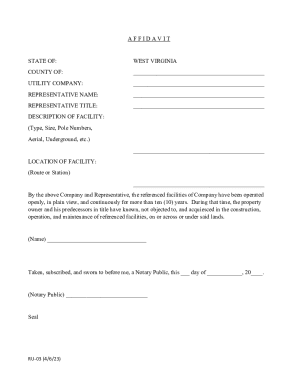

The property tax postponement form explained

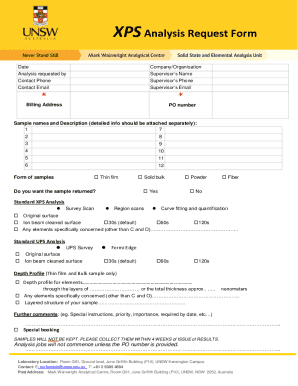

The property tax postponement form can appear complex at first glance, but understanding its structure can simplify the process. The form typically includes sections that request personal information, financial information, and property details. Each section is essential to assess whether you qualify for the program and the amount of tax you may postpone.

Familiarizing yourself with common terms found in the form will enhance your understanding and help eliminate confusion. Key terms include 'postponement amount,' which refers to the total amount of property tax you wish to defer, and 'property tax collector,' the official responsible for managing tax records and payments.

Step-by-step instructions for filling out the form

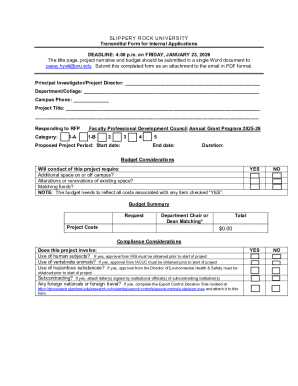

Before diving into filling out the property tax postponement form, it’s crucial to prepare adequately. This includes compiling all necessary documents and personal information. You should ensure that your financial records are up to date and reflect your current situation.

Deciding whether to submit your application online or offline can impact the ease of your experience. While online submission might be a prefered option for many due to instant confirmation, paper submissions are also commonly accepted. Carefully read the application instructions relevant to the method you choose.

Editing and customizing your form

Once you have access to the property tax postponement form, utilizing tools for editing can be incredibly beneficial. pdfFiller offers a suite of editing tools that allow you to amend fields, add additional information, and incorporate electronic signatures directly into your document, enhancing the submission process.

Thoughtful storage of your completed form is equally essential. Using cloud storage solutions not only keeps your documents organized but also ensures they are easily accessible whenever you need them. This way, you avoid last-minute scrambles when deadlines approach.

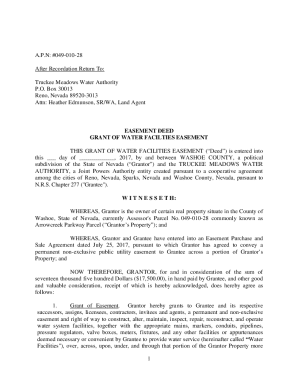

Submitting your property tax postponement form

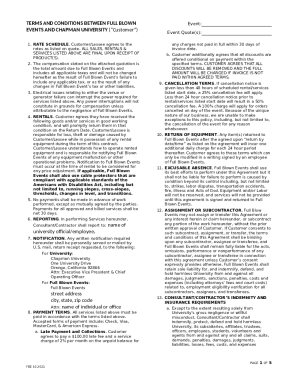

Submitting your property tax postponement form correctly is paramount to ensuring your request is processed smoothly. For online submissions, steps typically involve uploading your completed form through the designated portal and receiving a confirmation receipt immediately upon submission.

If opting for a mail-in submission, ensure that you follow clear guidelines to avoid any delays. Include all required materials and double-check that your envelope is properly addressed to the appropriate tax collector’s office. You can also track your application status through online platforms if available.

Managing your property tax postponement account

Postponing property taxes doesn’t eliminate obligations; it simply defers them until a later date. Individuals must remain vigilant about their responsibilities following acceptance into the property tax postponement program. Key deadlines—like renewals and payment timing—must be adhered to closely to avoid complications.

If your financial situation changes significantly—be it an income increase or a change in residency status—it’s imperative to report those changes promptly. This proactive management ensures compliance and facilitates future transactions regarding your property.

Frequently asked questions (FAQs)

Many individuals have concerns regarding their applications for the property tax postponement program. A common question is what to do if your application gets denied. Typically, applicants have the right to appeal the decision by submitting additional documentation or other supporting information that could reinforce their request.

Others may wonder about the time frame of their applications. While processing times can vary by locality, staying in communication with your local tax office for updates is advised. Always feel free to reach out for guidance if you encounter uncertainties.

Additional support and resources

Navigating the property tax postponement program can be challenging, but assistance is readily available. Homeowners are encouraged to reach out directly to their local tax office for personalized support. Many communities also offer online resources that describe the program eligibility requirements and available assistance. Connecting with local advocacy groups can also provide valuable insights.

Utilizing outreach tools is another way to inform others within your community about the property tax postponement program. Educating neighbors or friends can ensure that those who may benefit from the deferment understand the process and have access to necessary resources.

Information for tax collectors and assessors

Individuals responsible for processing applications for the property tax postponement form play a vital role in ensuring proper adherence to program guidelines. Best practices involve verifying submitted applications against established criteria and maintaining a streamlined communication channel with applicants. It’s crucial for tax collectors and assessors to remain knowledgeable about state laws and updated regulations pertaining to the tax postponement program.

Counties often compile reports regarding the effectiveness of the property tax postponement program. Counties should prioritize transparency and resource accessibility for homeowners. This ensures that both the community and local government remain aligned and informed about potential changes or needs in the program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my property tax postponement in Gmail?

How can I edit property tax postponement from Google Drive?

Can I sign the property tax postponement electronically in Chrome?

What is property tax postponement?

Who is required to file property tax postponement?

How to fill out property tax postponement?

What is the purpose of property tax postponement?

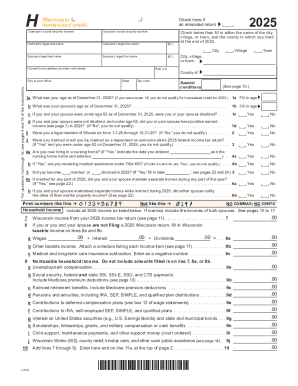

What information must be reported on property tax postponement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.