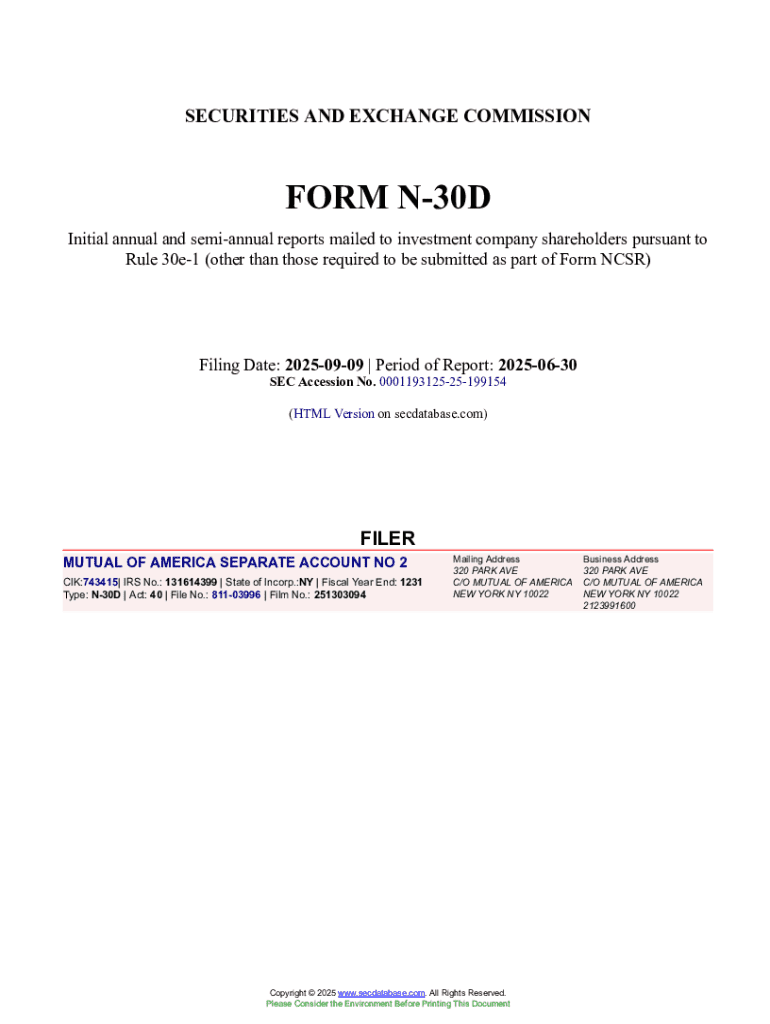

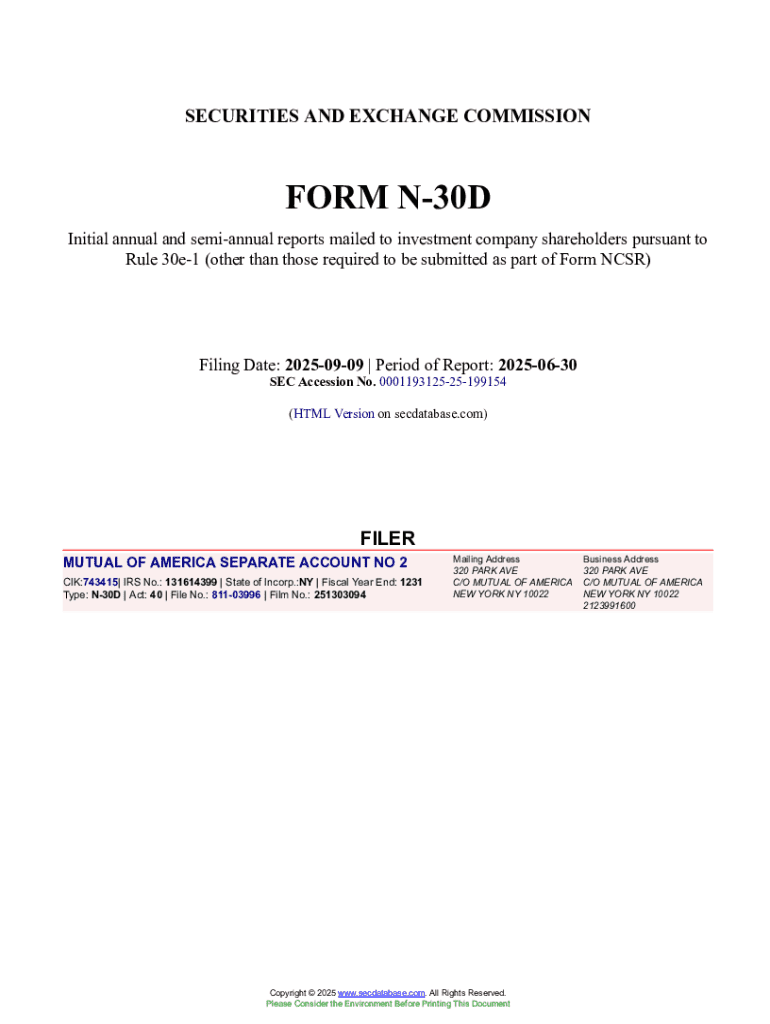

Get the free MUTUAL OF AMERICA SEPARATE ACCOUNT NO 2 Form N-30D Filed 2025-09-09. Accession Number

Get, Create, Make and Sign mutual of america separate

How to edit mutual of america separate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual of america separate

How to fill out mutual of america separate

Who needs mutual of america separate?

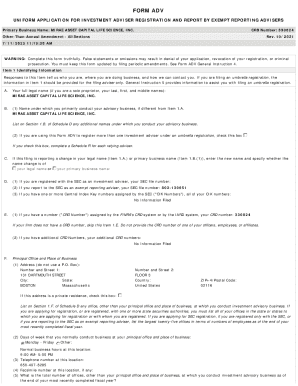

Understanding the Mutual of America Separate Form

Understanding the Mutual of America Separate Form

The Mutual of America Separate Form is a crucial document used primarily for retirement planning purposes. This form is designed to allow individuals and organizations to make specific adjustments or changes to their retirement plans. The process is streamlined for efficiency, ensuring that users can access the necessary tools and information to facilitate their retirement planning strategies.

Importantly, the Mutual of America Separate Form serves as a fundamental part of retirement plan solutions offered to both employees and employers. It highlights various contribution limit information which is essential for staying compliant with federal regulations. Furthermore, understanding the key features of this separate form can empower users to take control of their retirement savings products, ensuring long-term financial security.

Who needs the Mutual of America Separate Form?

The Mutual of America Separate Form is tailored for a diverse audience, including individuals planning for retirement and organizations managing employee retirement accounts. Individuals who are looking to make a change to their investment options or adjust their contribution limits will find this form particularly useful. Employers, on the other hand, may need this document to ensure that their employee’s plans align with the organizational goals and legal requirements.

Common scenarios requiring the Separate Form include updating beneficiary information, changing investment allocations, or adjusting contribution limits. These adjustments not only reflect personal financial goals but also adapt to changing market conditions. Ultimately, the value of the Mutual of America Separate Form lies in its versatility, making it an essential resource for both individuals and teams engaged in retirement planning.

Step-by-step guide to accessing the Mutual of America Separate Form

Accessing the Mutual of America Separate Form is straightforward, especially when utilizing the pdfFiller platform. First, navigate to the pdfFiller website where you can find a plethora of document management tools. Use the search bar to quickly locate the Mutual of America Separate Form. The user-friendly interface ensures that you can find the specific document you need without hassle.

Should you need to create an account on pdfFiller, the process is simple and takes only a few minutes. This enables you to not only download the form but also to use additional features like editing and electronic signing, enhancing your document management experience. Being a registered user allows users to manage multiple forms and documents efficiently from anywhere.

Filling out the Mutual of America Separate Form

Correctly filling out the Mutual of America Separate Form is key to ensuring your retirement planning is carried out accurately. Start by providing your personal information, such as name, address, and contact details. This section establishes your identity and is essential for any follow-up communications.

Next, move on to the financial information section. Here, you’ll need to provide details regarding your current retirement savings, expected contributions, and any investment options you wish to adjust. Being thorough in this section allows you to set clear financial goals and make informed decisions. Finally, review your investment options carefully to ensure they align with your retirement strategy.

Editing the Mutual of America Separate Form

Once you have filled out the Mutual of America Separate Form, it’s important to review and edit as needed. pdfFiller offers various editing tools that make it simple to add or remove text, include images, and attach digital signatures. This ensures that your form is both complete and presentable. If you make an error while filling it out, use the error correction strategies provided by pdfFiller to make quick amendments.

Another advantage of using pdfFiller is the interactive features that allow for collaborative editing. This is especially beneficial for teams looking to manage their retirement plans collectively. By inviting others to edit or review the form, your organization can enhance its document management process and ensure all necessary perspectives are considered.

Saving and managing your document

After completing the Mutual of America Separate Form, it’s time to save and manage your document appropriately. pdfFiller provides several options for saving your finished document. You can easily save it in various formats such as PDF, Word, or TXT according to your preference or requirements. This flexibility ensures you can revisit or share your document as needed.

Additionally, consider utilizing cloud storage solutions that integrate with pdfFiller. This offers the added convenience of accessing your documents from any location while keeping them secure and organized. Consequently, organizing your forms for easy retrieval will help streamline your future decision-making processes.

Signing the Mutual of America Separate Form

Signing the Mutual of America Separate Form is a critical step to validate your submission. pdfFiller simplifies this step by providing electronic signing options that are legally compliant. You can initiate the signing process by inviting relevant parties to sign the document directly through the platform.

The step-by-step process for obtaining signatures generally involves filling out the signature fields, selecting the signers, and setting a proper order for signing if necessary. Leveraging e-signatures not only speeds up the process but also ensures that all parties can execute the document regardless of their location, enhancing overall efficiency.

FAQ: Common questions about the Mutual of America Separate Form

After submitting the Mutual of America Separate Form, users often have questions regarding the next steps. It is advisable to keep a copy of your submission for your records. Usually, you will receive confirmation from the relevant organization, detailing any additional actions that may be necessary. If you need to revise or resubmit your form, pdfFiller makes this process seamless; simply access the saved document and make required edits.

For further assistance, reaching out to customer support is also an option. Knowing when and how to contact support is invaluable for addressing any specific queries that arise during the process.

Real-life examples and case studies

Exploring real-life examples of users harnessing the Mutual of America Separate Form reveals the significant advantages offered. Many individuals have successfully enhanced their retirement strategies using this form. A retiree might recount how an adjustment made via the Separate Form led to increased investment returns — a beneficial outcome stemming from more tailored financial choices.

Additionally, organizations sharing their journeys highlight how the use of the Separate Form helped streamline retirement planning, ensuring compliance and efficiency. Analysis shows that companies employing pdfFiller experienced a marked improvement in workflow, especially with document management, further underlining the advantages of integrating such tools in their financial processes.

Maximizing benefits with pdfFiller

To fully leverage the capabilities of the Mutual of America Separate Form, users should explore additional features available through pdfFiller. These include enhanced document management solutions that allow for easy organization, retrieval, and sharing of documents. Furthermore, collaborations with teams can be conducted seamlessly, promoting better productivity and efficiency in reaching collective retirement planning goals.

Security is another paramount feature. Users can rest assured that their documents and personal information are protected, which is essential for maintaining trust in financial transactions. By utilizing the robust tools within pdfFiller, individuals and organizations can create a secure and efficient document management environment that caters to their specific needs and markets.

Staying informed

Staying up to date about the Mutual of America Separate Form and its associated regulations can empower users in their retirement planning efforts. Regular updates are provided through pdfFiller, ensuring that users are made aware of any changes or developments. Keeping abreast of such updates is crucial, particularly in the context of evolving regulations regarding retirement plans and options.

In addition, pdfFiller is consistently enhancing its platform with upcoming features to further improve user experience. Engaging with these new tools not only benefits users on a functional level but also aligns with the ongoing educational aspect of effective retirement planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mutual of america separate directly from Gmail?

How can I get mutual of america separate?

Can I edit mutual of america separate on an iOS device?

What is mutual of america separate?

Who is required to file mutual of america separate?

How to fill out mutual of america separate?

What is the purpose of mutual of america separate?

What information must be reported on mutual of america separate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.