Get the free Introduction Form CRS What investment services and ...

Get, Create, Make and Sign introduction form crs what

How to edit introduction form crs what online

Uncompromising security for your PDF editing and eSignature needs

How to fill out introduction form crs what

How to fill out introduction form crs what

Who needs introduction form crs what?

Introduction to Form CRS: What Form You Need to Know

Understanding Form CRS

Form CRS, or Client Relationship Summary, is a document required by the SEC (Securities and Exchange Commission) that provides vital information about financial advisors and registered investment firms. This form serves as a gateway for investors seeking to understand the nature of their relationships with these financial service providers.

The primary purpose of Form CRS is to enhance investor protection by promoting transparency between firms and their clients. By summarizing critical details regarding services offered, fees, and conflict of interests, Form CRS plays a pivotal role in informing investors about the relationship they are establishing with a financial advisor or firm.

Key components of Form CRS include the types of services provided, the associated costs, potential conflicts of interest, and any disciplinary history related to the firm. Through these components, investors can make better-informed decisions when selecting their financial advisors.

Who needs to use Form CRS?

The implementation of Form CRS is essential for both financial advisors and investors. Financial firms and their representatives must prepare and present Form CRS to new and existing clients when they engage in advisory services. This ensures clients are well-informed from the outset.

For investors, Form CRS serves as a crucial tool for discerning the credibility and suitability of potential advisors. Situations that necessitate the use of Form CRS include when a client is seeking financial advice for the first time or when they are evaluating a new firm’s advisory services.

Key features of Form CRS

Form CRS highlights several key features essential for fostering transparency within the advisor-client relationship. The summary of key items required includes the types of services offered, the fees and costs associated, potential conflicts of interest, and any disciplinary history or legal issues the firm may have undergone.

Transparency in these disclosures not only empowers investors with the necessary knowledge but also compels financial firms to maintain ethical standards in their practices. Key features in Form CRS are designed to be straightforward, aiming to ensure that all clients, regardless of financial sophistication, can readily understand the document.

Step-by-step guide to completing Form CRS

Completing Form CRS requires careful attention to detail. Here’s a step-by-step guide to ensure accuracy and compliance.

Step 1: Gather necessary information. Before filling out the form, collect essential documents and data such as current service agreements, firm compliance records, and information about any past disciplinary actions.

Step 2: Filling out the form requires a detailed breakdown of each section. Make sure to include an exhaustive list of services offered, and any fees charged, ensuring clarity in potential conflicts of interest.

Step 3: Review your Form CRS. Create a checklist to verify that all information is accurate and complete. Ensure all required sections are filled before submitting.

Step 4: Submission process involves submitting Form CRS to the SEC through the appropriate regulatory portal. Ensure the submission complies with all state and federal requirements.

Best practices for using Form CRS

To maximize the effectiveness of Form CRS, financial advisors should employ best practices when presenting this document to clients. Effective communication about the contents of Form CRS can enhance trust and transparency in the advisor-client relationship. Consider using plain language when describing fees and potential conflicts.

For investors, understanding how to utilize Form CRS is essential for making informed decisions. Look for detailed service descriptions, clarity in fees, and any mention of disciplinary history. This knowledge is an advantage when comparing different advisors.

Common mistakes to avoid with Form CRS

Accuracy in completing Form CRS is crucial. Common mistakes include providing vague descriptions of services, failing to disclose all fees, and omitting previous disciplinary actions. Such errors can mislead clients and may result in regulatory penalties.

The consequences of inaccuracies and omissions are significant. Firms may face compliance audits or legal issues that could damage their reputation. Ensuring compliance with the required standards helps to avoid penalties and reinforce the integrity of the financial advisory profession.

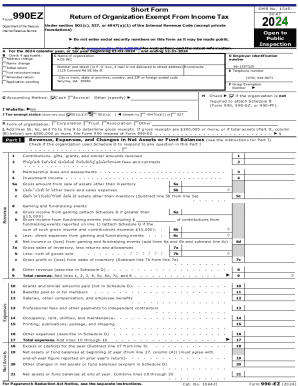

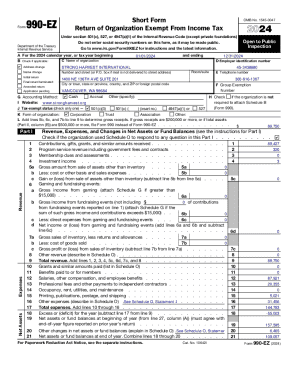

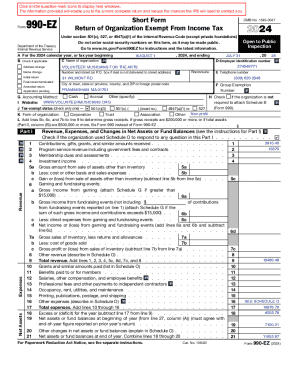

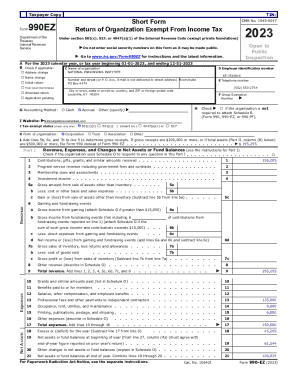

The role of pdfFiller in managing Form CRS

pdfFiller offers a streamlined solution for managing the preparation, completion, and submission of Form CRS. With its cloud-based platform, users can access the form from anywhere, enhancing flexibility and convenience.

Interactive tools provided by pdfFiller allow users to eSign, edit, and collaborate on documents effectively. This functionality is particularly useful for financial firms needing to compile multiple data points from various sources when filling out Form CRS.

Recent updates and trends in Form CRS regulation

Staying informed about recent updates in Form CRS regulation is critical for financial advisors. Regulatory bodies continuously refine guidelines to enhance investor protection and transparency in financial dealings. Recent updates have focused on improving disclosures surrounding fees and conflicts of interest.

The impact of these changes includes more robust compliance requirements for firms, demanding greater clarity in the presentation of information. Advisors must adapt to these changes to avoid penalties and maintain client trust.

Case studies: Effective use of Form CRS

Real-world examples of financial firms that have successfully implemented Form CRS reveal best practices in action. These organizations prioritize transparency and customer education, leading to improved client satisfaction and retention rates.

Lessons learned include the necessity of clear communication about services, proactive discussion of fees, and transparent disclosures regarding any disciplinary history. By following these practices, firms can enhance their reputations and foster better regulatory compliance.

Interactive tools for crafting Form CRS

pdfFiller provides a range of document creation solutions designed to facilitate the development of Form CRS. The platform features templates specifically tailored for Form CRS, making the form-completion process more efficient.

Interactive features such as collaboration tools and sharing capabilities enhance the user experience, allowing multiple team members to contribute to the form or review it in real time. This functionality ensures that the final Form CRS is comprehensive and compliant with regulatory standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit introduction form crs what on a smartphone?

How do I fill out the introduction form crs what form on my smartphone?

How do I edit introduction form crs what on an iOS device?

What is introduction form crs what?

Who is required to file introduction form crs what?

How to fill out introduction form crs what?

What is the purpose of introduction form crs what?

What information must be reported on introduction form crs what?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.