Get the free Tax Deferred Annuity & Deferred Compensation Plan

Get, Create, Make and Sign tax deferred annuity amp

How to edit tax deferred annuity amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax deferred annuity amp

How to fill out tax deferred annuity amp

Who needs tax deferred annuity amp?

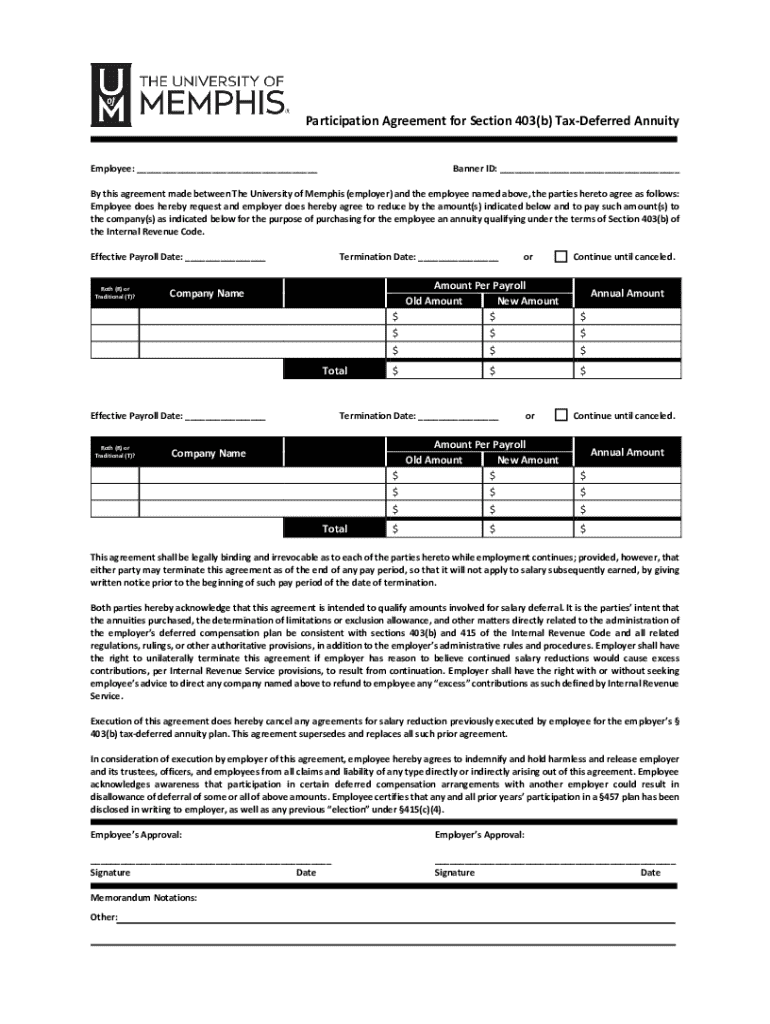

Comprehensive Guide to Tax Deferred Annuity AMP Form

Understanding tax deferred annuities

A tax deferred annuity is a financial product that allows individuals to accumulate funds for retirement while deferring taxes on the earnings until withdrawal. This product is primarily designed to help individuals save and grow their wealth in a tax-efficient manner, ultimately providing a more substantial income during retirement. Key features of tax deferred annuities include the ability to contribute regularly, the potential for compounded growth, and the flexibility of accessing funds later without immediate tax consequences.

The primary benefit of tax deferral is the potential for enhanced growth over time. By postponing taxes, you allow your investments to grow unfettered by annual tax bills, which can significantly increase the amount of money you have accrued by the time you retire.

Types of tax deferred annuities

Tax deferred annuities are categorized into several types, primarily distilling down to fixed and variable annuities. Fixed annuities offer a guaranteed interest rate and predictable returns, making them suitable for conservative investors. Conversely, variable annuities allow investors to choose from a range of investment options, with returns fluctuating based on market performance. Additionally, tax deferred annuities can be classified as immediate or deferred. Immediate annuities start paying out income immediately after a lump-sum investment, while deferred annuities accumulate for a set period before payout.

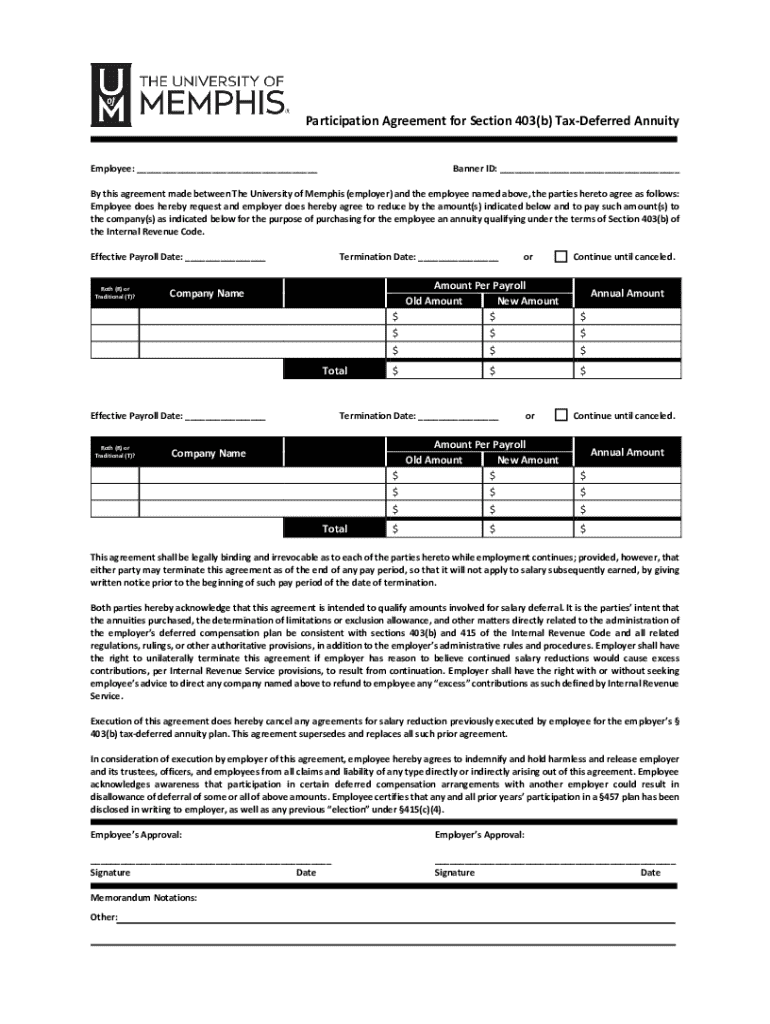

The AMP form explained

The AMP form (Annuity Management Plan) serves as a critical bridge between investors and their tax deferred annuity accounts. This form is essential for documenting personal and financial details, allowing users to manage their annuities effectively. The accuracy of the information submitted via the AMP form plays a significant role in defining the terms and management of the annuity.

Understanding key terminology associated with the AMP form enhances your ability to navigate this process effectively. Terms such as 'contribution limits,' 'distribution,' and 'surrender charges' are vital to grasp, as they dictate how your annuity operates in practice.

Key terminology

Steps to fill out the tax deferred annuity AMP form

Filling out the AMP form correctly is crucial for the successful submission and management of your annuity. Before you start, gather necessary documents to ensure a smooth process. Typical documents include personal identification, Social Security number, financial information detailing income and assets, and any previous annuity contracts.

Gather the necessary documents

Follow the step-by-step filling instructions

Editing and customizing the AMP form

Editing your AMP form can streamline your submission process, ensuring it captures precisely what you want. Tools like pdfFiller enable users to make necessary modifications efficiently. Accessing these editing tools is straightforward; simply upload your AMP form to the platform, where you can make changes.

Using pdfFiller tools for form editing

Once you've uploaded your document, utilize the editing suite to fill in blanks, adjust text, or reorganize sections with ease. Following these simple steps—clicking the section you wish to edit, making modifications, and saving changes—turns a traditional form filling task into an efficient online experience.

Incorporating digital signatures

With pdfFiller, signing your AMP form is quick and paperless. Digital signatures offer several benefits over traditional signing methods, such as enhanced security and the convenience of signing from anywhere at any time. To eSign within pdfFiller, simply select your signature option and follow the prompts to sign electronically.

Managing your tax deferred annuity post-submission

After submitting your AMP form, effective management is crucial for your annuity. Monitoring your submission’s status is straightforward; users can typically track their application status via the financial institution's online platform or by directly contacting customer support. By remaining proactive, you can ensure all documented details are correct.

Common post-submission queries

It’s not uncommon to have questions after submission, such as how long the approval process takes or options for modifying beneficiary selections later. Most financial institutions provide FAQ sections that address these concerns, or you can reach out directly to your advisor for personalized advice.

Collaborative features for teams

For professional teams managing multiple tax deferred annuities, collaboration features become essential. pdfFiller offers tools that enable team members to work on the AMP form together, allowing for real-time feedback and edits. This functionality helps to streamline the review process, ensuring that everyone is on the same page.

How teams can work together

To utilize these collaborative features, simply share the document link with your team members. They can access the form, make edits, and leave comments without the need for back-and-forth emails. This efficiency saves time and reduces the risk of errors in the filling out of important financial documents.

Assigning roles and permissions

When working in a team environment, assigning roles becomes vital. pdfFiller allows you to designate specific permissions for each member, ensuring that only authorized personnel can make significant changes, while others can provide input or merely view the document. This added layer of control mitigates confusion and enhances document integrity.

Best practices for handling tax deferred annuities

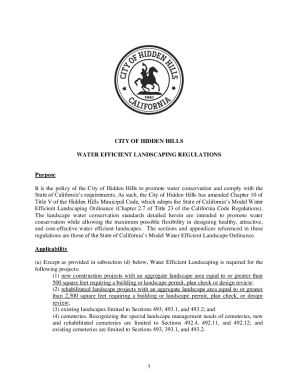

Managing tax deferred annuities effectively involves understanding the regulatory environment. Regulatory compliance is important for ensuring that the annuity performs within legal boundaries and meets the diverse needs of different states. Familiarizing yourself with the relevant regulations helps you stay informed about changes that could impact your investments.

Maintaining records

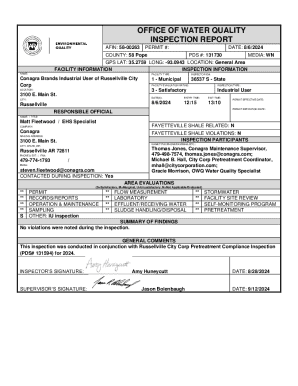

Maintaining meticulous records is vital for managing your tax deferred annuity successfully. Document all communications, updates, and financial statements related to your annuity. This detailed tracking not only aids in monitoring performance but is also necessary for tax reporting. You can later use this information to make informed decisions regarding future contributions.

Consulting financial advisors

Engaging with financial advisors is beneficial for both first-time investors and seasoned individuals managing substantial portfolios. Advisors can provide tailored strategies based on unique financial situations, such as optimizing tax implications or recommending suitable annuity products, ensuring you make the most of your investment.

Troubleshooting common issues

Encountering issues when filling out the AMP form can be frustrating. Common errors relate to missing information or miscalculations regarding financial details, which can delay the submission process. Reviewing each section thoroughly before submitting can minimize such mistakes.

Resolving submission problems

If you experience issues after submitting the AMP form, the first step is to contact the financial institution’s customer service. They can assist you with clarifying any problems or provide alternatives. Often, submission problems stem from technical issues, which are usually resolvable with a simple online form resubmission.

Success stories and case studies

Real-life examples of successful management of tax deferred annuities illustrate the benefits that diligent oversight can yield. For instance, individuals who began investing early in their careers often reap significant tax advantages later due to compounded growth over time. These stories reinforce the impact of sound financial planning.

Lessons learned from case studies

Key takeaways from various case studies highlight the importance of regularly reviewing annuity performance and adaptability in changing financial environments. Such lessons underscore the necessity of staying informed about both personal circumstances and external market conditions that affect investments.

Further engagement with pdfFiller

pdfFiller not only makes it easy to manage your tax deferred annuity AMP form, but it also offers a host of additional features through its platform. Users can access tools for on-the-fly editing, document tracking, and a library of templates that enhance the ease of document management across various applications.

Utilizing interactive tools on pdfFiller

Delving into interactive tools available through pdfFiller reveals options for creating customized documents tailored to specific needs. Interactive features allow users to insert checkboxes, dropdown menus, and even digital signatures, making form management effective and user-friendly.

Continuous learning through webinars and tutorials

Engaging in webinars and training tutorials offered by pdfFiller can enrich your understanding of document management practices. Being proactive about ongoing learning will help you stay updated about new features and best practices, ensuring you utilize the platform to its full potential.

Key features of pdfFiller

pdfFiller is designed to elevate your tax deferred annuity management experience through innovative features that enhance document handling. A cloud-based solution increases accessibility, enabling users to manage documents from virtually anywhere. This feature is especially beneficial for individuals and teams frequently on the move or working remotely.

Seamless document management

Using a cloud-based platform like pdfFiller ensures that you can access your documents securely and conveniently. This streamlines the process of filling out forms, making revisions, and obtaining signatures, allowing you to focus on strategic financial planning rather than tedious paperwork.

Integrated collaboration services

Collaboration within pdfFiller fosters an environment of efficiency. By enabling team members to comment and edit documents in real-time, you can enhance the quality of your submissions while ensuring all contributions are well-integrated.

User-oriented support

Customer support resources offered by pdfFiller are designed to cater specifically to the needs of users dealing with tax deferred annuities. Whether requiring assistance in filling out the AMP form or navigating the platform features, helplines and online resources provide essential guidance that empowers users at every step.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax deferred annuity amp in Chrome?

Can I create an electronic signature for signing my tax deferred annuity amp in Gmail?

How can I fill out tax deferred annuity amp on an iOS device?

What is tax deferred annuity amp?

Who is required to file tax deferred annuity amp?

How to fill out tax deferred annuity amp?

What is the purpose of tax deferred annuity amp?

What information must be reported on tax deferred annuity amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.