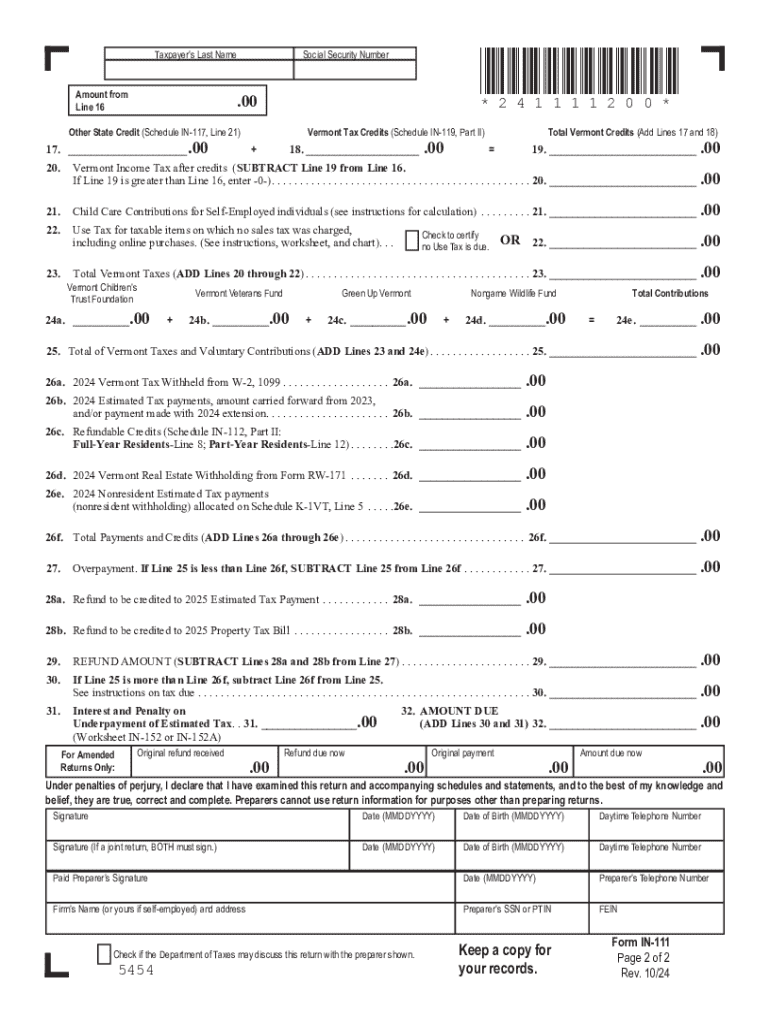

Get the free Other State Credit (Schedule IN-117, Line 21)

Get, Create, Make and Sign oformr state credit schedule

Editing oformr state credit schedule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out oformr state credit schedule

How to fill out oformr state credit schedule

Who needs oformr state credit schedule?

Understanding the Oformr State Credit Schedule Form: A Comprehensive Guide

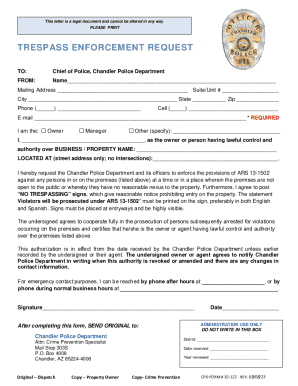

Overview of the Oformr State Credit Schedule Form

The Oformr State Credit Schedule Form plays a pivotal role for residents in California seeking to claim certain tax credits. It is designed to streamline tax returns for individuals and ensure they accurately report their eligibility for state credits. Understanding this form is essential for maximizing potential tax benefits, ensuring that every resident can leverage the credits available to them under California law.

Eligibility for the Oformr State Credit often hinges on specific criteria, such as income levels, residency status, and property ownership. To qualify, individuals must meet defined income thresholds, which can vary depending on family size and filing status. Accurately completing the Oformr State Credit Schedule Form is crucial; errors or omissions can result in delays or even denial of tax benefits, which could significantly impact financial outcomes.

Key features of the Oformr State Credit Schedule Form

The Oformr State Credit Schedule Form is structured into various sections, each designed to capture specific information necessary for credit determination. These include sections for personal identification, income reporting, and potential deductions. One common mistake during this process is neglecting to double-check information against documentation, which can lead to discrepancies.

To simplify the completion process, pdfFiller provides interactive elements. For instance, users can easily navigate the form, access drop-down menus, and utilize auto-fill features that enhance accuracy and efficiency. Recognizing common mistakes—such as incorrect income amounts or forgetting to sign the form—can help applicants avoid needless setbacks. Being proactive with error-checking processes ensures a smoother submission.

Step-by-step guide to completing the Oformr State Credit Schedule Form

Completing the Oformr State Credit Schedule Form requires careful organization and preparation. First, gather all necessary documentation such as proof of income, identity verification, and any related tax forms. This will not only save time but also enhance the accuracy of the information presented on the form.

Gathering required information

Before beginning the form, ensure you have the following items at hand: - Your recent resident income tax return - Proof of residency in California - Details regarding your income and any deductions claimed These documents are essential in ensuring that the information provided is both complete and accurate, eliminating potential issues during processing.

Filling out the form

When filling out the Oformr State Credit Schedule Form, follow these instructions closely to ensure accuracy: 1. Start by entering your personal information in the designated fields. 2. Report your income clearly as stated in your tax return, ensuring numbers align with supporting documents. 3. Carefully read through any instructions associated with sections to avoid overlooking critical information. Utilizing pdfFiller’s editing tools allows you to easily correct any mistakes or add annotations as needed.

Additional considerations

Keep in mind there are specific claim limits associated with the Oformr State Credit. For example, homeowners may have different eligibility criteria compared to renters, and understanding these nuances is vital. Additionally, be aware of the deadlines for submissions; missing deadlines may hinder your ability to claim benefits for the tax year sought. Make it a point to mark these dates on your calendar to ensure timely submission.

Utilizing pdfFiller for efficient form management

pdfFiller offers a range of features that enhance form management, particularly when dealing with the Oformr State Credit Schedule Form. The platform allows users to edit, sign, and save documents online in a secure cloud environment. This is particularly beneficial for those who may be collaborating with others on their tax preparations.

The ability to share forms easily among team members or family provides a collaborative advantage. With pdfFiller, it’s simple to work on documents simultaneously, whether for editing or reviewing purposes. Maintaining an organized system for forms can prevent complications during tax season, streamlining the overall process for users.

Troubleshooting common issues

Although filling out the Oformr State Credit Schedule Form can seem straightforward, users often face various challenges. Common FAQs related to this form include questions about eligibility criteria, submission confirmations, and timelines. Familiarizing yourself with these questions can mitigate stress and streamline your experience.

If you encounter technical issues while using pdfFiller, such as loading errors or difficulties with save options, a prompt resolution often involves refreshing your page or checking your internet connection. Additionally, pdfFiller offers support for users needing assistance with unique scenarios; engaging with their support can provide valuable insights and help clarify your path forward.

Next steps after submitting the Oformr State Credit Schedule Form

After submitting the Oformr State Credit Schedule Form, understanding the subsequent steps is crucial. Generally, you can expect an acknowledgment of your submission within a certain timeframe, but monitoring the status of your credit claim will provide peace of mind. Utilize any tracking features available through the California tax authority’s website.

If errors are identified post-submission, don’t be alarmed. Residents in California have options for correcting mistakes via amendments. Keeping a record of all submitted documents will aid significantly in the rectification process, ensuring you can accurately adjust any part of your submission as needed.

Related forms and publications

Alongside the Oformr State Credit Schedule Form, several other tax forms may prove beneficial to residents, such as the resident income tax return and various state-specific credit applications. Being aware of these related forms can enhance your overall tax strategy, ensuring maximum benefits are realized.

Moreover, consulting the instruction booklet and tax tables relevant to California can provide clarity on deductions and credits applicable to your situation. Ensure you have access to these publications as they can serve as valuable resources throughout the filing process.

User experiences and testimonials

Feedback from users who have utilized pdfFiller for completing the Oformr State Credit Schedule Form reveals positive experiences largely centered around ease of use and efficiency. Many individuals appreciate the intuitive design of pdfFiller’s platform and the way it streamlines the form completion process.

Success stories emphasize the benefits received from streamlined document management and collaboration. Teams and individuals remark on the swift turnaround times for submissions, which ultimately helped maximize their state tax credits while minimizing stress during the filing season.

Best practices for document management

Maintaining organized electronic records of all submitted forms can significantly alleviate the stress associated with tax filing. Effective document management practices suggest saving digital copies of all forms, ensuring easy access and version control. Utilizing pdfFiller’s cloud services provides an added layer of security and accessibility.

Consider implementing a filing system categorized by tax year and form type. This organization allows for straightforward retrieval of necessary documents whenever needed. Additionally, saving the most recent updates frequently mitigates the risk of losing any information during the filing process.

Educational resources for further learning

To deepen your understanding of tax credits and forms, several educational resources are available online. Websites like the California Department of Tax and Fee Administration provide thorough guides and might also offer webinars aimed at helping residents navigate the tax filing landscape effectively.

Additionally, pdfFiller offers webinars and tutorials that can enhance your document management skills, ensuring you can effortlessly manage not just the Oformr State Credit Schedule Form but other essential tax documents as well. Engaging with these resources can empower you to take full advantage of the available tax benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit oformr state credit schedule in Chrome?

Can I edit oformr state credit schedule on an iOS device?

Can I edit oformr state credit schedule on an Android device?

What is oformr state credit schedule?

Who is required to file oformr state credit schedule?

How to fill out oformr state credit schedule?

What is the purpose of oformr state credit schedule?

What information must be reported on oformr state credit schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.