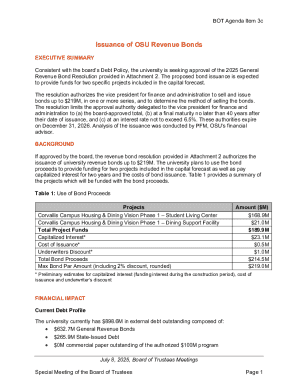

Get the free MINNESOTA. REVENUE - Certificate of Exemption

Get, Create, Make and Sign minnesota revenue - certificate

How to edit minnesota revenue - certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minnesota revenue - certificate

How to fill out minnesota revenue - certificate

Who needs minnesota revenue - certificate?

Navigating the Minnesota Revenue Certificate Form

Overview of the Minnesota Revenue Certificate Form

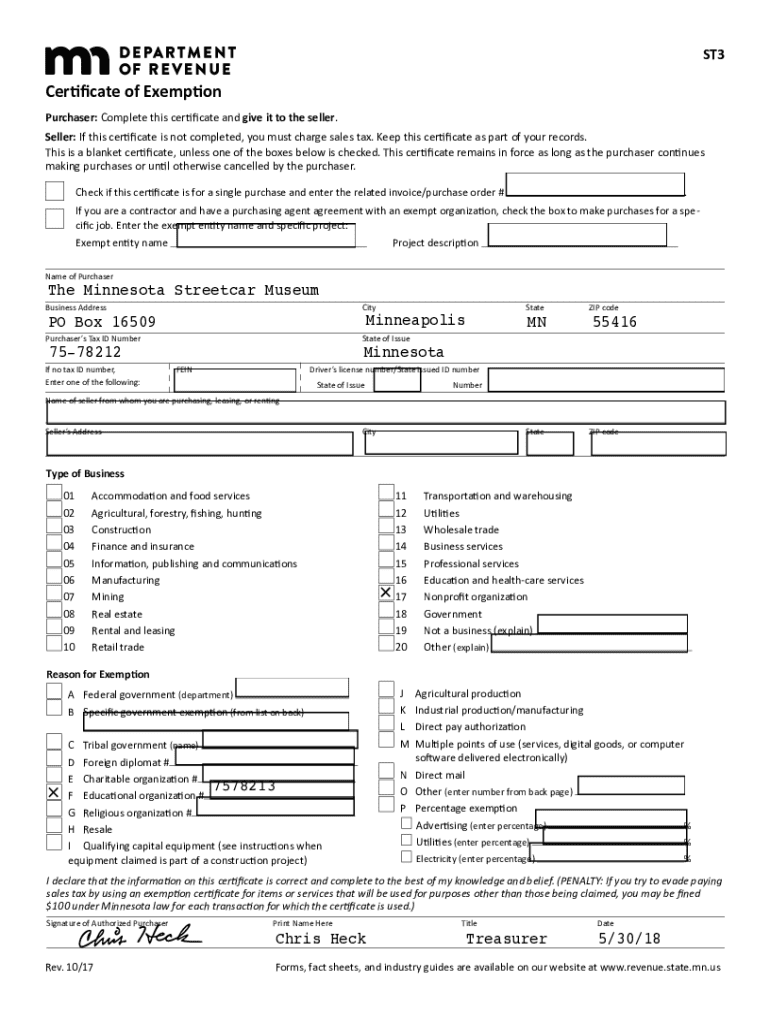

The Minnesota Revenue Certificate form is a crucial document used by individuals and businesses in Minnesota to manage their obligations and claims related to taxes. This form serves various purposes, including claiming tax exemptions and filing for refunds. Understanding the importance of this document is essential for anyone looking to navigate Minnesota's tax landscape efficiently. Whether you are a small business, a non-profit organization, or an individual taxpayer, having the right form can make a substantial difference in your tax responsibilities and benefits.

Types of Minnesota Revenue Certificate Forms

In Minnesota, various types of revenue certificate forms are designed to accommodate different tax situations. The most commonly used forms include the Sales Tax Exemption Certificate and the Property Tax Refund Certificate. Each of these forms has distinct purposes and requirements that residents and businesses must follow.

Step-by-step guide to accessing the Minnesota Revenue Certificate Form

Accessing the Minnesota Revenue Certificate Form is straightforward. Start by visiting the official Minnesota Department of Revenue website. From there, navigating through the various resources to find certificate forms is user-friendly.

Completing the Minnesota Revenue Certificate Form

Filling out the Minnesota Revenue Certificate Form requires careful attention to detail. There are mandatory fields that must be completed to ensure your application is processed without delays. Additionally, including optional information can enhance your application’s acceptance rate.

Editing and customizing your Minnesota Revenue Certificate Form with pdfFiller

Using pdfFiller, you can easily edit your Minnesota Revenue Certificate Form to suit your needs. This all-in-one document management tool provides features that simplify the editing process. You can add text, images, or even your digital signature directly on the document, ensuring it meets all submission requirements.

Signing the Minnesota Revenue Certificate Form

After completing your Minnesota Revenue Certificate Form, the next step is signing it. With pdfFiller, you can take advantage of eSigning features that ensure your form is compliant with Minnesota’s legal standards. Electronic signatures are recognized as valid in the state, allowing for a smooth submission process.

Submitting the Minnesota Revenue Certificate Form

After completing and signing your Minnesota Revenue Certificate Form, the submission process can vary based on your preference. You have multiple options for submitting your forms, depending on your situation and convenience.

Tracking the status of your Minnesota Revenue Certificate submission

Once submitted, it’s important to track the status of your Minnesota Revenue Certificate Form. Ensuring that your form has been received and processed can alleviate uncertainty during tax season.

FAQs about the Minnesota Revenue Certificate Form

Navigating tax forms can be overwhelming, and many taxpayers have similar questions regarding the Minnesota Revenue Certificate Form. FAQs offer essential insights into topics such as eligibility requirements, common submission issues, and procedures for updating forms.

Collaborating on the Minnesota Revenue Certificate Form with pdfFiller

For businesses or teams, collaboration on the Minnesota Revenue Certificate Form can enhance efficiency. Utilizing pdfFiller, team members can work together on the same document, ensuring everyone’s input is included before submission.

Keeping your Minnesota Revenue Certificate Form organized

Maintaining an organized repository of your Minnesota Revenue Certificate Forms is vital for future reference. pdfFiller provides document management features that simplify this task.

Contact information for Minnesota Revenue Department

For questions or concerns regarding your Minnesota Revenue Certificate Form, direct communication with the Minnesota Department of Revenue is crucial. They offer various contact options for effective assistance.

Sign up for updates on Minnesota Revenue forms and requirements

Keeping up with changes in Minnesota Revenue forms and requirements is important for compliance. The Department of Revenue offers options to subscribe for updates, ensuring you are always in the know.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute minnesota revenue - certificate online?

How do I make changes in minnesota revenue - certificate?

Can I edit minnesota revenue - certificate on an iOS device?

What is minnesota revenue - certificate?

Who is required to file minnesota revenue - certificate?

How to fill out minnesota revenue - certificate?

What is the purpose of minnesota revenue - certificate?

What information must be reported on minnesota revenue - certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.