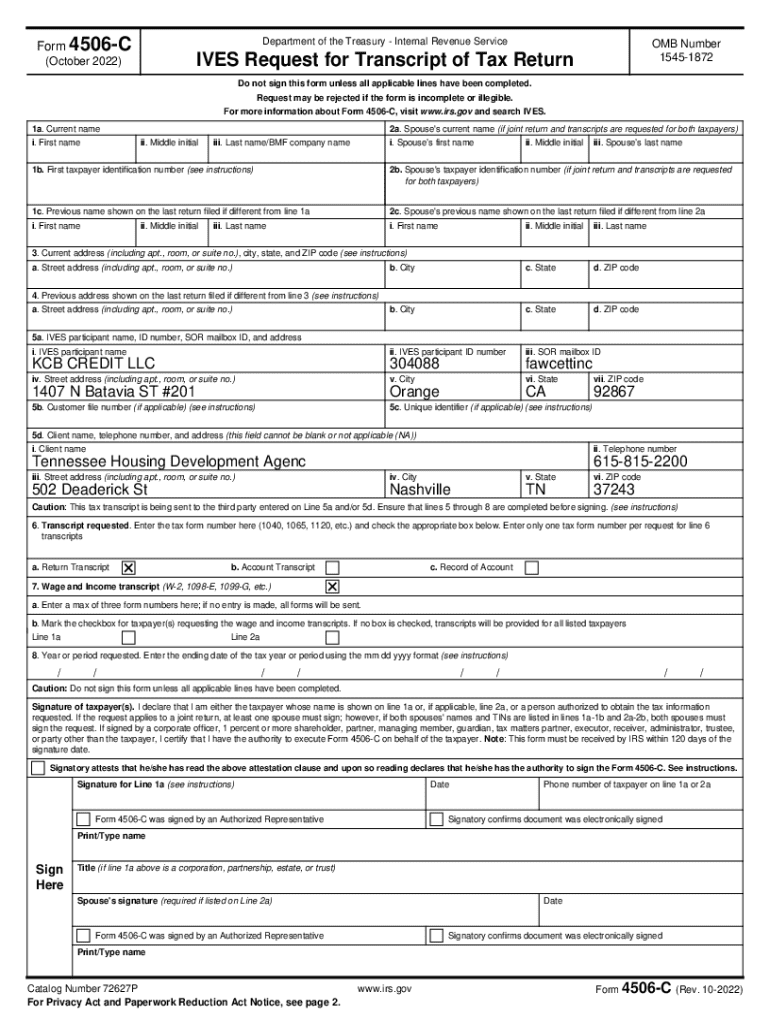

Get the free Form 4506-C - Cloudfront.net

Get, Create, Make and Sign form 4506-c - cloudfrontnet

Editing form 4506-c - cloudfrontnet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4506-c - cloudfrontnet

How to fill out form 4506-c - cloudfrontnet

Who needs form 4506-c - cloudfrontnet?

Form 4506- - CloudFrontNet Form: Your Complete How-To Guide

Overview of Form 4506-

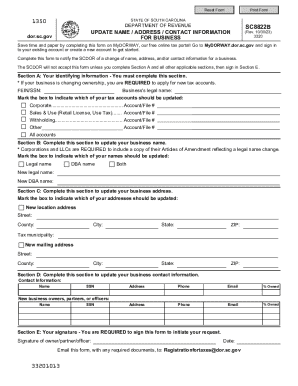

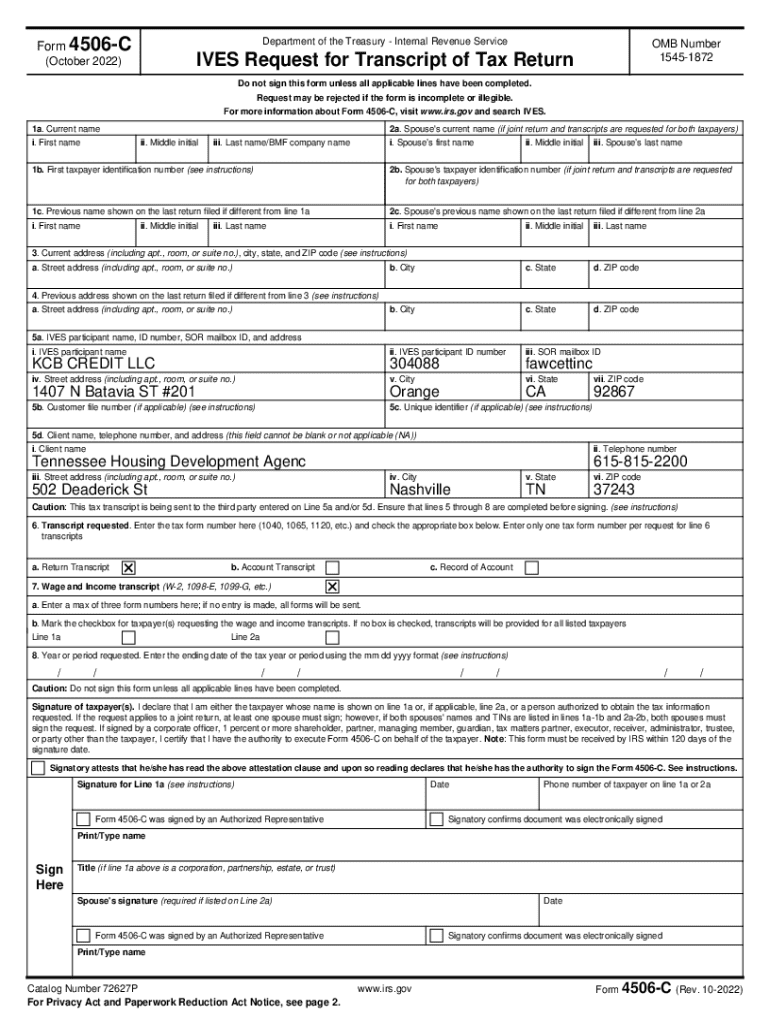

Form 4506-C is a critical IRS document that enables individuals and businesses to request a copy of their tax return transcripts or the returns themselves directly from the IRS. This form serves a vital purpose in verifying income and tax information required for various applications, including loans, mortgages, and state benefits.

Understanding the importance of Form 4506-C is crucial as accurately completed forms can expedite processes critical in financial situations, while errors can lead to delays or even the loss of potential financial opportunities.

Who should use Form 4506-?

Both individuals and businesses can benefit from using Form 4506-C. Individuals typically request copies of their tax returns to satisfy lender requirements, apply for government assistance, or resolve tax issues. Meanwhile, businesses may need this form to fulfill regulatory compliance or to provide proof of income during financing processes.

Understanding the need for cloud-based access

Managing documents in the cloud is an emerging standard that offers operational advantages for users of Form 4506-C. Cloud solutions enhance accessibility, allowing users to access their forms and necessary documents from any device, anywhere. This flexibility is particularly beneficial for those who frequently need to retrieve important documents for various requirements.

Navigating the CloudFrontNet platform

CloudFrontNet offers intuitive features designed to simplify the handling of Form 4506-C and other documents. Its user-friendly interface allows for easy navigation, ensuring that users can quickly find what they need without unnecessary frustration.

One of the standout features of CloudFrontNet is its real-time collaboration tools, enabling multiple users to work on forms simultaneously. This capability is particularly beneficial for teams managing tax documents together.

How pdfFiller integrates with CloudFrontNet

pdfFiller complements the capabilities of CloudFrontNet by offering powerful editing and signing functionalities. This seamless integration allows users to edit the Form 4506-C directly within the platform, ensuring that all necessary modifications can be made quickly and efficiently. Additionally, pdfFiller enhances document tracking, making it easier to monitor changes and verify the status of submissions.

Step-by-step guide to completing Form 4506-

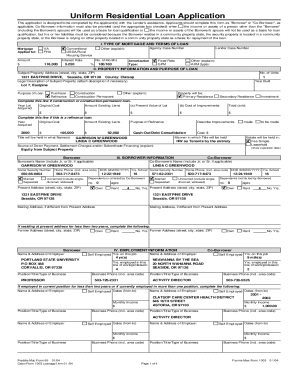

Filling out Form 4506-C requires precise attention to detail. Begin by gathering all necessary personal and tax-related information to ensure accuracy throughout the process. Essential details include your full name, address, Social Security Number, and the tax form specifics such as the year and type of return you are requesting.

Required information to fill out

Filling out each section of Form 4506-

The form is divided into several sections, each requiring specific information for completion. Here’s a breakdown of what needs to be included in each section:

Tips for accurate completion

To reduce the risk of delays, verify the information provided before submission. Common mistakes to avoid include forgetting to sign the form, leaving critical information blank, or using incorrect tax years. A simple checklist can ensure you’ve covered all necessary points:

Editing and signing Form 4506- with pdfFiller

Once you have your Form 4506-C ready, utilizing pdfFiller for editing and signing can enhance your efficiency. Start by uploading the form to the pdfFiller platform for immediate access to advanced editing features.

How to upload and import Form 4506- to pdfFiller

You can easily upload your form by following these steps:

Using editing tools within pdfFiller

pdfFiller offers an array of editing tools that support effective document management. You can annotate, highlight essential sections, and add custom text or images as required. This facility is particularly useful for ensuring the clarity of instructions or notes for the reviewer.

eSigning the form

Creating and applying your eSignature on pdfFiller is straightforward. Simply select the eSignature feature, draw or type your signature, and apply it where needed on the document. It’s significant to note that eSignatures hold the same legal validity as handwritten ones, thus ensuring your submissions are compliant with IRS standards.

Submitting Form 4506-: A how-to guide

After completing and signing your Form 4506-C, the next step is to submit it to the IRS. Here, you have options regarding the submission method. The choice between e-filing and mailing the form depends on personal preference and circumstances.

Methods of submission

Both methods have their benefits; e-filing allows quicker processing, while mailing provides a tangible copy for your records.

Tracking your submission

Utilizing CloudFrontNet, you can easily track the status of your submission. You should receive confirmation notifications from the IRS, and tracking within CloudFrontNet allows you to stay updated without having to contact the agency.

Typically, applicants can expect to receive updates within a few weeks after submission, so it's important to integrate this tracking into your workflow.

Troubleshooting common issues

Common challenges exist when filling out Form 4506-C that can hinder the submission process. Incomplete fields are among the most significant reasons for delayed approvals or flat-out rejections.

If issues arise, the IRS has resources for assistance. Furthermore, pdfFiller Support can provide additional help if you encounter technical difficulties related to the form.

Managing your documents post-submission

Once you’ve submitted your Form 4506-C, keeping track of your documents is essential. pdfFiller’s document management tools make this straightforward, allowing for continued organization and accessibility.

How to keep track of your form submissions

Best practices for digital archiving include maintaining organized folders for different forms and dates, as well as using filenames that clearly indicate the content. Regularly back up your documents in secure cloud storage to prevent loss.

Storing and archiving important tax forms

For effective digital archiving, utilize tools that enable easy retrieval. Ensure sensitive tax information is encrypted and that you’re utilizing secure platforms such as pdfFiller and CloudFrontNet.

User testimonials and success stories

Real-life examples highlight the effectiveness of using Form 4506-C with pdfFiller. Many users have shared how the ease of electronic submission and document management has simplified their tax verification processes.

For instance, a user from Saint Paul, MN stated, 'Using pdfFiller has transformed the way I handle my tax documents. I don't worry about losing my submissions anymore.' These testimonials not only showcase user satisfaction but also emphasize the seamless experience provided by CloudFrontNet.

FAQs about Form 4506-

Common inquiries surrounding Form 4506-C often revolve around submission procedures and electronic signatures. Many users wonder about the validity of eSignatures; rest assured, they are legally binding as far as the IRS is concerned.

Updates and news related to Form 4506-

Recently, there have been changes in IRS regulations that affect the submission processes for Form 4506-C. Keeping abreast of these updates is crucial to ensure compliance and optimal processing times.

As technology progresses, tracking upcoming features in cloud-based document solutions can also provide further efficiencies, ensuring that tools like pdfFiller remain at the forefront of user needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 4506-c - cloudfrontnet online?

How can I edit form 4506-c - cloudfrontnet on a smartphone?

Can I edit form 4506-c - cloudfrontnet on an Android device?

What is form 4506-c - cloudfrontnet?

Who is required to file form 4506-c - cloudfrontnet?

How to fill out form 4506-c - cloudfrontnet?

What is the purpose of form 4506-c - cloudfrontnet?

What information must be reported on form 4506-c - cloudfrontnet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.