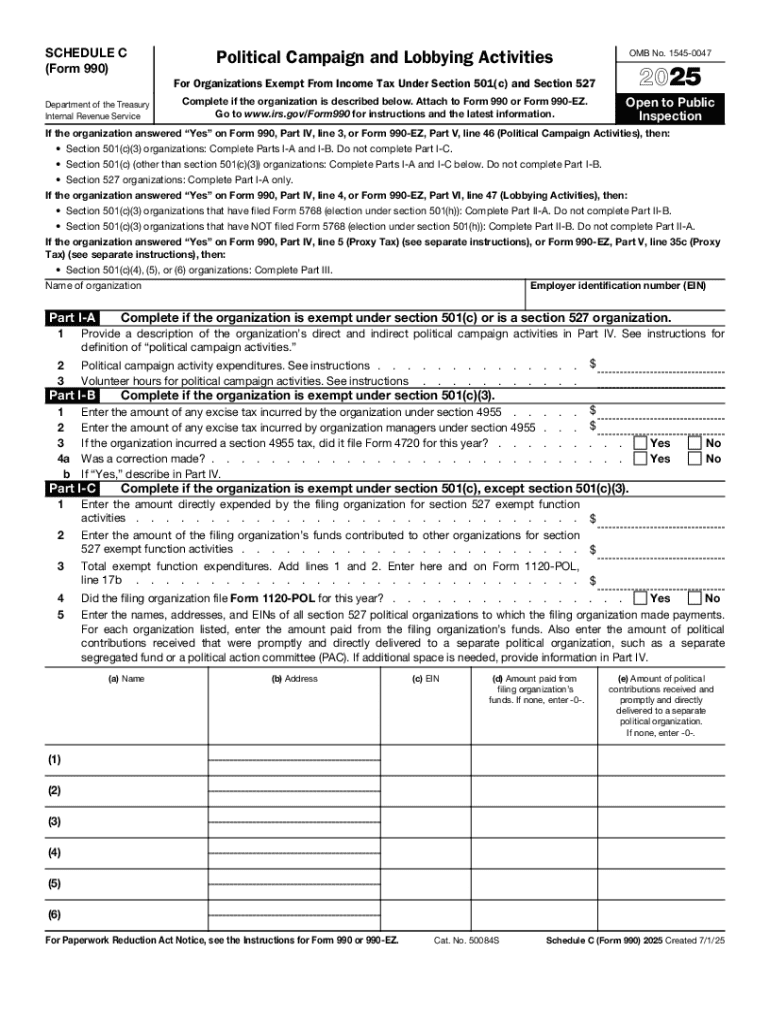

IRS 990 or 990-EZ - Schedule C 2025-2026 free printable template

Instructions and Help about IRS 990 or 990-EZ - Schedule

How to edit IRS 990 or 990-EZ - Schedule

How to fill out IRS 990 or 990-EZ - Schedule

Latest updates to IRS 990 or 990-EZ - Schedule

All You Need to Know About IRS 990 or 990-EZ - Schedule

What is IRS 990 or 990-EZ - Schedule?

Who needs the form?

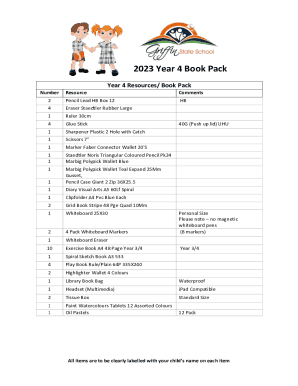

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 990 or 990-EZ - Schedule

What should I do if I realize I've made a mistake on my filed IRS 990 or 990-EZ - Schedule?

If you've made an error after filing the IRS 990 or 990-EZ - Schedule, it's important to submit an amended return. You can file a Form 990-X to correct any mistakes, ensuring that you detail the corrections clearly. Be prepared to provide any necessary documentation that supports your amendments.

How can I verify if my IRS 990 or 990-EZ - Schedule has been received and processed?

To verify the status of your submitted IRS 990 or 990-EZ - Schedule, you can use the IRS's online tracking system or call their helpline. It's recommended to note your submission confirmation details, as you may need these to check processing. Regularly monitoring the status can help avoid unnecessary complications down the line.

Are there any common errors that filers encounter with IRS 990 or 990-EZ - Schedule? How can I avoid them?

Common errors on the IRS 990 or 990-EZ - Schedule include incorrect figures, missing signatures, or improper formatting of forms. To avoid these mistakes, double-check your entries and ensure all required fields are complete before submission. Familiarize yourself with the form's guidelines to minimize the chances of running into issues.

What should I do if I receive an audit notice regarding my IRS 990 or 990-EZ - Schedule?

Receiving an audit notice for your IRS 990 or 990-EZ - Schedule can be concerning. First, carefully read the notice to understand what is being requested or questioned. Prepare the relevant documentation supporting your submissions, and consider consulting a tax professional to assist with your response to the IRS.