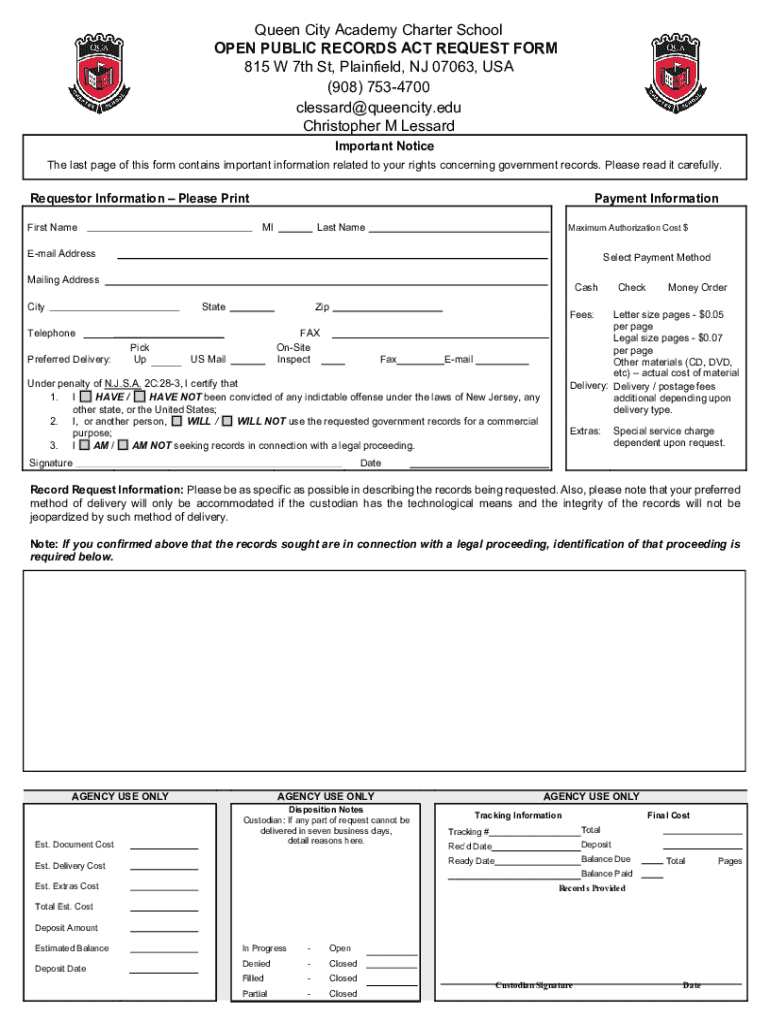

Get the free Spending - an Open Public Records Act request to Queen ...

Get, Create, Make and Sign spending - an open

How to edit spending - an open online

Uncompromising security for your PDF editing and eSignature needs

How to fill out spending - an open

How to fill out spending - an open

Who needs spending - an open?

Spending - An Open Form: Mastering Expense Management with pdfFiller

Understanding spending forms

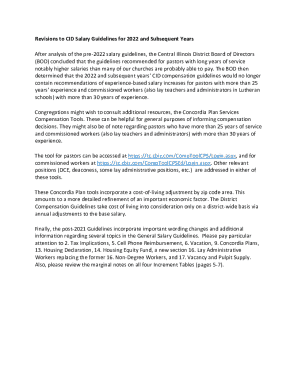

Spending forms are essential documents designed to track, authorize, and manage expenditures efficiently. These forms can vary widely in purpose and structure, serving both personal finance management and business expense reporting. Understanding the nature of spending forms is crucial for individuals and teams alike, as they streamline financial tracking, provide accountability, and simplify approvals.

The importance of spending management cannot be overstated. Properly managed expenses can lead to better budgeting, improved financial health, and enhanced organizational efficiency. Moreover, having a clear overview of spending enables proactive decision-making, helping to ensure that funds are allocated appropriately to meet personal or organizational goals.

Common uses for spending forms include tracking personal monthly budgets, facilitating expense reimbursements, and managing procurement processes in businesses. Regardless of their application, these forms must be efficient and easy to use to accommodate the diverse needs of various users.

Types of spending forms

Spending forms come in two primary types: personal and business forms. Personal spending forms enable individuals to manage their finances effectively, while business spending forms are crucial for organizational finance management.

Personal spending forms

1. Monthly Budget Trackers: These tools help individuals maintain a budget by tracking income and expenses to ensure that spending aligns with financial goals. Budget trackers can assist in illustrating where funds are being allocated, effectively facilitating more informed spending decisions.

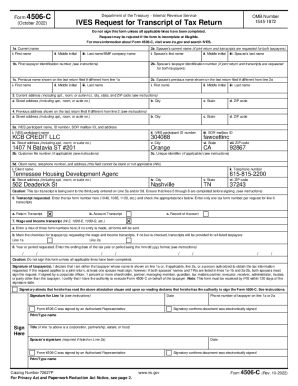

2. Expense Reimbursement Forms: These forms are used to reclaim costs incurred during work-related activities. Employees submit these documents to request reimbursement, ensuring that expenditures are documented and approved.

Business spending forms

1. Purchase Order Forms: These are used to authorize the purchase of goods or services. They ensure that purchases align with budgetary approvals and can serve as legal documentation for financial transactions.

2. Invoice Templates: Invoice forms are vital for businesses to bill clients for services rendered or products sold. These forms support cash flow management and record-keeping, making it easier for businesses to track income and expenses effectively.

Key features of effective spending forms

To create spending forms that serve their purpose effectively, a few key features are essential. A user-friendly design is fundamental; this includes a clear layout that guides users through the necessary information without confusion. Comprehensive data fields ensure that every necessary detail regarding spending is captured, promoting accuracy and thoroughness.

Another vital feature is calculation capabilities, allowing users to automatically tally expenses and manage subtotals and totals efficiently. Such automation reduces the chances of errors compared to manual calculations. Lastly, eSignature integration allows for a smooth approval process, enabling forms to be signed digitally, which increases efficiency and speeds up the overall workflow.

How to create a spending form with pdfFiller

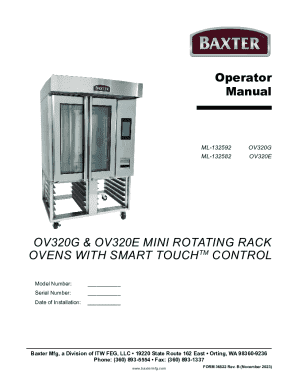

Creating a spending form with pdfFiller is a straightforward process that enhances your document management capabilities. Here’s a step-by-step guide:

Utilizing pdfFiller’s editing tools

pdfFiller’s editing tools are user-friendly and versatile. With text editing options, you can easily modify existing text or add new information. You can also include images or company logos to personalize your forms further. Color and style customization features enhance the visual appeal, making documents not only functional but also professional.

Filling out the spending form

Filling out your spending form correctly is essential for both personal and business use. Here are some instructions tailored for each:

Instructions for personal use

When using personal spending forms, it’s crucial to be accurate. Keep receipts and other documentation handy as you fill out expense details. Regularly review your completed forms to ensure compliance with budgeting goals, making adjustments as necessary to stay on track.

Best practices for business use

For business forms, effective delegation is often essential. Consider assigning specific team members to complete form sections relevant to their roles. Maintain oversight to ensure all submissions adhere to organizational policies. Additionally, tracking the submission status helps manage workflows and ensures forms are processed timely, improving overall efficiency.

Managing and storing your spending forms

Efficient management and storage of spending forms can greatly enhance productivity. Cloud-based storage solutions provide secure and accessible storage options, allowing you to retrieve forms from any device with internet access. This enhances collaboration, as team members can access the documents they need at any time.

Implementing security policies ensures that sensitive financial information is protected from unauthorized access. Organizing documents into clearly labeled folders can further aid in easy retrieval, reducing the time spent searching for important forms.

Signing and sharing your spending form

pdfFiller’s eSignature feature allows for quick and secure signing of spending forms, streamlining the approval process dramatically. Once your form is prepared and signed, sharing it becomes hassle-free. You can send your filled forms via email or integrate them into various applications for collaborative purposes.

Valuable sharing options include the ability to manage access rights among team members, ensuring that only those with appropriate permissions can view or edit sensitive information, which is particularly critical in corporate environments.

Troubleshooting common issues

While using spending forms, users may encounter various challenges. From difficulties with filling out fields to technical problems with signatures and submissions, addressing these common issues swiftly is crucial. Familiarizing yourself with troubleshooting techniques can save time and frustration.

In cases where issues arise, pdfFiller offers robust technical support. This support can guide users through filling out forms correctly, resolving signature complications, and ensuring submissions meet compliance standards.

Enhancing spending management with pdfFiller

Integrating spending forms into your workflow using pdfFiller can significantly improve overall efficiency. Not only does it streamline the creation and completion of forms, but it also provides analytics features to track spending over time. Such insights are invaluable for making informed financial decisions and adjustments.

Tips for enhancing team collaboration on spending include regular check-ins on form submissions, encouraging prompt approvals, and reviewing collective spending data together. This approach promotes accountability and encourages careful financial planning.

Advanced features for power users

For more advanced users, creating custom spending dashboards with pdfFiller can provide a comprehensive view of financial activities. Utilizing automated workflows reduces the manual effort required for form management, ensuring more time dedicated to analysis rather than administration.

Furthermore, leveraging data insights from your spending forms can enhance decision-making. Identifying trends and future needs can position individuals and organizations to react strategically to financial challenges and opportunities.

Case studies: Successful spending management

Examining real-life examples of effective spending management can illustrate the advantages of utilizing spending forms. For instance, a personal finance management example could outline how an individual implemented a structured budget tracker to save for a significant life purchase. This practice allowed them to reach their financial goals rapidly while maintaining healthy spending habits.

On a small business level, a case study might demonstrate how a company adopted structured expense reimbursement processes, leading to improved employee satisfaction and smoother financial operations. For larger corporations, enforcing spending controls through well-designed purchase order forms can instill rigorous financial discipline, significantly reducing waste and unauthorized expenses.

FAQs about spending forms

Addressing common questions regarding spending forms is essential for ensuring smooth use. Users often inquire about document creation and usability, so providing clear answers fosters a better understanding of how to leverage these tools effectively.

Misconceptions about form usability can also hinder adoption. By addressing these and clarifying submission and compliance guidelines, individuals and organizations can optimize their document management strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my spending - an open directly from Gmail?

How can I edit spending - an open on a smartphone?

How do I fill out spending - an open using my mobile device?

What is spending - an open?

Who is required to file spending - an open?

How to fill out spending - an open?

What is the purpose of spending - an open?

What information must be reported on spending - an open?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.