Get the free Bad Tax Bill Request - Phelps County Property Tax Inquiry

Get, Create, Make and Sign bad tax bill request

How to edit bad tax bill request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bad tax bill request

How to fill out bad tax bill request

Who needs bad tax bill request?

Comprehensive Guide to the Bad Tax Bill Request Form

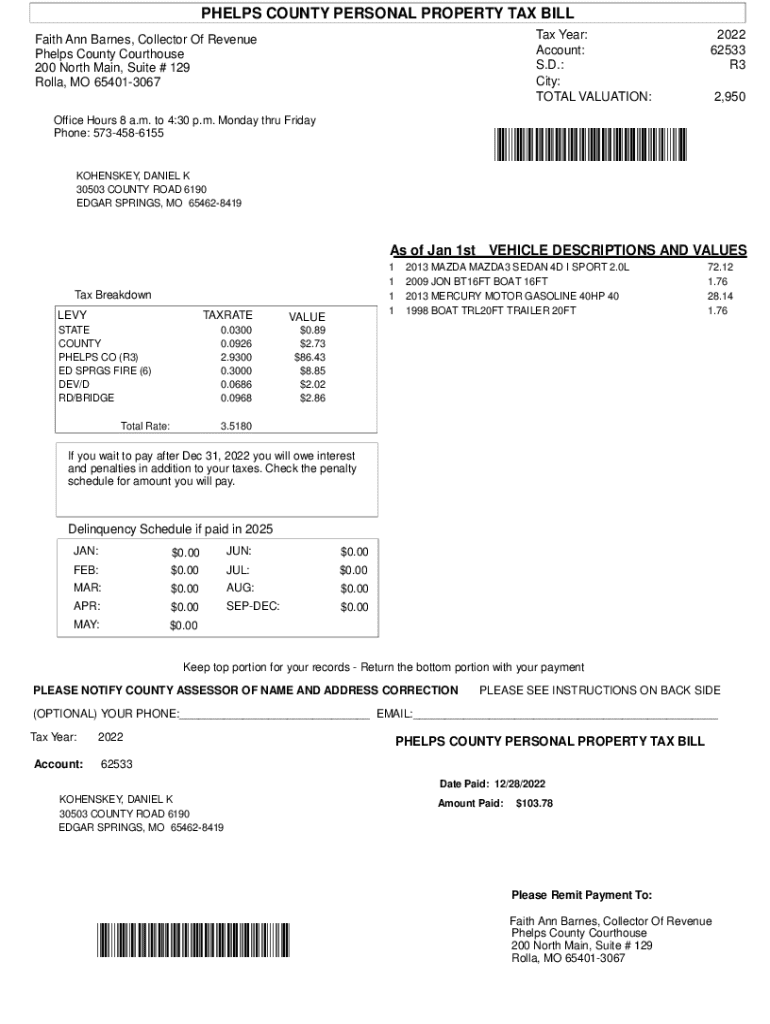

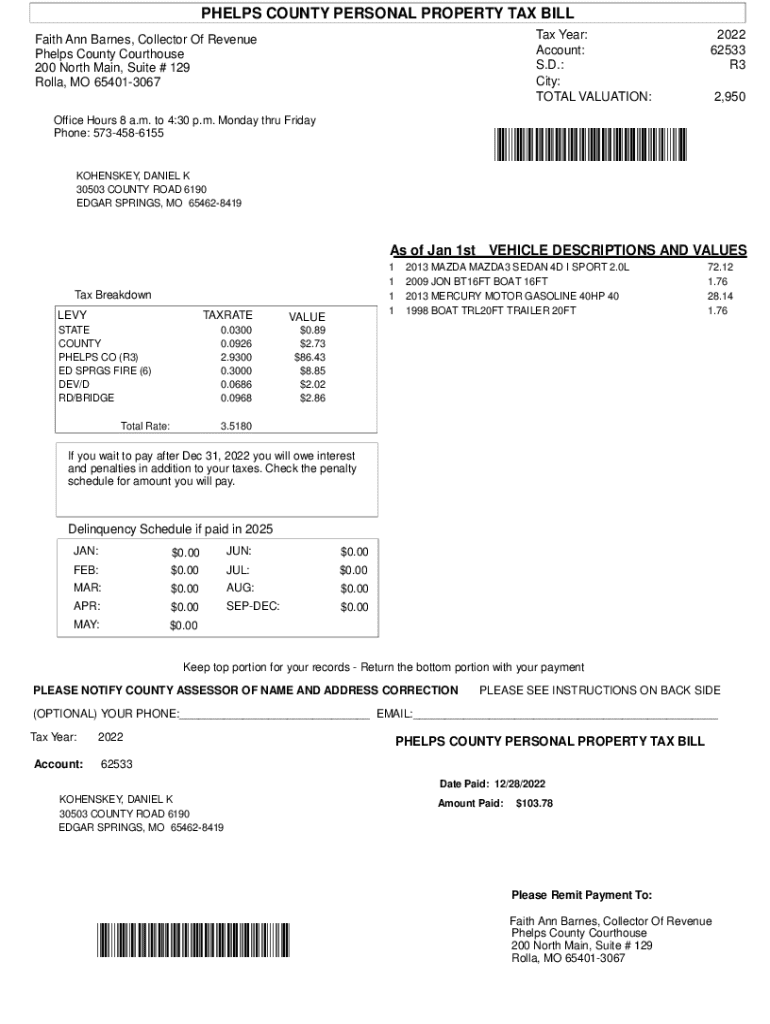

Understanding the bad tax bill request form

A bad tax bill request form serves as a formal request to contest inaccuracies in a property tax bill. Filing this form is crucial for individuals and organizations that believe their tax assessment does not accurately represent the true value of their property. By addressing inaccuracies, taxpayers can potentially reduce their financial burdens and ensure compliance with local tax laws.

When to file a bad tax bill request

Filing a bad tax bill request is time-sensitive. Local regulations dictate specific timelines, usually within a few weeks after receiving your tax bill. It's essential to be aware of your eligibility criteria, which may include having received an erroneous bill or proof of improper assessment. Furthermore, regulations differ widely, with some counties, such as Los Angeles County, implementing stricter rules compared to others.

Step-by-step guide to completing the bad tax bill request form

Completing the bad tax bill request form involves detailed documentation and accurate data entry. Start by gathering necessary documentation like purchase agreements, previous tax bills, and the property’s current assessment details. These documents will substantiate your request and provide evidence for your claims, making your case stronger.

Electronic submission vs. paper submission

Choosing between electronic and paper submission can depend on personal preference and the requirements set by your local tax collector's office. Electronic submissions often provide faster processing times and reduce the risk of lost documents.

What to expect after submission

Once you've submitted your bad tax bill request form, it's essential to understand the typical processing timeline. This can vary based on location but often takes several weeks. It's wise to keep records of your submission, including confirmation numbers or receipts.

After your request: Possible outcomes

The outcome of your request can significantly impact your future tax bills. If approved, you may see a reduction in your property taxes, relieving some financial pressure. If denied, it is crucial to understand the reasons behind the denial, as there may be options for appeal.

Tips for a successful request

To boost your chances of a successful bad tax bill request, focus on the accuracy of the information you provide, coupled with thorough documentation. Engaging with local tax advisors can also offer invaluable assistance, providing insights into nuances that could enhance your request.

Utilizing pdfFiller for document management

pdfFiller serves as an excellent resource for managing tax forms, including the bad tax bill request form. Its platform allows you to edit PDFs with precision, collaborate with team members, and maintain all documents in a secure environment.

Case studies of successful bad tax bill requests

Reviewing real-life examples can offer insights into effective strategies when filing a bad tax bill request. Case studies reveal diverse circumstances where thorough documentation and a clear understanding of local tax laws led to approvals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my bad tax bill request directly from Gmail?

How do I make edits in bad tax bill request without leaving Chrome?

How do I complete bad tax bill request on an iOS device?

What is bad tax bill request?

Who is required to file bad tax bill request?

How to fill out bad tax bill request?

What is the purpose of bad tax bill request?

What information must be reported on bad tax bill request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.