Get the free Instructions for Form 1023-EZ (Rev. January 2025). Instructions for Form 1023-EZ, St...

Get, Create, Make and Sign instructions for form 1023-ez

Editing instructions for form 1023-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 1023-ez

How to fill out instructions for form 1023-ez

Who needs instructions for form 1023-ez?

Instructions for Form 1023-EZ: A Comprehensive Guide

Understanding Form 1023-EZ: The Basics

Form 1023-EZ is a streamlined version of the traditional Form 1023, designed for smaller nonprofit organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. By simplifying the application process, this form allows eligible organizations to save time and resources while establishing their nonprofit status.

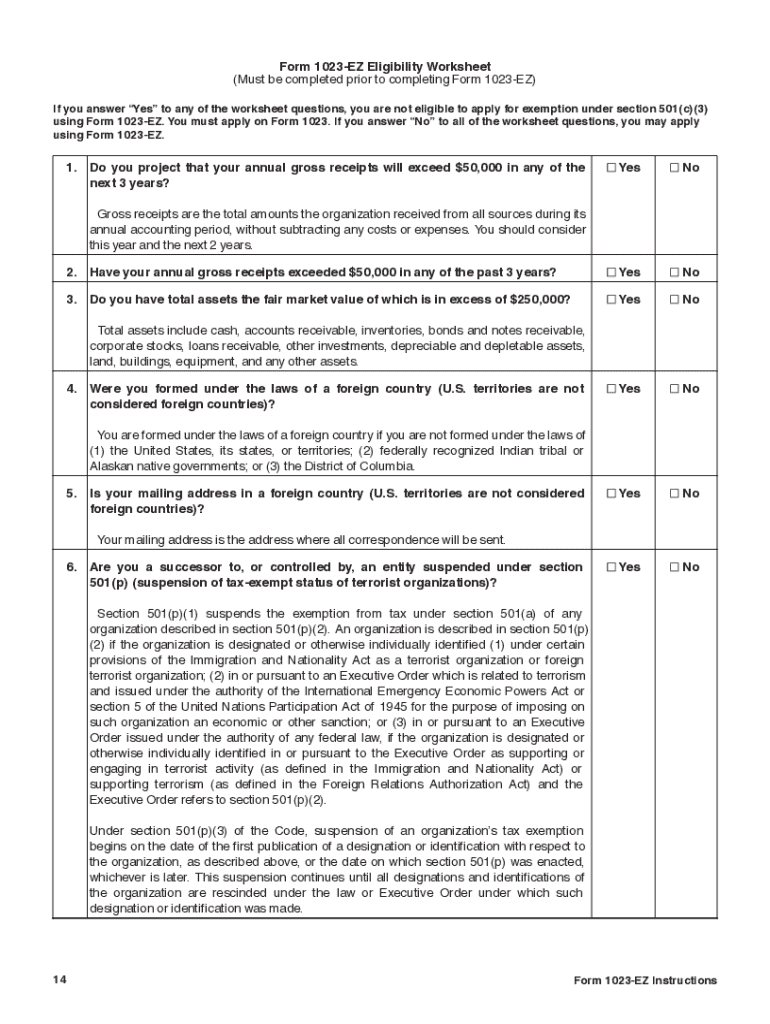

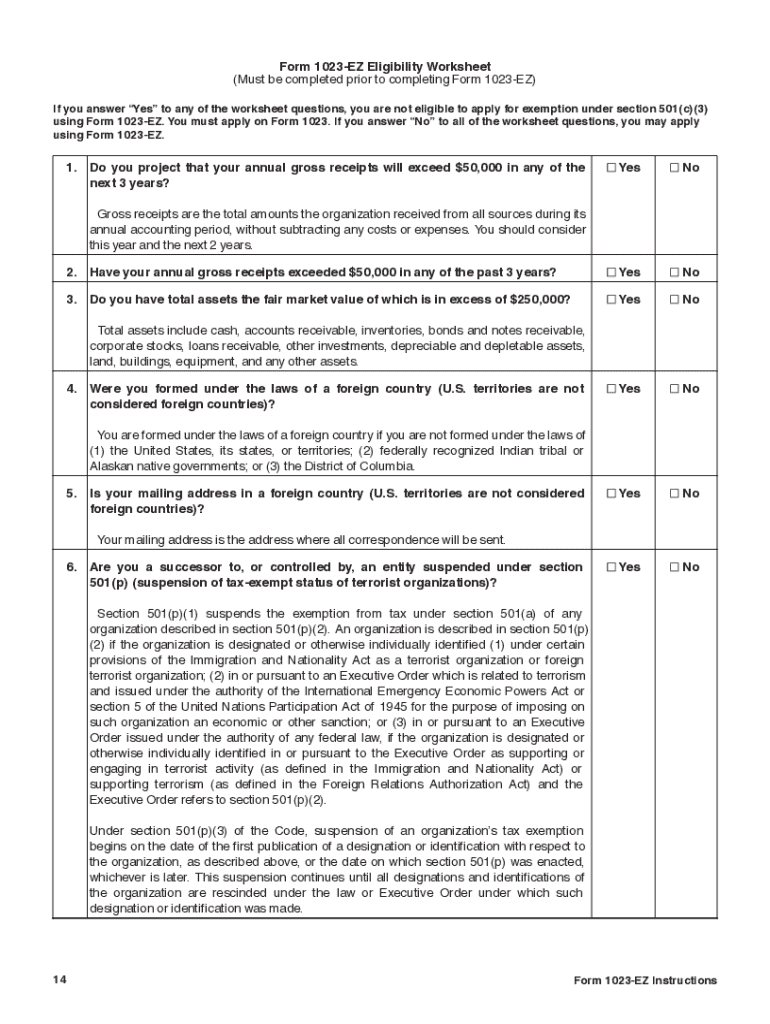

Eligibility to file Form 1023-EZ is primarily determined by the size and scope of your organization. To qualify, organizations must have projected annual gross receipts of $50,000 or less and total assets of $250,000 or below. Additionally, applicants must not be involved in certain activities that would disqualify them, such as political campaigning or lobbying beyond permissible limits.

Using Form 1023-EZ offers significant benefits over the longer Form 1023. The simplified form not only reduces the amount of paperwork but typically results in quicker processing times. This allows nonprofits to start operating sooner and begin their crucial fundraising efforts without unnecessary bureaucratic delays.

Key differences between Form 1023 and Form 1023-EZ

While both Form 1023 and Form 1023-EZ serve the purpose of securing tax-exempt status, they cater to different types of organizations. Form 1023 requires a detailed narrative of your nonprofit’s activities, detailed financial projections, and a comprehensive governance description. In contrast, Form 1023-EZ requires less information and places an emphasis on declarations rather than extensive descriptions.

The processing times also vary significantly. Form 1023 applications can take months or even longer, while Form 1023-EZ submissions are often approved within a few weeks, due to their straightforward nature. This expedited timeline benefits organizations eager to begin operations and fundraising immediately.

Step-by-step instructions for filling out Form 1023-EZ

Before diving into the details of Form 1023-EZ, it's critical to prepare with a pre-application checklist. Having the essential documents and information at hand will ease the process significantly. Essential details about your organization include its legal name, EIN (Employer Identification Number), organizational structure, and a clear mission statement.

Financial information is pivotal as well. You’ll need to summarize your projected income, contributions, and expenditures for the next three years, demonstrating your ability to maintain operational expenses. Additionally, provide data on initial funding sources and any existing grants.

Common mistakes to avoid when completing Form 1023-EZ

When filling out Form 1023-EZ, applicants often make critical oversights that can jeopardize their application. One prevalent mistake is mishandling financial projections. Accurately forecasting your organization’s income and expenses is crucial not only for proving viability but also for meeting IRS expectations.

Misinterpretations of the eligibility criteria can also hinder progress. Ensure that you thoroughly review the eligibility requirements before applying. Providing an incomplete description of the organization can lead to delays or denial; therefore, take care to articulate your mission, programs, and governance structure in clear terms.

Tips for a successful application submission

To boost the odds of your application being approved, employ best practices for document preparation. Start by consolidating all essential documents, ensuring that they are complete and accurate before submission. This not only mitigates potential issues but also reflects professionalism.

Implement strategies for accuracy, such as double-checking all figures and descriptions, and seeking feedback from others who are familiar with nonprofit standards. Tools like pdfFiller offer invaluable features for document management, allowing users to edit, collaborate, and securely eSign documents to expedite processes.

Follow-up steps after submitting Form 1023-EZ

After submitting your application, it’s crucial to understand the IRS review process. Typically, once your application is submitted, it enters a queue for evaluation. The review process can take anywhere from 2 to 6 weeks, depending on the volume of applications being processed.

Be prepared to respond to any IRS follow-up requests promptly. This might include clarifications on financial projections or additional documentation. Staying organized and ready to provide supplementary information enhances your chances of a smooth approval process.

Managing your nonprofit post-approval

An important aspect of managing a nonprofit is ensuring ongoing compliance with IRS regulations. This encompasses adhering to your stated organizational purpose and maintaining transparency in financial reporting. Regularly reviewing IRS guidelines will help prevent slips in compliance that can jeopardize your tax-exempt status.

Utilizing services like pdfFiller can streamline the documentation and reporting processes. The platform allows nonprofits to maintain thorough records, ensuring that essential forms and documentation are easily accessible and organized for audits or IRS inquiries.

FAQs about Form 1023-EZ

Applicants often have questions regarding the next steps after their application submission. Common concerns include: "What if my application is denied?" If your application is rejected, the IRS typically provides a letter explaining the reasons. You can address these issues and reapply with necessary adjustments.

Another frequent question is how to make changes after submission. Any amendments or updates must be communicated to the IRS promptly to ensure accuracy in your application status. Understanding these details can significantly affect the management of your nonprofit.

Using pdfFiller for all your document needs

pdfFiller empowers users to easily create, edit, and manage documents online. With features tailored for nonprofits, it simplifies handling forms like Form 1023-EZ. Whether you need to edit PDFs or utilize the eSignature solution for expediency, pdfFiller ensures you have the right tools at your fingertips.

Accessing your documents anytime, anywhere is a breeze with pdfFiller’s cloud-based platform. This is particularly beneficial for nonprofits that require a streamlined workflow for document management. By leveraging digital tools, organizations can maintain efficiency, organization, and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my instructions for form 1023-ez directly from Gmail?

How do I edit instructions for form 1023-ez in Chrome?

How do I complete instructions for form 1023-ez on an Android device?

What is instructions for form 1023-ez?

Who is required to file instructions for form 1023-ez?

How to fill out instructions for form 1023-ez?

What is the purpose of instructions for form 1023-ez?

What information must be reported on instructions for form 1023-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.