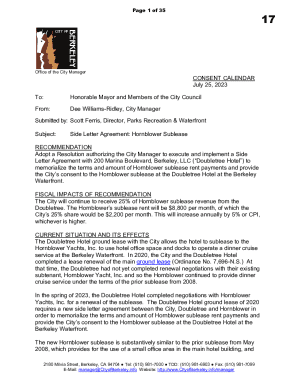

Get the free L - 40 Claim Outstanding ageing

Get, Create, Make and Sign l - 40 claim

How to edit l - 40 claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out l - 40 claim

How to fill out l - 40 claim

Who needs l - 40 claim?

A Comprehensive Guide to the - 40 Claim Form

Understanding the - 40 claim form

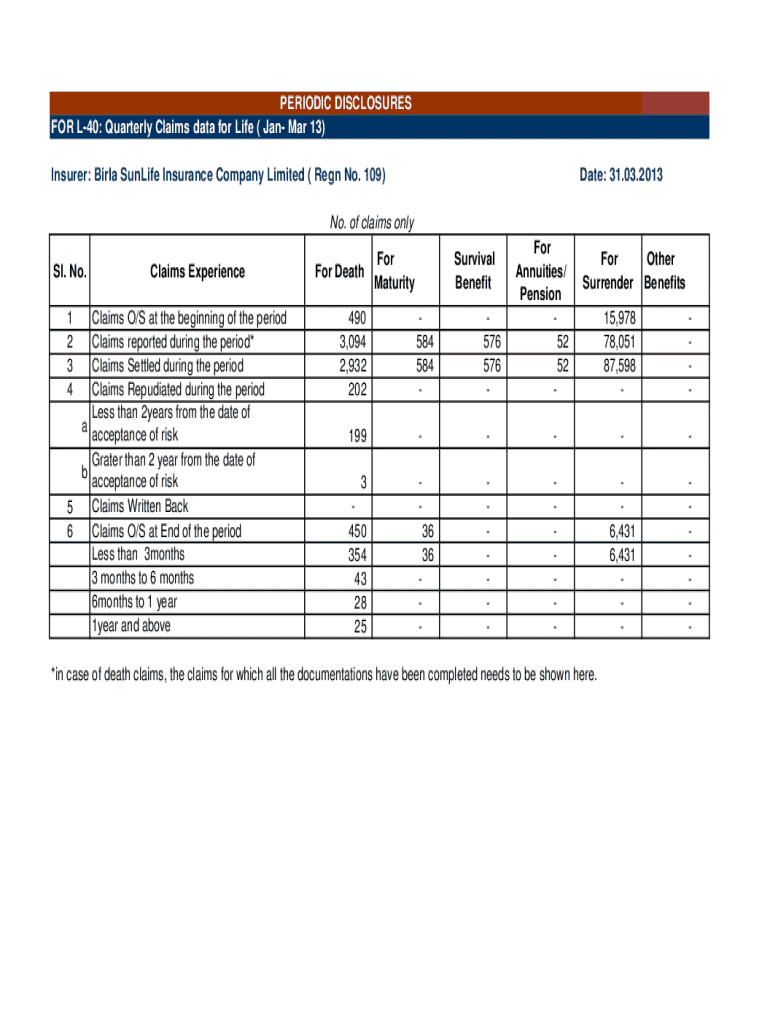

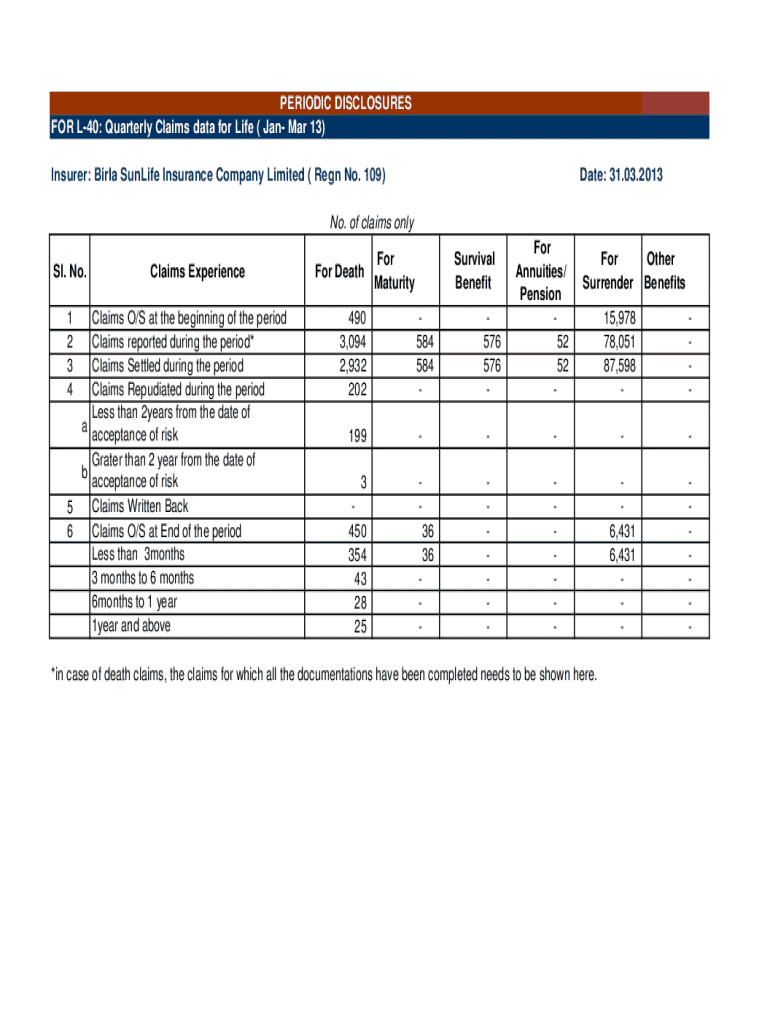

The L - 40 claim form is a specialized document used primarily for submitting claims related to insurance policies. Designed to streamline the process for policyholders, the form serves as a key mechanism in filing a claim efficiently while ensuring all necessary information is gathered.

Essentially, the L - 40 claim form provides a structured format for individuals and teams to report claims, request compensation, and submit supporting evidence related to their unique situations. Understanding its purpose is vital for ensuring that claims are handled accurately and promptly.

Who should use the - 40 claim form?

The L - 40 claim form is tailored for two main groups: individual applicants and teams representing a group or business entity. Understanding the eligibility requirements is crucial for successful claim submissions.

Individuals with active insurance policies can use the L - 40 claim form when seeking compensation or resolution for incidents covered by their terms. Teams, such as business partnerships or organizations with multi-policy coverage, can also utilize the form to consolidate claims for various members under a single submission.

Preparing to complete the - 40 claim form

Prior to filling out the L - 40 claim form, gathering all necessary documents and information is critical. Missing or unclear information can lead to delays or denials of your claim.

Start by collecting personal identification details, such as your insurance policy number, the name of the insured individual, and contact information. This foundational data will be the backbone of your claim.

Organizing your documentation will make the form completion process smoother. Using folders or digital files to categorize documents by importance can prevent confusion and ensure everything is readily accessible.

Step-by-step instructions for completing the - 40 claim form

When filling out the L - 40 claim form, adherence to a structured approach ensures comprehensive submissions. Each section of the form is designed to capture specific information that your insurer requires.

Begin with Section 1, where you provide your personal information. This encompasses your full name, address, and contact details. This step is foundational, as it establishes your identity as a policyholder.

Utilizing pdfFiller for the - 40 claim form

pdfFiller simplifies the process of completing the L - 40 claim form by offering an interactive platform where users can access, fill, and submit forms effortlessly. This intuitive interface is ideal for both individuals and teams.

Accessing the L - 40 claim form on pdfFiller can be done via a web browser, making it easy to manage from anywhere, at any time. The platform’s interactive tools enhance user experience, guiding you through the form completion process.

Common mistakes to avoid when completing the - 40 claim form

Several common pitfalls can hinder your claim process when filling out the L - 40 claim form. Awareness of these mistakes can save you time and stress.

One prevalent mistake is submitting an incomplete application. Insurers often flag missing fields, which delays processing. Another area of concern is miscalculating claim amounts. It’s essential to correctly summarize any financial claims to avoid unfavorable outcomes.

Submitting your - 40 claim form

Once the L - 40 claim form has been thoroughly filled out and reviewed, it’s time for submission. There are various methods available, allowing flexibility based on your preferences.

Submitting online is often the fastest method. Insurers typically provide portals for uploading completed forms. If you prefer or if required, mail-in submissions can also be made; just ensure that you follow the protocols established by your insurer.

Tracking status of your - 40 claim

Tracking your claim's status post-submission is essential to stay informed of your claim’s progress. Many insurers offer online systems where you can view the status of your claim.

Understanding the waiting periods and any potential challenges helps in managing expectations. This transparency enables you to address issues proactively.

Troubleshooting common issues

Encountering issues during the claims process with your L - 40 claim form is not uncommon. However, knowing how to navigate them can save time and effort.

If your claim is denied, understanding the appeal process is vital. Review the reasons provided by your insurer, addressing any necessary adjustments or providing additional documentation can enhance your chances of success.

Conclusion

Properly managing your L - 40 claim form is central to achieving a favorable outcome in your claim process. By understanding each aspect of the form, from preparation to submission, you are better equipped to navigate the complexities involved in filing an insurance claim. This knowledge is invaluable for both individuals and teams seeking to claim their entitlements effectively.

Leveraging pdfFiller for ongoing document management

Beyond the L - 40 claim form, pdfFiller offers a wider range of templates and tools for document management. Harnessing a cloud-based solution allows seamless access and management of insurance documents and other forms even after your claims process is complete.

This long-term benefit ensures that individuals and teams maintain organized records and are always prepared for future submissions. Using pdfFiller not only empowers you to handle your L - 40 claim effectively but also supports ongoing document management endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find l - 40 claim?

How do I complete l - 40 claim online?

Can I create an eSignature for the l - 40 claim in Gmail?

What is l - 40 claim?

Who is required to file l - 40 claim?

How to fill out l - 40 claim?

What is the purpose of l - 40 claim?

What information must be reported on l - 40 claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.