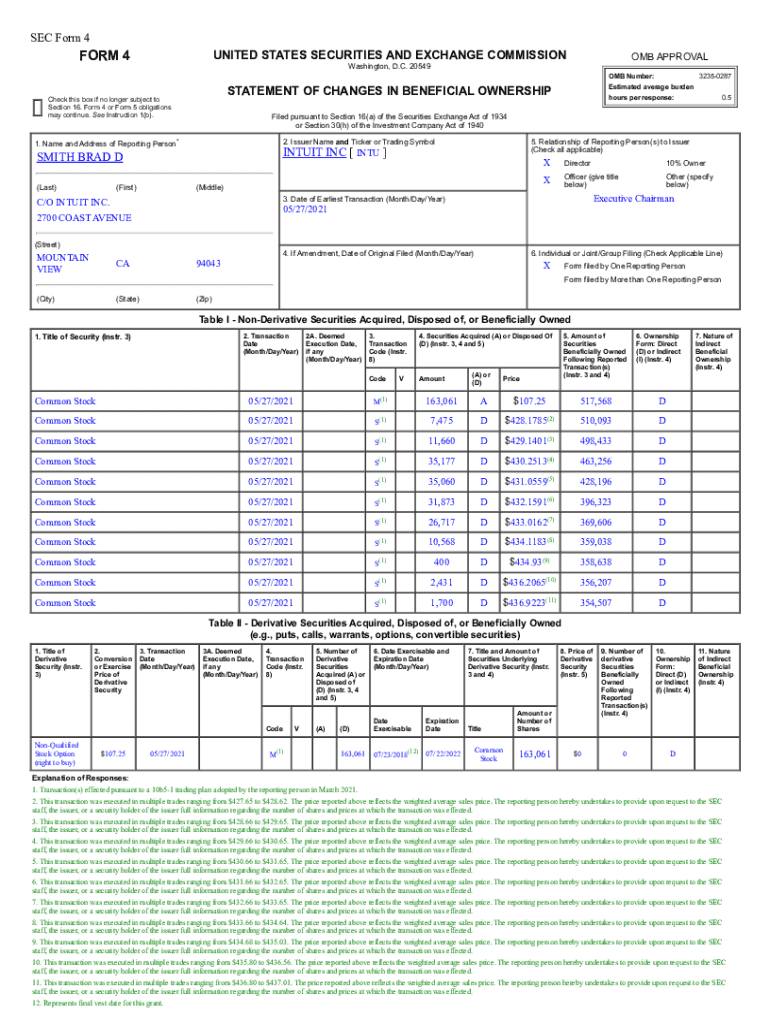

Get the free Transaction(s) effected pursuant to a 10b5-1 trading plan adopted by the reporting p...

Get, Create, Make and Sign transactions effected pursuant to

How to edit transactions effected pursuant to online

Uncompromising security for your PDF editing and eSignature needs

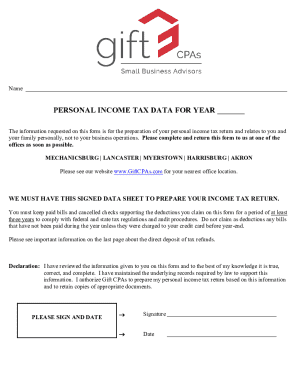

How to fill out transactions effected pursuant to

How to fill out transactions effected pursuant to

Who needs transactions effected pursuant to?

Transactions effected pursuant to form: A comprehensive guide

Understanding transactions effected pursuant to form

Transactions effected pursuant to form refer to the processes by which various activities—such as trades, agreements, or financial operations—are conducted using structured documents known as forms. These forms help standardize the transaction process, ensuring that all parties can understand obligations, rights, and conditions attached to each transaction.

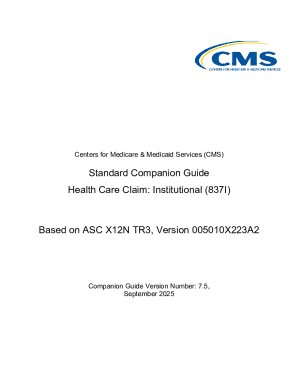

Compliance is crucial in these transactions. Properly filled forms not only facilitate smooth operations but also protect the involved parties from legal penalties and disputes. Investment advisers, financial institutions, and firms must adhere to stringent regulations set forth by authorities such as the Securities and Exchange Commission (SEC) to uphold ethical standards and transparency in transactions.

To navigate these requirements, individuals and teams must familiarize themselves with the relevant regulations and guidelines governing the transactions. This involves knowing how to complete the necessary forms correctly and understanding the implications of non-compliance.

Key forms involved in transactions

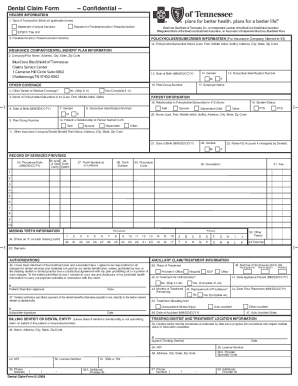

Various types of forms play a pivotal role in transactions, particularly in the financial sector. Commonly used forms include:

Choosing the right form is essential for ensuring that all regulatory compliance needs are met. Each form serves distinct purposes and understanding these differences can save time and prevent errors in the transaction process.

Step-by-step process for completing transaction forms

To ensure that transactions are effectively executed, following a systematic approach when completing transaction forms is essential. Here are the fundamental steps:

Following these steps will minimize errors and enhance the likelihood of your transaction being processed smoothly and without delay.

Interactive tools for transaction management

pdfFiller offers a plethora of interactive features designed to streamline transaction management. Here’s a brief overview:

By leveraging these tools, individuals and teams can enhance productivity and reduce the likelihood of complications during the transaction process.

Understanding the legal implications

Properly effected transactions pursuant to form have significant legal implications. Compliance with filing requirements and regulations is paramount; failure to do so can lead to various penalties. For investment advisers and related professionals, adhering strictly to the applicable code of ethics requirement is crucial in maintaining reputational integrity.

Non-compliance can result in penalties ranging from fines to revocation of licenses, emphasizing the need to ensure that all transactions are completed in accordance with established standards. Moreover, securing document integrity through encryption and access controls is vital to protect sensitive information related to financial dealings.

Management of completed transactions

Once transactions are completed, proper management becomes critical. pdfFiller offers ways to store and organize completed forms effectively. Here are some best practices:

Adopting these strategies can significantly enhance the management of transaction-related documentation, fostering efficiency and reliability.

Frequently asked questions

Navigating through transaction forms can lead to several questions. Here are some common inquiries and their corresponding answers:

User testimonials and case studies

Real-life feedback from users highlights the effectiveness of pdfFiller in managing transactions. Many investment advisers have reported streamlined workflows that significantly reduce the time spent on paperwork.

For example, an investment firm using pdfFiller for their transaction forms noted a 50% decrease in completion times and a marked improvement in document accuracy, thanks to the platform's intuitive editing and collaborative features.

Additional features of pdfFiller relevant to transactions

In addition to standard editing and signing capabilities, pdfFiller offers additional features that cater specifically to transaction needs, enhancing productivity and collaborative capabilities.

These features position pdfFiller as a robust solution for transaction management, reinforcing its value as a go-to platform for both individuals and teams.

Conclusion: Empowering your transaction processes

Effectively managing transactions pursuant to form is not just about compliance; it is also about leveraging technology to improve efficiency. pdfFiller provides a comprehensive solution that empowers users to streamline the entire process of form creation, submission, and management.

Taking advantage of the platform's robust features can dramatically reduce the time and effort required to manage transactions, ultimately leading to more successful and compliant operations. Embracing these tools positions users to navigate transaction challenges with confidence and ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send transactions effected pursuant to to be eSigned by others?

How do I complete transactions effected pursuant to online?

How do I edit transactions effected pursuant to online?

What is transactions effected pursuant to?

Who is required to file transactions effected pursuant to?

How to fill out transactions effected pursuant to?

What is the purpose of transactions effected pursuant to?

What information must be reported on transactions effected pursuant to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.