Get the free Homestead Property Tax Credit and Renter's Refund

Get, Create, Make and Sign homestead property tax credit

Editing homestead property tax credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out homestead property tax credit

How to fill out homestead property tax credit

Who needs homestead property tax credit?

Homestead Property Tax Credit Form: Your Comprehensive Guide

Understanding the Homestead Property Tax Credit

The Homestead Property Tax Credit is a valuable financial relief program designed to reduce the property tax burden for eligible homeowners. This credit helps those who reside in their homes as a primary residence by offering substantial savings on property taxes, making homeownership more affordable for many families. Programs may vary by state, with specific regulations governing eligibility and benefits.

Eligibility requirements for this credit typically include factors such as ownership status and residency. Homeowners must have legal title to their property and reside there as their main home. Additional criteria may involve income levels, age, disability status, or the length of time one has lived in the home. Understanding these requirements is crucial for increasing chances of approval.

The benefits of the Homestead Property Tax Credit not only lead to financial savings that can significantly impact your annual budget but also promote local government support for residents. This can result in improved community services and infrastructure, as local tax revenues are often redistributed for public projects.

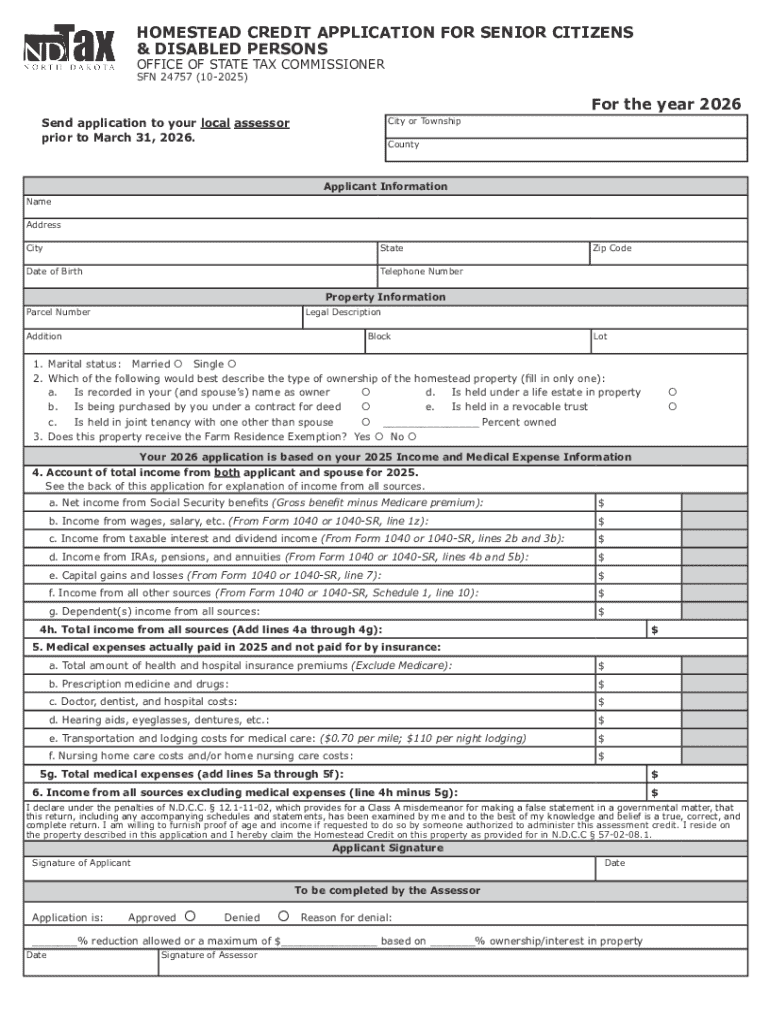

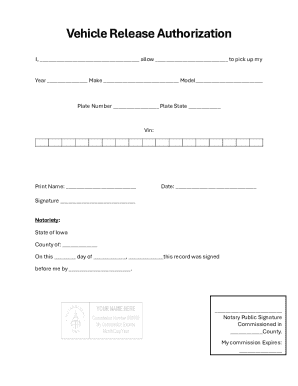

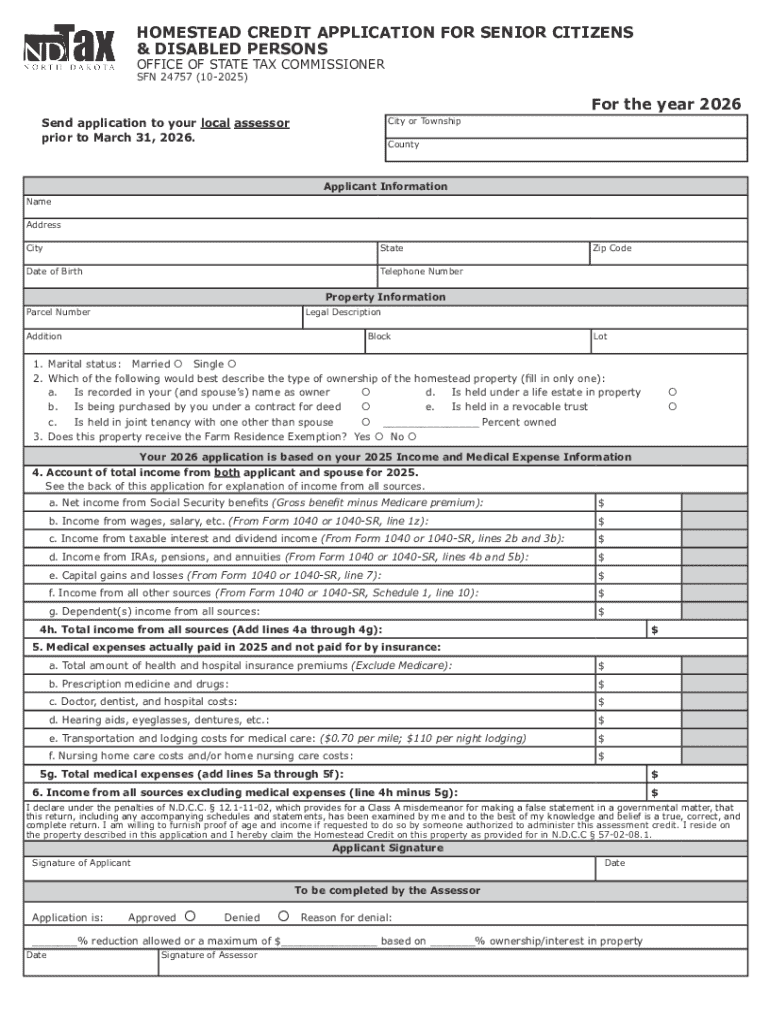

Overview of the Homestead Property Tax Credit Form

The Homestead Property Tax Credit Form plays an essential role in the application process, requiring specific information to ensure the accurate assessment of your eligibility. It is vital for homeowners to complete the form correctly to receive the financial relief intended by the government. Missing or inaccurate details could result in delays or rejection of your application.

On this form, you’ll need to provide key personal information, including your full name, address, and contact details. Additionally, information regarding your property—such as its assessment value and type—is necessary. Tax-specific details, including previous tax returns and exemptions claimed, are also critical for processing your application.

You can find the Homestead Property Tax Credit Form from your state’s department of revenue website, where it is often available as a downloadable PDF. Generally, these forms can also be completed and submitted online through designated government platforms for added convenience.

Step-by-step guide to filling out the Homestead Property Tax Credit Form

Filling out the Homestead Property Tax Credit Form can seem complex, but breaking it into manageable steps will streamline the process. Begin by gathering all required documentation upfront to avoid multiple rounds of data collection.

Common mistakes include omitting important information or providing inconsistent data. Therefore, use a checklist to confirm all entries are correct. Once completed, submit the form via your preferred method. Be mindful of any deadlines to ensure that your application is processed in time.

Managing your application process

After submitting your Homestead Property Tax Credit Form, staying informed about the status of your application is crucial. Most state revenue departments offer online portals where you can check the progress of your application. This feature allows you to quickly identify if your application is still being processed or requires additional information.

Typically, feedback on your application can be expected within a few weeks. Post-submission, understand that your application may receive approval or denial. Depending on the outcome, the next steps may involve accepting the savings on your home property taxes or reviewing the reasons for any denial to address issues for future applications.

Troubleshooting common issues

It’s not uncommon to encounter issues when applying for the Homestead Property Tax Credit. One frequent concern is a 'No Application' status appearing in the portal. If this happens, it might indicate that your application is still under review or has not been processed correctly. It’s best to contact the department for clarification.

If any documentation is lost, consider alternative sources of proof, such as utility bills or lease agreements. If your application is denied, review the feedback and follow the appeals process, which typically requires a formal statement and supporting evidence to contest the decision.

Additional tips for maximizing your Homestead Property Tax Credit

To get the most out of your Homestead Property Tax Credit, keep track of all related documents organized for future applications. Create a secure system, either physical or digital, that maintains records like tax filings, property tax statements, and correspondence with the tax office. Staying informed about potential changes in tax laws can also help you adapt and secure benefits you might not be aware of.

Using tools like pdfFiller can significantly enhance your document management experience. This platform is tailored for users seeking a comprehensive, access-from-anywhere document creation solution. You can easily edit and eSign PDFs, collaborate with team members, and enjoy the safety of cloud storage for your important documents.

Frequently asked questions

Clarifying common questions about the Homestead Property Tax Credit can ease the application journey. For instance, various property types qualify, including single-family homes, condos, and townhouses. You can apply immediately if you just moved in, provided you meet other eligibility criteria. Tax credits are calculated based on your property’s assessed value and your residency status, making it crucial to confirm these figures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in homestead property tax credit?

Can I create an eSignature for the homestead property tax credit in Gmail?

How do I complete homestead property tax credit on an iOS device?

What is homestead property tax credit?

Who is required to file homestead property tax credit?

How to fill out homestead property tax credit?

What is the purpose of homestead property tax credit?

What information must be reported on homestead property tax credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.