Get the free Colorado Personal Property Bill of Sale Form

Get, Create, Make and Sign colorado personal property bill

Editing colorado personal property bill online

Uncompromising security for your PDF editing and eSignature needs

How to fill out colorado personal property bill

How to fill out colorado personal property bill

Who needs colorado personal property bill?

Colorado Personal Property Bill Form - How-to Guide

Understanding the Colorado personal property bill form

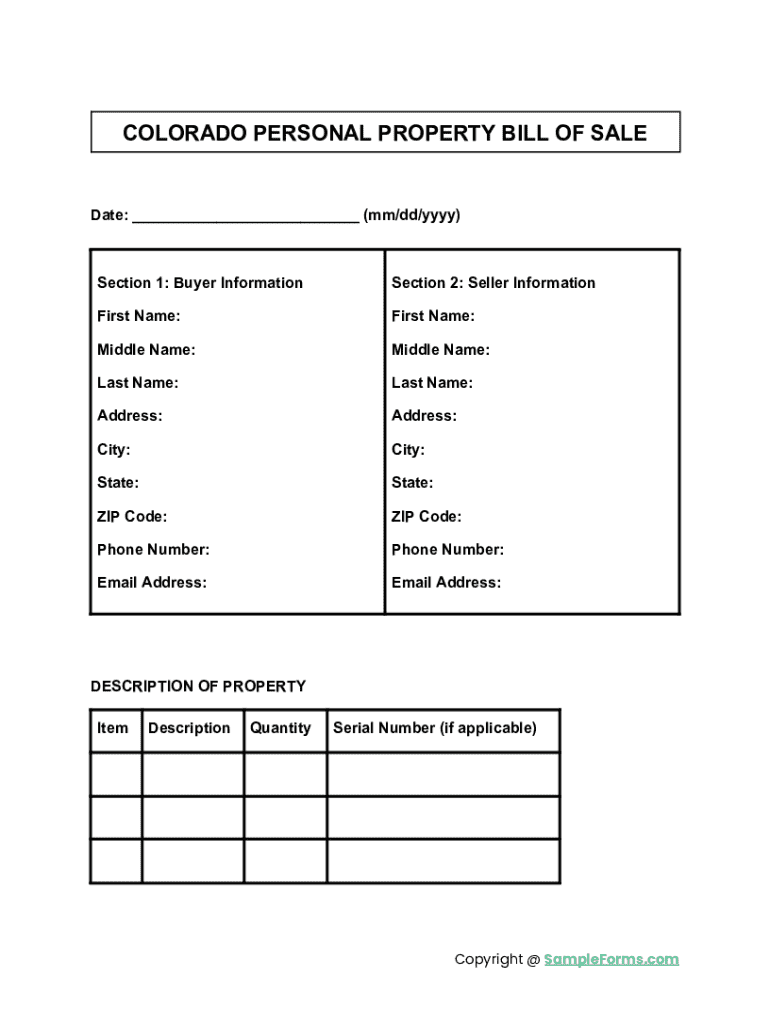

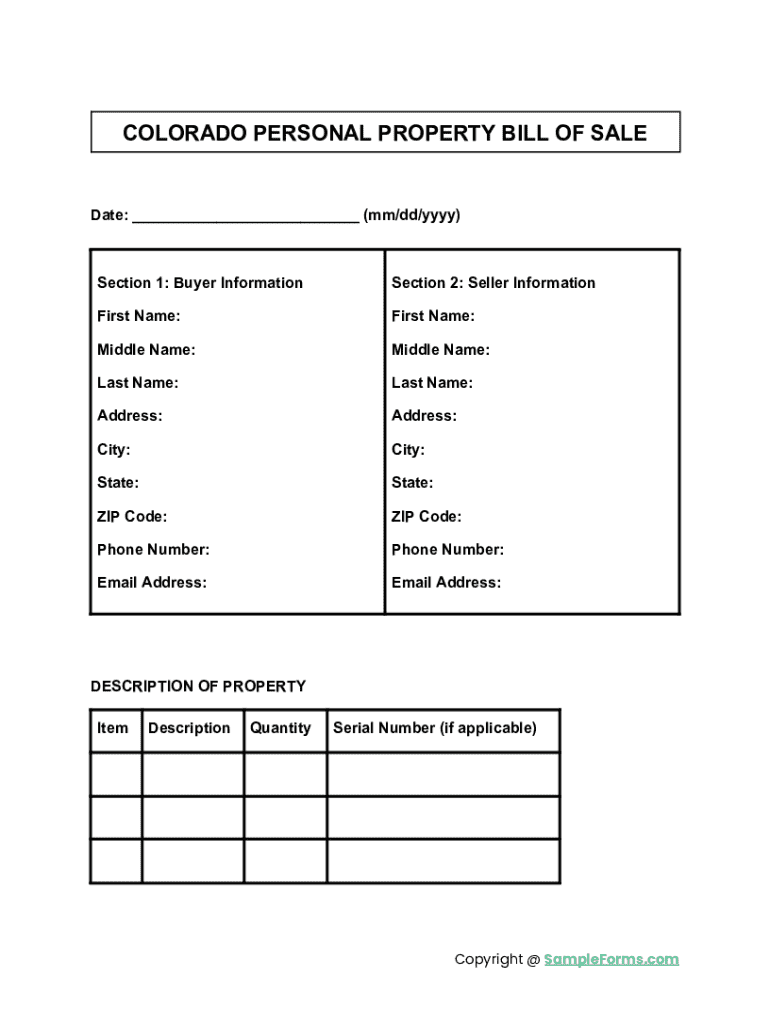

The Colorado Personal Property Bill Form is a crucial document in the realm of property tax assessment, designed to report personal property owned by individuals and businesses. This form is essential for ensuring accurate taxation based on the assessed value of personal property, including equipment, furniture, and other tangible assets. Understanding this form is fundamental to complying with the local property tax laws and ensuring that your property is correctly classified and valued.

Within the context of Colorado's property taxation framework, the state has established various tax laws and assessment procedures, making it imperative for property owners to engage with the Personal Property Bill Form. Accurate reporting not only helps in the fair assessment of tax liabilities but also plays a crucial role in budgeting for personal or business expenses linked to property ownership.

Who needs to file a personal property bill form?

The obligation to file a Colorado Personal Property Bill Form extends to various entities, primarily encompassing individuals and businesses. Homeowners who possess valuable personal property such as vehicles, boats, or high-value collectibles are required to file. Additionally, renters who own significant personal property can also benefit from filing to ensure proper assessment of their assets.

Small business owners and corporate entities are typically the most significant filers of this form. Businesses may need to report their inventory, machinery, furniture, and other equipment. Filing is especially important for businesses that meet certain valuation thresholds, ensuring that they are compliant with state regulations. Specific criteria for filing include having personal property with a value exceeding the state-determined minimum, which may vary depending on the asset.

Key components of the Colorado personal property bill form

While every Colorado Personal Property Bill Form might have slight variations, several key components remain consistent. The form generally requires personal and business identification, including the owner's name, address, and tax identification number. Furthermore, it demands a detailed accounting of the personal property owned, categorized appropriately.

Utilizing accurate terminology is crucial for effective communication and compliance. Understanding terms like 'depreciated value' or 'real property' can enhance your completion of the form. Mistakes in data entry can lead to inaccurate property assessments, resulting in inflated taxes.

Steps to complete the Colorado personal property bill form

Completing the Colorado Personal Property Bill Form can be straightforward when approached systematically. Start by gathering all necessary documentation, as outlined below. This ensures that you have all the relevant details at your fingertips, minimizing the risk of errors during data entry.

Gather required documentation

After gathering documentation, proceed to fill out the form. Each section should be completed diligently, taking special heed to instructions that accompany the form. For example, accurately recording the purchase date and value of each item minimizes misunderstandings with tax assessors.

Common mistakes to avoid include misreporting values, neglecting to sign the form, and failing to categorize the property correctly. Double-check your entries to ensure they are both accurate and honest.

Utilizing pdfFiller for form management

pdfFiller offers an excellent solution for managing your Colorado Personal Property Bill Form. Its features enable users to edit forms easily, add digital signatures securely, and collaborate within teams. This ensures that everyone involved in the filing process can contribute effectively, minimizing errors and fostering transparency in your property assessment.

Submitting your completed form

Once the Colorado Personal Property Bill Form is filled out, it’s important to understand the submission process. Make sure to send your form to the appropriate county assessor's office; each Colorado county has specific submission requirements that might differ slightly.

Adequate attention to submission deadlines is necessary, as failing to file on time can result in penalties or late fees. Keeping track of key dates and confirming the successful receipt of your form enhances your filing experience and ensures compliance with state regulations.

Understanding post-submission processes

After submitting the Colorado Personal Property Bill Form, you may wonder what happens next. The assessor’s office will review the submitted data, which could lead to further inquiries or a request for additional documentation if there are discrepancies.

It’s vital to stay proactive following your submission. Regularly checking for assessment updates or any notices regarding your form can prevent issues down the line. If disputes arise, be prepared for a clear communication process with the assessor's office to resolve any inconsistencies.

FAQs on Colorado personal property bill form

A variety of common questions surround the Colorado Personal Property Bill Form, especially for first-time filers. For instance, individuals often inquire about exemptions available or how often they are required to file. Such queries highlight the importance of understanding state-specific regulations and how they apply to your personal or business assets.

The role of the Colorado Division of Property Taxation

The Colorado Division of Property Taxation serves an essential role in assisting property owners throughout the personal property taxation process. They provide guidelines, support, and resources for individuals and businesses navigating their tax obligations.

As a part of their mission, they frequently update stakeholders about changes in laws, assessment procedures, and important deadlines, ensuring that property owners remain informed and compliant.

Additional tips for managing your personal property taxes

To effectively manage your personal property taxes, consider implementing best practices such as maintaining organized records of all assets, keeping track of valuations annually, and staying informed on any legislative changes that may affect your liabilities. Using digital solutions like pdfFiller also simplifies the process, streamlining form management and signature processes.

User testimonials and case studies

Many users have shared their success stories using pdfFiller for managing the Colorado Personal Property Bill Form. Testimonials indicate that the platform’s intuitive design and collaborative tools have minimized common errors typically experienced with form submissions.

For instance, one small business owner reported a significant time savings and ease of collaboration, allowing them to focus on other aspects of their operations while confidently managing their tax obligations. These real-life experiences underscore the effectiveness and efficiency of utilizing a digital solution for property tax management.

Interactive tools and resources

To further streamline the process of managing your Colorado Personal Property Bill Form, pdfFiller provides various tools and resources. Offering downloadable guides, calculators for estimating property taxes, and fillable templates, pdfFiller equips users with the means to simplify their property tax management.

Accessing these resources can help provide a clear pathway through the complexities of personal property taxation. By leveraging technology, users can optimize their experience, resulting in accurate and timely submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify colorado personal property bill without leaving Google Drive?

How can I send colorado personal property bill to be eSigned by others?

Can I edit colorado personal property bill on an iOS device?

What is colorado personal property bill?

Who is required to file colorado personal property bill?

How to fill out colorado personal property bill?

What is the purpose of colorado personal property bill?

What information must be reported on colorado personal property bill?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.