Get the free Private Car Takaful

Get, Create, Make and Sign private car takaful

Editing private car takaful online

Uncompromising security for your PDF editing and eSignature needs

How to fill out private car takaful

How to fill out private car takaful

Who needs private car takaful?

Private Car Takaful Form: A How-to Guide

Understanding private car takaful

Private car takaful refers to a cooperative insurance model rooted in Islamic principles, emphasizing mutual assistance and shared responsibility among participants. In contrast with conventional insurance, which often operates on profit-making motives, takaful operates on the concept of pooling resources to protect against unforeseen events. This approach not only aligns with Islamic teachings but also offers peace of mind to policyholders who prefer ethical financial solutions.

The importance of takaful in the automotive sector cannot be understated. As vehicles are essential to daily life, having a protective mechanism in place is crucial. Takaful provides a safety net for those involved in accidents, property damage, and liability claims without compromising Islamic values.

Key principles of takaful include mutual cooperation (taawun), risk sharing, and the avoidance of uncertainty (gharar) and gambling (maysir). Participants agree to contribute to a common fund, which is used to compensate any member facing a loss, creating a community-oriented model that enhances social responsibility.

Types of car takaful coverage

When considering a private car takaful form, understanding the coverage types available is essential. The offerings generally vary based on individual needs and preferences.

Comprehensive coverage protects against a wide array of risks, including accidents, theft, and damage from natural disasters. On the other hand, third party liability coverage primarily shields you from the financial consequences of causing harm or damage to others.

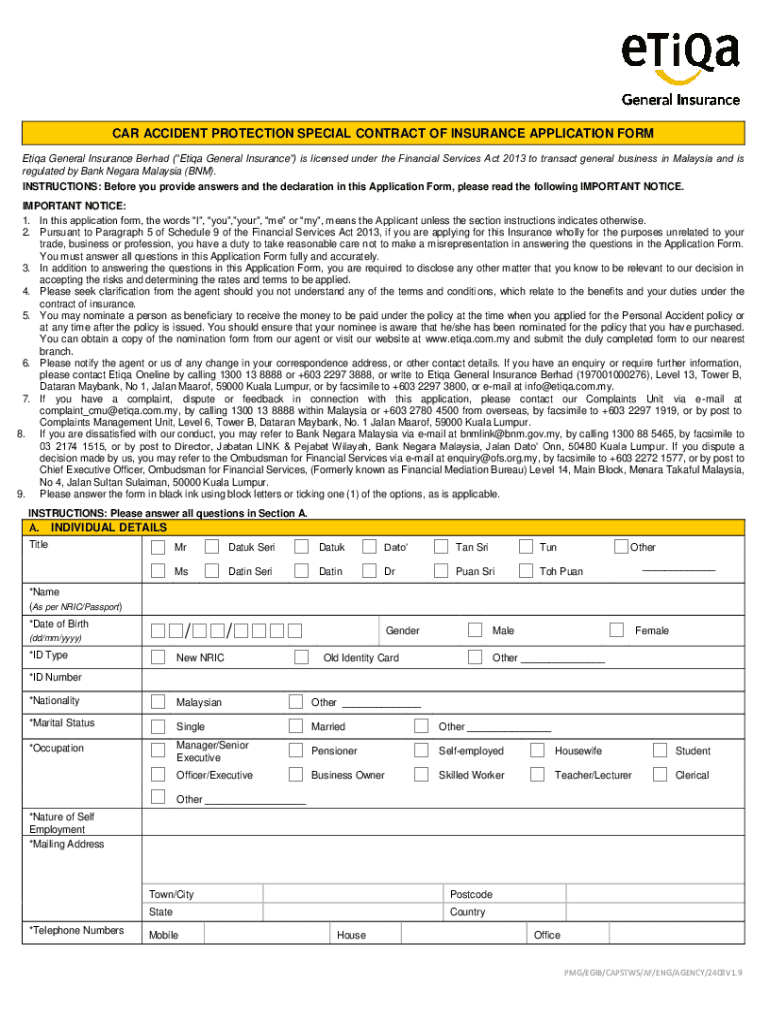

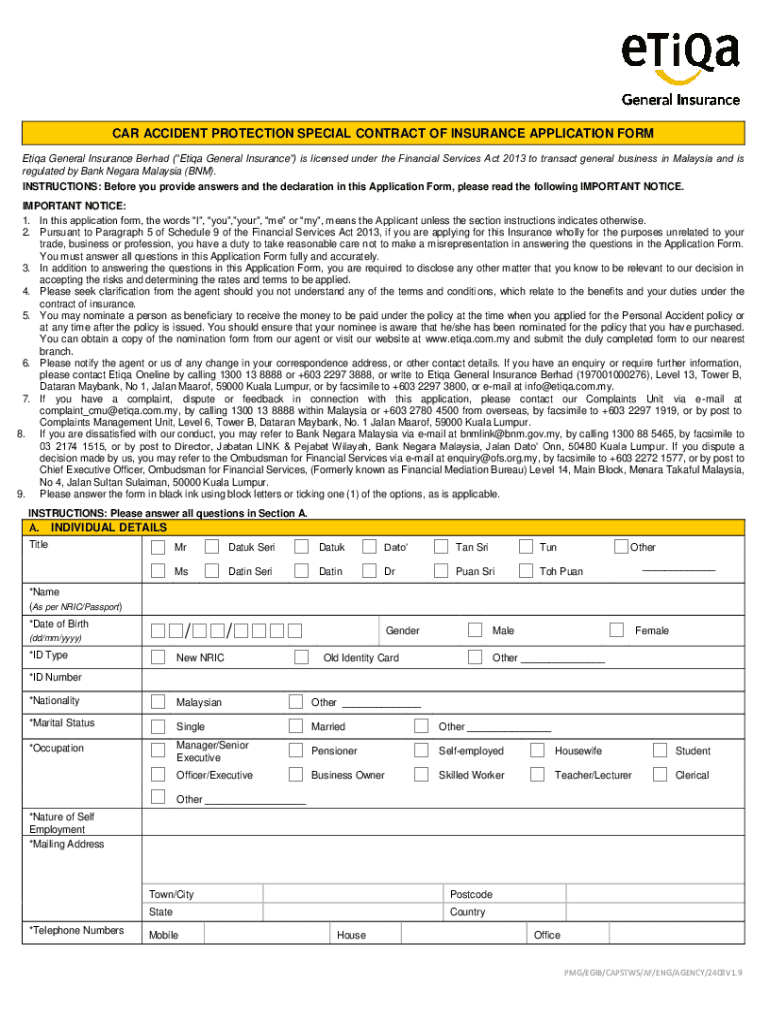

Requirements to apply for private car takaful

Before completing a private car takaful form, it's necessary to know the eligibility criteria and documentation required. Most providers require that policyholders be individuals who own a vehicle and can demonstrate responsible driving behavior.

Required documentation may include the vehicle registration document, which indicates ownership and details of the vehicle. Previous insurance records are also important to demonstrate your history as a responsible driver, while personal identification ensures that the applicant is verified.

Step-by-step guide to filling out the private car takaful form

Filling out the private car takaful form can seem daunting, but following a structured approach simplifies the process significantly. Start by accessing the required form from your takaful provider's website or directly via the pdfFiller platform, which empowers users to seamlessly edit and manage documents.

The personal information section requires details such as your name, address, and contact number. Next, you'll need to enter vehicle information, including the make, model, year of manufacture, and vehicle identification number (VIN). Finally, you'll select your preferred coverage options, based on your needs and budget.

Common mistakes to avoid include leaving fields blank, inaccurate vehicle information, and selecting inappropriate coverage. Also, check for any specific requirements that may vary between providers. Lastly, it's essential to clarify any doubts, and remember that pdfFiller offers interactive features to enhance ease of use—allowing for quick edits and collaboration if needed.

FAQs around form submission often center on the necessity of certain documents and timelines for processing, which can vary by provider. Make sure to confirm these with your chosen takaful provider.

Editing and signing the takaful form

After completing the private car takaful form, you may find the need to make adjustments or sign digitally. Utilizing pdfFiller tools for form editing is conveniently streamlined, allowing you to amend your documents without starting from scratch. This ensures seamless experiences whether you're revising details or making corrections.

To eSign your takaful form simply follow a few simple steps. With pdfFiller, you can easily include an electronic signature by adding your names in the designated area or using the signature creation tool to apply a scanned image of your signature. This digital signing process is not only quick but also compliant with legal standards.

Submitting your private car takaful form

Once you have completed and signed your private car takaful form, the next step is submission. Different providers offer multiple options, including online submission, email, and physical delivery.

If opting for online submission, you can upload directly through the provider's portal or via pdfFiller, which allows for smooth uploading of completed forms. For email submissions, ensure the right address is used to avoid mishaps. If choosing to submit physically, ensure you send it via certified mail or delivered in person to receive confirmation.

Tracking the application status is vital to ensure your application is being processed. Check the provider's guidelines for estimated processing times and follow up if there are delays to address any potential issues effectively.

If your application is rejected or needs more information, understanding the next steps is crucial. Promptly provide required documents or clarifications to avoid reinstatement delays.

Managing your takaful policy

After securing your private car takaful policy, you'll want to actively manage it for optimal benefits. Accessing and updating your policy can be done easily via pdfFiller, ensuring that you can make changes when necessary—from personal details to coverage options.

Renewal of your takaful policy is essential before the expiration date, ensuring continuous coverage. Typically, providers will send notifications, but it's wise to track renewal dates personally. Making changes to coverage is also feasible, allowing for enhanced protection as your needs evolve.

In the claim process, ensure you gather all required documentation as per your provider's guidelines and submit promptly to avoid complications. Knowing the required documentation helps streamline your experience.

Frequently asked questions about private car takaful

Common inquiries often arise surrounding the distinctions between takaful and conventional insurance, especially regarding risk management and profit distribution. Understanding that takaful revolves around community support sets it apart in many critical aspects.

Another frequent question concerns whether one can change coverage after submission. Generally, most providers allow modifications, although they may specify limitations based on policy stages. Queries about claims assessment methods are also prevalent; providers assess based on predefined criteria that include the cause and degree of damage or injury.

Incomplete or incorrect forms can lead to delays or rejections, thus emphasizing the importance of reviewing submissions thoroughly before sending them in. When in doubt, utilize the integrated help options available on pdfFiller or consult customer support for assistance.

Support and assistance

Accessing support for your private car takaful form needs is straightforward. pdfFiller provides robust customer support options, ensuring you have a reliable channel for your queries during every stage of the process.

You can utilize interactive tools on their platform for customized help, allowing you to navigate the form easily. Additionally, user testimonials emphasize the effectiveness of using pdfFiller for a hassle-free experience while handling takaful-related documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

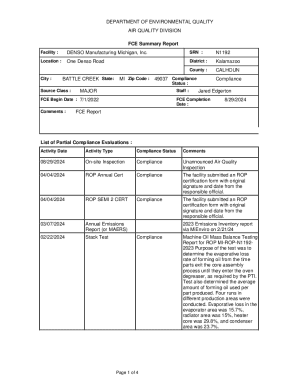

How do I edit private car takaful online?

How do I edit private car takaful in Chrome?

Can I create an electronic signature for signing my private car takaful in Gmail?

What is private car takaful?

Who is required to file private car takaful?

How to fill out private car takaful?

What is the purpose of private car takaful?

What information must be reported on private car takaful?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.