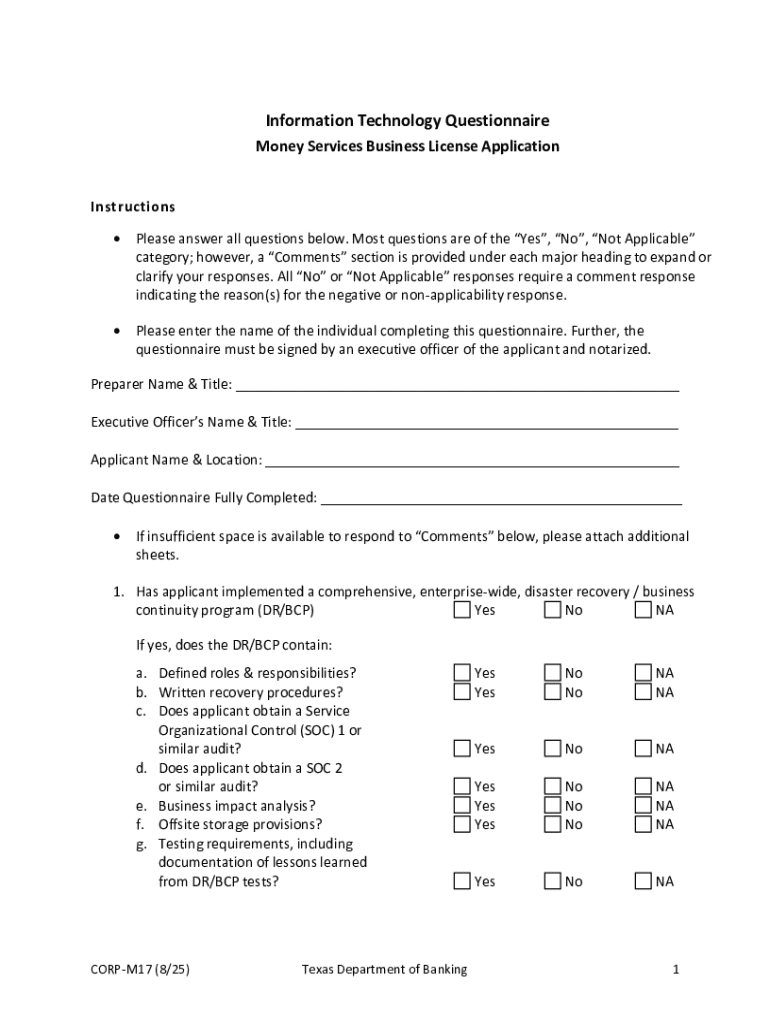

Get the free money services business (msb) questionnaire

Get, Create, Make and Sign money services business msb

How to edit money services business msb online

Uncompromising security for your PDF editing and eSignature needs

How to fill out money services business msb

How to fill out money services business msb

Who needs money services business msb?

Money Services Business (MSB) Form How-to Guide

Understanding money services businesses (MSBs)

A money services business (MSB) is an entity that engages in financial activities beyond traditional banking services. MSBs provide vital functions in the financial ecosystem, offering alternative avenues for consumers and businesses to manage their money effectively.

There are several types of services offered by MSBs, including currency exchange, money transfers, check cashing, and payment processing. Each of these services plays a critical role in facilitating commerce and enhancing financial inclusion, especially in underserved communities.

Compliance is paramount in MSB operations. MSBs must adhere to federal and state regulations, maintaining anti-money laundering (AML) policies and ensuring customer verification processes are in place. This fosters trust with clients and regulators alike.

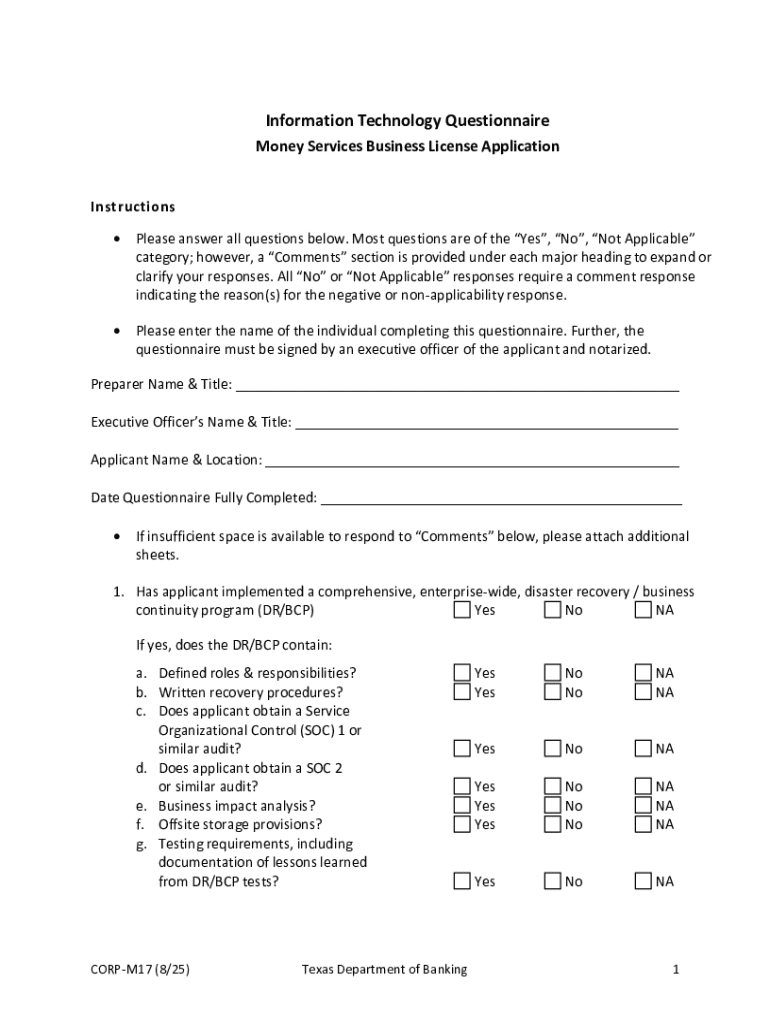

The MSB registration process

Registering as an MSB involves a systematic approach starting with the determination of whether your business qualifies as an MSB under regulatory definitions. Understanding the criteria for registration, including the services you provide, is essential.

Step 1: Determine if you need to register as an MSB

Not every financial service provider classifies as an MSB. The Financial Crimes Enforcement Network (FinCEN) provides guidelines, identifying entities that operate money orders, currency exchanges, or engage in funds transfer as candidates for MSB registration. It's pivotal to assess each service your business provides against the criteria outlined by the government.

Additionally, understand the local jurisdiction requirements as they may vary, with some states mandates requiring further registrations beyond federal compliance.

Step 2: Collect necessary documentation

When preparing for registration, organizations need a comprehensive set of documentation including identification and proof of ownership (e.g., driver’s license, ownership certificates), business formation documents (like Articles of Incorporation), financial statements that depict the financial health of the enterprise, and critical elements of the compliance program your MSB will employ.

Step 3: Complete the MSB form

The heart of the registration process is the completion of the MSB form. This form requires detailed information, including the entity’s name and address, business activities, and a robust description of the compliance program. Ensure accuracy and clarity, as mistakes can prolong the review process.

Taking the time to complete this form properly will streamline your application process and enhance your business's compliance posture from the get-go.

Submitting your MSB form

Step 4: Choose your submission method

After completing the MSB form, it's time to submit it to the appropriate authority. You can choose between online submission processes via government portals, mailing the form directly to FinCEN, or visiting their offices for an in-person submission.

Online submissions are encouraged due to their efficiency and faster processing times. Ensure to keep a copy of your submission and any confirmation numbers received, should you need to follow up.

Step 5: Government review timeline

Once submitted, MSB applications will undergo government review. Expect a timeline of several weeks for processing. It’s essential to monitor your application status closely and be prepared for potential inquiries or follow-up requests from the authorities as they seek clarifications.

Editing and managing your MSB form

Utilizing pdfFiller can significantly enhance the ease of managing your MSB form. With its user-friendly interface, you can edit your PDF documents online, making real-time adjustments as needed.

Using pdfFiller to edit your MSB form

pdfFiller allows you to make edits seamlessly, whether correcting mistakes or updating information as your business evolves. Collaborating with team members is simple; share a link with your colleagues to solicit input and feedback efficiently.

With these tools, maintaining an up-to-date MSB form becomes a hassle-free task, ensuring you remain compliant with all regulatory requirements.

Handling rejections and appeals

Despite careful completion and submission of your MSB form, there may be instances where your application is rejected. Common reasons for rejections include incomplete information, discrepancies in documentation, or insufficient compliance measures.

An effective way to address these issues is by thoroughly reviewing the rejection notice, which typically includes details on why your application didn’t meet the standards. Rectifying the mistakes and resubmitting your application with the necessary corrections is crucial.

Navigating the appeal process if necessary

If you believe your application was unjustly rejected, you may have the option to file an appeal. Understanding the process, gathering substantial evidence, and providing clear documentation can enhance your chances of a successful appeal.

Ongoing compliance obligations for MSBs

Once registered, maintaining compliance is an ongoing responsibility for MSBs. Keeping accurate, updated records and adhering to AML regulations are critical. Regular audits can help businesses proactively identify any compliance gaps.

Implementing these best practices will not only keep your MSB compliant but also build client trust in your operations.

Interactive tools for MSB management

Interactive tools available on pdfFiller enhance MSB management significantly. These tools allow for efficient document handling, from form completion to record management.

Overview of interactive tools available on pdfFiller

Utilizing templates for future MSB form submissions can save time and streamline the registration process. Real-time collaboration features during document creation also facilitate feedback and revisions seamlessly.

These interactive tools on pdfFiller transform document management, ensuring that MSBs can focus on compliance and growth.

FAQs about the MSB form and process

Potential MSB owners often have numerous questions regarding the registration process. Common queries revolve around compliance requirements, specific documents needed, and troubleshooting submission issues.

Addressing these frequently asked questions can empower business owners to navigate the registration landscape with confidence. It is vital to stay informed about evolving regulations and document requirements to avoid pitfalls.

Common queries related to MSB registration

Key takeaways for aspiring MSB owners

Successfully registering as an MSB requires thorough preparation, adherence to compliance standards, and meticulous documentation. Understanding each step of the process can drastically improve your chances of a smooth registration experience.

Leveraging technology solutions like pdfFiller's cloud-based platform provides essential support for document management and compliance monitoring. This is crucial for aspiring MSB owners aiming to navigate the complexities of financial service regulations efficiently.

Importance of using technology for document management

In today’s compliance-driven environment, utilizing a comprehensive solution for document management cannot be overstated. Technology will not only simplify the filling and submitting of forms but also ensure ongoing compliance and documentation practices are meticulously maintained.

Relevant regulations & updates

Stay informed about evolving regulations affecting MSBs. Understanding both federal and state requirements is essential for maintaining compliance and avoiding penalties. Utilize various industry resources and publications to keep abreast of legislative changes.

Being proactive about staying informed positions your MSB favorably in a landscape of regulatory scrutiny.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my money services business msb in Gmail?

How can I send money services business msb to be eSigned by others?

Can I create an electronic signature for the money services business msb in Chrome?

What is money services business msb?

Who is required to file money services business msb?

How to fill out money services business msb?

What is the purpose of money services business msb?

What information must be reported on money services business msb?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.