Get the free Michigan State and Local Public Health Measles Standard ...

Get, Create, Make and Sign michigan state and local

Editing michigan state and local online

Uncompromising security for your PDF editing and eSignature needs

How to fill out michigan state and local

How to fill out michigan state and local

Who needs michigan state and local?

Michigan State and Local Form: A Comprehensive Guide

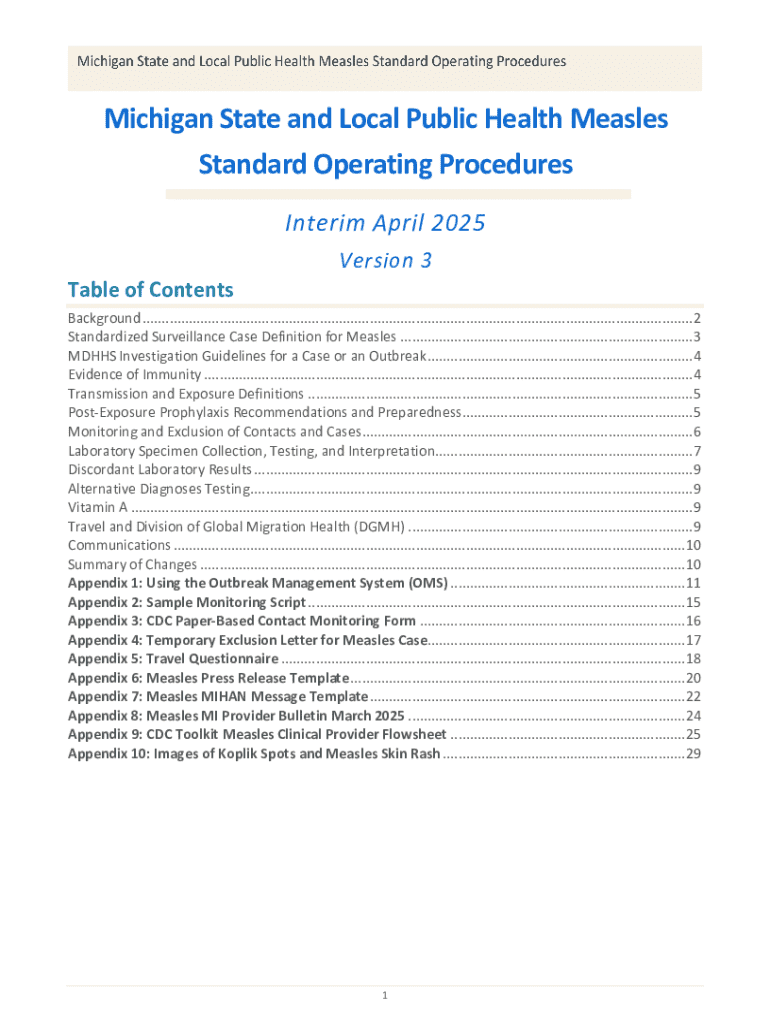

Understanding Michigan state and local forms

Michigan state and local forms serve as essential documents used in various administrative, financial, and regulatory processes across the state. They encompass a wide range of applications, from tax filings to business registrations, ensuring that individuals and businesses comply with local and state laws.

Michigan state forms primarily include documents mandated by the state government for tax purposes, legal filings, and official registrations. Local forms, on the other hand, are created by cities, counties, and townships and may include zoning applications, local permits, and community-specific regulations. Each form has its distinct purpose and destinations, crucial for ensuring compliance within a specific jurisdiction.

Understanding the differences between state and local forms is fundamental for proper compliance. For example, you would use a corporate tax form when filing state taxes, while a zoning application would be necessary for approval to build or modify structures within your local city limits.

Navigating Michigan state forms

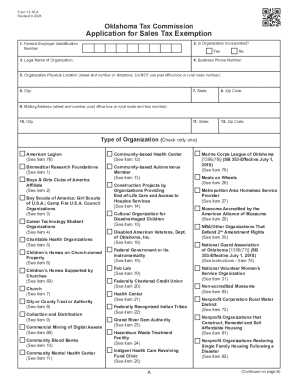

When dealing with Michigan state forms, it’s crucial to recognize the variety available. Common state forms include tax-related documents such as the Income Tax Return (Form 1040) and Corporate Tax Form (Form CIT), business registration forms, health compliance, and employment forms.

To search for specific state forms, the Michigan Department of Treasury website offers a comprehensive database where users can find necessary documentation. It is conducive to recording all forms that relate to employment, taxes, and business operations digitally, simplifying the search process. Additionally, physical resources such as local libraries or government offices remain available for those who prefer offline access.

Exploring local forms in Michigan

Local forms in Michigan play a critical role in the governance and regulatory framework of cities and counties. These forms are created by local governments based on their unique regulations and requirements, differing from one locality to another. Variances in forms might be based on local zoning laws, tax regulations, and permits required for business operations.

Common types of local forms include zoning and land use forms, which are crucial for development and construction projects, local tax forms specific to municipalities, and building permit applications necessary for renovations or new constructions. Accessing these forms can usually be done through local government websites, which often have dedicated portals for residents. Additionally, community resource centers provide physical access to local forms and assistance in filling them out.

Utilizing online portals of local governments significantly simplifies the access to required documentation, allowing residents to fill out and submit forms with ease. These online resources also provide necessary guidelines on process protocols and administrative requirements.

Step-by-step guide to filling out Michigan forms

Successfully filling out Michigan state and local forms necessitates adherence to clear guidelines. Generally, every form requires specific information like identifying details, tax identification numbers, and accurate financial data, so having these at hand is crucial. Additionally, understanding the structure of forms can prevent common pitfalls, such as overlooking mandatory fields or miscalculating tax amounts.

For instance, filling out the Michigan Income Tax Return involves several important steps: first, gather all necessary information pertaining to your income sources, deductions, and credits. Next, accurately complete each section of the form, ensuring your entries align with supporting documents such as W-2s and 1099s. Finally, review your completed form multiple times for errors or omissions, as mistakes can lead to delays or audits.

Similarly, when submitting a local zoning application, it is vital to understand local zoning regulations to ensure compliance. Completing the application form accurately entails providing necessary project details and specifications. Don’t forget to account for any associated fees to secure your application submission.

Editing and signing Michigan forms

Editing requirements for Michigan forms necessitate that users prepare their documents accurately before submission. Utilizing a tool like pdfFiller ensures customizing your forms is a smooth and effective process. The platform allows users to upload various forms, modify them as necessary, and prepare them for electronic signatures.

With pdfFiller, adding electronic signatures becomes incredibly straightforward. This not only saves time but also enhances the security and validity of your documents in a digital format. It supports collaboration as well, enabling multiple users to review and provide feedback on the document, ensuring that the final version meets all requirements before submission.

Managing your Michigan forms efficiently

Effective organization of your Michigan forms is vital, especially if you frequently handle a variety of documentation. Using pdfFiller, you can implement folder management techniques that allow for systematic storage of your forms. By categorizing documents into specific folders, retrieving the right form becomes much faster.

Additionally, taking advantage of tagging features and search functionalities enhances accessibility. For instance, tagging documents based on topics such as taxes, permits, or compliance helps streamline retrieval, reducing the time spent searching for specific forms. Security remains a prime concern; hence, understanding data protection standards while employing best practices for document management minimizes the risk of data breaches.

Frequently asked questions (FAQs) about Michigan state and local forms

Navigating Michigan state and local forms can come with its share of questions. Common inquiries often concern the submission process — including deadlines and required supporting documentation. Understanding these nuances helps in avoiding potential pitfalls that can delay the compliance process. Frequently, users may run into issues with form acceptance, usually due to incomplete information or incorrect submission techniques.

For troubleshooting issues, it's important to consult the respective state or local agency for assistance. Additionally, many online resources provide comprehensive guides and examples, offering extra help in ensuring your forms meet necessary criteria before submission.

Case studies: Successful form management in Michigan

Individuals and teams across Michigan have utilized effective form management strategies to overcome administrative challenges. By harnessing tools like pdfFiller, many have streamlined their processes, improved accuracy, and significantly reduced the time associated with document preparation.

For example, community organizations focused on local governmental engagement have shared how they successfully submitted various forms while exceeding compliance requirements by completing forms collaboratively. Testimonials highlight that working as a team reduced errors and fostered better communication, proving that strategic form management not only simplifies individual tasks but also enhances overall organizational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my michigan state and local in Gmail?

How do I edit michigan state and local straight from my smartphone?

How can I fill out michigan state and local on an iOS device?

What is michigan state and local?

Who is required to file michigan state and local?

How to fill out michigan state and local?

What is the purpose of michigan state and local?

What information must be reported on michigan state and local?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.