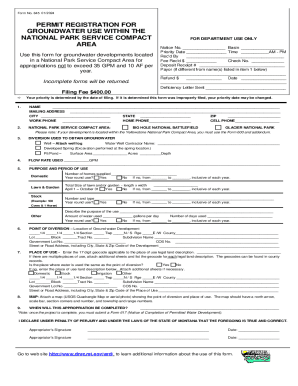

Get the free form 3520 mailing address

Get, Create, Make and Sign 3520 mailing address form

How to edit form 3520 mailing address online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 3520 mailing address

How to fill out irs form 3520 for

Who needs irs form 3520 for?

Understanding IRS Form 3520: A Comprehensive Guide

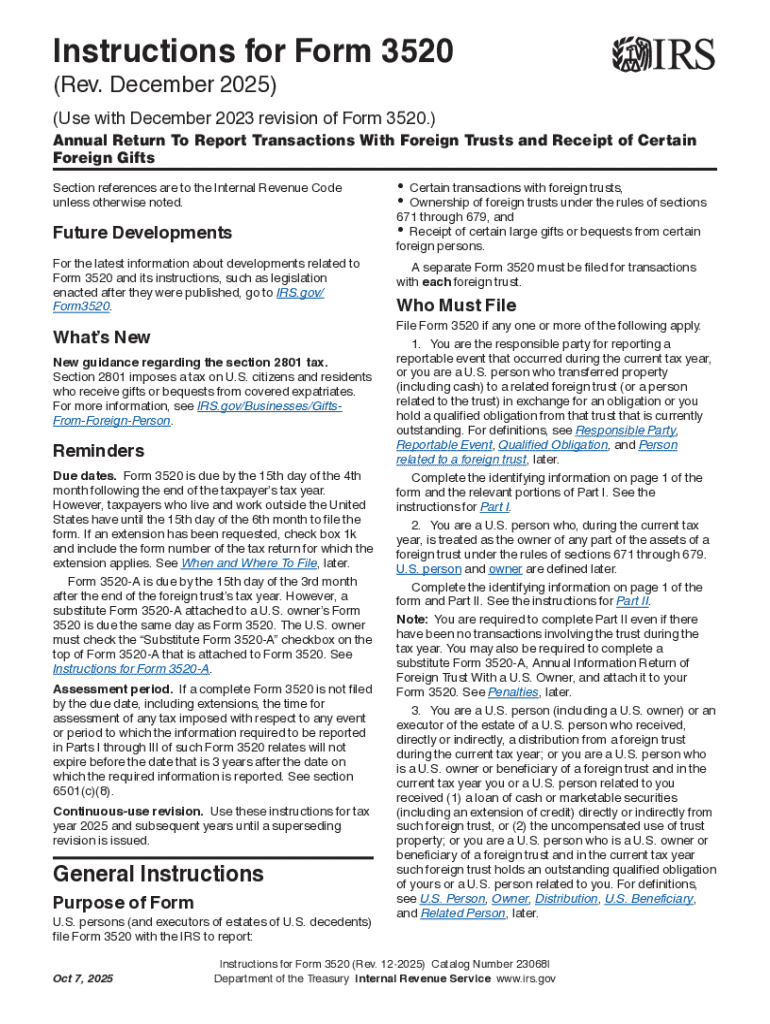

Understanding IRS Form 3520

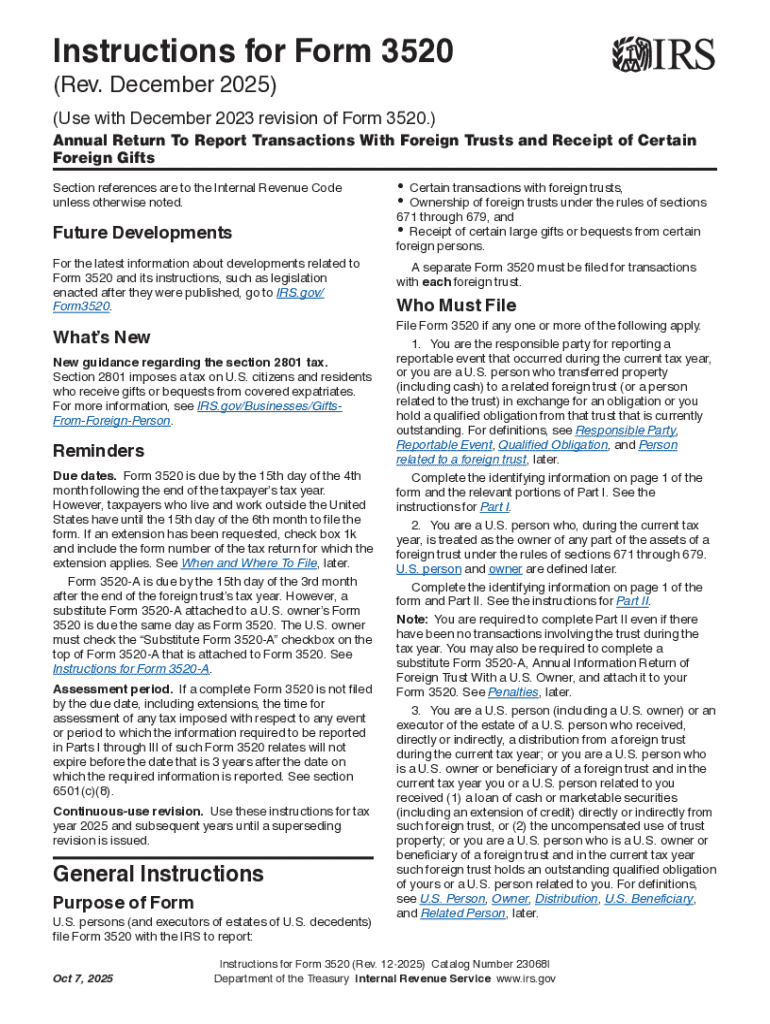

IRS Form 3520 is a crucial document for U.S. taxpayers involved in international financial transactions. This form serves to report transactions with foreign trusts, ownership of foreign trusts, and receipt of certain foreign gifts. Understanding its specifics is vital for meeting legal obligations and avoiding potential penalties.

The primary purpose of Form 3520 is to ensure that taxpayers disclose their foreign assets, reporting obligations, and dealings properly. The form is not a standard tax return; rather, it focuses on compliance with U.S. tax laws regarding foreign entities. Therefore, filing this form correctly can safeguard individuals against IRS scrutiny.

Who needs to file Form 3520?

Various individuals and entities are required to file Form 3520. Primarily, U.S. taxpayers who are beneficiaries or owners of foreign trusts, or who receive gifts exceeding specific thresholds from foreign individuals or entities, must complete this form. It's essential for all taxpayers engaging in foreign transactions to be aware of these requirements.

Specifically, if you have control over a foreign trust or have received foreign gifts, you are required to file Form 3520. Additionally, certain taxpayers, including corporations and partnerships, have reporting obligations related to foreign transactions and should exercise due diligence to ensure compliance.

Consequences of not filing

The IRS imposes stringent penalties for failure to file Form 3520. Penalties often start at $10,000 for each failure to report, and the consequences can escalate depending on the nature and circumstances of the transaction. Failure to meet reporting obligations can lead to significant fines, and in severe situations, criminal investigation.

Moreover, if the IRS determines that the failure to report was willful, penalties can be even more severe. Taxpayers who inadvertently failed to comply might still face fines unless they can demonstrate reasonable cause for their omission.

Key components of Form 3520

IRS Form 3520 comprises multiple sections, each designed to capture specific information regarding foreign gifts and trusts. The form's structure includes multiple parts that taxpayers must complete based on their particular circumstances. Here’s a detailed breakdown of its sections:

Providing accurate details in each section is critical. Each part connects with different reporting requirements and helps the IRS evaluate your compliance with tax obligations. Carefully reviewing each section of the form will aid in successful completion.

Supporting documentation and requirements

When filing IRS Form 3520, various supporting documents are essential to substantiate the information reported. Accurate records enhance the credibility of your filing and ensure compliance with reporting obligations. Key documentation may include:

These documents—as well as any additional evidence that delineates control over foreign trusts—should accompany the form to justify your claims and facilitate the IRS's evaluation process.

Filing requirements for different scenarios

Filing requirements for Form 3520 may vary greatly based on your involvement in foreign transactions. For instance, those reporting foreign trusts must provide specific information that adheres to IRS guidelines depending on their individual circumstances. Here’s what you need to know about various scenarios:

Understanding the specifics of each part is crucial for accurate reporting, as different parts of the form correspond with various reporting obligations set by the IRS.

Specific instructions for filling out Form 3520

Filling out IRS Form 3520 accurately requires attention to detail. Here’s a step-by-step guide to help you navigate through each section of the form:

Ensuring each part is filled out correctly minimizes the risk of penalties. Be attentive to details to avoid common mistakes such as incorrect figures or incomplete information.

Common mistakes to avoid

When filing Form 3520, taxpayers often make a range of errors that can lead to compliance issues. Common mistakes include:

Being aware of these pitfalls can enhance your filing accuracy. If uncertain, consider consulting a professional familiar with international tax law.

Interactive tools for managing Form 3520

pdfFiller offers comprehensive interactive tools that simplify the process of managing Form 3520. Some notable features include:

These tools streamline the workflow for both individuals and teams, making tax reporting less cumbersome and more efficient.

Examples and scenarios

Let’s explore some fictional examples that illustrate different potential filing scenarios for Form 3520:

These examples highlight the importance of recognizing different transactions that necessitate Form 3520 filing, ensuring compliance with IRS regulations.

Understanding related penalties

Filing IRS Form 3520 incorrectly or not at all can lead to a variety of penalties. These include:

Understanding these penalties can encourage timely and accurate filing, which in turn helps maintain compliance and avoids unnecessary fees.

Consulting with professionals

Navigating the complexities of IRS Form 3520 may sometimes necessitate professional assistance. Key indicators that it's time to consult a tax professional include:

By consulting with a tax professional, you can ensure that all aspects of Form 3520 are handled correctly, mitigating the risk of penalties.

Utilizing pdfFiller’s network of professionals

In addition to filing tools, pdfFiller connects users with a network of tax professionals skilled in handling Form 3520 scenarios. This feature enables users to receive tailored advice suited to their individual circumstances.

Engaging with tax professionals via pdfFiller streamlines the process, ensuring that every user's unique situation is navigated with appropriate expertise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 3520 mailing address in Chrome?

How can I fill out form 3520 mailing address on an iOS device?

How do I fill out form 3520 mailing address on an Android device?

What is IRS Form 3520 for?

Who is required to file IRS Form 3520?

How to fill out IRS Form 3520?

What is the purpose of IRS Form 3520?

What information must be reported on IRS Form 3520?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.