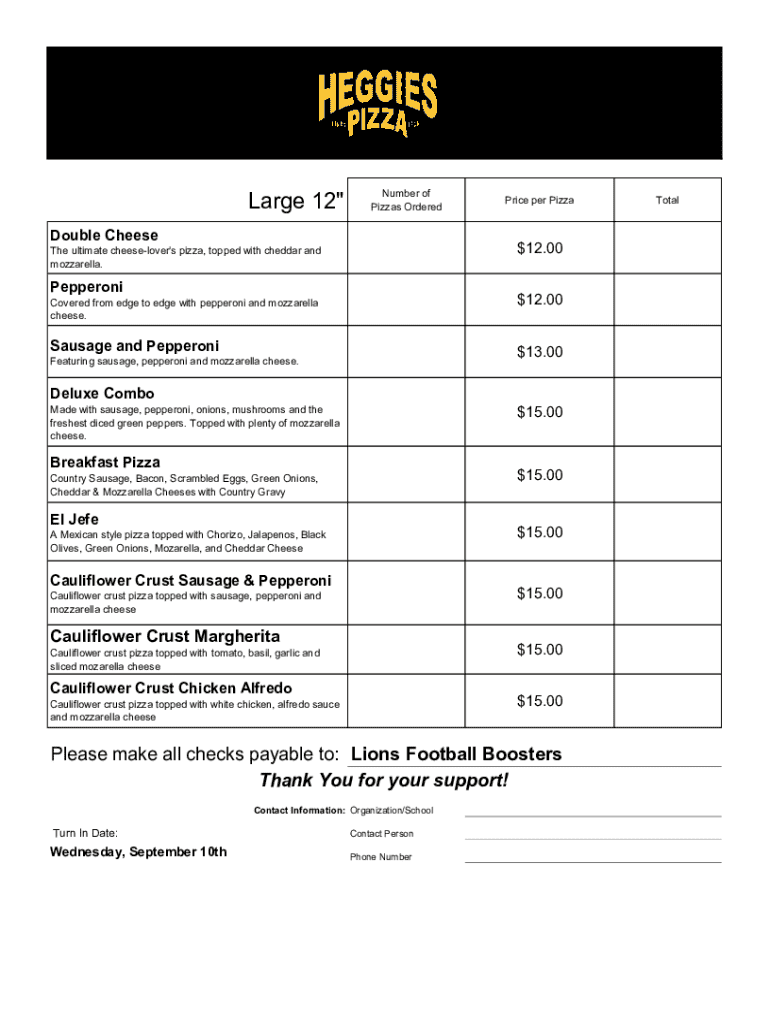

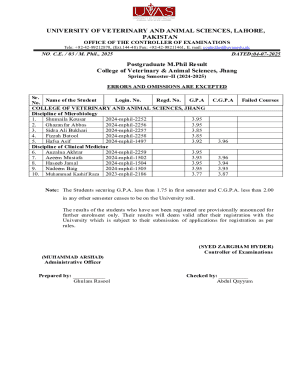

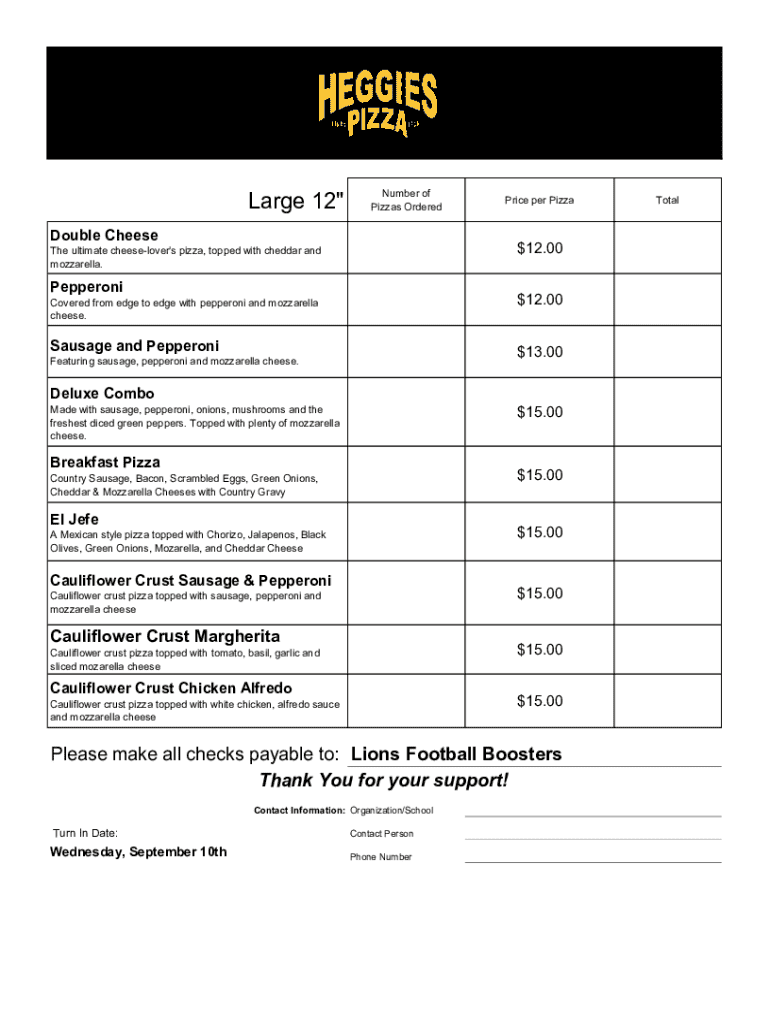

Get the free Large 12"

Get, Create, Make and Sign large 12

Editing large 12 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out large 12

How to fill out large 12

Who needs large 12?

A comprehensive guide to the large 12 form

Understanding the large 12 form

The large 12 form is a critical document used primarily in legal and business settings to streamline a variety of processes. This form consolidates essential information that can assist in reporting, compliance, and other administrative functions. It typically requires a detailed set of data, which can include financial information, personal identification, and relevant compliance data.

Common scenarios necessitating the large 12 form include tax filing for businesses, compliance reporting for accounting firms, and cases involving high-stakes legal documentation. Its importance extends to ensuring that businesses meet regulatory requirements, conduct audits, or provide tax reports that are clear and concise.

Understanding the crucial role of the large 12 form in documentation can significantly aid individuals and teams in navigating complex processes and keeping their records organized. Its relevance in generating precise reports for clients and maintaining transparent accounting workflows cannot be overstated.

Overview of the components of the large 12 form

The large 12 form is segmented into several key sections that are designed to capture the necessary information efficiently and comprehensively. Each section addresses a specific type of data or requirement.

Familiarizing oneself with the terminology used in the large 12 form enhances accuracy. Terms such as 'tax identification number,' 'deductions,' and 'compliance' are integral to understanding the form's purpose. By recognizing these terms, users can ensure they fill out the form correctly and comprehensively.

Step-by-step instructions for completing the large 12 form

Before diving into completing the large 12 form, it's essential to prepare adequately. Gather all necessary documents, which may include W-2 forms, previous tax returns, and any compliance-related documents. Tools like pdfFiller can simplify the process, allowing for easy editing and signing of forms.

Thoroughly reviewing your completed form is crucial. Errors or omissions can lead to complications with regulatory bodies or processing delays. Establish a checklist of items—correct personal information, accurate financial statements, and completed signature sections—to verify before submitting.

Tools for editing and managing the large 12 form

Utilizing digital tools is fundamental when managing the large 12 form. Platforms such as pdfFiller offer interactive tools designed to streamline the entire process, from initial editing to final signing.

When working within teams, effective collaboration tools can significantly enhance workflow management. Cloud-based solutions not only facilitate real-time document editing but also ensure that all contributors can track changes and updates efficiently.

Signing and submitting the large 12 form

Signature requirements for the large 12 form vary based on the context in which it is being used. Understanding these requirements is key for compliance and acceptance.

Submitting the completed large 12 form can be done through various channels including online platforms or traditional mail. Ensure you follow any specific submission guidelines provided by the relevant authority. After submission, tracking your document and confirmation of receipt through pdfFiller can minimize stress and ensure everything is accounted for.

Troubleshooting common issues with the large 12 form

Despite thorough preparation, individuals can encounter challenges during the completion and submission processes. Awareness of common pitfalls can help mitigate any disruptions.

Proactively understanding these challenges and knowing where to seek help can streamline your experience with the large 12 form, ensuring a smooth process from start to finish.

Related topics and resources

The large 12 form is one among several related documents tailored to address different administrative needs. Familiarizing yourself with similar forms, like the large 11 or large 13, can provide a broader understanding of the documentation landscape.

Additionally, implementing best practices in document management like proper organization, retention strategies, and using software for workflow tracking will benefit organizations across the board.

Enhancing your document management strategy

Transitioning to digital tools can significantly enhance your document management strategy. pdfFiller's cloud-based solutions provide an efficient alternative for managing the large 12 form and other essential documents.

By adopting a digital-first approach, organizations can leverage case studies highlighting improved efficiency and reduced errors stemming from utilizing advanced document management software like pdfFiller.

Learning more about the large 12 form

Knowledge is power, especially when dealing with important documents like the large 12 form. Participating in webinars and tutorials provides invaluable insights into mastering the use of this form.

Staying informed through these educational resources can empower individuals and teams to navigate their document processes efficiently, ensuring compliance and fostering a smoother workflow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

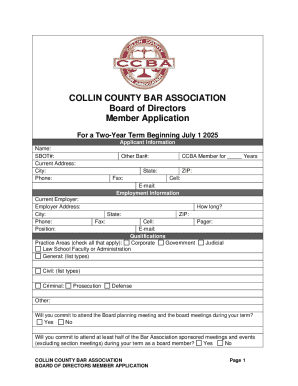

How do I execute large 12 online?

Can I create an electronic signature for the large 12 in Chrome?

How do I fill out large 12 using my mobile device?

What is large 12?

Who is required to file large 12?

How to fill out large 12?

What is the purpose of large 12?

What information must be reported on large 12?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.