Get the free About the CFTC

Get, Create, Make and Sign about form cftc

Editing about form cftc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out about form cftc

How to fill out about form cftc

Who needs about form cftc?

About CFTC Form: A Comprehensive Guide

Understanding the CFTC Form

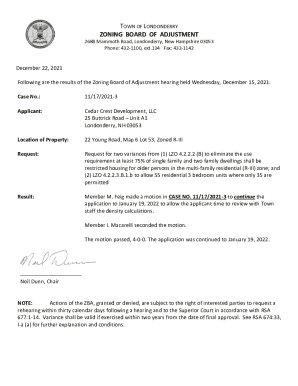

The CFTC Form, designed by the Commodity Futures Trading Commission, primarily serves as a regulatory tool to monitor and structure the trading of commodity and derivative markets. This form captures essential information about the entities involved in these transactions, ensuring transparency and accountability among market participants.

Compliance with CFTC Form filing is not merely a bureaucratic necessity; it's a critical component of maintaining fair and orderly markets. By requiring detailed reporting, the form acts as a safeguard against market manipulation and ensures the integrity of trading activities across various platforms.

Overview of the CFTC Form

The CFTC Form consists of several key sections that collectively capture all necessary information regarding the entity’s trading practices. Each section of the form serves a distinct purpose, ensuring that comprehensive details about ownership, control, trading habits, and signatory authority are documented.

Understanding the common terms used in the CFTC Form can streamline the filing process. For instance, terms like 'position aggregation' refers to combining multiple positions into a singular report for clarity in compliance, while 'swap execution facilities' pertain to platforms on which swaps are traded.

How to access the CFTC Form

Finding the CFTC Form is straightforward via the CFTC official website, which hosts various compliance resources for traders and companies. Detailed navigation steps can guide users to locate the specific form they need.

Once on the site, the form can be accessed easily by selecting 'Forms' from the menu. Users can then download the desired CFTC Form in PDF format, allowing for offline review and completion.

Step-by-step guide to filling out the CFTC Form

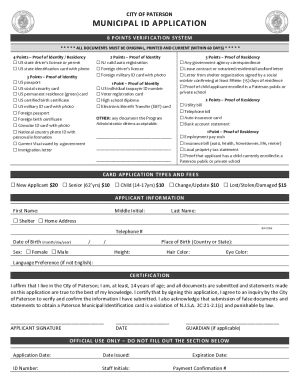

Filling out the CFTC Form requires careful attention to detail and accuracy. Begin by gathering all preliminary information including the entity's name, address, and identification details. Make sure all stakeholders understand their roles to ensure correct data submission.

Each section of the form requires specific details that must be accurately reported. For example, in the 'Filing Entity Information' section, you’ll need to provide the legal name of the business along with any relevant identifiers. Ownership and control details will require disclosures about significant ownership interests and control structures.

To avoid common mistakes, ensure that all figures are accurate, and all required fields are completed. Remember to review the form for any inconsistencies before submission.

Editing and modifying the CFTC Form

Utilizing tools like pdfFiller, users can easily edit and modify their CFTC Forms to reflect accurate information or required changes. This online tool allows for interactive editing, ensuring all submissions are clear and professional.

Editing a PDF document can be simplified into a few steps. Start by uploading the CFTC Form into pdfFiller, make necessary edits using the editing tools features, and don't forget to save your changes. Keeping track of document versions is crucial to prevent confusion down the line and can be managed via pdfFiller's version control capabilities.

Signing the CFTC Form

Signing the CFTC Form is a crucial step in verifying the authenticity of the submission. pdfFiller offers various eSignature options that allow users to sign documents electronically without the hassle of printing, scanning, and faxing.

The legal validity of eSignatures is firmly established, ensuring that electronically signed documents are recognized by regulatory bodies, including the CFTC. Additionally, collaborative signing features enable multiple team members to sign the document as needed, facilitating teamwork in compliance efforts.

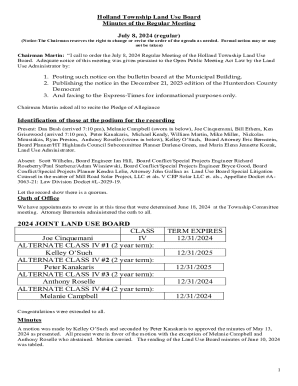

Submitting the CFTC Form

The submission process for the CFTC Form can vary based on whether you choose to submit online or through physical mail. Each method has its advantages, and understanding the preferred option for your organization is crucial to ensure timely processing.

Once you have completed the form and signed it, review the submission guidelines on the CFTC’s website to confirm compliance with submission protocols. After submitting, tracking your submission status should be the next step to ensure it has been received and processed correctly.

Managing and tracking submitted CFTC Forms

Keeping track of submitted CFTC Forms is an integral part of the compliance process. pdfFiller offers robust tools for document management, enabling users to easily locate and manage their forms after submission.

Being able to track submission statuses and receive updates can greatly enhance organizational efficiency. Moreover, if amendments or corrections are necessary, pdfFiller provides a straightforward process to request these changes while retaining the document's integrity.

Troubleshooting common issues

Common reasons for CFTC Form rejections can stem from incomplete information, incorrect data entry, or failure to meet submission deadlines. Understanding these potential pitfalls is essential for successful compliance.

When faced with complaints or queries regarding a submission, having a detailed record of communications and submissions can be valuable. Additionally, the CFTC provides resources for further assistance, ensuring users can seek help when necessary.

Regulatory considerations and updates

Staying informed about recent changes in CFTC filing requirements is essential for maintaining compliance. Regulatory updates can influence the information required on the CFTC Form and the deadlines for submissions.

Utilizing platforms like pdfFiller, organizations can ensure they monitor relevant resources to keep their filing processes up-to-date. Regular compliance checks and updates on filing protocols should be an integral part of documentation practices.

Real-life case studies and examples

Investigating success stories of organizations that effectively utilize the CFTC Form can provide valuable insights into best practices and strategies. Analyzing challenges faced by others can help in developing better submission approaches.

For instance, many traders report significant organizational improvement by leveraging platforms like pdfFiller for their document management. This experience showcases how technology can streamline compliance efforts, mitigate errors, and enhance collaboration.

Final tips for mastering the CFTC Form

To master the CFTC Form, organizations should adopt best practices in document preparation and submission. This includes setting clear protocols for filling out forms, ensuring that all stakeholders are trained, and maintaining an updated checklist of compliance requirements.

Additionally, leveraging technology can significantly enhance the ease and efficiency of compliance. Tools like pdfFiller can streamline processes such as editing, signing, and tracking submissions, enabling organizations to remain compliant and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the about form cftc electronically in Chrome?

Can I edit about form cftc on an iOS device?

Can I edit about form cftc on an Android device?

What is about form cftc?

Who is required to file about form cftc?

How to fill out about form cftc?

What is the purpose of about form cftc?

What information must be reported on about form cftc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.