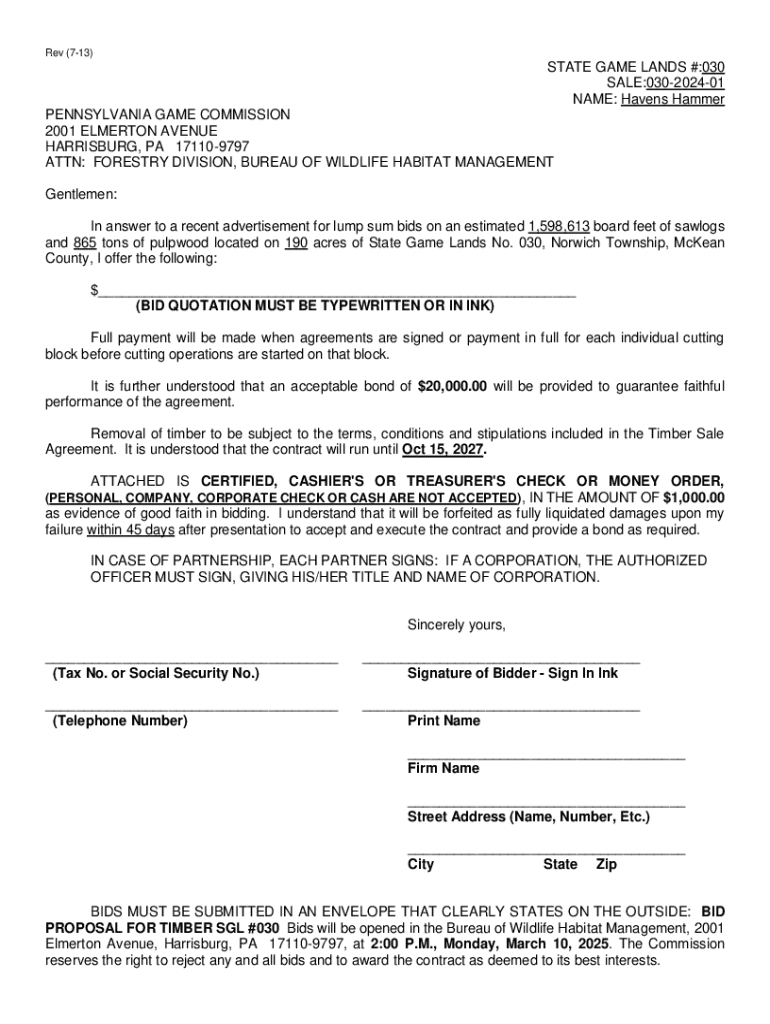

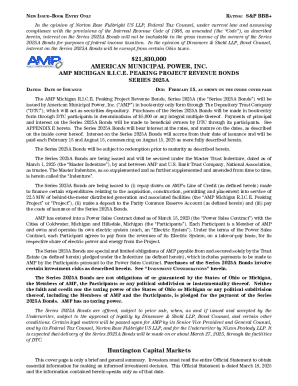

Get the free Online Rev (713) STATE GAME LANDS #: 242 SALE

Get, Create, Make and Sign online rev 713 state

How to edit online rev 713 state online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online rev 713 state

How to fill out online rev 713 state

Who needs online rev 713 state?

A Comprehensive Guide to the Online Rev 713 State Form

Understanding the online Rev 713 state form

The Rev 713 state form is a document crucial for individuals and businesses to report tax information and compliance status to their state revenue departments. It serves as a verification tool for tax obligations, ensuring that all necessary information is accurately reported and recorded. By submitting the online Rev 713 form, taxpayers can streamline their obligations, ensuring timely filing and adherence to state-specific regulations.

Accuracy and detail are paramount when completing the Rev 713 form. This document can influence licensing, tax credits, and other important decisions made by state agencies. Therefore, understanding its purpose and intricacies becomes essential for effective financial management.

Who should use the Rev 713 state form?

The Rev 713 state form is designed for a diverse audience, including individuals, small business owners, and tax professionals. Each group requires this form for specific applications related to tax filing and compliance verification.

Typical scenarios for using the Rev 713 form include completing annual tax returns, complying with state business regulations, and applying for permits or licenses. For example, if a small business is preparing to renew its operating license, having an accurate and up-to-date Rev 713 form can facilitate the approval process.

Key features of the Rev 713 state form

To effectively fill out the Rev 713 state form, it is essential to understand its key sections. The form typically requires detailed identifying information such as names, addresses, tax identification numbers, and specific tax-related data pertinent to the individual's or entity's obligations.

Notably, variations in the Rev 713 can exist based on state regulations. Different states might have additional fields or specific requirements that reflect local tax laws and compliance measures. Understanding these differences is crucial for accurate submissions.

Accessing the Rev 713 state form online

To access the Rev 713 state form online, navigating official state department websites is necessary. Generally, these forms are available in PDF format and can include interactive elements for ease of use.

Moreover, pdfFiller offers exceptional resources to help users locate and access the Rev 713 state form easily. As individuals search for forms, they need to ensure they are using the most recent version, as state regulations can frequently change. Utilizing pdfFiller’s platform guarantees that users have the latest updates.

Filling out the Rev 713 state form

Completing the Rev 713 state form accurately is central to its effectiveness. Guidelines suggest that every field should be filled out with care to avoid processing delays or rejections.

Utilizing pdfFiller can greatly enhance the efficiency of form completion. Interactive tools such as autofill and templates streamline the process, while collaboration features allow easy document sharing among team members or advisers for feedback before finalization.

Editing and finalizing your Rev 713 state form

After filling out the Rev 713 form, users may find it necessary to make edits. pdfFiller provides intuitive tools to edit any field with ease. If corrections are required, the platform allows users to undo changes and manage different versions of the document.

Ensuring clarity and professionalism in the presentation of the form is crucial. A well-prepared document increases the chances of smooth processing and quick approvals.

Signing and submitting the Rev 713 state form

Once editing is complete, signing the Rev 713 form is the next vital step. The e-signature process through pdfFiller is secure and legally valid, allowing users to sign documents electronically without issues.

Submission channels vary—users can submit online, in person, or via mail. Tracking the submission status is also facilitated by pdfFiller, giving peace of mind regarding the document’s journey.

Common issues and troubleshooting

Despite thorough preparation, users may encounter issues when using the Rev 713 state form. Common challenges include missing information or signature errors, which can delay processing.

If issues persist, contacting state offices for assistance can provide clarity, helping users resolve concerns promptly.

Additional tips for managing your documents

Keeping your Rev 713 form and related documents organized is vital for effective management. pdfFiller offers document management features that assist users in archiving and retrieving forms quickly.

Ongoing document management is essential to ensure that you can efficiently reference past forms and avoid making repeated mistakes. Organized records can significantly ease the burden during tax season or when applying for licenses.

Conclusion reminder

Proper management of the Rev 713 state form, from initial filing to final submission, plays a crucial role in maintaining compliance with state regulations. Leveraging tools like pdfFiller empowers users to manage documents more effectively, ensuring future document handling is a breeze.

By understanding the nuances and processes associated with the online Rev 713 state form, individuals and businesses can streamline their reporting, enhance their compliance, and focus on their primary objectives. Engaging with the right digital tools not only saves time but also minimizes errors, ultimately making document management an effortless task.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get online rev 713 state?

How do I edit online rev 713 state online?

Can I create an electronic signature for signing my online rev 713 state in Gmail?

What is online rev 713 state?

Who is required to file online rev 713 state?

How to fill out online rev 713 state?

What is the purpose of online rev 713 state?

What information must be reported on online rev 713 state?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.