Get the free Banks & Trust Forms and Requirements - finance mo

Get, Create, Make and Sign banks amp trust forms

How to edit banks amp trust forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out banks amp trust forms

How to fill out banks amp trust forms

Who needs banks amp trust forms?

Comprehensive Guide to Banks and Trust Forms: Completing with Confidence

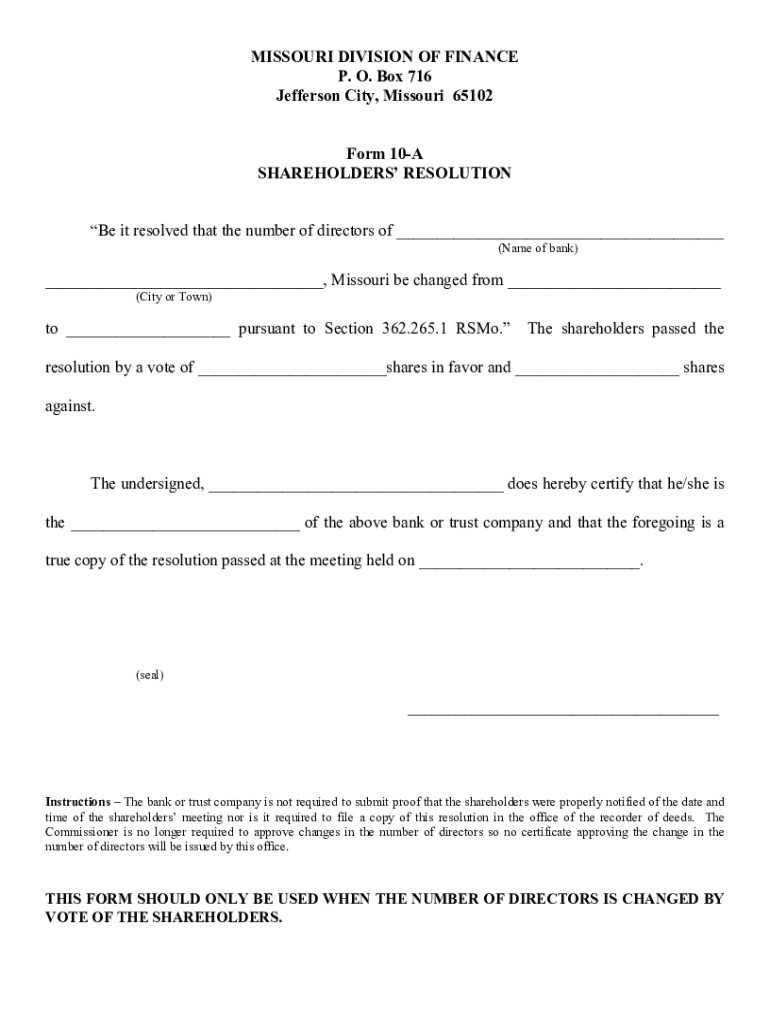

Understanding banks and trust forms

Banks and trust forms are essential documents that facilitate significant financial and legal transactions. They serve as the bedrock for establishing trusts, opening bank accounts, and designating beneficiaries. A proper comprehension of these documents ensures individuals and organizations navigate their financial matters with clarity and legality.

These forms are typically used in various scenarios, including estate planning, managing assets, and ensuring that funds are distributed according to an individual's wishes after their passing. Incorrect or incomplete information on these forms may lead to dire consequences, highlighting their importance across financial and legal settings.

Understanding why completing these forms accurately matters cannot be overstated. Errors can result in denied claims, misallocation of funds, and even legal disputes that may be costly and time-consuming.

Key elements of banks and trust forms

Each banks and trust form has specific essential information required. Generally, you will need to provide personal information such as names, addresses, and dates of birth. Additionally, financial details including account numbers, trust fund specifics, and related documentation must be precise.

Signatures are crucial for validation, and many institutions require notarization. This may seem cumbersome but is critical for protecting against fraud. With the rise of digital solutions, eSigning has become commonplace, allowing users to execute documents quickly and securely from any location.

The requirements can vary significantly between different institutions or regions, making it crucial to familiarize yourself with the specific protocols required for each. Local regulations and standards further complicate these processes, reinforcing the need for careful attention to detail.

Step-by-step guide to completing banks and trust forms

Completing banks and trust forms begins with gathering necessary documentation. Often, individuals need to present valid identification, previous agreements, and any financial statements relating to the trust or account in question. Starting with an organized collection of documents can save a lot of time and confusion.

When filling out the forms, clarity is key. Accurate completion hinges on understanding the requirements and providing the exact requested information. Common pitfalls include leaving fields blank or providing outdated information, all of which can lead to processing delays or rejections.

Proofreading is an indispensable step before submitting your forms. Utilizing tools like pdfFiller allows for seamless document edits. By investing time in this review process, you mitigate the risk of delays or complications and ensure a smoother transaction.

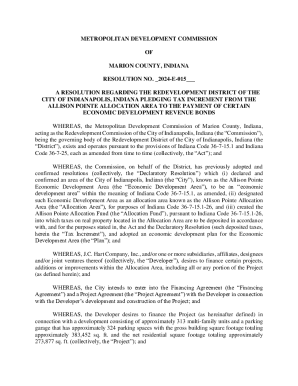

Managing your forms with pdfFiller

pdfFiller provides a cloud-based solution that allows users to store and access their banks and trust forms from any device. This convenience translates into time savings and streamlined document management. Being able to access your forms on-the-go enhances flexibility and enables collaboration with financial advisors or family members effortlessly.

Collaboration tools within pdfFiller make it seamless to work with teams or legal advisors. Features like shared links and comments foster teamwork, ensuring that all relevant parties can weigh in on document edits and approvals. This aspect is particularly beneficial for complex financial matters that require various approvals.

Tracking changes and comprehending documentation history is essential for effective management. pdfFiller’s version control ensures users can revert to previous iterations and maintain an organized portfolio of forms, thereby enhancing accountability and clarity in transactions.

Common challenges with banks and trust forms

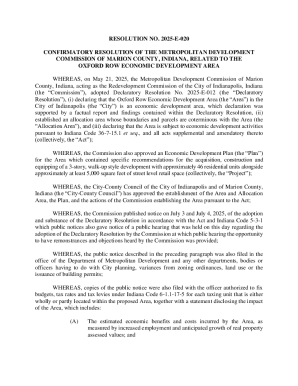

Navigating the world of banks and trust forms can present various challenges. One common issue is misunderstanding compliance requirements which can lead to inadvertent errors in submissions. Legal obligations can vary widely depending on the jurisdiction and institution, making it vital to stay informed about the specific regulations that apply to you.

Institutional variations often complicate matters when moving between banks or trusts. Each may have different policies and requirements, which challenges individuals attempting to adhere to all necessary guidelines. Incomplete forms are another frequent hiccup, underscoring the need for thoroughness during the documentation process.

To tackle these challenges effectively, familiarize yourself with the specific policies of the institutions you interact with. Establish a checklist to ensure all required documents are accounted for before submission, reducing the risk of incomplete forms.

Interactive tools to enhance your experience

pdfFiller offers several interactive tools that can significantly enhance your experience when completing banks and trust forms. Utilizing editing features allows users to make precise alterations to documents, ensuring they are tailored to meet their unique financial needs.

Access to specific templates can expedite the form completion process, allowing individuals to input their data quickly rather than starting from scratch. Additionally, compliance tools help ensure that any alterations maintain adherence to legal standards, preventing complications later on.

By leveraging these resources within pdfFiller, users can streamline their form management processes while ensuring accuracy and legal compliance continuously.

Industry updates and trends in banks and trust forms

The landscape surrounding banks and trust forms is evolving rapidly. Recent regulatory changes have significant implications for how trusts are documented and managed. Keeping abreast of these shifts is crucial for individuals and professionals involved in financial planning.

Moreover, the increasing reliance on digital solutions has shifted expectations regarding form completion. Technology is now central to the workflow surrounding financial documentation, allowing users to execute transactions more swiftly and efficiently than ever before.

The future outlook for banks and trust forms indicates a broader incorporation of technology and tools that enhance user experience and compliance. Staying informed will empower individuals and teams to adapt to changing landscapes effectively.

Best practices for using banks and trust forms effectively

To leverage banks and trust forms effectively, individuals should prioritize regularly updating their documents. Keeping forms current and reviewed ensures alignment with any changes in personal circumstances, institutional policies, or legal regulations.

Understanding your rights and obligations regarding these forms is equally essential. Individuals should familiarize themselves with any potential limitations, responsibilities, or stipulations associated with bank or trust agreements.

Utilizing pdfFiller’s comprehensive features and functionalities allows for streamlined document management while ensuring that users stay compliant and complete their forms with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify banks amp trust forms without leaving Google Drive?

How can I get banks amp trust forms?

How do I fill out banks amp trust forms on an Android device?

What is banks amp trust forms?

Who is required to file banks amp trust forms?

How to fill out banks amp trust forms?

What is the purpose of banks amp trust forms?

What information must be reported on banks amp trust forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.