Get the free How to Complete Employee Disciplinary Forms or Write-Ups

Get, Create, Make and Sign how to complete employee

How to edit how to complete employee online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to complete employee

How to fill out how to complete employee

Who needs how to complete employee?

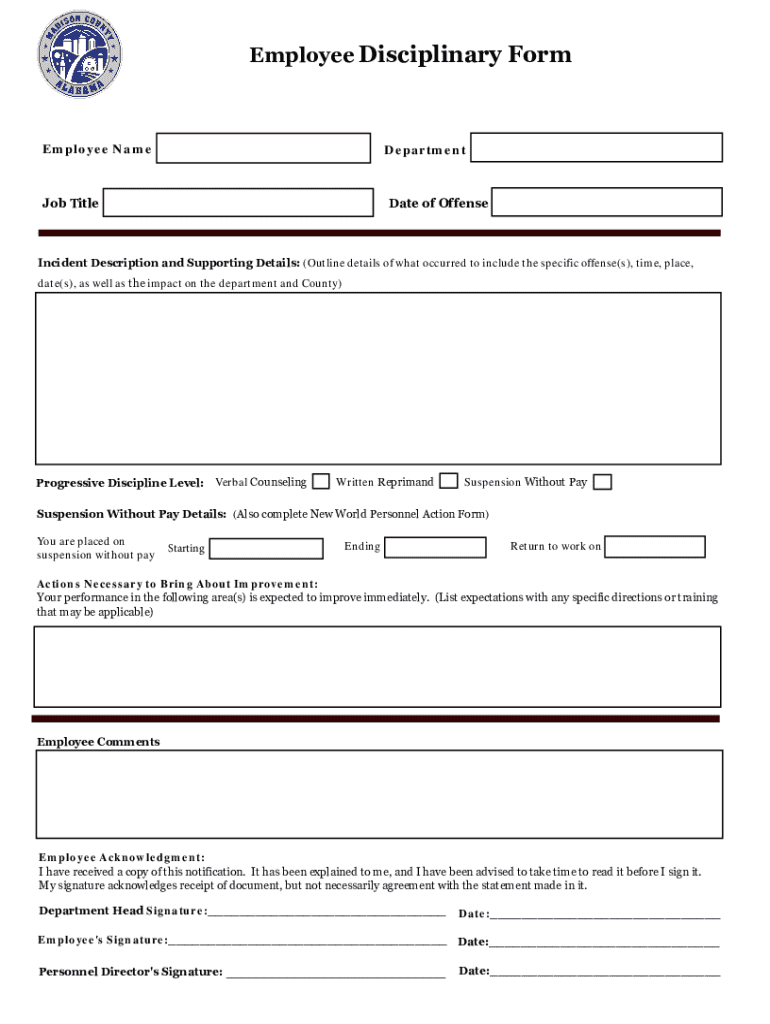

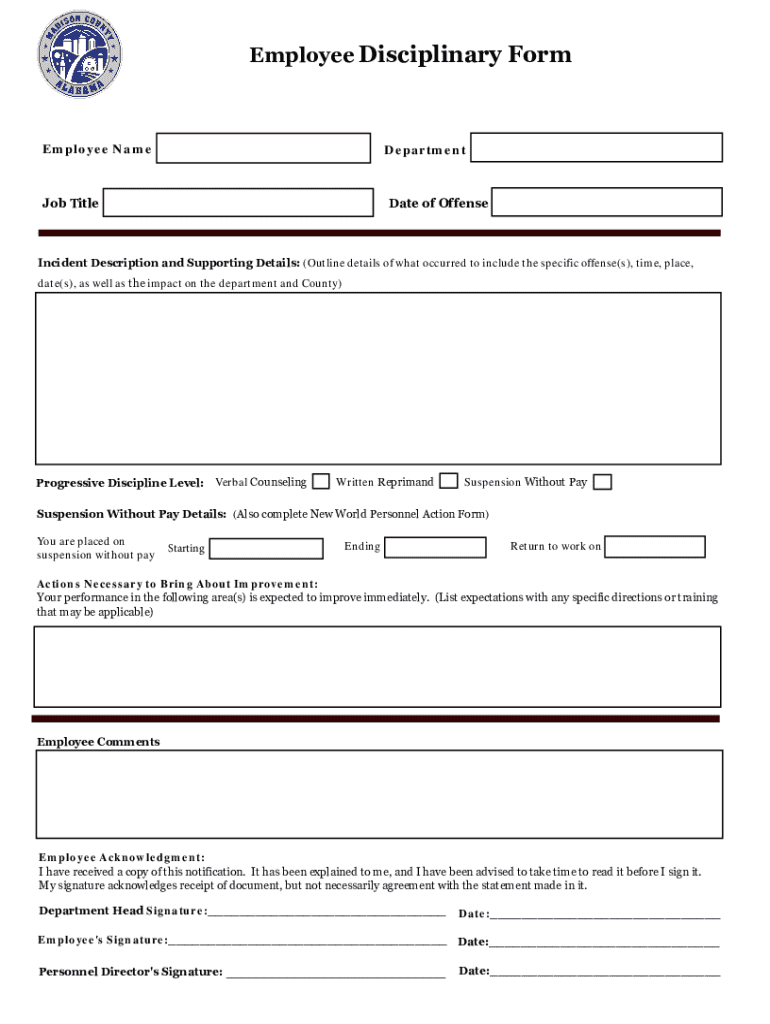

How to Complete Employee Form: A Comprehensive Guide

Understanding the importance of employee forms

Employee forms are essential documents in the onboarding process, serving as the foundation for an organized workplace. They not only capture necessary employee information but also ensure compliance with various laws and regulations. Accurate completion of these forms is critical for smooth operations, as they prevent delays in payroll processing, benefits enrollment, and tax reporting. In a well-structured system, each completed form contributes to the overall efficiency of both HR departments and employees, promoting a professional environment.

Moreover, these forms serve legal purposes, safeguarding both the employer and the employee. Failure to provide accurate information can lead to issues such as miscalculations in tax withholding or eligibility for benefits, which can result in complications further down the line. Understanding the importance of each employee form helps streamline the onboarding process and increases employee satisfaction from day one.

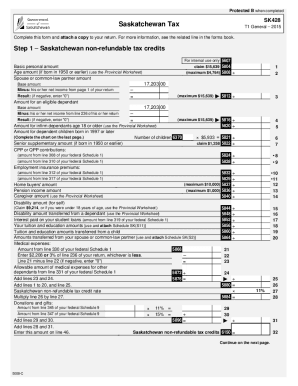

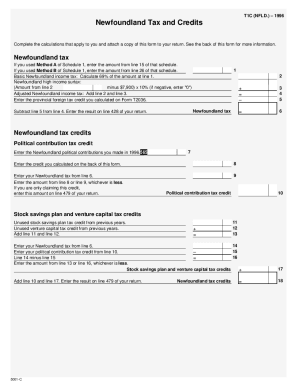

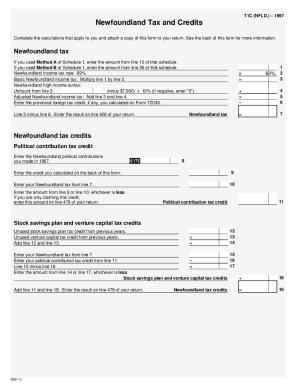

Types of employee forms you may encounter

As you navigate the onboarding process, you will come across various types of employee forms, each serving a specific purpose. Familiarizing yourself with these forms can expedite your completion and ensure you have all necessary information ready.

Preparing to complete your employee forms

Preparation is key to efficiently completing your employee forms. It’s essential to gather all necessary information to ensure accuracy and compliance. Having a list of required documents ready can minimize delays and frustrations during the process.

Creating an organized workspace can further enhance your focus and efficiency. A distraction-free environment fosters concentration, allowing you to avoid unnecessary errors. Various digital tools, such as pdfFiller, can aid in organizing documents and streamlining the completion process.

Step-by-step guide on completing your employee form

Completing employee forms can feel daunting, but breaking it down into manageable steps can make the process smoother. Here’s a detailed guide to help you.

Utilizing interactive tools for form completion

One of the best practices in completing employee forms is leveraging digital tools like pdfFiller, which simplifies the completion of various documents. Its features allow users to streamline the process and make it less cumbersome.

Common challenges and how to overcome them

While the process of completing employee forms may seem straightforward, various challenges can arise that may hinder smooth transitions. Here are some common pitfalls and strategies for successful navigation.

Frequently asked questions about employee forms

As you complete employee forms, various questions may arise, particularly regarding deadlines, submission processes, and how to amend previously submitted forms. Knowing the answers to these frequently asked questions can simplify the process.

Tips for future form completion

Once you have gone through the onboarding process, it’s beneficial to maintain organized records. This practice not only prepares you for future employment but also ensures that you can easily reference information when required.

Conclusion of the process: what to expect after submission

After submitting your completed employee forms, it's essential to understand what happens next. The HR department will process your documents, and efficient completion can lead to a seamless transition into your new role.

Check in with HR after a reasonable amount of time to confirm that all documentation has been processed correctly. Any follow-ups regarding benefits enrollment, tax information, and payment methods ensure you start your new position with clarity and support.

pdfFiller: your partner in efficient document management

Navigating the employee form completion process can be daunting, but platforms like pdfFiller make it accessible and efficient. With its user-friendly features designed for seamless editing, eSigning, and collaborating, pdfFiller stands out as a vital tool in your document management toolkit.

Explore the additional services of pdfFiller to enhance your form completion experience and streamline your documentation needs. Empower yourself with tools that make completing employee forms and other documents an organized and simple task.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in how to complete employee?

Can I create an eSignature for the how to complete employee in Gmail?

How do I fill out how to complete employee on an Android device?

What is how to complete employee?

Who is required to file how to complete employee?

How to fill out how to complete employee?

What is the purpose of how to complete employee?

What information must be reported on how to complete employee?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.