Get the free w 4 form 2026

Get, Create, Make and Sign w 4 form 2026

How to edit w 4 form 2026 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w 4 form 2026

How to fill out 2026 ia w-4

Who needs 2026 ia w-4?

2026 IA W-4 Form: A Comprehensive How-to Guide

Understanding the 2026 IA W-4 Form

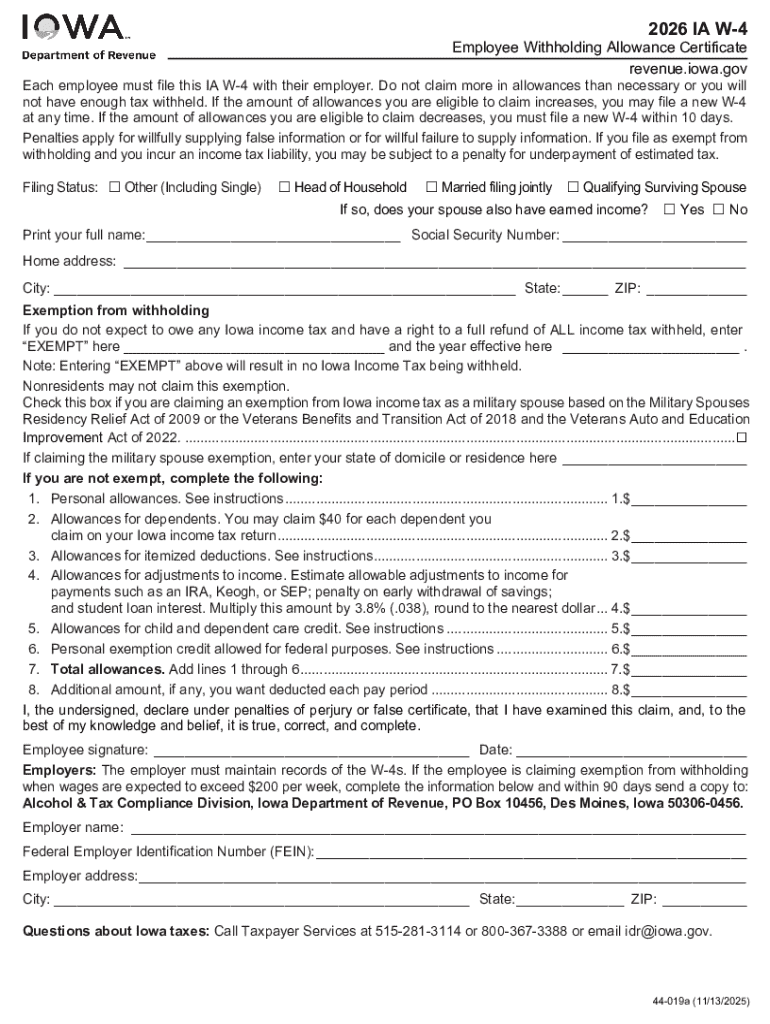

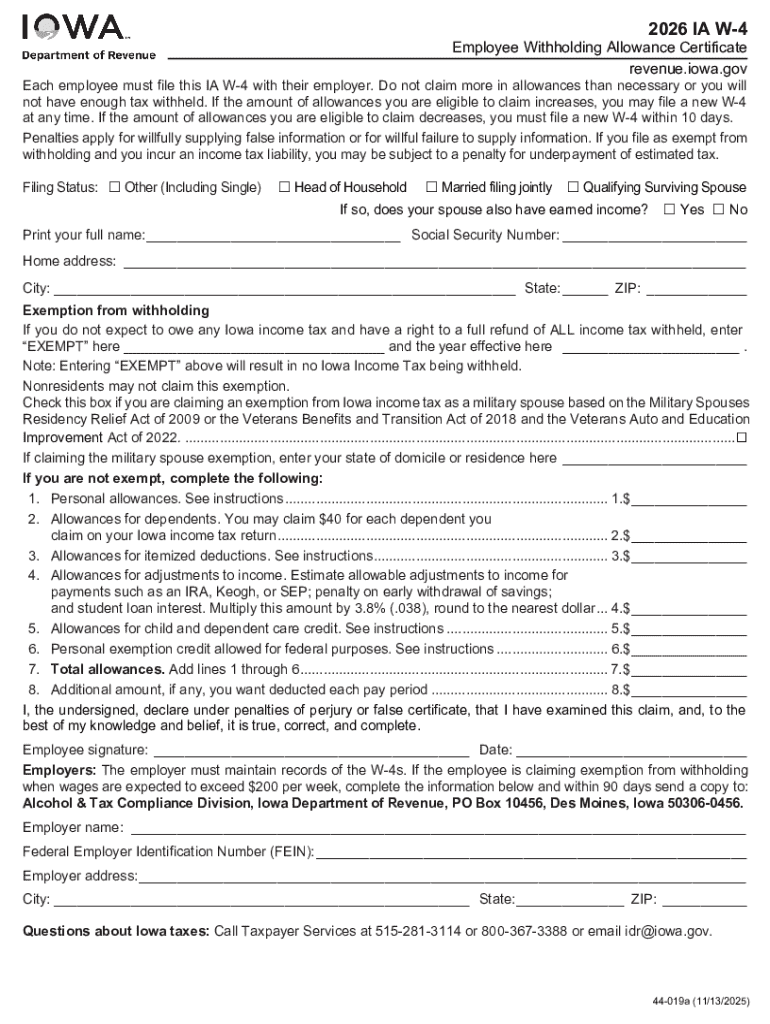

The 2026 IA W-4 Form is a crucial document for Iowa residents and workers, designed specifically for the state to determine tax withholdings from employees' paychecks. This form serves as a tool for employees to communicate their tax liability effectively to their employers, ensuring accurate calculations during tax season. Filling out the IA W-4 correctly is essential for avoiding over-withholding or under-withholding, both of which can lead to financial challenges come April.

Its purpose extends beyond merely satisfying paperwork requirements; the 2026 IA W-4 Form plays a vital role in ensuring that taxpayers do not pay more than required or risk owing money when filing state taxes. Compared to the federal W-4, the IA W-4 includes several state-specific sections tailored to Iowa's tax laws, with particular attention to local credits and deductions.

Who needs to fill out the 2026 IA W-4 Form?

The 2026 IA W-4 Form must be filled out by any employee working in Iowa who wishes to have taxes withheld from their paycheck accurately. This includes newly employed workers beginning a job as well as those whose financial circumstances have changed significantly throughout the year, such as a raise, marriage, or the birth of a child. Understanding when to file a new IA W-4 is crucial for managing your tax obligations effectively.

Employers also have responsibilities regarding the IA W-4. They must ensure that employees are provided with the form, understand how to fill it out, and submit it accurately to the payroll department. Maintaining accurate records of these forms is essential for compliance with Iowa tax regulations, and employers often provide guidance on proper submission techniques to minimize errors and complications.

Step-by-step instructions for filling out the 2026 IA W-4 Form

Filling out the 2026 IA W-4 may seem daunting, but it can be straightforward with this step-by-step guide. Begin by gathering necessary personal information such as your full name, Social Security Number (SSN), and current address. These details form the basis for identifying you as a taxpayer.

Filing status is another critical piece of information, as it significantly affects your calculations for withholding. Individual taxpayers can choose among several options, including single, married filing jointly, and head of household.

Step 1: Gather necessary information

Step 2: Complete the form sections

Next, proceed to complete the various sections of the form. The Personal Allowances Worksheet will guide your calculations for the number of allowances you can claim based on factors like dependents and other sources of income.

Be thorough in entering information regarding additional income, deductions, and adjustments. These are crucial for a balanced withholding figure. For example, individuals with other income sources should account for this in the additional income section to avoid under-withholding.

Specific instructions for each section will typically provide guidance on how to calculate allowances correctly. Using a straightforward approach reduces errors and ensures compliance with state tax laws.

Step 3: Review and double-check information

After filling out the form, the last step is to review and double-check the information provided. Accuracy is key, as common errors such as typos or incorrect SSNs can lead to processing delays. Society's administrative burden needs to be reduced, and error reduction is an essential aspect of timely tax filing.

Be particularly cautious with numerical entries, ensuring that you’ve accurately calculated allowances and any other relevant values. It may also help to have someone else review the form for an additional layer of scrutiny.

Editing and modifying your 2026 IA W-4 Form

Sometimes it’s necessary to make adjustments to your existing IA W-4 Form. Changes in your personal or financial situations such as a new job, a change in salary, or significant life events require an updated form. These periodic adjustments help ensure that you aren’t paying too little or too much in taxes over the course of the year.

Making such changes is a straightforward process. Simply fill out a new IA W-4 and resubmit it to your employer’s payroll department. They’ll retire the previous form and ensure the updated withholding is in place. Frequent communication with HR can help pre-empt any issues stemming from outdated forms.

Utilizing pdfFiller tools can greatly facilitate this process, allowing you to edit your W-4 form easily, making modifications as needed quickly without needing to print and scan hard copies.

Digital signing and submitting your 2026 IA W-4 Form

In the digital age, eSigning your IA W-4 Form has become increasingly common, providing both convenience and security. Platforms such as pdfFiller streamline this process, allowing users to eSign their forms quickly and securely without needing to manually print or sign documents.

Once signed, the next step is submission. Most employers will require a digital or printed version of your W-4 Form to be submitted. Therefore, check with your organization's HR department for specific submission protocols, which can vary widely between companies.

Maintaining accurate records is pivotal, especially for reference during tax filing or if discrepancies arise later. Accurate record-keeping can save both time and effort down the road, ensuring a smoother tax experience.

Frequently asked questions (faqs) about the 2026 IA W-4 Form

Addressing common questions about the 2026 IA W-4 Form helps clarify its importance and the related processes. For example, what if you don’t submit the form? Failing to submit your W-4 could leave your employer with no instructions for tax withholdings, potentially leading your wages to be taxed at the maximum rate. This can result in unexpected expenses during tax filing.

How often should you update your W-4? It’s advisable to review and adjust your form any time there is a significant change in income or personal circumstances. Common life events like getting married or having children can necessitate a review of your withholdings.

Advanced considerations for the 2026 IA W-4 Form

Understanding the tax implications linked to your withholding calculations is essential for making valuable financial decisions. As you consider your 2026 IA W-4 Form, think about how adjustments might impact your overall financial health. Utilizing tax credits effectively could reduce your overall tax footprint while optimizing your withholdings can lead to a more favorable tax declaration.

There are various strategies to optimize your withholdings, such as taking into consideration expected income fluctuations throughout the year or making large purchases that could provide tax deductions. Consulting tax professionals can provide additional insights tailored to your specific needs.

Utilizing pdfFiller for your document needs

pdfFiller stands out as a powerful platform for managing documents, including the 2026 IA W-4 Form. With features allowing users direct editing, eSigning, and document collaboration, the platform enhances the management process significantly. Whether you're an individual managing your personal documents or part of a team handling multiple forms, pdfFiller eliminates many administrative hurdles.

Users can optimize their workflow with interactive tools designed for ease of use. Its cloud-based solution enables access from anywhere, ensuring that you can manage and sign forms conveniently whether in the office or remotely, adding practical versatility to your document handling.

Troubleshooting common issues with the 2026 IA W-4 Form

Common issues can arise when completing the 2026 IA W-4 Form, such as difficulties with submission methods or errors in the information provided. Should you face challenges when submitting the form, it’s wise to reach out to your HR department as they are typically well-equipped to assist with any inquiries or direct you on the proper path to take.

Additionally, if you realize a mistake has been made after submission, contacting HR promptly can facilitate corrections before any issues arise during tax processing. It's vital to maintain open communication with your employer about your W-4 to ensure that your withholdings remain accurate and in line with your financial needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit w 4 form 2026 from Google Drive?

Can I create an electronic signature for the w 4 form 2026 in Chrome?

How do I fill out w 4 form 2026 using my mobile device?

What is 2026 ia w-4?

Who is required to file 2026 ia w-4?

How to fill out 2026 ia w-4?

What is the purpose of 2026 ia w-4?

What information must be reported on 2026 ia w-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.