Understanding the Individuals or Entities File Form: A Comprehensive Guide

Understanding the individuals or entities file form

The Individuals or Entities File Form is a critical document intended for various purposes, mainly associated with tax obligations and financial disclosures. This form can serve both individuals and entities, such as corporations and partnerships, enabling them to provide necessary information for compliance with tax regulations, thereby avoiding penalties and ensuring accurate reporting of income.

Proper completion of this form is essential, as errors or omissions can lead to complications, including audits or delays in processing. It's crucial for any individual or entity planning to engage in transactions that may impact their tax liabilities to be familiar with this form. Common scenarios where the individuals or entities file form is required include starting a new business, filing an income tax return, or applying for specific licenses.

Key components of the individuals or entities file form

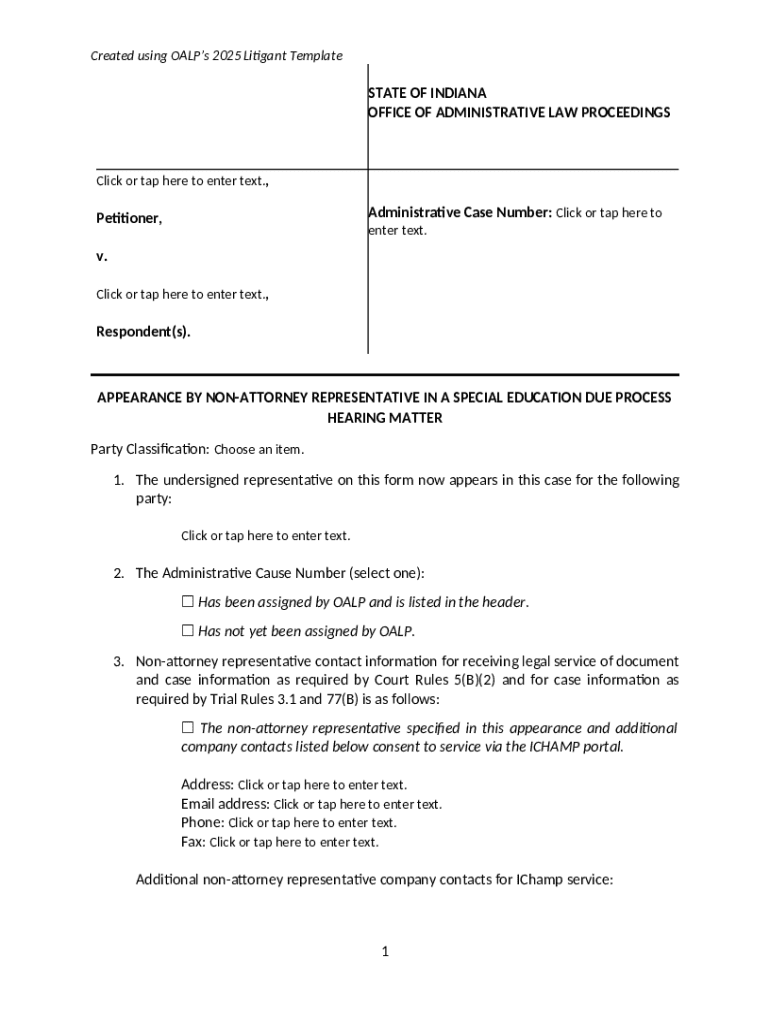

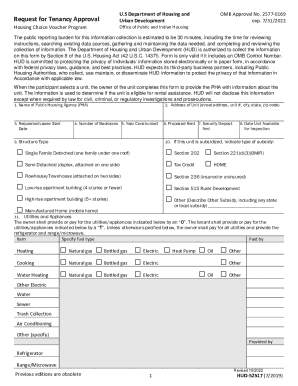

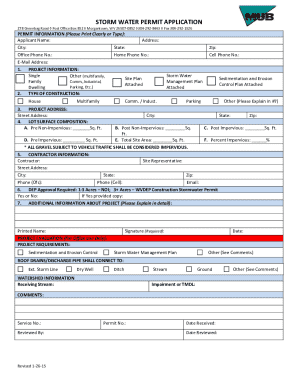

When diving into the specifics of the individuals or entities file form, it is essential to understand the basic information required. For individuals, this typically includes personal identification details such as Social Security numbers and contact information. Businesses, on the other hand, need to provide entity information such as their legal name, tax identification number (TIN), and address.

Personal Identification Details: This includes full name, address, contact information, and Social Security Number (SSN).

Entity Information for Businesses: Legal name, TIN, address, and type of business (e.g., corporation, partnership, etc.).

Furthermore, the sections of the form are designed to capture vital information for tax evaluation. Notably, this encompasses tax identification numbers, essential for accurate tax processing, as well as financial information covering business and investment income, which can significantly affect tax duties. Additional disclosures may also be required, depending on the nature of the entity or individual’s activities.

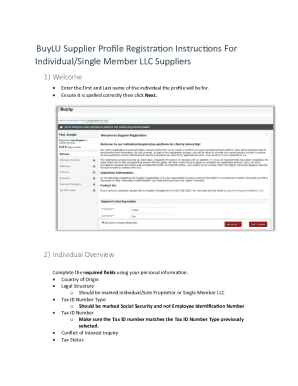

Step-by-step guide to filling out the form

Filling out the individuals or entities file form correctly requires careful preparation. Before starting, gather all necessary documentation such as previous tax returns, financial statements, or any legal entity formation documents. Understanding the specific requirements based on your entity type—whether you are an individual, corporation, or another business structure—is critical.

Inputting Personal/Entity Information: Begin by accurately detailing your name, address, and tax identification numbers.

Detailing Financial Background: Include applicable income and expenditures to give a comprehensive view of your financial situation.

Providing Supporting Documents: Attach necessary documentation to substantiate the information listed on the form.

Once the form is filled, review it for accuracy to ensure all information aligns with your records. This includes obtaining necessary signatures, which, for business entities, may require additional approvals from board members or stakeholders.

Editing and managing your form with pdfFiller

Using pdfFiller for managing your individuals or entities file form offers several advantages, particularly through its interactive tools. Users can fill, edit, and sign documents directly within the platform, minimizing the risk of errors compared to hand-filled forms. The integration of cloud-based document management means that you can access your forms from anywhere, providing flexibility and efficiency.

Utilizing Interactive Tools for Better Accuracy: pdfFiller provides tools that auto-fill and check entries to reduce mistakes.

Benefits of Cloud-Based Document Management: Store, edit, and retrieve your forms from anywhere—ideal for individuals and teams.

Collaborative Features for Teams: Work on documents in real-time with team members, enhancing productivity.

Signing your individuals or entities file form

Understanding the requirements for signing the individuals or entities file form is crucial. Different entities may have varying rules regarding who can legally sign forms, especially corporations or partnerships. Typically, an authorized person, such as a member or an owner, will be required to provide their signature.

Understanding the Signatory Requirements: Ensure that the individual signing has the authority to represent the entity.

How to eSign through pdfFiller: Easily use electronic signature features for a streamlined process.

Tracking Signatures and Document Status: Use pdfFiller’s tracking system to monitor the signing process and document status.

Common issues and how to troubleshoot

Common issues that arise when filling out the individuals or entities file form include incorrect information. Submitting forms with inaccuracies not only leads to delays but may also incur penalties. To avoid this, verify all provided details against official records.

Incorrect Information: Double-check all entries before submission to ensure accuracy.

Documentation Inconsistencies: Ensure that all supporting documents match and support the information in your form.

Signing Errors: Ensure that the correct individuals sign the form where required to avoid processing delays.

Addressing these issues requires proactive management and ongoing vigilance when completing the document, ensuring all parties understand their responsibilities and the information being reported.

Filing and post-filing considerations

When you’re ready to file the individuals or entities file form, consider the methods available for submission. This form can typically be submitted either online or via mail, with online submission often yielding faster processing times. Familiarize yourself with the submission deadlines to avoid late charges or penalties, particularly around tax periods.

Submission Methods: Compare online submission versus traditional mail, considering advantages such as speed and confirmation.

Keeping Track of Submission Deadlines: Use calendars or alerts to remember important dates.

What to Expect After Filing: Know what follow-up actions might be necessary and what communications to expect.

Understanding these aspects will help ensure smooth processing of your submission and keep your records in good standing.

Frequently asked questions

Many individuals and teams often have questions about the individuals or entities file form. One common question is who exactly needs to fill out this form. Generally, any individual who has tax obligations or any entity engaged in business activities subject to taxation must complete this form. If you find that you’ve made a mistake on your form, options typically include amending the form or contacting the appropriate authorities to rectify the situation.

Who Needs to Fill Out the Individuals or Entities File Form? Any individual or business entity with taxable transactions must file.

What if I Made a Mistake on My Form? Understand how to amend or correct any errors without facing penalties.

How Can pdfFiller Help? Offering tools for easy completion, editing, and signing of forms.

Are There Fees Associated with Filing? Review potential filing fees depending on your jurisdiction.

Additional insights and tips

When filling out the individuals or entities file form, adhering to best practices can significantly improve your experience. It’s essential to take your time and ensure accuracy at every step, utilizing available resources to aid in completing the form correctly. Consider consulting with a tax professional if you are unsure about any information related to your filing requirement.

Best Practices for Filling Out Forms: Take your time, check your entries, and use online tools to verify information.

Resources for Ongoing Document Management: Explore tools that can streamline future forms and filings.

Leveraging Technology for Efficient Filing: Use technology to your advantage, making filing easier and less stressful.

By embracing these practices and strategies, individuals and teams can enhance their document management capabilities, ensuring that they are well-prepared for tax responsibilities and compliance requirements.