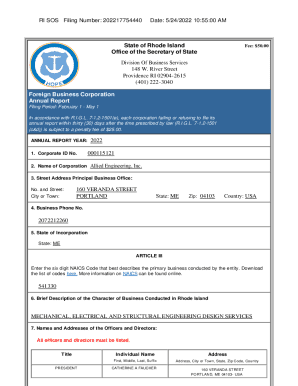

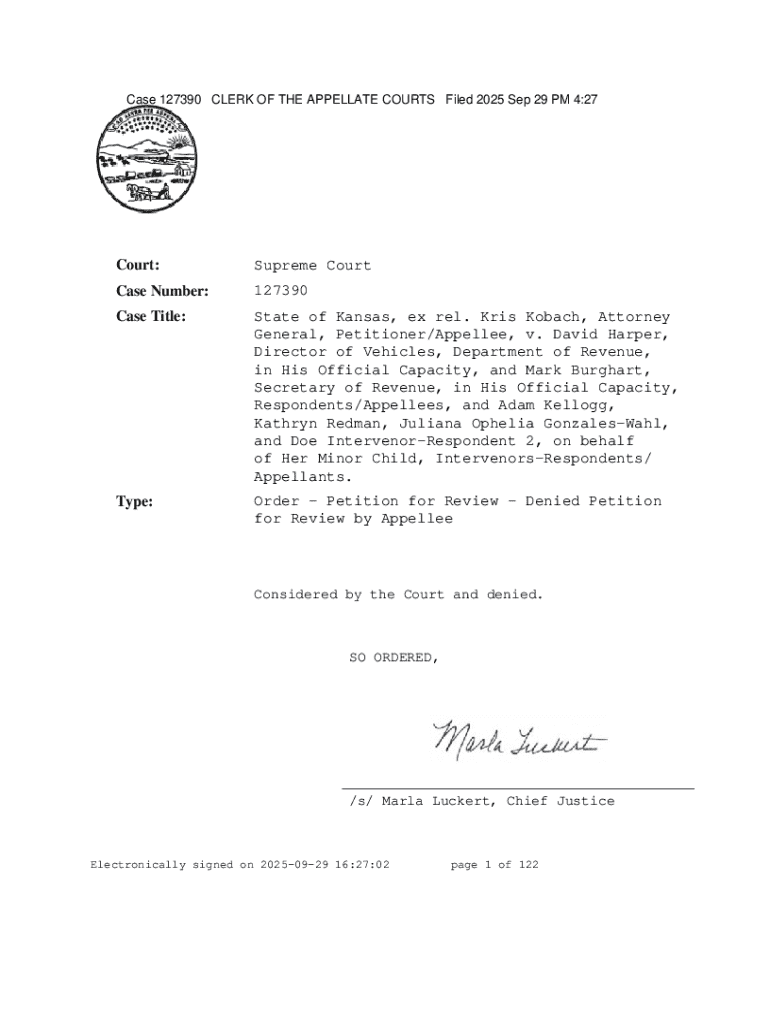

Get the free State of Kansas, ex rel. Kris Kobach, Attorney General ...

Get, Create, Make and Sign state of kansas ex

How to edit state of kansas ex online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of kansas ex

How to fill out state of kansas ex

Who needs state of kansas ex?

State of Kansas Ex Form: A Comprehensive How-to Guide

Understanding the state of Kansas Ex Form

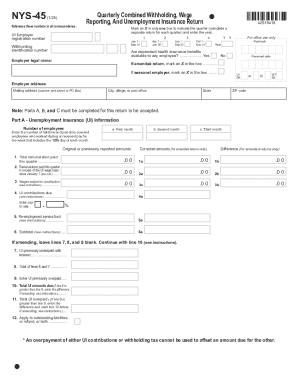

The state of Kansas Ex Form, often simply referred to as the Ex Form, is a crucial document in the realm of Kansas tax regulations. This form serves as an application for various tax exemptions, allowing individuals and organizations to apply for relief from sales tax and other applicable taxes under specific circumstances.

Understanding the purpose and importance of the Ex Form is key for anyone operating in Kansas. By filing this form correctly, businesses and individuals can benefit from significant tax savings, particularly when engaging in activities exempt from sales tax—such as purchasing materials for construction contracts or labor services.

Key components of the Kansas Ex Form

The Kansas Ex Form is segmented into several key components, each essential for accurately representing your exemption request. Understanding these components not only simplifies the filing process but also ensures that your application is well-prepared and more likely to be approved.

The primary sections of the Ex Form include taxpayer information, exemption details, and signature and certification. Taxpayer information captures essential identifying data, while the exemption details are where you specify the type of exemption sought and the reasoning behind the request.

Understanding required documentation

To support exemption claims on the Ex Form, certain documentation is required. This may include previous exemption certificates held by the applicant and detailed invoices or receipts for materials and services that qualify for exemption. It's important to include all relevant supporting documents as this strengthens your application.

If you need additional documentation, several resources are available. The Kansas Department of Revenue provides guidelines and examples that can be useful as you compile your support materials.

Step-by-step instructions for filling out the Kansas Ex Form

Filling out the Kansas Ex Form correctly ensures minimal delays and maximizes the likelihood of receiving the desired exemptions. Here’s a step-by-step breakdown of the process.

First, preparation is key. Gather all necessary information, including your taxpayer information, details of the exemption you seek, and any required supporting documents.

Editing and signing the Kansas Ex Form with pdfFiller

Editing the Kansas Ex Form has never been easier with pdfFiller. This innovative platform allows users to manage their forms seamlessly and efficiently. With its cloud-based interface, you can access your documents from anywhere and make necessary edits without hassle.

To get started, simply upload your Kansas Ex Form to pdfFiller. Once your form is loaded, you can utilize interactive tools to edit any information directly on the document. This includes correcting errors in the taxpayer information section or clarifying exemption details.

Lastly, the eSigning process within pdfFiller is straightforward. Follow the prompted steps to validate your signature, making sure it meets compliance requirements.

Managing and submitting your Kansas Ex Form

Once the Kansas Ex Form is completed, the next step is submission. The form can be submitted to local tax departments or, in certain cases, through online submission portals if available. Knowing where exactly to submit your form can have a significant impact on how quickly your exemption is processed.

For individuals or businesses unfamiliar with the submission process, it’s beneficial to confirm receipt of your submission. This ensures that your application is in hand and can be processed without any complications.

Frequently asked questions about the Kansas Ex Form

Understanding potential issues with the Kansas Ex Form is important for all taxpayers. Common queries often revolve around what happens if an exemption request is denied or if it's possible to amend a submitted form.

If your exemption is denied, reviewing the reasoning provided by the tax department can help clarify steps to either appeal the decision or address specific deficiencies in the application.

When resolving issues with your Ex Form, don’t hesitate to reach out to local tax officials or consult the Kansas Department of Revenue for guidance.

Additional tools and resources for Kansas residents

For Kansas residents seeking further assistance with the Ex Form, pdfFiller provides several interactive features that can enhance the document management experience. Collaboration options are especially beneficial for teams working on complex tax-exempt projects.

Additionally, finding templates for other related forms and accessing webinars or tutorials about navigating tax documentation can empower users to fill out forms correctly, understanding the finer aspects of local tax regulations.

How pdfFiller simplifies your document management experience

pdfFiller transforms the way you handle documents, providing a cloud-based solution that enhances accessibility and collaboration. Its user-friendly interface means that even those with minimal experience can navigate document editing, signing, and sharing with ease.

Key features of pdfFiller include comprehensive storage solutions, allowing users to create, edit, and manage forms efficiently. Whether you are an individual or part of a team, pdfFiller enhances productivity through its wide array of customizable options.

Real-world impact of the Kansas Ex Form on individuals and businesses

The Kansas Ex Form can have a significant financial impact on businesses and individuals who qualify. For many contractors in the construction industry, the tax savings from successfully obtaining exemptions can lead to substantial cost reductions.

Case studies illustrate how proper filing of the Ex Form can help businesses lower operational costs, allowing them to reinvest in their operations and create more job opportunities. Furthermore, feedback from users often emphasizes how access to tax exemptions has provided relief during financial challenges.

Conclusion of the guide

Navigating the state of Kansas Ex Form requires an understanding of the requirements, accurate completion, and efficient management via platforms like pdfFiller. Utilizing this guide can simplify the process, empowering individuals and businesses to maximize their tax exemption opportunities.

As you embark on your tax exemption journey, remember that pdfFiller is here to enhance your document management experience, making the filing process more accessible and efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the state of kansas ex electronically in Chrome?

How do I edit state of kansas ex on an iOS device?

How do I fill out state of kansas ex on an Android device?

What is state of kansas ex?

Who is required to file state of kansas ex?

How to fill out state of kansas ex?

What is the purpose of state of kansas ex?

What information must be reported on state of kansas ex?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.