Get the free What to Do if You Lost Your DiplomaCHC Blog

Get, Create, Make and Sign what to do if

Editing what to do if online

Uncompromising security for your PDF editing and eSignature needs

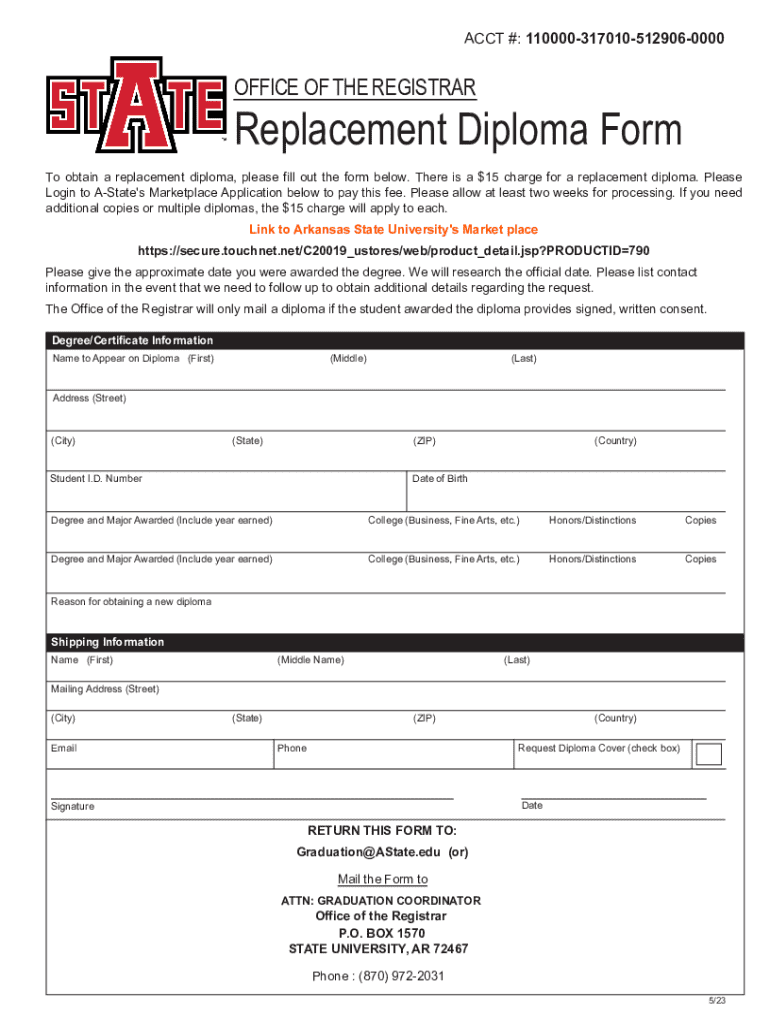

How to fill out what to do if

How to fill out what to do if

Who needs what to do if?

What to do if Form is required: A comprehensive guide

Understanding the importance of Form

Form X is often a crucial requirement within various legal and financial frameworks. Whether it pertains to taxes, applications, or compliance documents, understanding its relevance is paramount. For example, many people encounter Form X while managing their IRA contributions, particularly when differentiating between traditional and Roth IRAs. Failure to submit Form X may lead to penalties or issues in processing your requests.

Understanding the legal implications of not submitting Form X is critical. Missing a deadline could result in a significant loss of potential financial benefits, tax deductions, or even eligibility for programs. Thus, proactive engagement with Form X is essential.

Determining your eligibility and need for Form

Determining who must fill out Form X starts with understanding your unique financial situation and obligations. Individuals with specific income thresholds, such as those with Modified Adjusted Gross Income (MAGI) affecting their IRA contributions, often require this form. It's a necessary step to demonstrate eligibility for various tax advantages.

There are exceptions, such as certain circumstances where low-income taxpayers may not need to file Form X. Understanding these exceptions can save time and effort, yet individuals should familiarize themselves with their specifics.

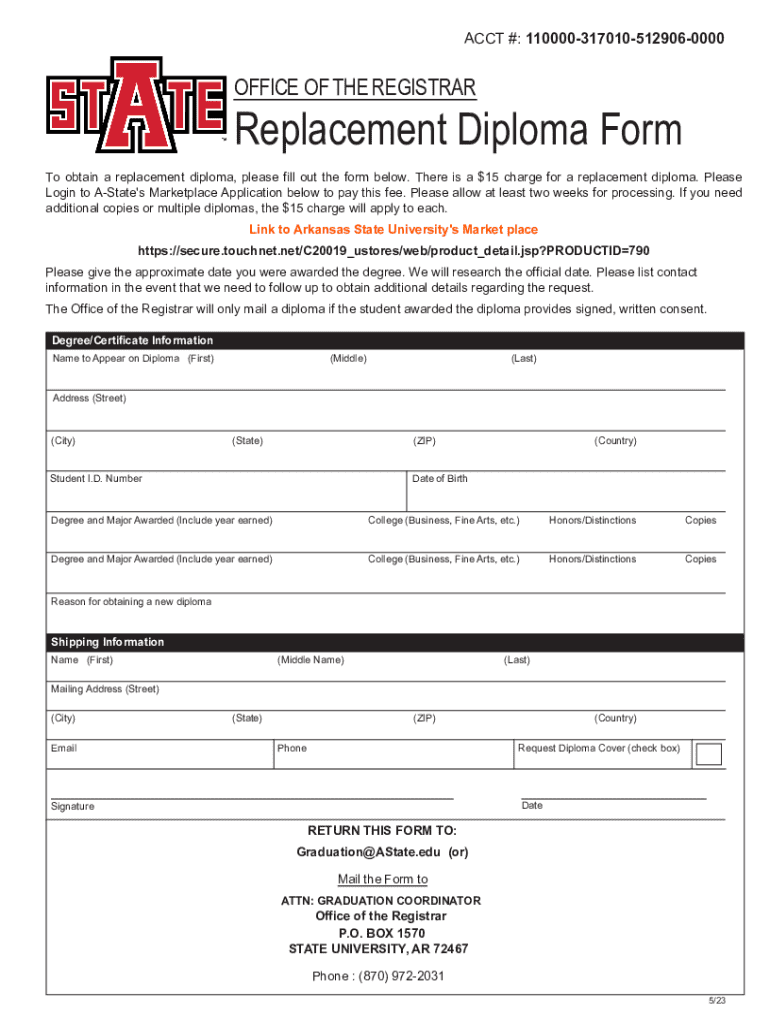

Gathering necessary information for Form

To prepare for filling out Form X accurately, gather all necessary documentation in advance. This may include previous tax returns, income records, and details of your IRA contributions. Efficient collection of data eases the process and minimizes errors during completion.

When collecting this information, ensure you verify its accuracy. Mistakes can lead to complications down the line. Organizing this information using a digital folder or a checklist makes for efficient completion of the form.

Step-by-step guide to filling out Form

Completing Form X requires attention to detail. Begin with your personal information, ensuring accuracy in your name, address, and social security number. This information lays the foundation for the rest of your submission.

Avoid common mistakes like omitting significant information or miscalculating numbers. After completing the form, double-check your entries to ensure all information is correct.

Utilizing pdfFiller for completing Form

pdfFiller simplifies the management of Form X through its cloud-based tools. Users can start by uploading Form X directly to the platform, which allows for straightforward editing and completion online.

The benefits of using pdfFiller extend beyond simple data entry; its collaborative features allow for team reviews and edits, ensuring a seamless document management experience. Plus, with robust security measures, your sensitive information remains protected.

Submitting Form

Once Form X is completed, choose the appropriate submission method. Depending on your situation, you may submit it online through the IRS portal or via mail. Each method has its own verification requirements; ensure that you comply fully.

To ensure your submission is complete, double-check that all sections of Form X are filled out. Tracking your submission allows you to confirm its status, helping you stay engaged with your application process.

What to do after submitting Form

After submitting Form X, follow up promptly to confirm its receipt. Waiting too long can lead to unforeseen issues, especially if you need to address discrepancies.

Knowing how to navigate these post-submission processes can facilitate a smoother outcome and help avoid potential penalties in your filings.

Frequently asked questions about Form

Addressing common concerns about Form X can provide clarity to those uncertain about its requirements. Many individuals wonder whether they truly need to fill out Form X and under which circumstances it becomes mandatory.

Providing accurate answers to these questions enhances understanding and ensures that individuals can approach the completion of Form X with confidence.

Real-life scenarios involving Form

Understanding how Form X applies to different situations can help demystify its usage. For instance, some individuals share their experiences with successfully managing their forms under strict deadlines facilitated by pdfFiller.

Each case highlights the versatility and necessity of Form X in various contexts and illustrates effective strategies for leveraging tools like pdfFiller.

Exploring additional features of pdfFiller

Beyond Form X, pdfFiller provides a wide array of document management capabilities. Users can take advantage of collaboration tools that streamline teamwork, ensuring everyone is on the same page when handling sensitive financial or tax documents.

As organizations increasingly focus on digital document management, pdfFiller stands as an invaluable resource for maintaining compliance and organization.

Conclusion: Simplifying your document management with pdfFiller

Utilizing pdfFiller for managing Form X and other documents significantly enhances the efficiency of your processes. The platform’s intuitive features empower users to easily navigate form complexities, all while ensuring compliance and security.

Embrace the ease of managing Form X by exploring all the templates and features pdfFiller offers, ensuring you always remain one step ahead in your document management tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the what to do if electronically in Chrome?

Can I create an electronic signature for signing my what to do if in Gmail?

How do I fill out what to do if on an Android device?

What is what to do if?

Who is required to file what to do if?

How to fill out what to do if?

What is the purpose of what to do if?

What information must be reported on what to do if?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.