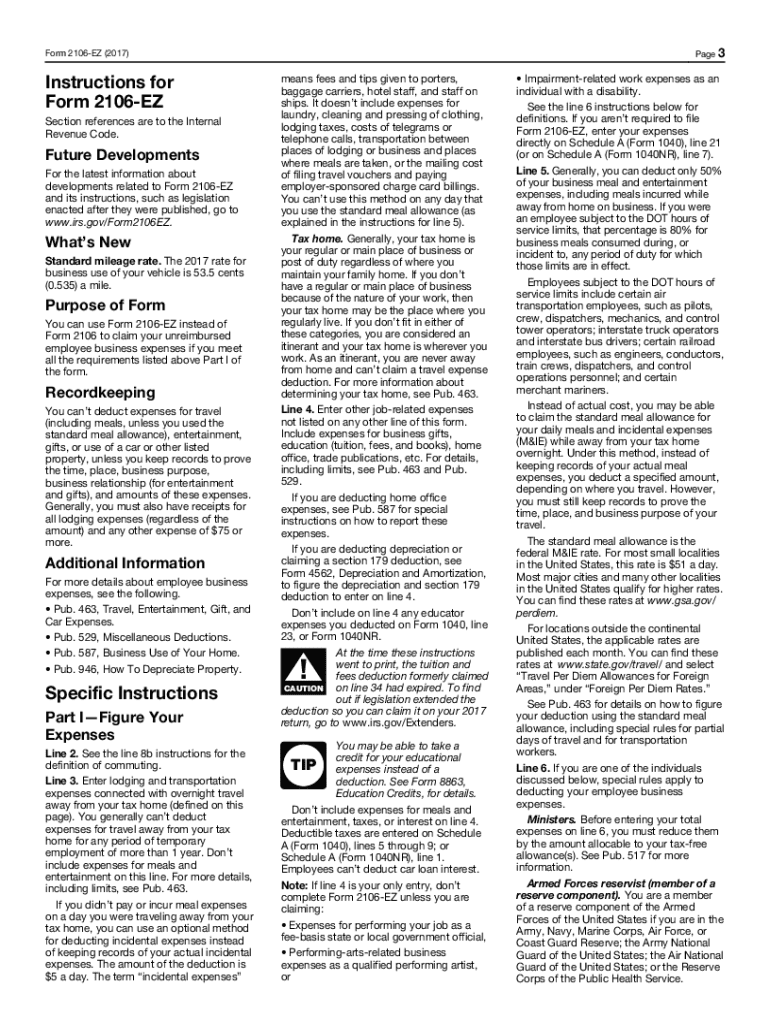

Get the free Instructions for Form 2106-EZ Specific Instructions

Get, Create, Make and Sign instructions for form 2106-ez

Editing instructions for form 2106-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 2106-ez

How to fill out instructions for form 2106-ez

Who needs instructions for form 2106-ez?

Instructions for Form 2106-EZ: A Comprehensive Guide to Employee Business Expenses

Overview of IRS Form 2106-EZ

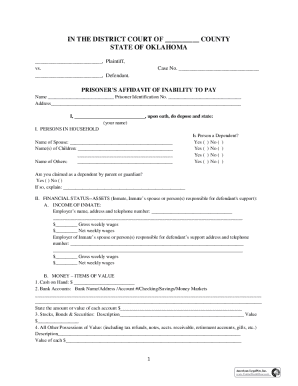

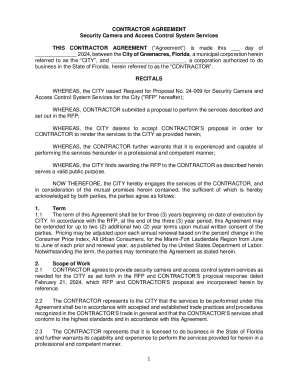

IRS Form 2106-EZ is specifically designed for employees to claim business expenses related to their job. This simplified version of Form 2106 is particularly useful for employees who incur unreimbursed business expenses, as it allows them to deduct eligible expenses when filing their tax returns. Unlike Form 2106, which can be more complicated, the 2106-EZ streamlines the process for taxpayers, especially for those who use their personal vehicles for work.

Who needs to file Form 2106-EZ? Generally, this form is essential for workers who travel frequently for work, such as sales representatives, performing artists, or employees who incur significant job-related expenses that are not reimbursed by their employers. If you regularly pay out-of-pocket for travel expenses associated with your job, understanding how to accurately complete this form is critical.

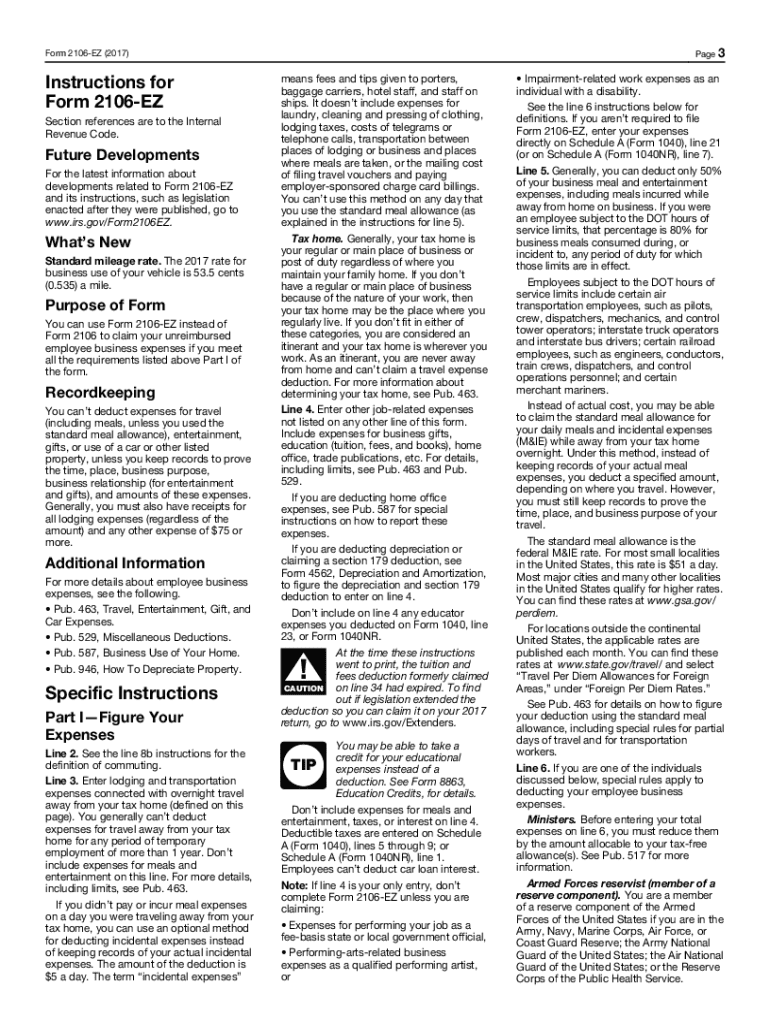

How to complete IRS Form 2106-EZ

Completing IRS Form 2106-EZ involves several key steps to ensure accuracy and compliance. Here’s a step-by-step guide detailing how to fill out the form, enabling individuals to efficiently report their business expenses.

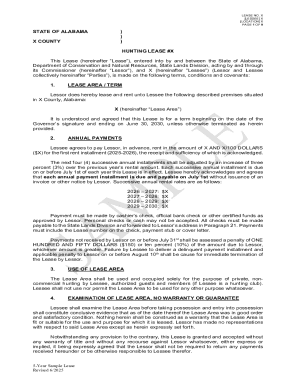

For accurate reporting, maintain thorough records of all business expenses. Use receipts and notes about the purpose of each expense to avoid common mistakes, such as misreporting or missing deductions. Establish a structured system for organizing your documents, so when tax season comes, all relevant information is readily available.

Important changes to IRS Form 2106-EZ

Recent tax law changes significantly affect how taxpayers complete Form 2106-EZ. Notably, the Tax Cuts and Jobs Act altered many deduction rules starting from the 2018 tax year. Under these new regulations, many miscellaneous itemized deductions, including some employee business expenses, are no longer available. Therefore, it is vital for taxpayers to be aware of these changes, as they may influence the decision to use Form 2106 or its EZ counterpart.

Understanding what deductions were eliminated and what remains permissible can significantly impact potential tax liabilities or refunds. For example, employees who had typical deductions for job-related travel and equipment may find themselves in a more restrictive situation since the itemized deduction for unreimbursed employee expenses has been suspended through 2025.

Video walkthrough of completing IRS Form 2106-EZ

Visual learners can benefit from video tutorials when completing IRS Form 2106-EZ. An accessible video guide is available on pdfFiller, providing a detailed walkthrough of each part of the form. This resource makes it easier for individuals to follow along and ensures a greater understanding of how to input their information correctly.

Key highlights from the video cover the essentials of gathering necessary documents, tips for making deductions, and specific details about the completion of each section on Form 2106-EZ. Accessing the video will give viewers a clearer idea of the importance of accurate recording and reporting of employee business expenses.

Who can file IRS Form 2106-EZ?

Eligibility for filing Form 2106-EZ is generally restricted to employees who incur unreimbursed business expenses. This form is specifically for those who claim vehicle-related expenses as their only deductions associated with business travel. To qualify, an applicant must also not claim any other unreimbursed expenses like equipment or supplies.

In contrast, Form 2106 is available for employees who want to itemize other business expenses beyond vehicle use. Distinguishing between the two forms is crucial, as using Form 2106-EZ limits the types of deductions you can claim. Thus, understanding your specific circumstances can guide you in choosing the right form to ensure compliance and maximize possible refunds.

Frequently asked questions about IRS Form 2106-EZ

A multitude of questions arises surrounding the completion of IRS Form 2106-EZ. Addressing common filing errors is essential to help prevent issues that could lead to delays in processing or audits by the IRS. Common pitfalls include incomplete information, incorrect expense calculations, and not maintaining documentation to support claims.

Where can find IRS Form 2106-EZ?

To access IRS Form 2106-EZ, taxpayers can directly visit the official IRS website, where the form is available for download in PDF format. Furthermore, pdfFiller provides users with an easy way to fill out and submit the form online, ensuring a streamlined process to handle tax documents.

Using pdfFiller, individuals can take advantage of features to edit, sign, and submit Form 2106-EZ seamlessly. This cloud-based solution not only facilitates document management but also ensures that you stay compliant with tax filing requirements while reducing the hassle associated with traditional paperwork.

Related tax articles

For those interested in maximizing their deductions, exploring related articles on tax forms and deductions proves beneficial. These resources often delve into other relevant tax forms that may be necessary, tips for effectively categorizing business expenses, and strategies to maximize legitimate deductions. Understanding these aspects empowers employees to navigate the complexities of tax reporting, aiding them in making informed decisions that can optimize their financial outcomes during tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify instructions for form 2106-ez without leaving Google Drive?

Can I create an electronic signature for the instructions for form 2106-ez in Chrome?

Can I edit instructions for form 2106-ez on an iOS device?

What is instructions for form 2106-ez?

Who is required to file instructions for form 2106-ez?

How to fill out instructions for form 2106-ez?

What is the purpose of instructions for form 2106-ez?

What information must be reported on instructions for form 2106-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.