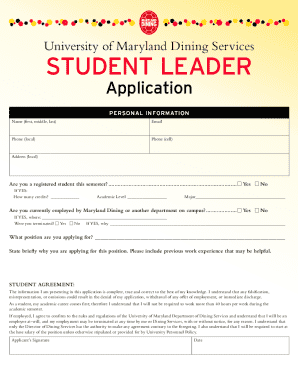

Get the free Nebraska Tax Commission Reverses Douglas County's ... - terc nebraska

Get, Create, Make and Sign nebraska tax commission reverses

How to edit nebraska tax commission reverses online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska tax commission reverses

How to fill out nebraska tax commission reverses

Who needs nebraska tax commission reverses?

Nebraska Tax Commission reverses form

Understanding the Nebraska Tax Commission's form reversal

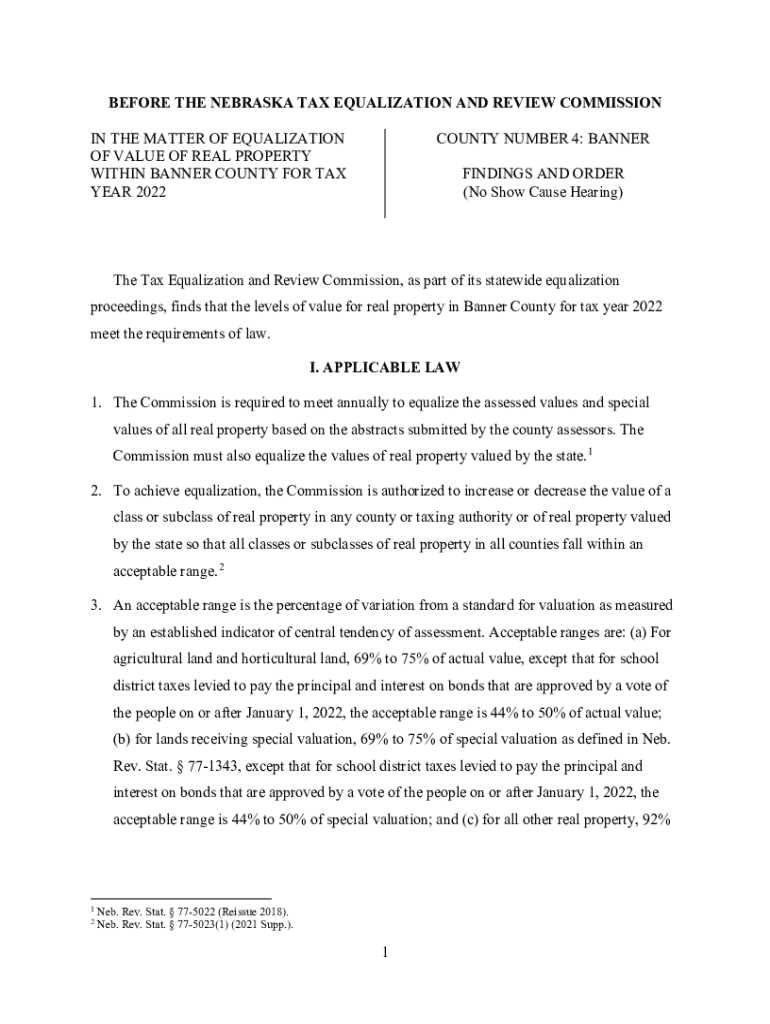

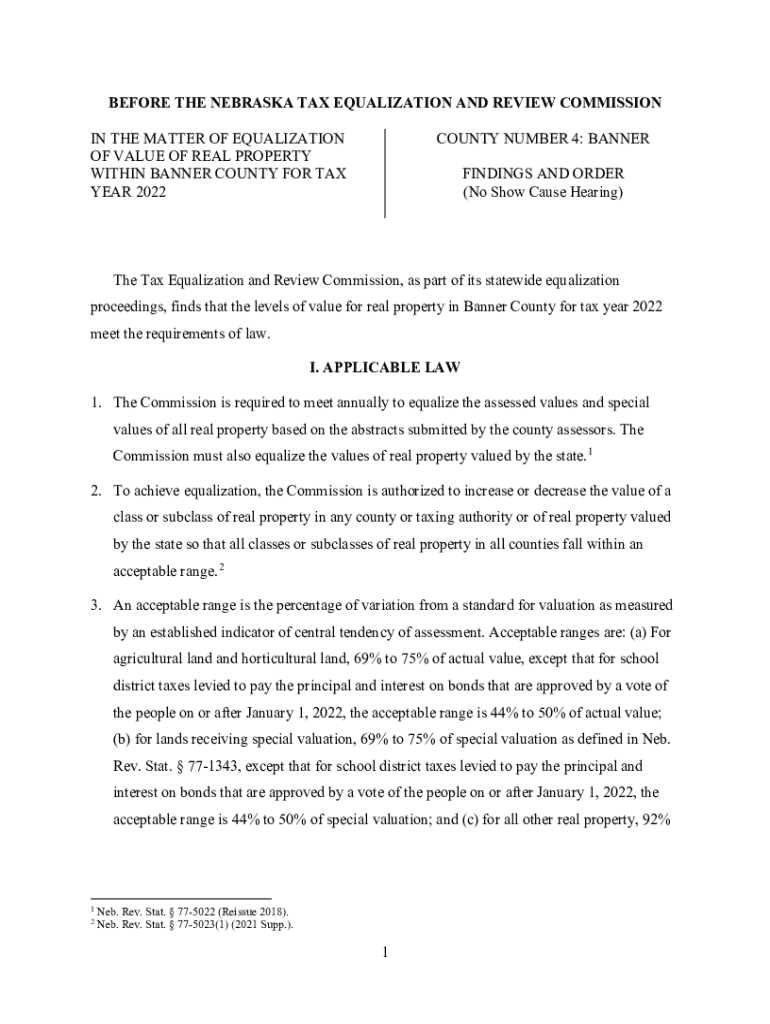

The Nebraska Tax Commission plays a critical role in overseeing the management of tax collection and compliance in the state. As part of its mandate, the Commission has authority over the formulation and adjustment of tax forms that govern taxation procedures. This includes ensuring forms are up-to-date with current legislation and reflecting changes in tax policy, which is vital for both taxpayers and businesses. The reversal of tax forms can significantly affect many individuals, as it may require them to adjust their filings and submissions.

A form reversal refers to the formal process wherein the Nebraska Tax Commission alters or withdraws previously established tax forms. This can happen for a variety of reasons, including legislative changes, updates in tax rates, or clarifications on tax reporting requirements. Understanding the nuances of form reversals is essential for any taxpayer to maintain compliance and avoid penalties.

Recent changes and their impact

Recently, the Nebraska Tax Commission has rolled out several changes that affect key forms utilized by taxpayers across the state. The specific forms affected by this reversal include documents related to Individual Income Tax, Fiduciary Income Tax, and various tax reporting forms associated with bingo, keno, and raffle activities. Timelines for these revisions have been established, indicating when taxpayers must adopt these new form guidelines to ensure compliance.

The implications of these changes can vary widely. For individual taxpayers, it may mean a re-evaluation of their income reporting practices, especially to avoid discrepancies with previous submissions. On the other hand, businesses, particularly those involved in the gaming sector, need to adjust their tax reporting processes to align with the new forms or risk facing fines and penalties due to incorrect filings.

Navigating the reversed forms

As the Nebraska Tax Commission reverses forms, several key forms have been identified that require taxpayer attention. The Individual Income Tax form, for instance, will now have updated instruction sets and new filing methods to reflect recent changes. The Fiduciary Income Tax form will also see revisions that impact how estates or trusts report their income. For direct access to the newly revised forms, check the Nebraska Tax Commission's website to download the latest documents.

To help facilitate the process of handling these reversed forms, we offer a step-by-step guide below. Be sure to follow these instructions carefully to ensure that your submissions are compliant with the most current requirements.

Enhanced PDF tools for managing tax forms

Utilizing tools like pdfFiller can significantly streamline the process of managing tax forms, especially during periods of change such as reversals by the Nebraska Tax Commission. With pdfFiller, users have the capacity to edit, sign, and collaborate on forms effectively, all within a cloud-based platform. This flexibility is essential when dealing with documents that need to be revised and resubmitted, as users can access their files from anywhere, enhancing convenience.

The interactive features offered by pdfFiller simplify the tax form process significantly. Users can fill forms electronically, share them with professionals for review, and even track changes made during the collaborative process. This ensures that all involved parties are on the same page regarding tax submissions and any updates affecting their jurisdictions.

Common issues and how to resolve them

Tax form reversals can lead to common issues faced by taxpayers. For example, many individuals find themselves unsure about the changes required when the forms are reversed, leading to incomplete or incorrect submissions. Often, users might miss important deadlines as well, resulting in penalties. It's advisable to carefully read through the instructions provided with each new form to mitigate these risks.

To avoid common pitfalls when dealing with reversed forms, consider these expert tips for ensuring accurate completion. Always double-check your entries against the new guidelines provided by the Nebraska Tax Commission and take advantage of resources available to help clarify any uncertainties.

Legal considerations and compliance

After a form reversal, it is vital to understand the compliance requirements that arise. Regulations enforced by the IRS and the state necessitate that all taxpayers remain updated with the latest form alterations to ensure adherence to tax obligations. The importance of this compliance cannot be overstated as non-compliance can result in severe consequences, including fines and potential audits.

Consulting with tax professionals post-reversal can also be beneficial, especially if there are complexities involved in a taxpayer's situation. A tax expert can provide insights that help navigate the new requirements and apply best practices when completing tax submissions.

Resources for further assistance

To stay fully informed, accessing online resources from the Nebraska Tax Commission can aid taxpayers in navigating the landscape of tax compliance. Official announcements, FAQs, and access to help centers provide vital support during this transition. Utilizing these resources can reduce confusion and streamline the direct navigation of reversed forms.

Moreover, incorporating pdfFiller within your ongoing tax needs provides further advantage. Beyond handling current reversed forms, pdfFiller offers tools and resources that support ongoing tax management, from editing forms to securing signatures. A subscription may unlock even more features beneficial for long-term document organization, ensuring efficient management well into the future.

Feedback and continuous improvement

The Nebraska Tax Commission actively encourages user feedback regarding form processes, believing transparency and communication can significantly enhance their operations. Taxpayer experiences with reversed forms are important for informing future updates to the Commission’s processes. By sharing insights, stakeholders can facilitate enhancements that benefit the broader tax community.

Taxpayers who wish to provide feedback can contact the Nebraska Tax Commission through designated channels. Each submission is a step towards refining the tax system, improving not only individual experiences but also contributing to the overall efficacy of Nebraska's tax management.

Looking ahead: future revisions and trends

Anticipating future changes regarding tax forms in Nebraska requires careful observation of legislative trends and shifts in fiscal policy. With ongoing developments in tax legislation, it is likely that further adjustments will occur as the tax landscape evolves. Understanding these trends allows taxpayers to prepare ahead, ensuring compliance and enhanced accuracy in their tax submissions.

One way to stay prepared is to continue leveraging tools like pdfFiller, which offer flexibility and adaptability—critical characteristics as tax forms fluctuate. Keeping abreast of announcements from tax authorities will also enhance a taxpayer's readiness as they navigate these forthcoming changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nebraska tax commission reverses to be eSigned by others?

How do I edit nebraska tax commission reverses on an Android device?

How do I fill out nebraska tax commission reverses on an Android device?

What is nebraska tax commission reverses?

Who is required to file nebraska tax commission reverses?

How to fill out nebraska tax commission reverses?

What is the purpose of nebraska tax commission reverses?

What information must be reported on nebraska tax commission reverses?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.