Get the free Do I need to file Form SP-2025 Business Tax Return for ...

Get, Create, Make and Sign do i need to

How to edit do i need to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out do i need to

How to fill out do i need to

Who needs do i need to?

Do need to form a legal entity?

Understanding the concept of formation

Formation, in the context of business and legal entities, refers to the process of establishing a recognized and structured framework for operations, whether for individuals or businesses. A clear and well-defined legal structure is crucial because it dictates the rules under which the entity must operate, its relationship with government regulations, as well as its interactions with clients and other businesses. The right formation provides not only a way to conduct business but also significant legal and financial advantages.

The common types of structures include Limited Liability Companies (LLCs), corporations, and sole proprietorships. LLCs offer flexibility with fewer requirements compared to corporations, while providing liability protection for its owners. Corporations, although more complex, can raise capital more effectively and provide added credibility. Meanwhile, sole proprietorships may suit freelancers or small business owners but leave personal assets vulnerable to business liabilities.

Key considerations before forming a legal entity

Before you decide to form a legal entity, consider the specific purpose it will serve. Are you striving for limited liability protection to safeguard personal assets from business risks? Would establishing a formal entity grant you access to business banking services and better tax opportunities? Evaluating the reasons for formation against your business goals provides valuable clarity.

Next, assess your own risk and liability exposure. For instance, if your operations involve considerable risk, forming an LLC may provide the necessary layer of protection against personal liability. Additionally, tax implications must be a priority in your decision-making process since different entities are taxed differently. An LLC might offer pass-through taxation while corporations face double taxation on profits unless they qualify for S-corporation status.

When you might not need to form a legal entity

In some cases, operation as a sole proprietor may suffice, especially for individuals without substantial financial risk or investment. This straightforward approach allows entrepreneurs to keep their financial obligations simple, without the complexities of maintaining a legal entity. Moreover, high formation costs or ongoing maintenance fees may exceed potential benefits, particularly for small, temporary projects or side businesses.

Informal business structures can also prove effective for short-term endeavors where compliance with regulatory requirements isn't practical. Many developers, for instance, choose to start their ventures informally while validating their product concepts or gathering information about potential clients.

Steps to form a legal entity: A comprehensive guide

Forming a legal entity involves several key steps that require careful consideration and planning. Start with initial research by identifying the entity type that best suits your business needs. This requires gathering information about state regulations, specific requirements, and the nature of your business activities.

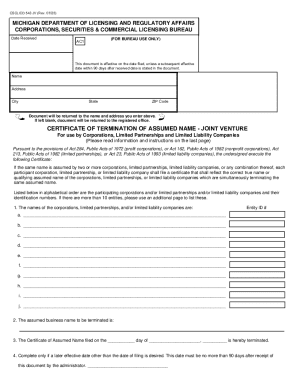

When you’ve selected the type of entity, you must then choose a name that is both unique and descriptive. Conducting a thorough name search ensures that your desired entity name adheres to state regulations and isn’t in use by another entity.

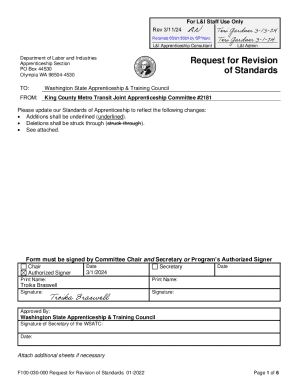

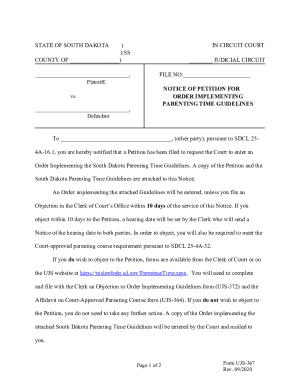

Next, filing the necessary documents is crucial. For LLCs, you’ll need to prepare Articles of Organization, while corporations require Articles of Incorporation. Once prepared, submit these forms to the appropriate state agency alongside any required fees.

Finally, creating operating agreements and bylaws is essential for outlining management structures, roles, and responsibilities. Even though not all states mandate these documents, having them will help clarify expectations and procedures for decision-making within the entity.

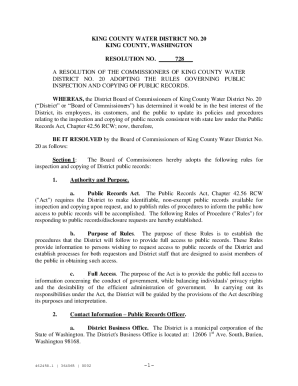

Ongoing management and compliance requirements

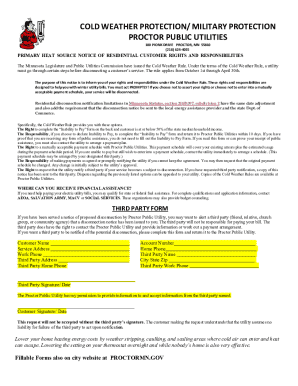

Once you have successfully formed your legal entity, it’s important to maintain compliance with state regulations. Most states require annual reports to be submitted, detailing your business activities and confirming that the entity is actively operating. Regularly checking in with state agencies ensures your business remains in good standing and that there are no outstanding issues such as unpaid fees.

Don’t forget tax obligations, which can vary based on the legal structure and location of your business. Ensure that you’re aware of any filings or payments required by local, state, and federal tax bodies, as staying compliant will help prevent potential penalties.

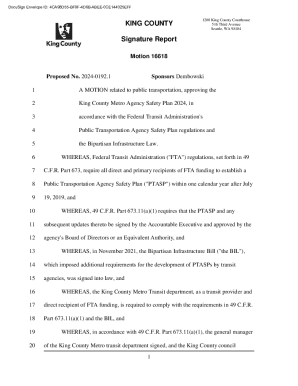

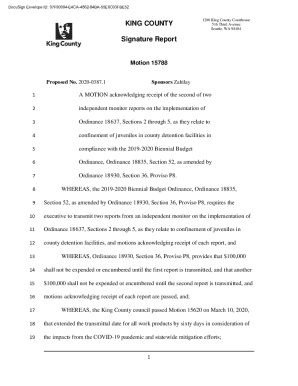

Utilizing pdfFiller for document creation and management

pdfFiller offers a seamless platform for individual and team users to create, edit, and manage essential legal documents related to entity formation. This powerful web application allows for quick access and efficient document management from any location, a crucial aspect for busy entrepreneurs and developers. With pdfFiller, you can easily eSign important agreements and collaborate with team members on documents that require input and validation.

Among the various features available, users can benefit from key templates tailored to common formation documents, including Articles of Organization and General Operating Agreements. This not only saves time but provides assurance that you are using the correct format aligned with legal requirements.

Interactive tools and resources to assist you

To further ease the formation process, consider utilizing interactive tools designed for prospective business owners. pdfFiller provides form generation tools that guide users through the completion process, ensuring all necessary information is captured efficiently. A valuable cost comparison calculator can help weigh the expenses of forming a legal entity against the potential costs of operating informally.

Additionally, an FAQ section within pdfFiller can address common questions and concerns about entity formation. This can help new entrepreneurs feel more prepared and educated as they embark on their business journey.

Real-life case studies

Understanding the implications of legal formation can be best appreciated through real-life case studies. Successful transformations occur when individuals or entities choose to form an LLC or corporation. For instance, a Virginia-based web-app developer expanded their operations and raised capital effectively after forming an LLC, offering them professional credibility and safeguarding personal assets.

Conversely, consequences can be dire for those who choose not to form. Freelancers or independent contractors might face severe financial implications when their informal operations lead to lawsuits or unpaid debts that impact their personal finances. These contrasting examples serve to highlight the critical need for understanding the legal landscape of formation.

Community insights and shared experiences

Communities often share insights from their own journeys regarding business formation, providing a wealth of knowledge for newcomers. Contributions from users exploring pdfFiller reveal firsthand experiences about the formations, including tips on maximizing benefits while avoiding common pitfalls such as neglecting compliance requirements or failing to keep detailed financial records.

By listening to these shared experiences, new entrepreneurs can learn about preparation and strategic planning, ensuring they feel more confident in their decision-making processes.

Hot network questions

Engagement with the community extends beyond just sharing experiences. Addressing live questions regarding formation helps present varied perspectives on the topic. Many users ask whether forming an LLC is necessary for side projects or how to mitigate the expenses associated with starting a legal entity.

Staying connected with current trends and queries allows potential entrepreneurs to gain insights into collective concerns while ensuring that they are well-equipped to navigate their own paths.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the do i need to in Chrome?

Can I create an eSignature for the do i need to in Gmail?

How do I edit do i need to straight from my smartphone?

What do I need to?

Who is required to file do I need to?

How to fill out do I need to?

What is the purpose of do I need to?

What information must be reported on do I need to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.