IRS Instruction 7004 2025-2026 free printable template

Get, Create, Make and Sign IRS Instruction 7004

How to edit IRS Instruction 7004 online

Uncompromising security for your PDF editing and eSignature needs

IRS Instruction 7004 Form Versions

How to fill out IRS Instruction 7004

How to fill out instructions for form 7004

Who needs instructions for form 7004?

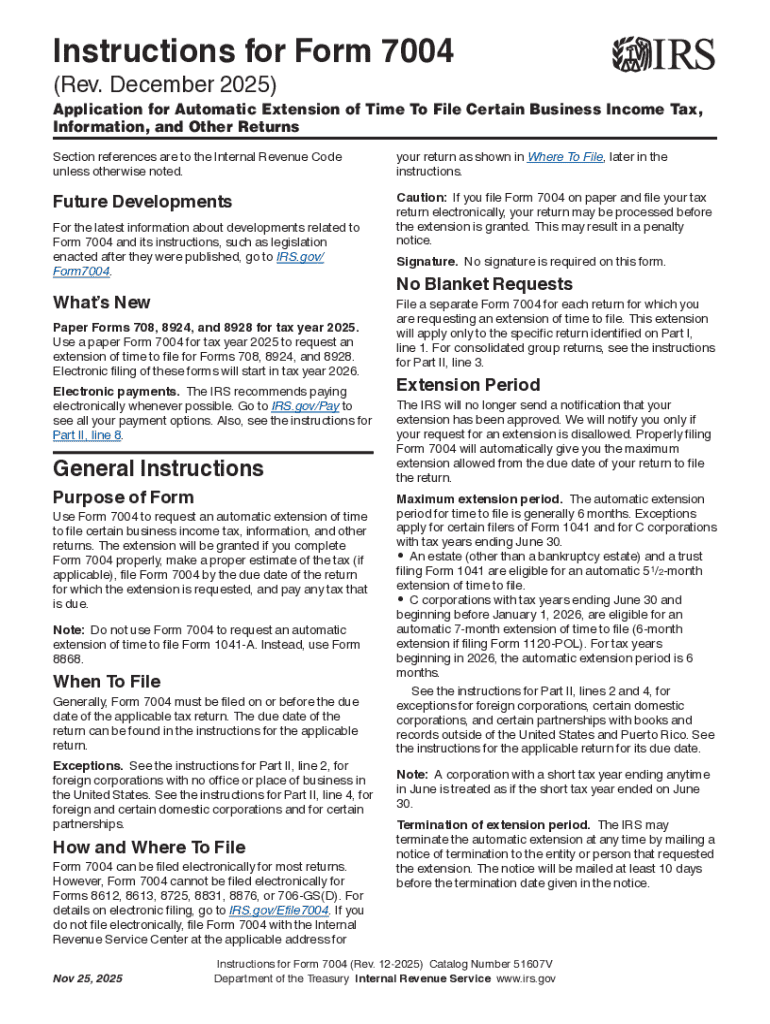

Instructions for Form 7004: A Comprehensive Guide

Understanding IRS Form 7004

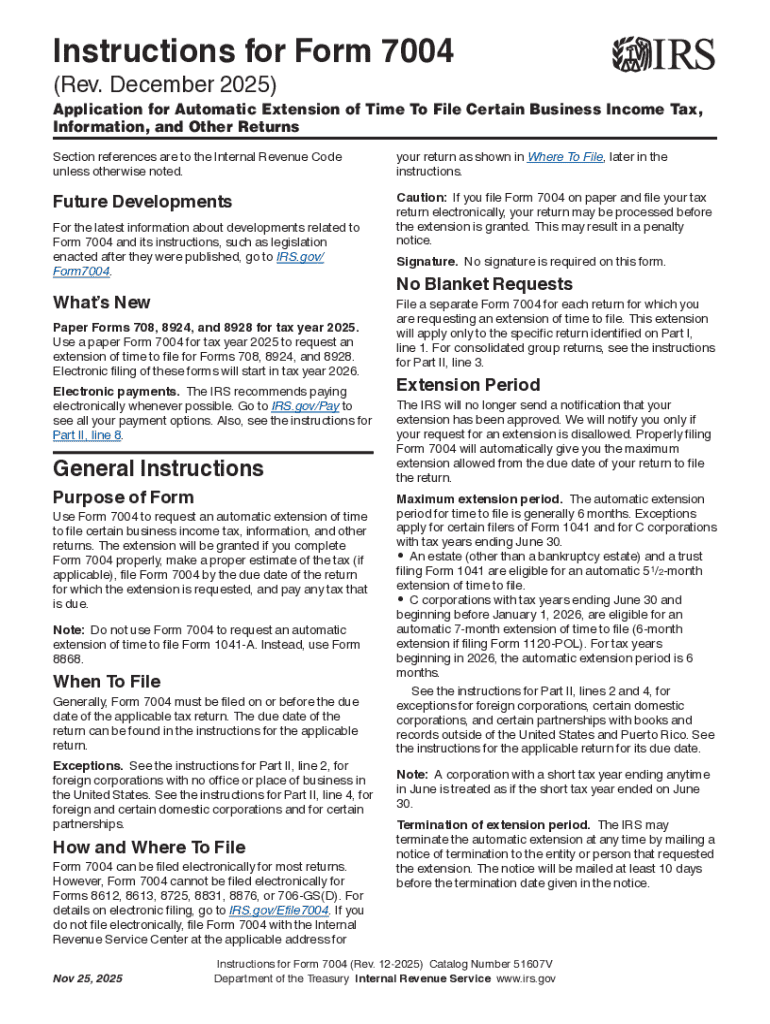

IRS Form 7004 is a vital document for businesses and entities seeking an extension of time to file their income tax returns. Specifically, it allows taxpayers to request an automatic extension for various types of business income tax returns. Utilizing Form 7004 can be crucial in situations where businesses need additional time to ensure proper preparation and compliance with tax requirements. However, it’s essential to understand that this form does not extend the time to pay any taxes due, only the time to file the return.

Eligibility criteria

Eligibility to file Form 7004 is primarily determined by the type of entity. Generally, any business entity that is required to file a tax return can request an extension. This includes corporations, partnerships, and certain trusts and estates. Understanding eligibility is crucial as it ensures that businesses do not miss out on the benefits of an extension.

Reasons to complete Form 7004

There are significant benefits associated with filing Form 7004. One of the primary advantages is the additional time to prepare taxes, which can be invaluable for businesses with complex financial situations or changes in operations. Not having enough time to prepare accurate and compliant returns can lead to costly penalties or errors in filings.

Another reason to complete this form is to avoid penalties for late filing. The IRS typically imposes financial penalties for late submissions, which can add up quickly. By submitting Form 7004 on time, you can mitigate these risks, giving your business a financial cushion when managing tax responsibilities.

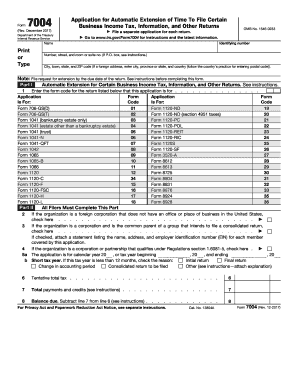

Step-by-step guide to completing Form 7004

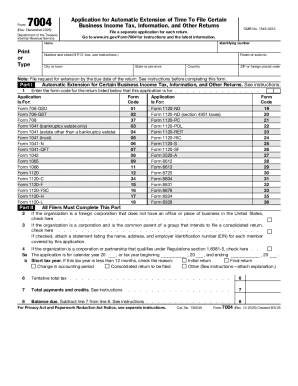

Filling out Form 7004 begins with gathering the necessary information. This includes your business's name, Employer Identification Number (EIN), address, and details of the tax return for which you need an extension. Understanding these obligations is critical as inaccuracies can lead to complications.

When filling out the form, it's important to pay close attention to each section. Start with basic entity information—this includes identification details like the name and EIN. Then, specify which return you are requesting the extension for. Various entity types will have specific selections to make here, so accuracy is paramount.

Filing Form 7004

Once the form is completed, the next step is submission. Businesses have two options: e-filing or paper filing. E-filing is generally faster and can reduce the likelihood of errors associated with handwritten submissions. Furthermore, e-filing through platforms like pdfFiller makes the process even easier, allowing for quick submissions with advanced editing features. However, some may prefer the tactile nature of paper filing, though it typically requires longer processing times.

It's critical to pay attention to submission deadlines. Typically, Form 7004 must be filed by the due date of the tax return for which you are requesting the extension. If you miss this deadline, you may no longer be eligible for the extension, meaning your tax return will be due immediately.

After filing Form 7004

Once you've filed Form 7004, it's crucial to understand the new filing deadline it grants you. Typically, the extension lasts for six months from the original due date of the tax return. However, specific deadlines can vary depending on the type of return, so verifying this information is vital to maintain compliance.

Additionally, businesses should be mindful of confirmation receipts from the IRS. After submission, it is important to track this confirmation to ensure the IRS has received your extension request. If you do not receive confirmation within a reasonable time frame, contacting the IRS for clarification may be necessary to avoid unnecessary complications.

FAQs about Form 7004

Many questions often arise regarding Form 7004, particularly concerning extensions for multiple years. Unfortunately, extensions cannot be applied for consecutive years automatically using Form 7004; each tax period requires its own request. Additionally, if businesses find they need more time after filing Form 7004, they can request a further extension by filing Form 4868 for personal returns, or if business needs dictate, they may need to consult tax professionals for bespoke scenarios.

Another consideration is the impact of Form 7004 on estimated tax payments. It’s important to remember that while the filing of Form 7004 may grant more time to file, it does not alter the requirement to remit estimated taxes on time during the year. Understanding these nuances can be vital in maintaining compliance and avoiding penalties.

Leveraging pdfFiller for your Form 7004 needs

pdfFiller presents an efficient solution for businesses needing to handle Form 7004. Users can fill out, edit, and manage the form seamlessly from anywhere, making document preparation more accessible. The platform allows for collaborative efforts, enabling multiple stakeholders to contribute to the preparation of tax documents, which can be especially helpful for larger businesses or those with complex returns.

In addition to filling out forms, pdfFiller offers capabilities like eSigning, ensuring that all necessary signatures are collected digitally and efficiently. This streamlining of processes not only saves time but also reduces the risk of errors that can occur during traditional signing methods. Users can easily access supportive resources within pdfFiller, assisting them through the process of managing their necessary documentation with ease.

Conclusion

Filing IRS Form 7004 accurately and on time is essential for businesses seeking to extend their tax deadlines. This process not only helps avoid penalties but also provides the necessary flexibility to accurately prepare tax returns. Leveraging platforms like pdfFiller can greatly enhance the experience of managing this paperwork, offering tools that simplify filling out, signing, and submitting forms from anywhere. To ensure compliance and reduce stress during tax season, understanding and using Form 7004 effectively should be a priority for all business owners.

People Also Ask about

How do I file an extension for my LLC tax 2022?

Where do you mail form 7004 to the IRS?

Do I need to file form 7004?

Can an LLC file form 7004?

What is the difference between form 4868 and form 7004?

How much does it cost to e file form 7004?

Do you need to attach 7004 to 1065?

Do I attach form 7004 to tax return?

Do I need to attach my extension to my tax return?

Who uses Form 7004?

How do I fill out a business tax extension?

How to fill out form 7004?

How do I submit a 7004 form?

What is 7004 form used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out IRS Instruction 7004 using my mobile device?

Can I edit IRS Instruction 7004 on an Android device?

How do I complete IRS Instruction 7004 on an Android device?

What is instructions for form 7004?

Who is required to file instructions for form 7004?

How to fill out instructions for form 7004?

What is the purpose of instructions for form 7004?

What information must be reported on instructions for form 7004?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.