IRS Form 15272 2025-2026 free printable template

Get, Create, Make and Sign form 15272

How to edit IRS Form 15272 online

Uncompromising security for your PDF editing and eSignature needs

IRS Form 15272 Form Versions

Your Comprehensive Guide to Form 15272 (Rev 10-2025)

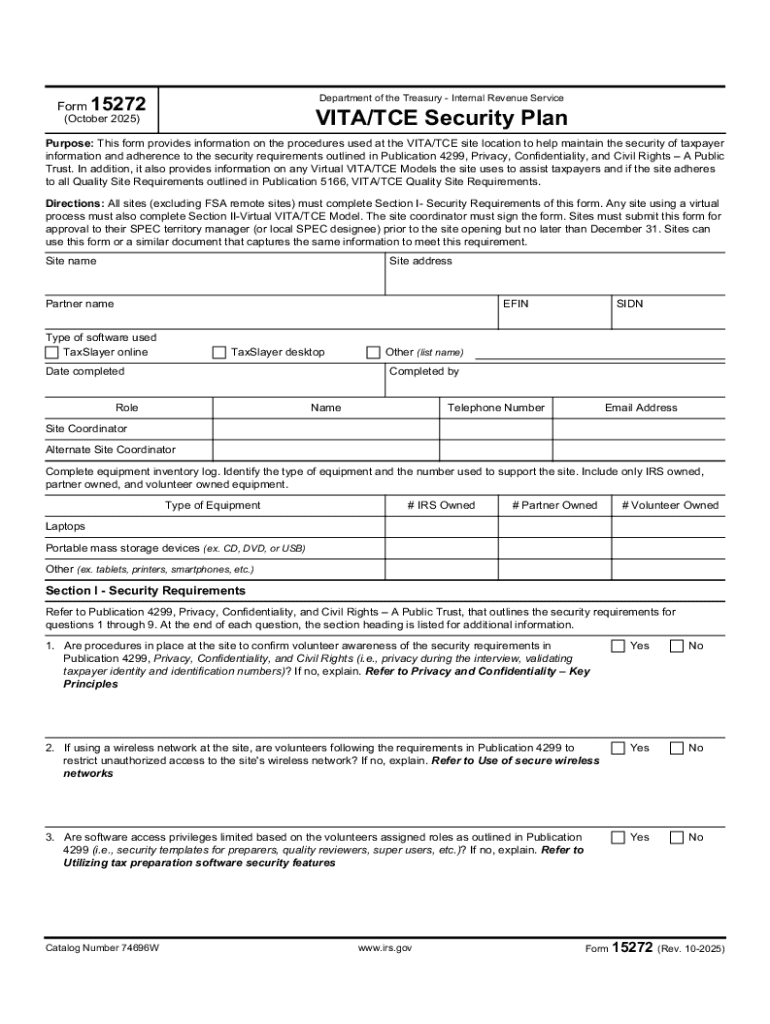

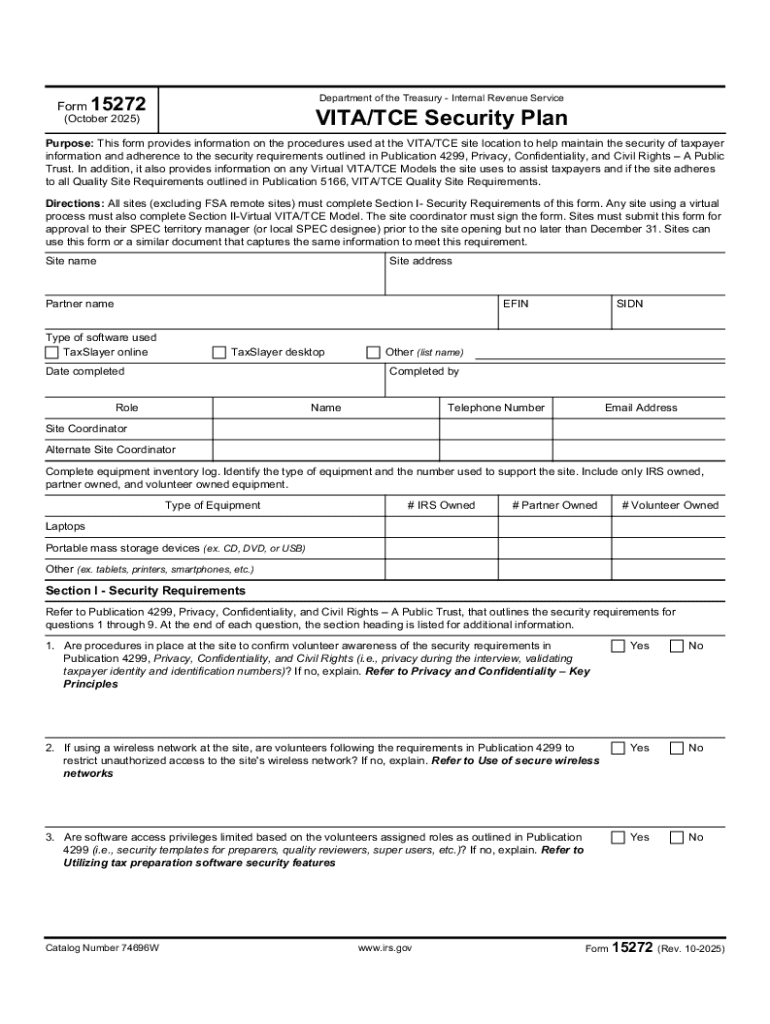

Understanding Form 15272 (Rev 10-2025)

Form 15272 is a critical document used in various administrative and procedural contexts, designed to gather essential information relevant to specific processes. The form's primary purpose is to ensure that accurate data is submitted, thereby facilitating a streamlined workflow and compliance with regulations. Individuals and organizations operating within regulated industries or needing to report specific activities often find this form indispensable.

This specific revision, labeled Rev 10-2025, indicates the latest updates and modifications made to improve clarity and usability. It's essential for users to understand not only what Form 15272 entails but also the implications of using the latest version. By utilizing the updated form, users can avoid potential pitfalls associated with outdated processes and regulations.

When to use Form 15272

Determining eligibility for completing Form 15272 is essential for proper compliance. Typically, this form is intended for individuals or entities involved in activities that fall under the jurisdiction requiring this documentation. Therefore, carefully reviewing the eligibility criteria is crucial to ensure your submission is both valid and accepted.

Common scenarios where Form 15272 is necessary might include reporting income for tax purposes, applying for grants, or documenting compliance with local regulations. For example, a small business may need to fill out this form to provide detailed financial information when seeking a loan. Failure to use the form correctly could result in delays or rejections from pertinent authorities.

Preparing to fill out Form 15272

Before diving into the completion of Form 15272, it is vital to gather all necessary information to ensure accuracy and thoroughness. This includes collecting relevant documents such as previous financial statements, identification numbers, and any additional data that might be required for submission. Organizing this information beforehand can significantly simplify the process.

Understanding the layout of Form 15272 is equally important. The form is divided into several sections, each dedicated to specific queries and information gathering. Familiarizing oneself with these sections, as well as the terminology used, can help avoid confusion and streamline the completion process. A clear roadmap of what to expect allows users to fill out the form with confidence.

Step-by-step instructions for completing Form 15272

To ensure clarity while filling out Form 15272, it’s essential to follow a structured approach. Start with the personal information section, where you’ll need to include your name, address, and contact details. It’s vital to double-check that all information is accurate to avoid complications down the road.

Subsequent sections will ask specific queries related to your eligibility and purpose for filling the form. It’s important to read each question carefully and provide complete answers. Ensure to check the signatory requirements at the end of the form, which may vary based on the purpose of the form and the nature of the submission.

Common pitfalls to avoid

As with any form, there are common pitfalls users should strive to avoid when completing Form 15272. These may include omitting required sections, providing inaccurate or inconsistent information, and neglecting to review the form after completion. Taking the time to proofread and verify all entries can prevent rejections and delays.

The use of the latest revision also holds importance, as some outdated forms may lead to confusion regarding regulations. Therefore, staying updated ensures compliance and smooth processing when submitting the form.

Editing and modifying Form 15272

Once you have completed Form 15272, you may need to make edits or modifications for accuracy or clarity. Platforms like pdfFiller allow users to upload and edit the form online easily. The user-friendly interface offered by pdfFiller ensures that modifications can be made efficiently without compromising on quality.

In addition to editing, pdfFiller offers functionalities for adding secure electronic signatures using eSign. This is crucial for maintaining the integrity of your submission and ensuring that your document is legally binding. E-signatures provide a secure method for signing documents while also facilitating quick and easy completion.

Collaborating on Form 15272

When working on Form 15272 as part of a team, effective collaboration tools are essential. pdfFiller allows users to share the form with teammates, making it easy to collaborate on the document in real time. This feature enhances teamwork, ensuring that all necessary information is captured and that everyone is on the same page.

Additionally, pdfFiller includes tracking features for changes and comments. This ensures that users can maintain version control and review edits made by different team members, thus allowing for seamless integration of feedback into the final document. Maintaining clear communication during this process can significantly influence the outcome.

Managing your completed Form 15272

Effective management of your completed Form 15272 is crucial, especially in assuring it is securely saved and stored. Engaging with cloud-based solutions, such as those provided by pdfFiller, means that you can save your form securely online, easily retrieving it whenever necessary. Such practices minimize the risk of data loss and unauthorized access.

When it comes to submission, it's guiding to know where and how to submit Form 15272. Different jurisdictions may have varied submission processes, and being aware of any deadlines associated with your form will help prevent last-minute issues. Familiarizing yourself with the correct submission pathways ensures prompt processing, thus avoiding any unnecessary delays.

FAQs about Form 15272 (Rev 10-2025)

While navigating the complexities of Form 15272, users frequently have questions about various aspects of the form. Common inquiries involve eligibility requirements, submission guidelines, and modification processes. Providing clear answers to these questions ensures users feel more confident in their submissions and can manage their paperwork effectively.

Additionally, troubleshooting issues can be a significant concern for those filling out or submitting the form. If users encounter problems, having a guide to address common issues can streamline resolutions and allow smoother processes. Engaging with support resources, such as customer service, can assist users when they need further clarification or assistance.

Leveraging pdfFiller for efficient form management

Utilizing pdfFiller provides an all-in-one document creation solution that streamlines the process of managing Form 15272. The platform not only facilitates easy form editing and collaboration but also ensures reliable access from anywhere. This flexibility allows users to fill out, submit, and manage their forms seamlessly, enhancing productivity.

Moreover, pdfFiller's accessibility features ensure that forms can be used effectively regardless of location. With customer support options readily available, individuals and teams can reach out for assistance when needed, reinforcing the understanding and completion of Form 15272. Overall, engaging with pdfFiller empowers users to manage their documentation efficiently and effectively.

People Also Ask about

How long does it take to process 4506-t?

What is an IRS Form 14446?

What is a 13615 form?

How long does it take the IRS to accept AE file?

What is the IRS consent form 4506 C?

What is a taxpayer first act consent form?

What is a 4506 t form used for?

Why do lenders need a 4506-T form?

What is 4506-T form used for SBA?

Is the taxpayer consent form required?

What does it mean when it says your taxes have been acknowledged?

Is SBA still requiring 4506-T?

What is tax payer consent?

What should the certified volunteer preparer do before starting the tax return?

What is Form 15272?

Who fills out form 9325?

Who fills out 9325?

What is Form 9325 Acknowledgement and General Information?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Form 15272 for eSignature?

How do I make edits in IRS Form 15272 without leaving Chrome?

How do I complete IRS Form 15272 on an iOS device?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.