Get the free Issuer Eligibility Requirements Fact Sheet

Get, Create, Make and Sign issuer eligibility requirements fact

Editing issuer eligibility requirements fact online

Uncompromising security for your PDF editing and eSignature needs

How to fill out issuer eligibility requirements fact

How to fill out issuer eligibility requirements fact

Who needs issuer eligibility requirements fact?

Understanding the Issuer Eligibility Requirements Fact Form

Understanding issuer eligibility requirements

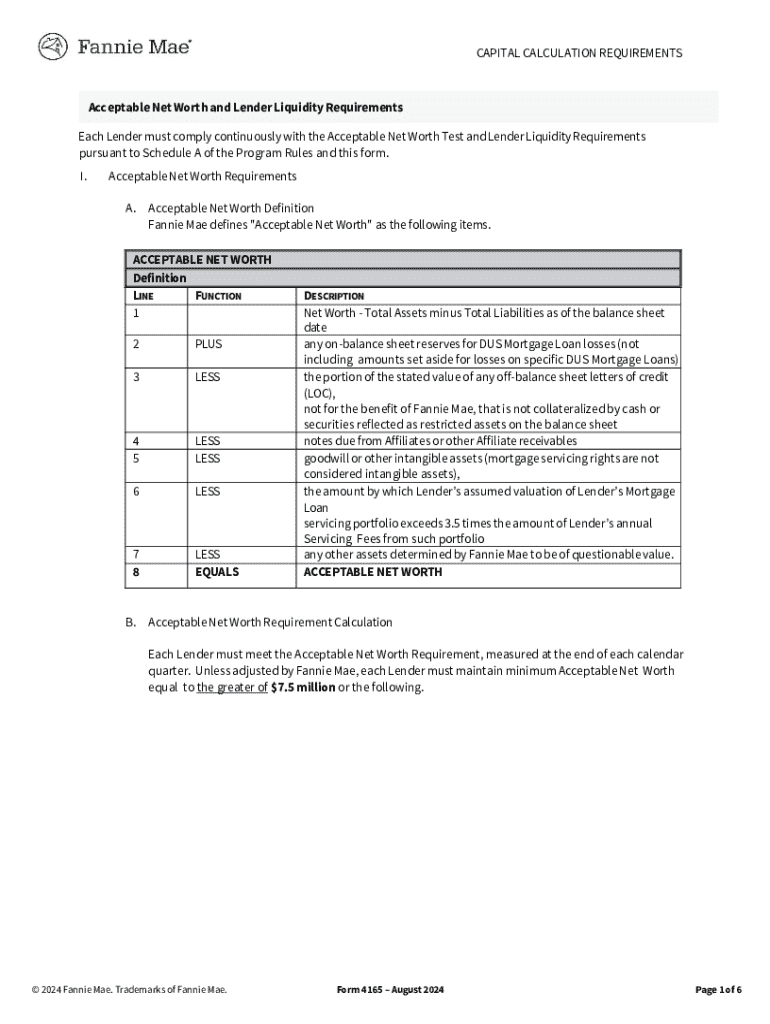

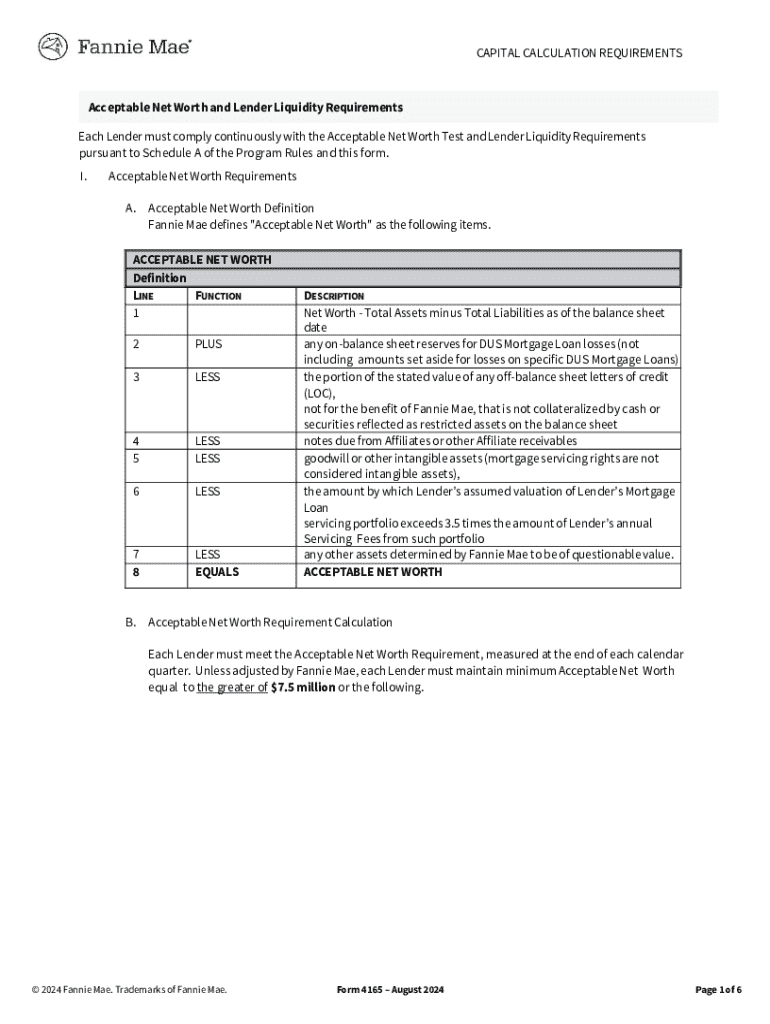

Issuer eligibility requirements are crucial for organizations looking to engage in various forms of capital raising, including equity and debt offerings. This concept encompasses a set of criteria that entities must meet to be deemed suitable for issuing securities. Organizations that understand and navigate these requirements effectively can enhance their chances of obtaining financing and building investor trust.

Those who fail to meet the issuer eligibility requirements risk delays in their application processes or outright rejections. This makes it vital for applicants to ensure they comprehend the nuances of these criteria. While many may assume issuer eligibility is a straightforward checklist, it is often more complex, with nuances varying across issuer types and jurisdictions.

Key components of the issuer eligibility requirements fact form

At the core of issuer eligibility documentation is the issuer eligibility requirements fact form, which serves as a structured outline for potential issuers. This form distinguishes between various types of issuers, including public, private, non-profit, and for-profit entities, underscoring the different eligibility criteria each must meet. Understanding the distinction between these issuer types is critical, as they face unique challenges and requirements.

The fact form is structured into several key sections, each designed to glean specific information from the applicant. Each section of the form serves a distinct purpose, enabling regulatory bodies to evaluate the eligibility of the issuer thoroughly.

General eligibility criteria

The general eligibility criteria for issuers are multifaceted, focusing predominantly on financial requirements, legal compliance, and operational factors. Financially, the issuer must provide minimum financial statements, including income statements, balance sheets, and cash flow statements. Additionally, compliance reports prepared by an independent auditor are often necessary to validate the accuracy of these statements.

Legal and regulatory considerations also play a significant role in establishing issuer eligibility. Organizations need to be aware of the compliance standards pertinent to their industry and geographical location, securing any necessary licensing or registration with regulatory bodies. Operational factors—including the evaluation of the business model and the governance framework—ensure that the issuer operates within industry best practices.

Specific criteria for different issuer types

Different issuer types face varied eligibility criteria based on their operational scale and structure. Emerging companies, defined as startups or small businesses, often confront unique challenges they must address through specific documentation, such as detailed business plans or letters of intent outlining future funding goals.

In contrast, established companies are subjected to more rigorous criteria due to their larger operational scales. Additional submission requirements may include comprehensive risk assessments and more extensive historical financial data. Non-traditional issuers, such as organizations in unique sectors or industries, may also have specific documentation needs that differ from standard criteria, necessitating a thorough understanding of their particular circumstances.

Filling out the issuer eligibility requirements fact form

Successfully completing the issuer eligibility requirements fact form necessitates a meticulous approach. A step-by-step guide is invaluable for applicants, with each section of the form requiring specific types of information. Heading into this process, applicants should begin by carefully reading the instructions and understanding what information is pertinent to each part of the form.

Common pitfalls include errors in financial reporting, miscommunication of licensing status, and incomplete documentation. By paying close attention to detail and ensuring all required elements are present, applicants can avoid up to 80% of the common reasons for application delays or rejections.

Interactive tools and resources

Utilizing tools like pdfFiller can drastically enhance the form completion experience. This platform allows users to edit and customize the fact form easily, providing essential eSigning features that expedite the entire process. Through its intuitive interface, users can make changes, add necessary annotations, and ensure their applications are as complete as possible.

Collaboration tools available within pdfFiller facilitate sharing the form with colleagues for real-time feedback and edits, making it an invaluable asset for teams. With everyone able to access the document from any location, project timelines remain intact, and valuable insights can be shared seamlessly.

Managing your issuer eligibility application

After submitting the issuer eligibility requirements fact form, tracking the status of your application is crucial. Familiarizing oneself with the key milestones in the review process will help set expectations. Therefore, engaging with regulatory bodies after submission can provide valuable updates on the application's progress.

Should you receive feedback requesting revisions or additional documentation, understanding common rejection reasons is essential. These typically include gaps in documentation or unmet regulatory standards, and addressing these concerns promptly will increase the likelihood of successful reapplication.

Frequently asked questions (FAQs)

When managing issuer eligibility applications, several common questions arise. One frequent inquiry is about the typical review timeline for eligibility applications. While it can vary depending on the issuing authority, applicants can expect a timeframe ranging from a few weeks to several months.

Another common concern involves how to ensure that applications meet all necessary criteria. Applicants are encouraged to conduct thorough reviews against the stipulated requirements outlined in the issuer eligibility requirements fact form. Lastly, understanding any associated fees with the application process can help avoid financial surprises, as many jurisdictions require nominal fees for processing applications.

Support and assistance

For additional support during the issuer application process, pdfFiller offers several avenues of assistance. Users can access customer support through multiple channels, ensuring prompt responses to inquiries. Additionally, pdfFiller provides a suite of supplementary services to aid in document management, enhancing the overall user experience.

Engaging with community forums and collaborative spaces allows issuers to connect with others who are going through the same process. Sharing experiences and gathering best practices can lead to better outcomes for future applications.

Case studies and success stories

Real-world examples of successful issuer applications highlight the importance of obtaining proper documentation prior to submission. Many organizations faced challenges with incomplete documentation or misunderstandings of the requirements, leading to application delays. However, upon employing more thorough strategies and utilizing tools like pdfFiller, these entities streamlined their processes and achieved successful outcomes.

These success stories underline not only the importance of adhering to the issuer eligibility requirements fact form but also the impact of thorough preparation. By leveraging available resources, applicants can ensure smoother approval processes, enhancing their ability to raise necessary funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit issuer eligibility requirements fact from Google Drive?

How can I get issuer eligibility requirements fact?

How do I make changes in issuer eligibility requirements fact?

What is issuer eligibility requirements fact?

Who is required to file issuer eligibility requirements fact?

How to fill out issuer eligibility requirements fact?

What is the purpose of issuer eligibility requirements fact?

What information must be reported on issuer eligibility requirements fact?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.