Get the free Federated GNMA Trust Form 8937

Get, Create, Make and Sign federated gnma trust form

How to edit federated gnma trust form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out federated gnma trust form

How to fill out federated gnma trust form

Who needs federated gnma trust form?

Federated GNMA Trust Form: A Comprehensive How-to Guide

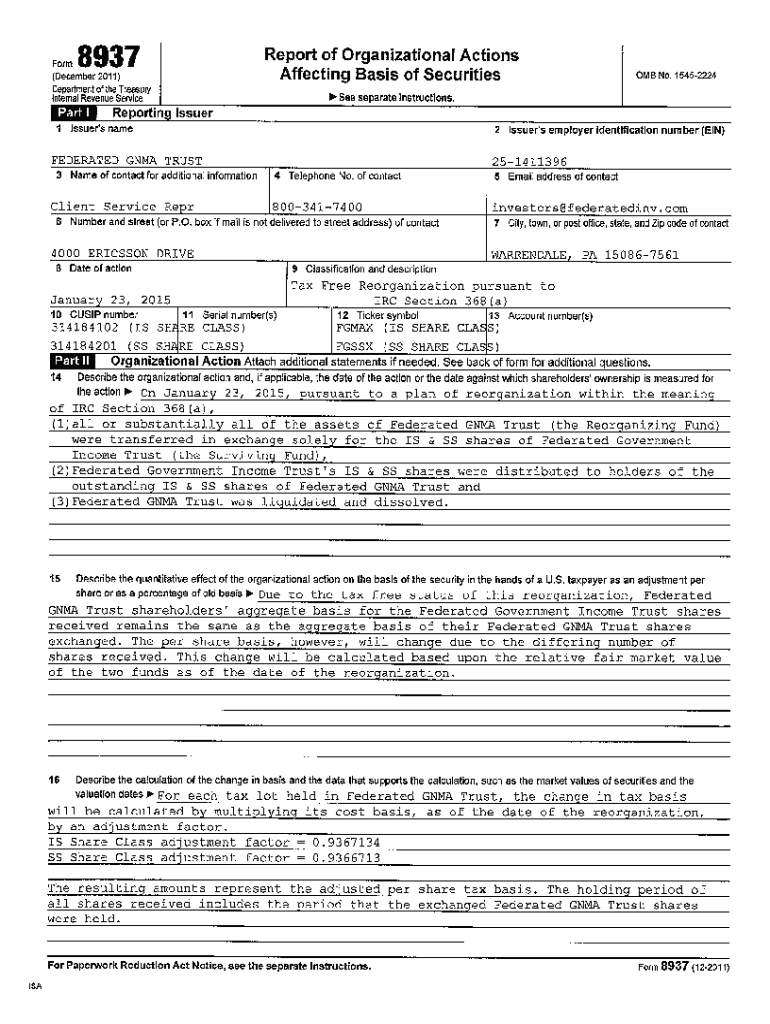

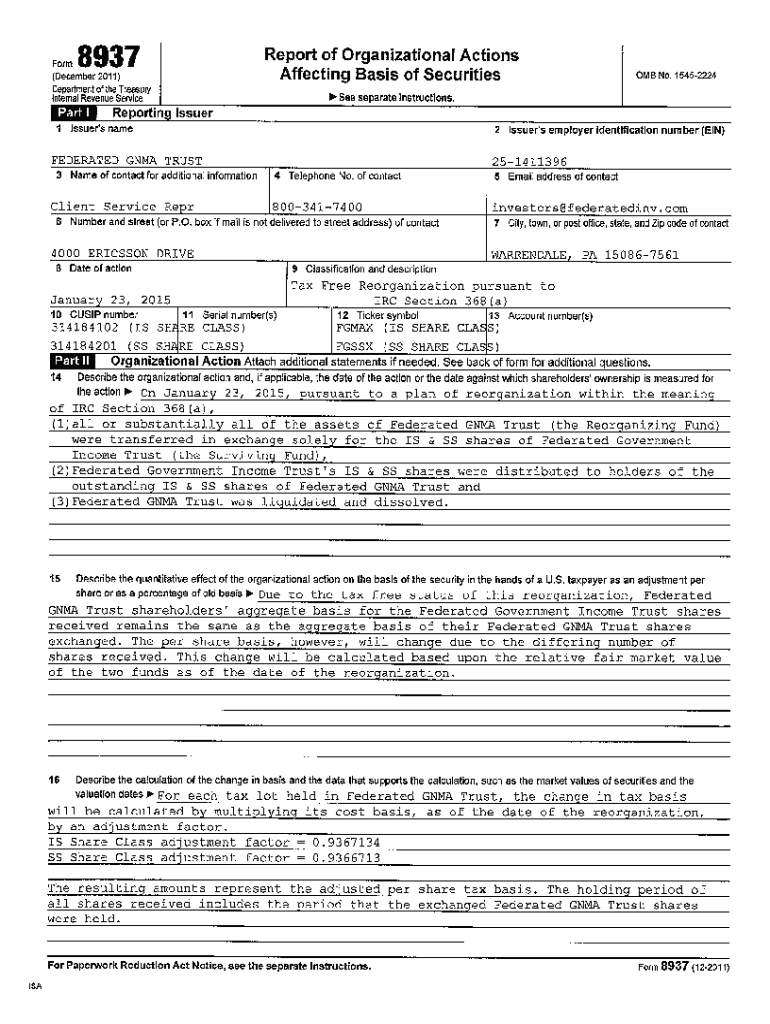

Understanding the Federated GNMA Trust Form

The Federated GNMA Trust Form is essentially a document utilized for investment in securities backed by government-insured mortgages. 'GNMA' stands for Government National Mortgage Association, which provides investors with a unique opportunity to invest in a diversified pool of mortgages, ensuring safety through government guarantees. This form is critical for individuals aiming to navigate the intricacies of real estate investment while minimizing risk.

Investing in GNMA securities allows individuals to benefit from regular income through the mortgage payments, making it an attractive option for many investors. Additionally, the trust structure enables a more organized approach to manage, track, and execute investment strategies, enhancing overall investment efficiency.

Preparing to complete the Federated GNMA Trust Form

Before diving into the completion of the Federated GNMA Trust Form, it's vital to gather all necessary documents and information meticulously. Essential pieces of documentation include identification documents such as driver's licenses or passports, property details including the address, purchase dates, and any existing loans on the property, along with up-to-date financial statements, which provide a snapshot of your financial health.

Understanding common terminology is equally crucial, hereby enhancing your ability to fill out the form accurately. GNMA is a government body that guarantees loans, effectively providing security against defaults for investors. The trust structure here refers to the mechanism under which properties are held, permitting smoother transaction processes. Lastly, clarifying your investment objectives will help in deciding the exact nature of the trust and the securities you choose to invest in.

Step-by-step instructions for filling out the Federated GNMA Trust Form

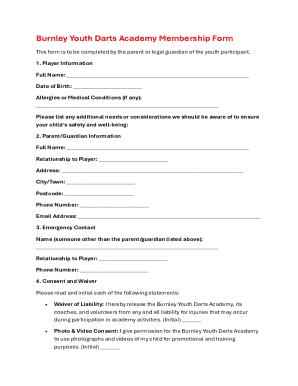

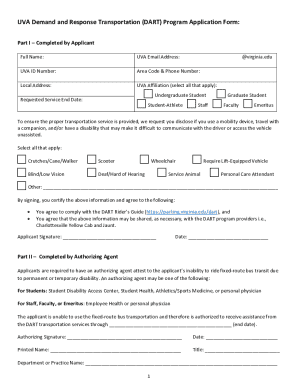

Filling out the Federated GNMA Trust Form requires careful attention to detail. Begin with the 'Personal Information' section, where you must provide complete details about yourself, including full name, contact information, and social security number. This section establishes your identity and your eligibility to create the trust.

Next, move on to the 'Trust Details' section, where you specify the name of the trust, list beneficiaries, and outline the management structure. This is crucial, as incorrect information here can delay trust establishment. The third section pertains to 'Property Information', where you input all relevant details about the property involved, including the market value and any encumbrances. Lastly, in the 'Financial Commitments' section, document any proposed investment amounts and projected earnings.

Editing and reviewing the Federated GNMA Trust Form

Once you have filled out the Federated GNMA Trust Form, using the right tools for editing and reviewing is pivotal. pdfFiller offers seamless editing features that allow users to make revisions to the PDF directly. The platform provides an intuitive interface that supports collaboration; thus, if you're working with a team or financial advisor, they can provide input in real-time.

During the review process, be vigilant about common mistakes. A frequent oversight is overlooking fields, which can lead to processing delays. Equally important is ensuring all terminologies are accurately interpreted to avoid legal repercussions. Properly understanding the context of legal terms can save you from future complications.

Signing the Federated GNMA Trust Form

Signing your completed Federated GNMA Trust Form carries significant legal implications. This binding agreement delineates your responsibilities as the trust creator and outlines the expectations for all parties involved. It is imperative to ensure that you comprehend the agreement fully before attaching your signature.

In today's digital landscape, electronic signature options are increasingly popular and legally valid in many jurisdictions. When using eSignature options via pdfFiller, you can sign the document conveniently from anywhere. It's essential to validate your eSignature, as this maintains its legal integrity, ensuring that all parties involved recognize its enforceability. Lastly, document security must also be prioritized to protect sensitive personal information.

Managing your Federated GNMA Trust Form after completion

After successfully completing and signing the Federated GNMA Trust Form, managing your document efficiently is crucial. Start by saving and securely storing your form. Best practices dictate that you should keep backups in both physical and electronic formats to prevent loss of information. Using pdfFiller to manage your forms allows you to access them from anywhere, reducing the risk of data loss.

Additionally, sharing your completed form with collaborators is made easy through secure sharing options within pdfFiller, allowing you to maintain control over how your sensitive documents are accessed. Keeping track of changes and version control is pivotal in ensuring that everyone is on the same page, eliminating any confusion when updates are made.

Troubleshooting common issues with the Federated GNMA Trust Form

Difficulties may arise when completing or managing your Federated GNMA Trust Form. Common issues include misunderstanding specific jargon or submitting incomplete forms. To mitigate these challenges, it's important to familiarize yourself with frequently asked questions. Many users report confusion around financial terms or the stipulations attached to the trust.

If persistent issues occur, reaching out for support can be beneficial. pdfFiller offers dedicated support channels to assist users in navigating challenges related to their Trust Forms. Clear communication is essential, so ensure you provide accurate details when seeking help.

Case studies and user experiences

Examining real-life experiences can provide a wealth of knowledge regarding the Federated GNMA Trust Form. Numerous users have successfully streamlined their investment processes by utilizing this form effectively, reducing turnaround times on their investment account setups. Notably, one user managed to clarify legal terminology through collaborative efforts, enabling a precise interpretation of the trust structures involved.

Conversely, challenges also present teaching moments. Users who previously overlooked key fields often found themselves having to restart their applications, a situation that emphasizes the importance of diligent review before submission. Analyzing both success stories and obstacles faced can offer invaluable insights into improving your own processes.

Conclusion of usefulness and versatility

Utilizing the Federated GNMA Trust Form via pdfFiller offers numerous benefits, including structured investment processes, enhanced security for personal data, and simplified editing and collaboration features. The form serves as a vital component for individuals and teams looking to participate in government-backed mortgage investments while maintaining compliance with legal standards.

As trends in document management and trust formulation continue to evolve, tools like pdfFiller remain at the forefront, ensuring that users can adapt to changes seamlessly. Embracing such electronic forms not only modernizes the investment process but also empowers individuals to take charge of their financial strategies with clarity and confidence.

Interactive tools and resources available

pdfFiller provides a suite of interactive tools designed to enhance document handling skills. Users can take advantage of PDF editing and signing tools that facilitate a seamless experience. These features allow for user-friendly document modifications and efficient sign-off processes, catering specifically to the needs of individuals and teams.

For those looking to broaden their knowledge, pdfFiller hosts webinars and tutorials that aim to educate users about maximizing these tools. Engaging with these learning resources enables you to enhance your proficiency in filling out, editing, and managing your Federated GNMA Trust Form as well as other critical documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the federated gnma trust form in Chrome?

How do I fill out federated gnma trust form using my mobile device?

How do I edit federated gnma trust form on an Android device?

What is federated gnma trust form?

Who is required to file federated gnma trust form?

How to fill out federated gnma trust form?

What is the purpose of federated gnma trust form?

What information must be reported on federated gnma trust form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.